The ESG investment shakeup could be one of the major events of this year, and as many of the headlines in our daily report suggest, there is a lot of work to be done, whether it is agreeing on a common set of measurement metrics – note the US and European differences discussed in one story – or the introduction of more empirical methods to judge whether what is labeled as an ESG investment fund is labeled correctly. There is also the issue of comparable disclosures, especially for companies in complex industries. It is interesting to note that in many analyses we see around carbon footprint or greenhouse gas emissions, and the potential routes to and cost of abatement, the chemical industry is omitted, except for ethanol and hydrogen. This is despite the industry accounting for 15% of the non-power emissions in the US industrial sector (similar in size to refineries). We believe that this is because the complexity of the industry makes it hard to model, and analysts choose to exclude it because they are not sure what they are doing.

Expected ESG Regulation Likely Good For Pure-Play Energy Transition Stocks

Jun 30, 2021 4:05:20 PM / by Graham Copley posted in ESG, Biofuels, Plastic Waste, CCS, Carbon, Dow, ESG Fund, solar, ESG investment, wind, European Carbon price, carbon emissions

Solar: A Clear Example Of Potential Renewable Energy Inflation

Jun 17, 2021 1:32:30 PM / by Graham Copley posted in ESG, Hydrogen, Biofuels, Polymers, ESG Investing, Electric Vehicles, Raw Materials, LyondellBasell, Inflation, Gevo, solar, polysilicon, Wacker, copper, silver, Aemetis, renewable energy

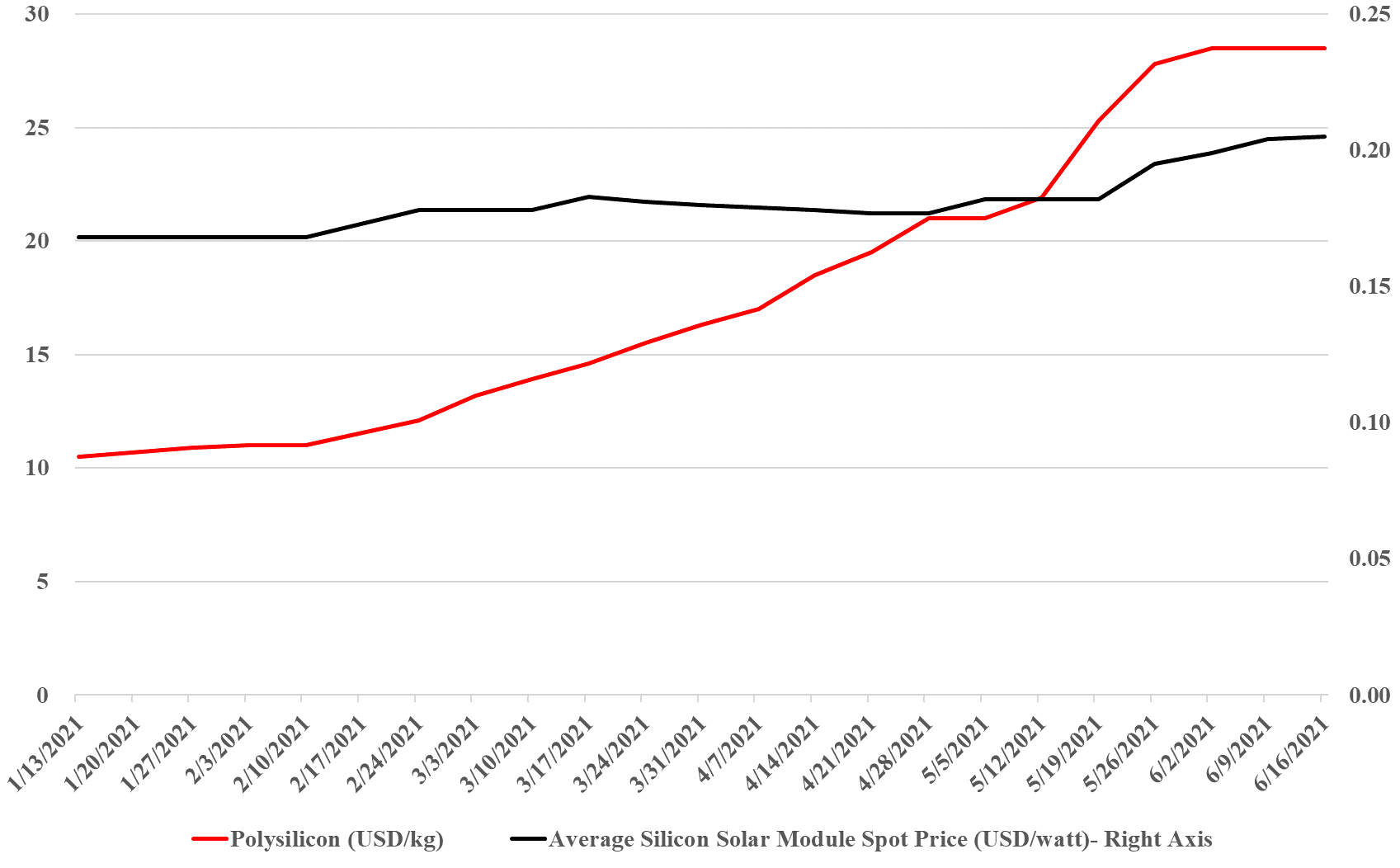

The exhibit below summarizes well one of the primary concerns that we have with some of the very ambitious goals for decarbonizing power grids, EV introduction, the further electrification of industry, and hydrogen. While the solar module price increase does not look that significant (yet), to put it in context, solar module prices have collapsed from over $1.80 per watt in 2010 to below $0.20 in 2020, and many of the expectations around cheap hydrogen require the cost to keep falling. The bigger concern is the polysilicon price, which is up 160% this year, good for the polysilicon producers like Wacker (see the headline here), but bad for the solar module producers, who are seeing major margin squeezes, especially given the rise in copper and silver as well this year. The raw material pressure should drive further increases in solar module pricing and while the higher margins for polysilicon will likely drive expansion investment, the metals are harder to call, given the ESG views on mining. We remain firmly of the view that raw material availability and price inflation, as well as module and wind turbine manufacturing capacity, will be the rate-determining constraint in terms of the growth in renewable power and this is why we question all of the near-term cheap power and cheap hydrogen goals that are being suggested by potential producers and government agencies.