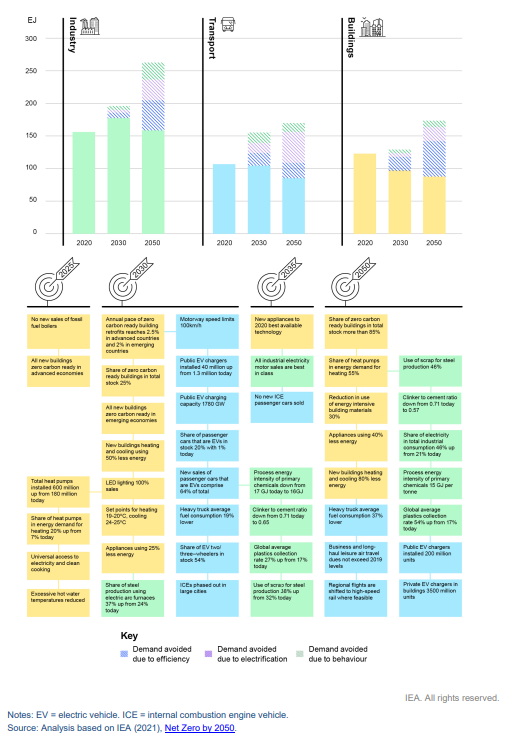

The IEA has published another report looking at energy intensity progress – noting that the rate of improvement in energy use is likely not fast enough to do its part in achieving net-zero needs. It is a comprehensive report (linked here) and we have chosen a couple of charts as you can see in today's daily report. The more interesting conclusion within the analysis may be that the IEA expects plastic collection for recycling to rise from 17% to only 27% by 2035. While this is a global average and will differ by country and likely by material, the overall rate looks low (but probably reasonable) and too low to allow packagers to meet recycle content goals, many of which are either 2025 or 2030 targets. We discuss some of the evolving packaging challenges in our ESG and Climate report today.

The IEA Energy Efficiency Analysis Is Bearish On Recycling

Nov 17, 2021 2:30:42 PM / by Graham Copley posted in ESG, Recycling, Sustainability, Plastics, Energy, Net-Zero, IEA, climate, packagers

Global Hydrogen Ambitions Will Fail Without CCS: The US Needs A Plan

Nov 11, 2021 1:36:40 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Green Hydrogen, CCS, Blue Hydrogen, Renewable Power, Energy, Emissions, CCUS

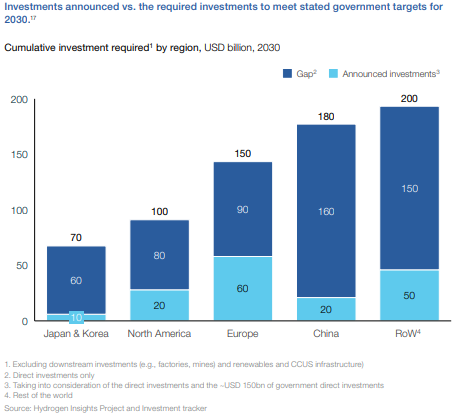

The hydrogen council chart below drags us away from 2050 and back to the more concerning near-term goals of 2030. The chart shows a significant gap in the current planned spend for hydrogen by region and the spending required to move far enough towards 2050 targets. This chart makes assumptions about the share of energy transition that will be met by hydrogen and given that it is the industry producing the chart, it is probably on the high side, but it is inclusive of both blue and green hydrogen. We have serious concerns about these totals being reached in general, but we see the target as completely unreachable without significant blue hydrogen (because of renewable power and electrolyzer capacity limits and we cannot rely on Canada to do all of the “heavy lifting” for blue hydrogen - see company section in today's daily report. The Biden administration may make more progress on emissions if the next order of business was just on CCUS rather than an omnibus bill that included CCUS but which could get held up in negotiations for months if it even gets passed.

Green Hydrogen Plans Look Expensive, Blue Looks Easier

Nov 5, 2021 3:15:29 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, Energy, Air Products, Ammonia, carbon footprint, natural gas, solar, carbon pricing

The US Remains Divided On How To Price Carbon

Nov 3, 2021 1:34:59 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, LNG, CCS, CO2, Energy, Emissions, Carbon Price, carbon credit, renewables, LCFS credit, COP26

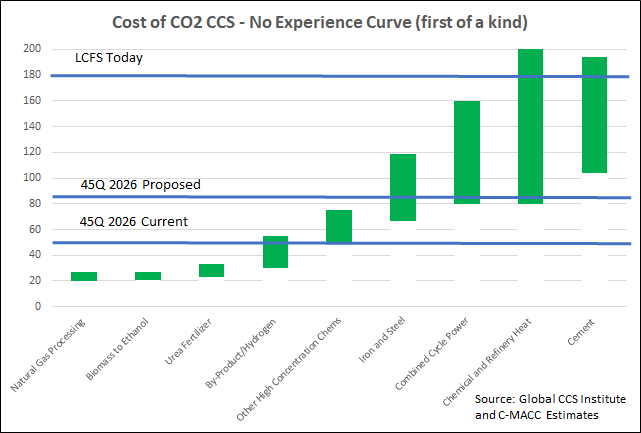

We want to focus today on the headlines around the possible increase in the 45Q CCS credit in the US and discuss the false logic of those that are objecting to it. There is no scenario where the US can move to a lower emissions power and transport profile while avoiding runaway inflation and social disorder without the continued use of fossil fuel-based power and transportation fuels for decades. The reliance on these fuels should and will decline over the years, but it is unreasonable to expect a transition that causes it to stop overnight. In the meantime, CCS is a mechanism that would allow fossil fuels to play a part with a much lower emissions footprint, and given that the CO2 impact on global warming is cumulative, if we can capture and store several billion tons of CO2 underground over that transition period it should be a good thing. Members of the Sierra Club and others would do well to look at the energy inflation problems in Europe and the move this week to put natural gas and nuclear back in the energy transition mix (too late in our view) because the move to renewables cannot keep pace with demand, which will grow faster as more EVs hit the road. The proposed 45Q credit is shown in the chart below vs. the current credit, the LCFS credit, and estimates of CCS costs.

Net-Zero Goals Need Stronger Action Plans

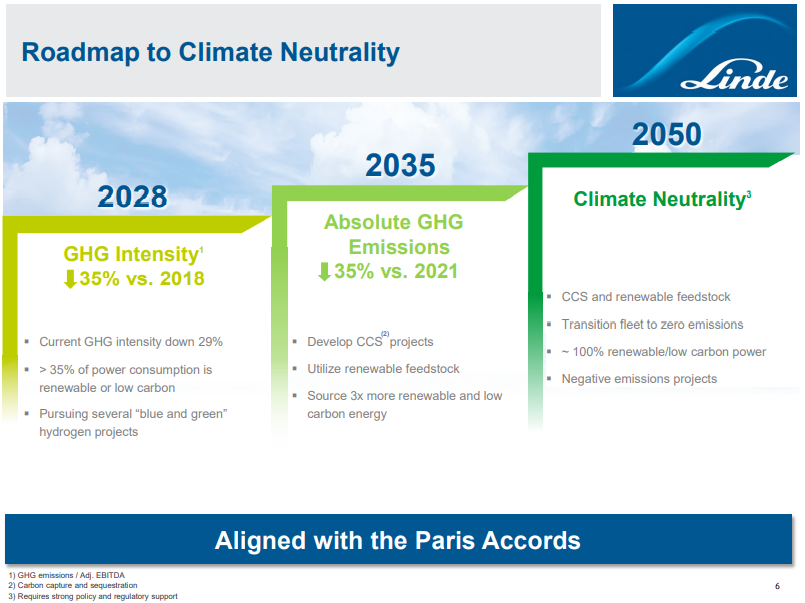

Oct 29, 2021 1:56:53 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, Energy, Air Products, Industrial Gas, LyondellBasell, Net-Zero, Dow, carbon footprint, carbon emissions, climate, COP26, materials, low carbon polyethylene, Linde

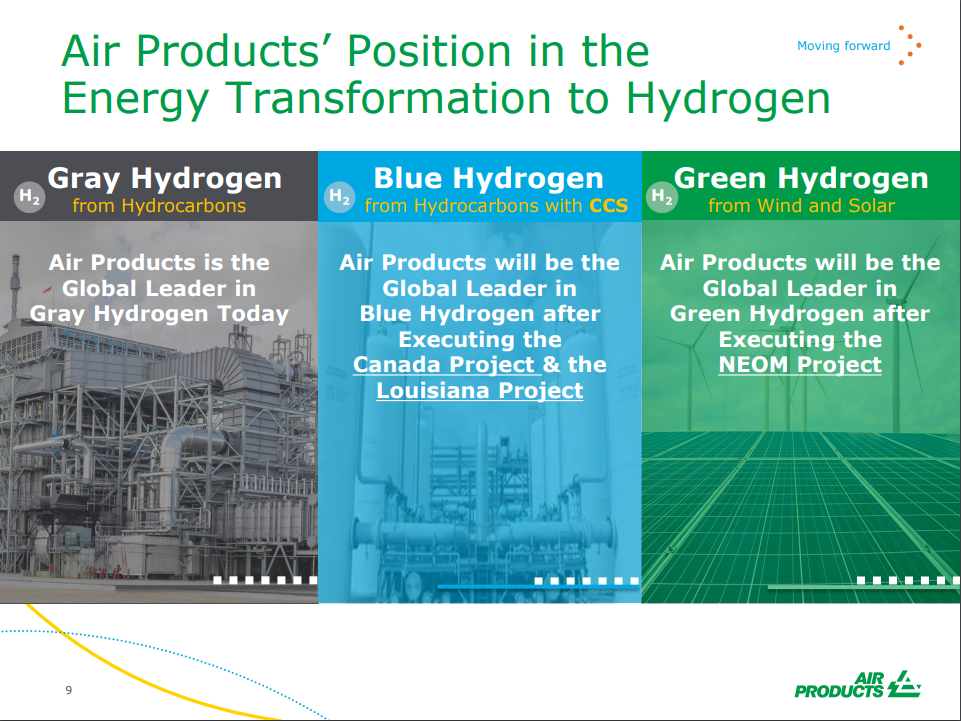

It is interesting to contrast Linde and LyondellBasell with Air Products and Dow. Air Products and Dow have transitioned away from the more generic messaging around broad objectives, and while they still have them, have started talking about concrete plans and spending aimed at lowering carbon emissions. Dow has a project on the books that will lower the emissions of existing capacity while Air Products is talking about greenfield low carbon investments at this point. Many of the commentators and climate activists are calling for concrete plans as opposed to broad objectives and we suspect that most of the narrative will move that way across energy and materials.

Air Products Is Right On Carbon Capture, Washington Needs To Get On Board

Oct 15, 2021 2:42:27 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Blue Hydrogen, Energy, Air Products, Net-Zero, carbon credit, natural gas, EIA, COP26, energy sources

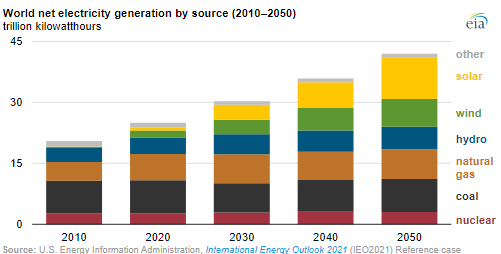

If you look back at our ESG and Climate piece this week (EIA View Suggests Natural Gas & CCS Critical To Net-Zero Goals), you will note that we focused on the recent EIA global energy outlook, and another chart from this outlook is shown below. In the ESG report, we talked about the global need to support increased “clean” natural gas use to offset as much of the coal predictions in the chart as possible and to drive additional hydrogen production to offset some of the petroleum product demand that the EIA still expects to be sued as a transport fuel in 2050. We also called for the broad and warm embrace of CCS so that some of the fossil fuel that the EIA is predicting – especially all of the fuel used for power in the exhibit below. Yesterday Air Products announced not only a large blue hydrogen complex for Louisiana but also the CCS to support it and made a very compelling argument in its presentation for the need for substantial volumes of blue hydrogen – something we fully agree with. We covered the subject in detail in yesterday’s daily. “Blue Is The Color, Hydrogen Is The Game…”

Net-Zero Pledges Remain Well Below What Is Needed: 2030 Particularly Worrying

Oct 13, 2021 12:27:36 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Energy, Net-Zero, fossil fuel, IEA, clean energy, COP26, Climate Goals, energy technologies

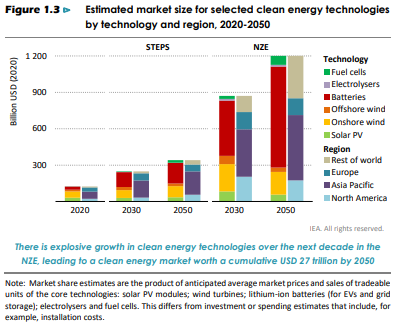

The IEA chart in the exhibit below is another stark reminder of how far away stated policies for clean energy are from what will be needed, and the 2030 gap is the most significant in our view as there is little time to correct it. The IEA has presented several studies over the last year that presents a series of “straw men” examples around how the World and, most recently China, might meet their respective net-zero targets, and the chart below is intended to show how far adrift we are, comparing what is needed to what has been stated. As we have mentioned a couple of times, it would be unusual for companies and countries to have firm plans for 2050 that sum to what the IEA is looking for as there are new technologies under development and the incentive/penalty landscape is still uncoordinated and very unclear. The latter is also a problem looking forward to 2030, but closing the gap between the STEPs scenario and the NZE scenario by 2030 looks almost insurmountable today, without a much tougher and more globally coordinated regulatory landscape, which looks unlikely given some of the low expectations for COP26 specifically. Note that how under the Net-Zero scenario discussed by the IEA, fossil fuel would peak by 2025 and compare this with the EIA analysis that we discuss in today's daily report – there is a huge disconnect.

Solar Module Raw Material Costs Reversing Long Term Price Declines

Sep 2, 2021 1:57:21 PM / by Graham Copley posted in ESG, Renewable Power, Energy, Raw Materials, raw materials inflation, solar, renewable energy, renewable investment, solar energy, solar module

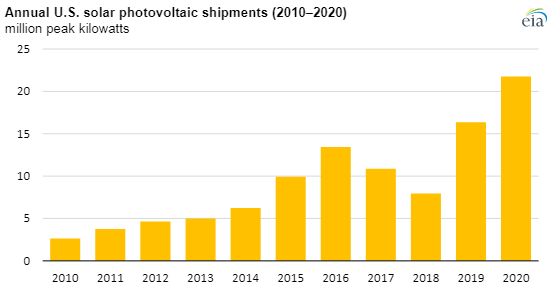

In our ESG and climate piece yesterday we discussed rising costs of climate-related actions, with a focus on some of the likely inflation in renewable power costs. The optimists are looking at the Exhibit below, and what were falling module costs through 2020, and concluding that solar installations can grow and that costs can still fall. While the module shipment growth in 2020 was impressive at 33%, some of the forecasts of what will be needed call for a much more dramatic rate of module growth than we saw in 2020.

Economics Have Driven US Emission Reductions More Than Policy

Jul 27, 2021 2:01:49 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Coal, CO2, Renewable Power, Energy, Emissions, natural gas, EV, clean power investments, power sector

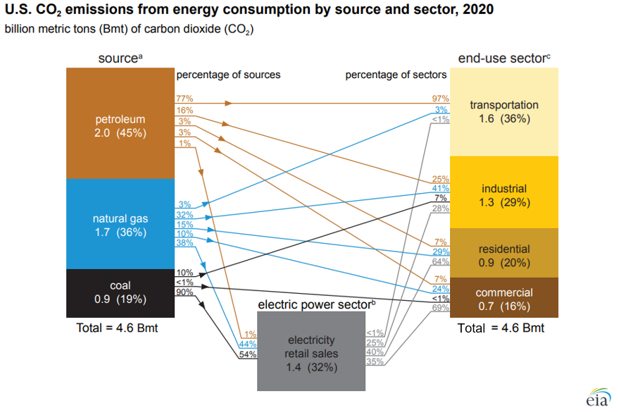

We are increasingly concerned that the US will remain a laggard concerning climate change initiatives given the major challenges of moving to the next steps and the bifurcated congressional views. The emissions reductions that the US has seen over the last 10 years have been more happenstance than planning, with the abundance of natural gas following the shale boom of the last decade creating economic reasons to replace coal-fired power with natural gas rather than environmental reasons. Lower costs for wind and solar power and focused industrial demand for that clean power have been the bigger driver of clean power investments. In the chart below, the decline in emission from the power sector is evident and it should continue. The diagram below shows sources and uses for US emissions in 2020, but the accompanying write-up talks about the step down in emissions overall in 2020. Except for the continuing electric power transition, most of the other 2020 declines are COVID-related and are expected to rebound in the near term, especially transport. The market share gains of EVs are not significant enough yet to make a difference. See more in today's daily report.

Friday Question: What Is Next For Oil? Help Us Write Our Next Report!

May 28, 2021 1:50:42 PM / by Graham Copley posted in Oil Industry, Energy, Emissions, Shell, Oil

We talked about the Dutch ruling against Shell in yesterday's report and the latest refinery sale in the US is another indication of one of the risks of unilateral court-based decisions. Shell could easily get to lower emissions by divesting assets, as can anyone else with a medium-term emission target on the books. We have written previously about the possibility of an energy equivalent of the “bad bank” structure that was set up during the financial crisis, where emissions challenged assets are divested into either private entities or public holding companies that have mandates to improve excessive emission pools but also have significant cash flows and pay investors to wait.