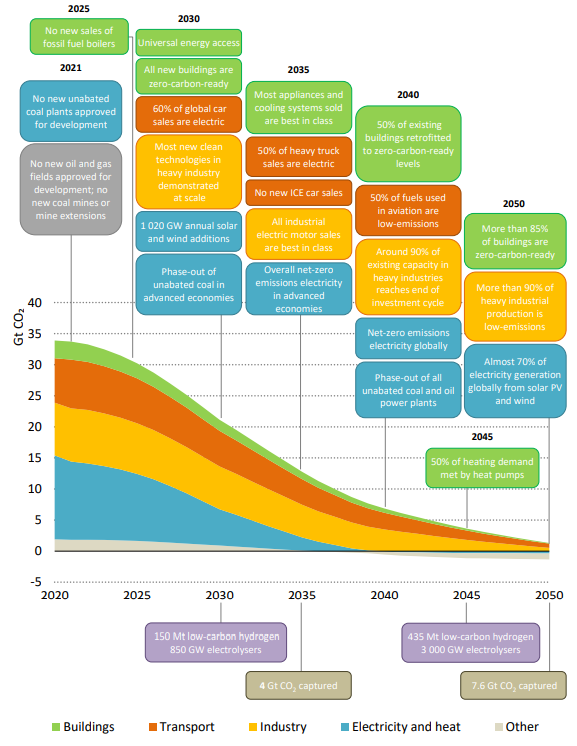

There is an unusual number of interesting topics in today's report, versus the normal mix of small pet projects or broad and unsubstantiated announcements. The EU 2030 targets are worth highlighting and they are in part connected to the central theme of the ESG and climate report that we will publish tomorrow. The European targets are not coordinated with what is happening in the rest of the World and while we admire the ambition, we suspect that the goal is not achievable, simply because the challenges of replacing the power and fossil fuel associated with the emissions to be avoided are too great, given the timeline. The level of additional renewable power generation, EV adoption, and hydrogen production needed to offset so much CO2 are extremely high, and it will be hard to get substantially more CCS offset than already announced because of land rights issues in Europe and logistics. To get the power, EV, and hydrogen, the EU will be competing with other regions that have their own targets and we see scare resources bidding up the price of power, impacting all of the elements, power itself, the cost of running EVs (see the chart below – the EV story does not work of you are using coal as a marginal source of power), and the cost of hydrogen.

Bold Climate Initiatives Will Need Equally Bold Incentives & Some Economic Logic

Jun 29, 2021 12:59:46 PM / by Graham Copley posted in ESG, Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Net-Zero, fossil fuel, bp, natural gas, EV

Solar: A Clear Example Of Potential Renewable Energy Inflation

Jun 17, 2021 1:32:30 PM / by Graham Copley posted in ESG, Hydrogen, Biofuels, Polymers, ESG Investing, Electric Vehicles, Raw Materials, LyondellBasell, Inflation, Gevo, solar, polysilicon, Wacker, copper, silver, Aemetis, renewable energy

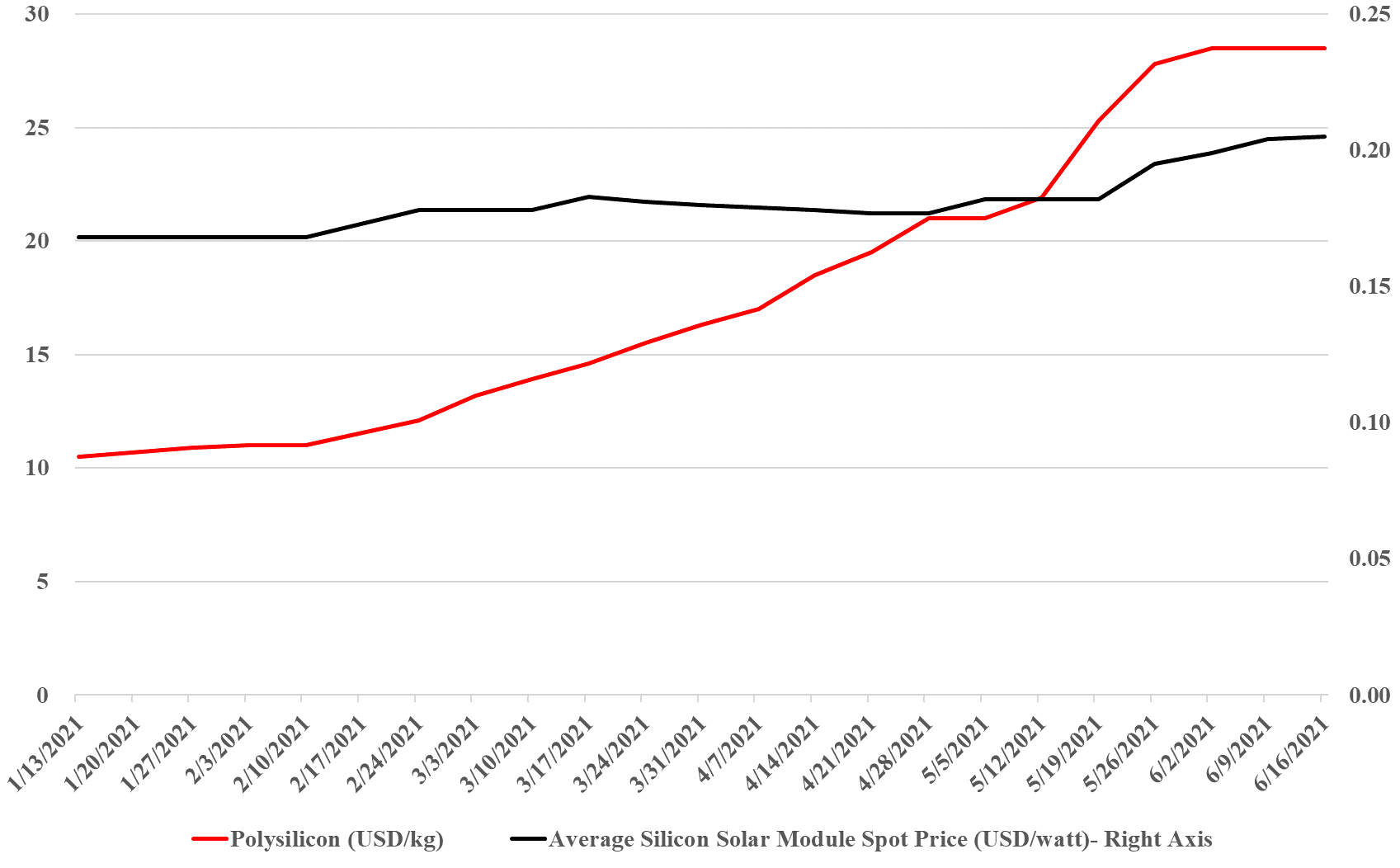

The exhibit below summarizes well one of the primary concerns that we have with some of the very ambitious goals for decarbonizing power grids, EV introduction, the further electrification of industry, and hydrogen. While the solar module price increase does not look that significant (yet), to put it in context, solar module prices have collapsed from over $1.80 per watt in 2010 to below $0.20 in 2020, and many of the expectations around cheap hydrogen require the cost to keep falling. The bigger concern is the polysilicon price, which is up 160% this year, good for the polysilicon producers like Wacker (see the headline here), but bad for the solar module producers, who are seeing major margin squeezes, especially given the rise in copper and silver as well this year. The raw material pressure should drive further increases in solar module pricing and while the higher margins for polysilicon will likely drive expansion investment, the metals are harder to call, given the ESG views on mining. We remain firmly of the view that raw material availability and price inflation, as well as module and wind turbine manufacturing capacity, will be the rate-determining constraint in terms of the growth in renewable power and this is why we question all of the near-term cheap power and cheap hydrogen goals that are being suggested by potential producers and government agencies.

We Need To Be More Inventive On Carbon Values In The US

Jun 16, 2021 2:00:36 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, CO2, Emissions, carbon credit, carbon abatement

In our ESG and Climate report published today we focus on hydrogen and what we believe are some unrealistic cost/timing estimates for green hydrogen. One of our concerns is that the hope of cheap green hydrogen, and absent any other strong incentives, will put the brakes on other carbon abatement initiatives and if the cost of hydrogen does not fall we could reach 2030 having made little progress on any front.

Some ESG Related Spending Is Less Risky Than Others

Jun 15, 2021 1:53:08 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Sustainability, Renewable Power, ESG Investing, Auto Industry, fossil fuel, carbon abatement, Power Industry, EBITDA, US Government

The WSJ article linked talking about rising ESG spending and the risks associated with it is in no way inconsistent with our view that lack of US Government guidelines is constraining ESG spending. The article focuses on the power and auto industries, which, while they face regulatory and incentive uncertainty, have a much clearer path than many others. The power industry is dealing with a customer which is increasingly asking for more renewable power, an investor base that is pushing for less reliance on fossil fuels, and a Government that is pushing for a 50% emissions reduction from the sector. The auto suppliers have clear directives from some US states and some countries about the phasing out of fossil fuel-based vehicle sales, and in some geographies, they have incentive systems that they can tap into. For both industries, there is a significant risk, in that the billions of dollars that they are investing in new plants and new equipment do not come with any guarantees that those investments will pay off well or quickly, but at least the direction of travel is unlikely to change. In other words, there will be demand for their products and investors will likely be happy with the progress – while they might not get the EBITDA they would like, they may get a better multiple of that EBITDA.

Could DoE Ambitious Hydrogen Plans Have Unintended Consequences?

Jun 11, 2021 1:17:40 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Electric Vehicles, Materials Inflation, Emission Goals, Net-Zero, Ammonia, carbon footprint, natural gas, R&D, capital cost, Praxair, DoE, production cost

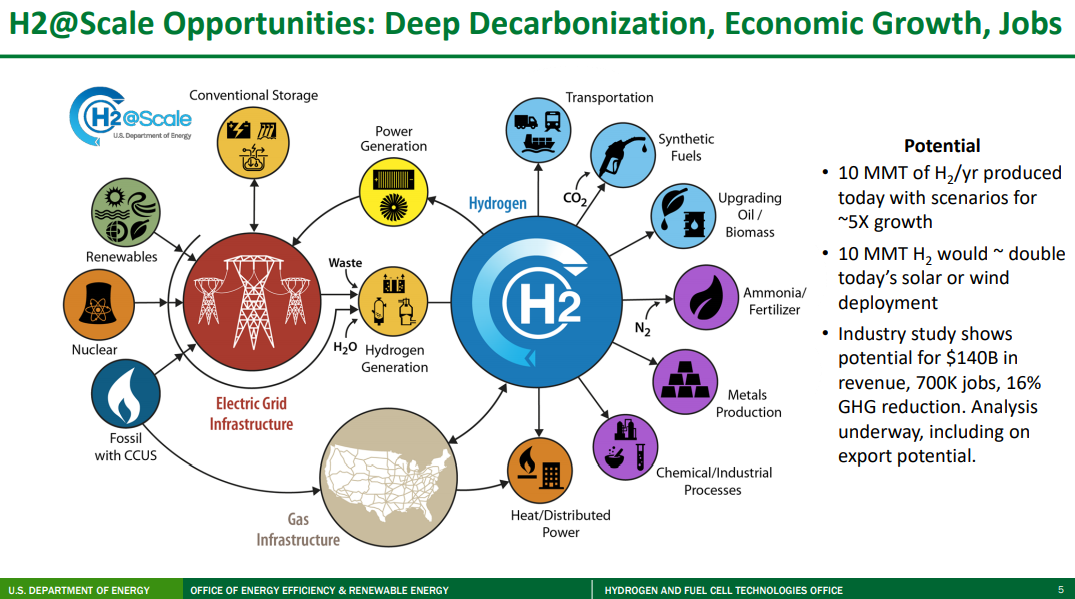

We will cover the very comprehensive DoE hydrogen work in more detail in the ESG report next week, but a couple of the charts from that work are worth mentioning today. The first picture below accurately depicts all of the potential uses of hydrogen and shows that over time it could solve a lot of “hard to solve” CO2 emission problems, especially where electricity cannot do the job efficiently. The reason why so many countries and companies are so interested in hydrogen is because of its potential versatility and because of its minimal carbon footprint (there is some carbon leakage in the full lifecycle of the production coming from construction around the plants themselves and infrastructure to use the hydrogen).

Government Indecision Is Driving A Lack Of Climate Related Investment

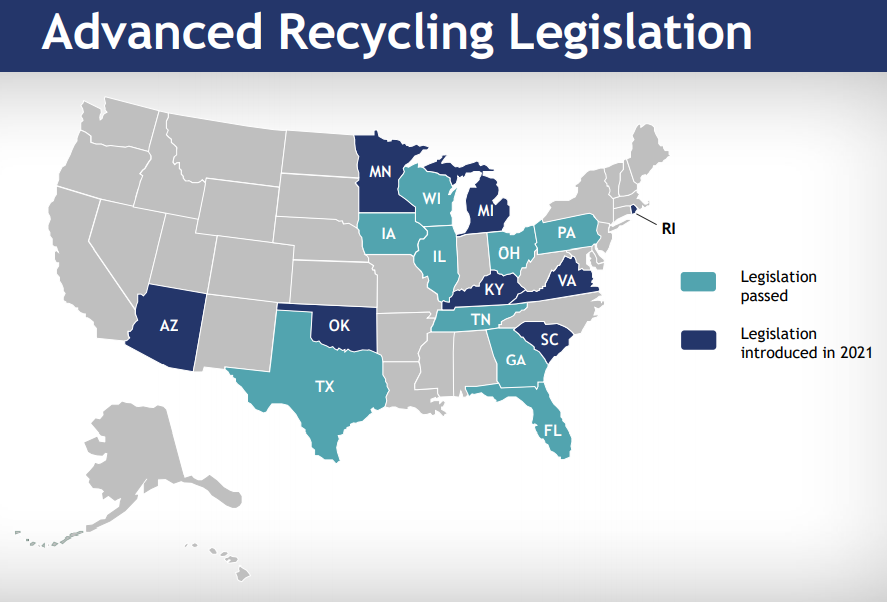

Jun 9, 2021 1:28:47 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Sustainability, Chemical Industry, Net-Zero, carbon credit, government guidance, plastics waste

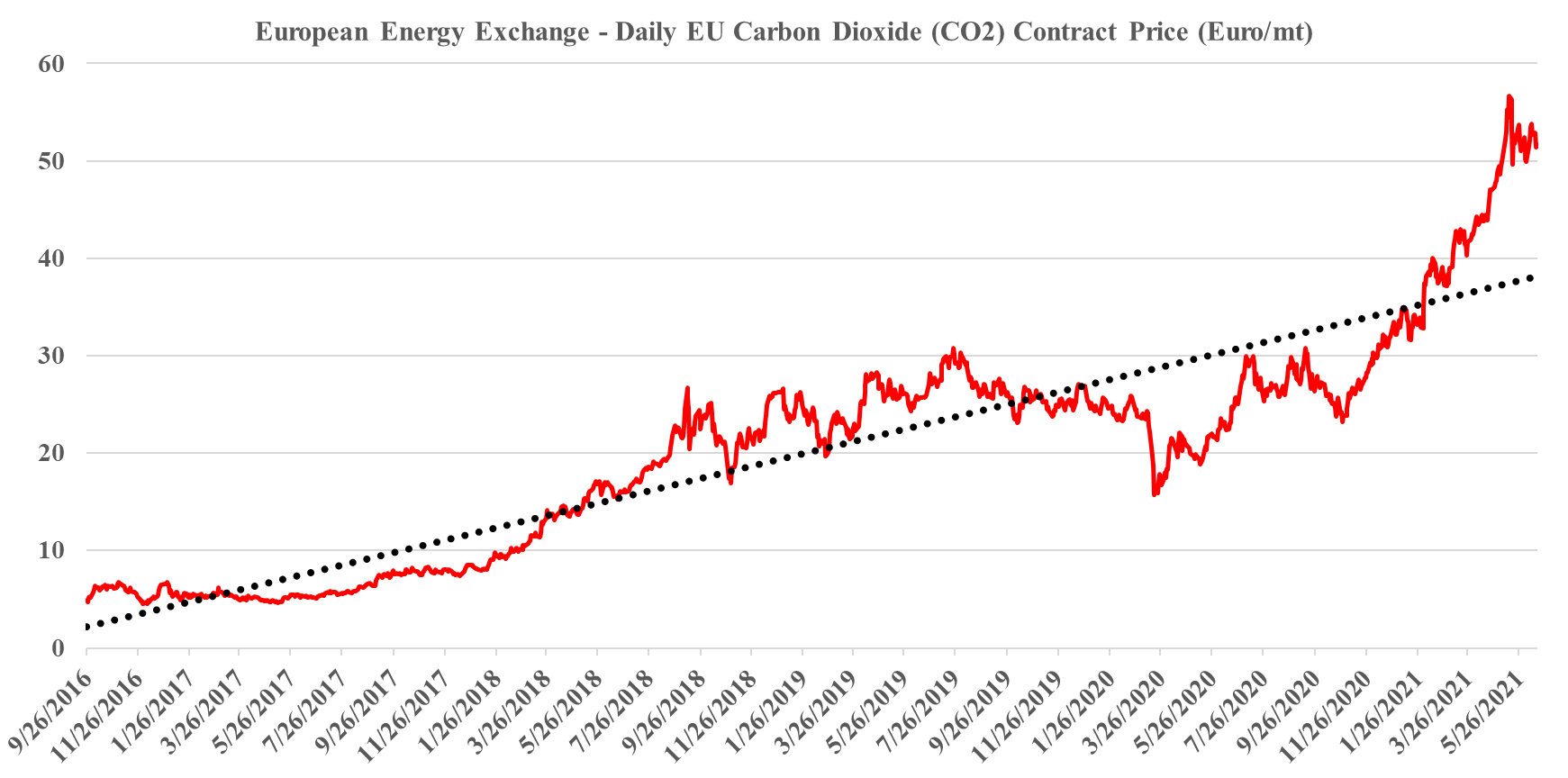

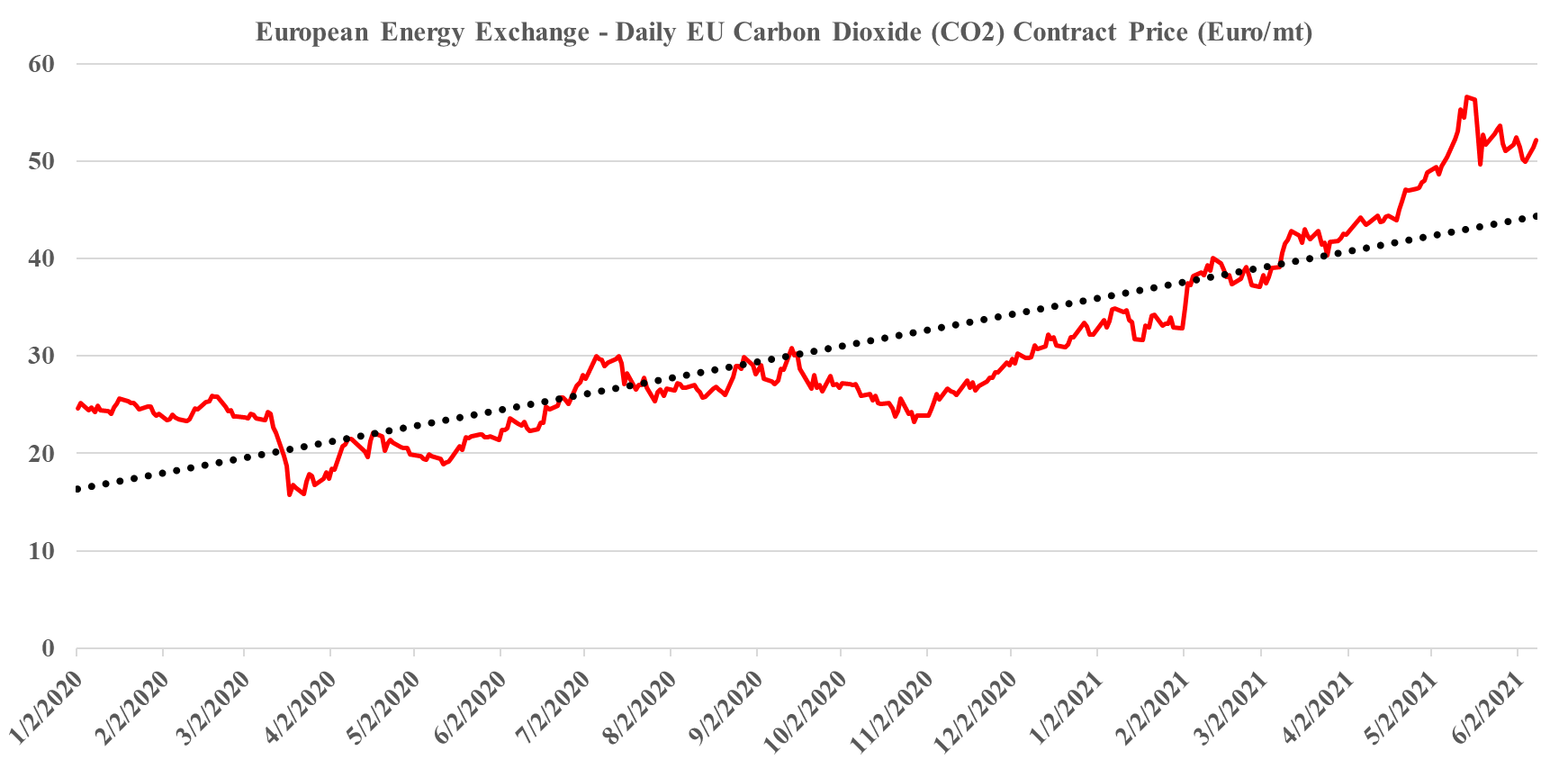

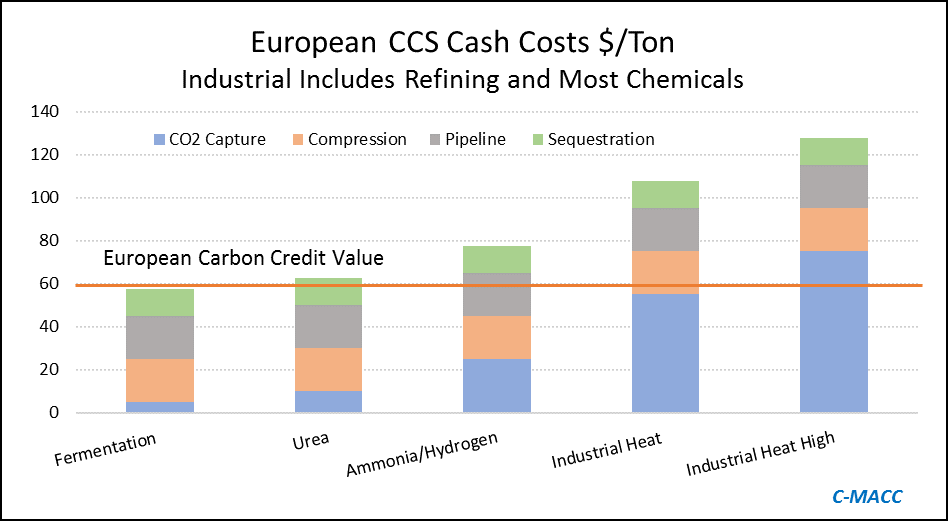

Whether it is carbon capture, hydrogen investments (blue versus green or just in general), plastics waste, or any other aspect of the drive to greater sustainability and net-zero emissions, everyone is looking for a “playbook”; a set of rules that allow for more effective and less risky decision making. The headline linked that talks about the chemical industry needing governments to take more action is another such example. Companies facing increasing shareholder pressure to make change are not only looking for government guidance and possible incentives but they are also not wanting to second guess what any regulatory move might be. No one wants to make a significant capital decision if there is a risk that a government policy shift will make it the wrong move. The European carbon credit price – shown below is at least a framework that many European companies can use to value possible decisions – even if some European companies and countries are moving at different paces than others in terms of emission and hydrogen mandates. The price is tangible and its mechanism for calculation should also allow companies to forecast how it might change. Europe is also working on a plastic waste tax – this would give a stronger economic framework to push improved recycling.

Source: Bloomberg, C-MACC Analysis, June 2021

More From The IEA; Expensive Hydrogen & Carbon Capture

May 19, 2021 1:44:48 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Green Hydrogen, CCS, Blue Hydrogen, Inflation, IEA, Ammonia

We discussed the IEA report yesterday at some length, but in such a comprehensive report we missed a couple of things that are probably worth noting today. See more in our ESG Report today.

Another Expensive CCS Project With Limited Capacity

May 11, 2021 11:39:27 AM / by Graham Copley posted in Hydrogen, Chemicals, Carbon Capture, Climate Change, CCS, Emissions, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Gulf Coast Sequestration, Emission Goals

The big news of the day is the massive grant that the Dutch government approved yesterday for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be focused within the Port of Rotterdam, where both of the oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the 2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $60 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs –see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir).

Source: Global CCS Institute, C-MACC Analysis, 2021

This is another example of a grossly inflated project, in terms of costs and while it may be the best option for the Port of Rotterdam we would make the following observations.

- It will consume a fraction of the CO2 in the local area

- It might give the Dutch operators a competitive edge over other European companies – either because they can produce low carbon fuel or hydrogen or other chemicals (which may get a premium price), or because they avoid paying the carbon prices. This may cause issues within the EU

- It might artificially lower the European carbon price by creating (subsidized) credits – if this project and other government-backed projects (the UK and Scandinavia so far) overwhelm the credit market, they may depress carbon values and discourage other moves to lower CO2 footprints

- Note that we expect a potential fly up in European carbon prices near-to-medium-term, and these mega-projects will not come into operation for a couple of years

- Like the ExxonMobil proposal for Houston, the implied cost per sequestered ton of CO2 is extremely high and while it might reflect problems with land rights, pipeline “right of ways” and other constraints specific to The Netherlands, it is multiples of the cost that we would expect US for on-shore sequestration and we would encourage all to check out the plans (currently with the EPA) that Gulf Coast Sequestration has in Louisiana.

Embracing Different Ways of Achieving Emission Goals

May 7, 2021 1:19:47 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Recycling, CO2, Renewable Power, Emissions, Carbon Neutral

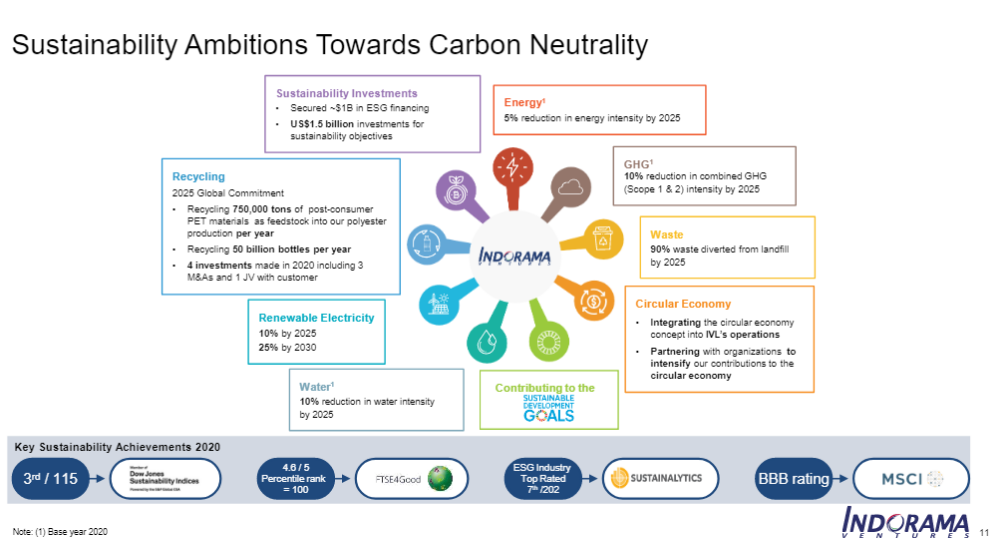

The headlines in today's daily report are interesting as they discuss a large number of different initiatives in recycling, carbon use, and capture, routes to hydrogen, etc. Each initiative is small, but the collective news is encouraging as it suggests that the mood might be changing from one which focuses on only a handful of tools to meet emission goals – which in turn are already helping to driven materials inflation - to a much broader approach that recognizes, or at least beings to recognize, that we need to try everything. We need to experiment with new approaches to recycling; we need more use for CO2 than simply pushing it all underground (but we must still push a lot underground), and we need to try multiple routes to hydrogen, not just those that need to consume vast amounts of renewable power. We need more partnerships – several listed this week - and we need government support where it can be most effective. The headlines today are far more heterogeneous, which is a good sign. One company's view of the solution is show in the chart below.

Sequestration, Hydrogen, and Another Critique of "Advanced Recycling"

Apr 1, 2021 12:04:55 PM / by Graham Copley posted in ESG, Hydrogen, Recycling, Sequestration

We discussed CCS as a possible enabler for US LNG above and we have noted a substantial increase in stories around CCS plans, projects, etc. since the beginning of the year. But what is missing in the US are actual physical plans – CCS ventures are being formed, like the Aemetis headline below, but they signal intent rather than action. Renewable fuel companies should be very interested in CCS as they can claim the 45Q tax credit for the CO2 sequestered and they can lower the carbon intensity of their fuel by doing so, resulting in a higher LCFS credit also (they are additive). The challenge for many is that the renewable fuel projects are not large and they are often not in locations that have had substantial seismic work done to identify pore spaces. There is also the additional problem of land rights and potential royalty payments – as there would be with an oil or gas find. Most of those who would like to capture carbon and are making statements like the one below have no subsurface experience and will likely need to turn to one of the oil service companies for help.