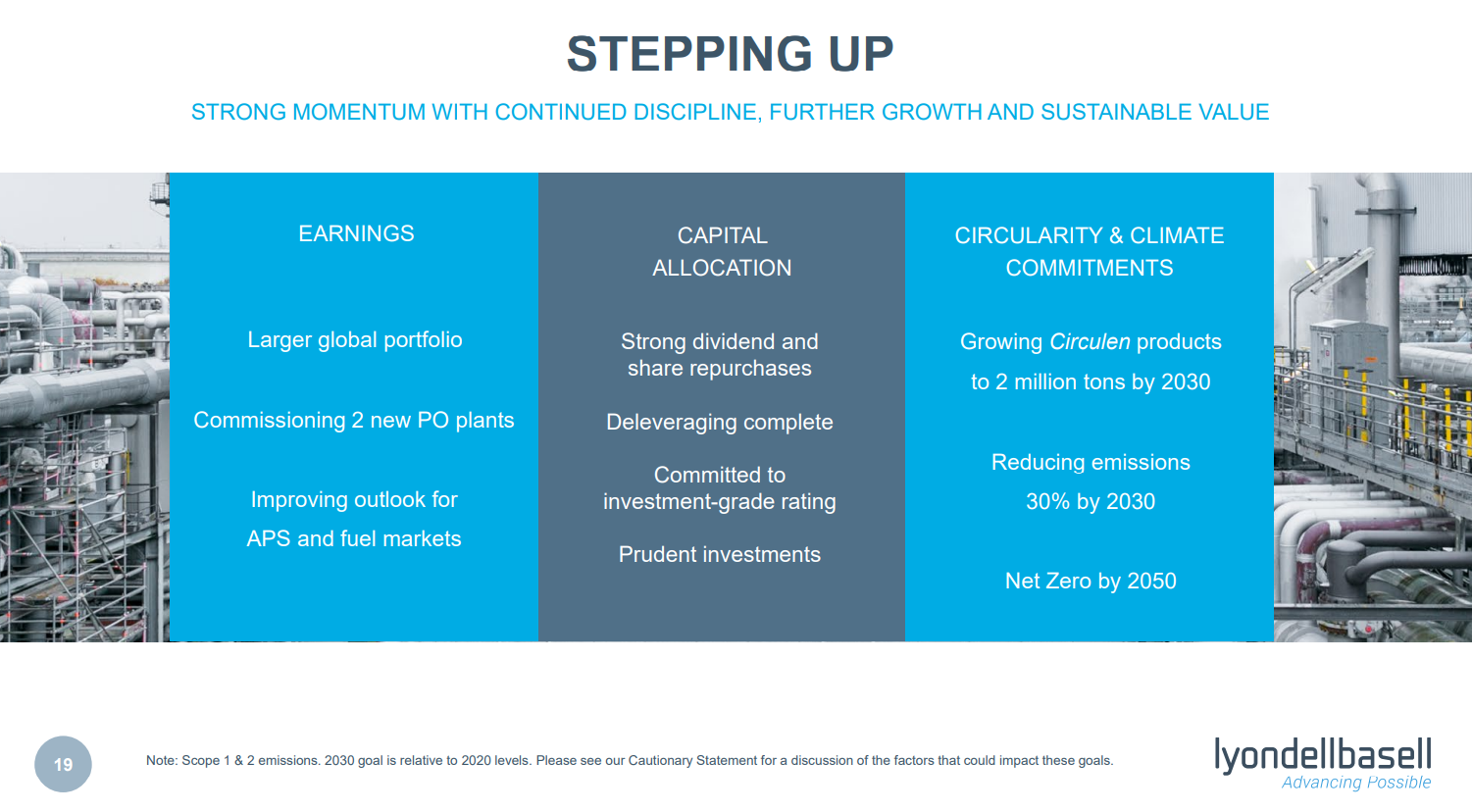

2022 is the year in which the rubber will need to meet the road for many of the chemical and other material and industrial companies who have made 2030 emission pledges. In the Dow release yesterday, the company used the call as an opportunity to remind investors about the Canada investment and tie that into the 2030 emission goals. We note LyondellBasell’s 30% emission reduction goal by 2030 and like others, LyondellBasell will not be able to get there without substantial investment. LyondellBasell and others do not necessarily have to spend in 2022 (neither does Dow), but unless there are some concrete plans by the end of the year stakeholders will likely start to question whether the emission goals are real. We suspect that most companies are trying to work out whether investments in hydrogen (likely blue hydrogen because of the volumes needed) are a better solution than trying to capture CO2 from a natural gas furnace. Any large hydrogen investment with associated CCS will take 5-6 years from concept to production. Like Dow, we would expect others to focus emission-reduction investments in countries/states that have a clear value on CO2. See today's daily report for more.

Emission Pledges Will Need To Become Emission Investments Soon

Jan 28, 2022 3:35:32 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Emission Goals, LyondellBasell, Chemical Industry, Dow, climate, materials, Investments, 2022

Is There A Place For Coal In Energy Transition?

Dec 23, 2021 12:35:22 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Coal, CCS, Blue Hydrogen, Net-Zero, fossil fuel, IEA, carbon footprint, natural gas, energy transition, climate, carbon storage, Climate Goals, material shortages, clean fossil fuel, coal gasification, Build Back Better

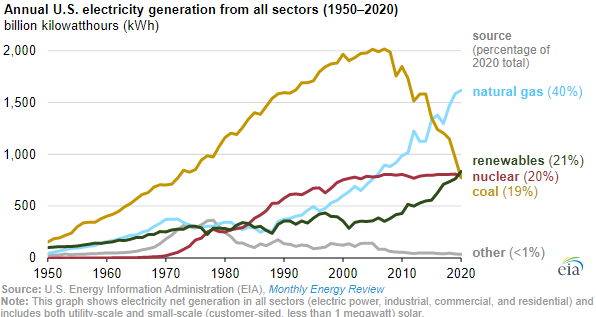

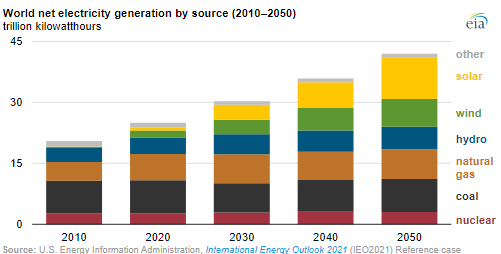

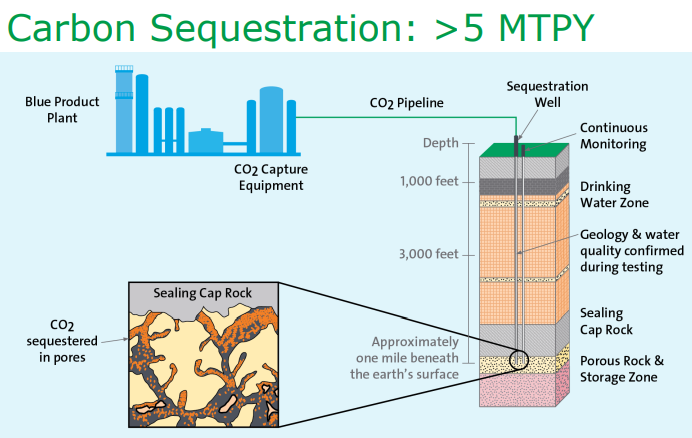

In yesterday's ESG and Climate report, we looked at an extreme example of how the right support for clean fossil fuel use through a long period of energy transition, could create economic growth, support job growth, and not require subsidies – coal gasification to produce low-cost hydrogen. With the opposition to the “Build Back Better” bill, there is a clear opportunity for the fossil fuel industry to step up and suggest compromises, and we are seeing increasing interest in large scale CCS, despite its cost, in part because it is a path that will allow natural gas and other fossil fuels to meet increasing demand in a way that has a much lower carbon footprint, and in part, because it will still be cheaper than some of the heavily subsidized ideas to try and accelerate investments in renewable power that will inevitably fall foul of equipment and material shortages – something we have written about at length in past research – linked here. The EIA has already noted that coal use in 2021 has risen globally and it is likely that it will rise again, given the increasing demand for electric power and the lack of supply elasticity in the renewable power and natural gas-based systems – coal is a large part of the swing capacity these days. Many of the CCS projects proposed for the US are not much more than proposals today, but we are seeing some initial investment to prove that subsurface storage opportunities are feasible.

Carbon Momentum Building

Dec 8, 2021 12:27:25 PM / by Graham Copley posted in ESG, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Carbon, IEA, climate, CCUS, carbon prices, solar capacity, wind capacity, hydrogen capacity

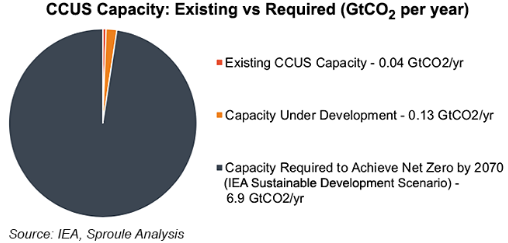

Most of the focus today is on carbon, in part because the CCS momentum is picking up, with more initiatives being announced daily all around the world, and partly because of the surge in European carbon prices as shown in Exhibit 1 from today's daily report. The IEA CCS projections in the Exhibit below, are likely low in our view, despite the significant investment needed to reach the target shown. In our ESG and climate report today we focus on many of the materials supply limitations that will likely emerge as the world tries to add wind and solar capacity at higher and higher rates. Our analysis of the IEA net-zero projections published earlier this year suggested that the IEA might be too ambitious on renewable power and that the balancing effect would likely be increased natural gas use versus its base case and more than forecast CCS. We have a long way to go to get there given the shortfall in the exhibit below, but at the same time, carbon prices are moving to make it happen. The European price has spiked again this week and is now slightly higher than $100 per ton of CO2, a level reached by the UK price late last week. At this level, we should see investments in Europe to abate carbon without additional local subsidies, or with minimal subsidies. The constraint in Europe will be finding inexpensive CCS locations. A $100 carbon price in the US would, in our opinion, drive a very significant investment in the US, not only in CCS capacity but also in new blue and green hydrogen capacity.

More CCS Plans Than Action Until We Get Proper Carbon Pricing

Nov 26, 2021 12:37:02 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, CCS, Blue Hydrogen, CO2, IEA, carbon footprint, tax credit, blue ammonia, climate, CO2 value, chemical companies, carbon pricing, CCUS, Power companies, oil companies, greenfield investment

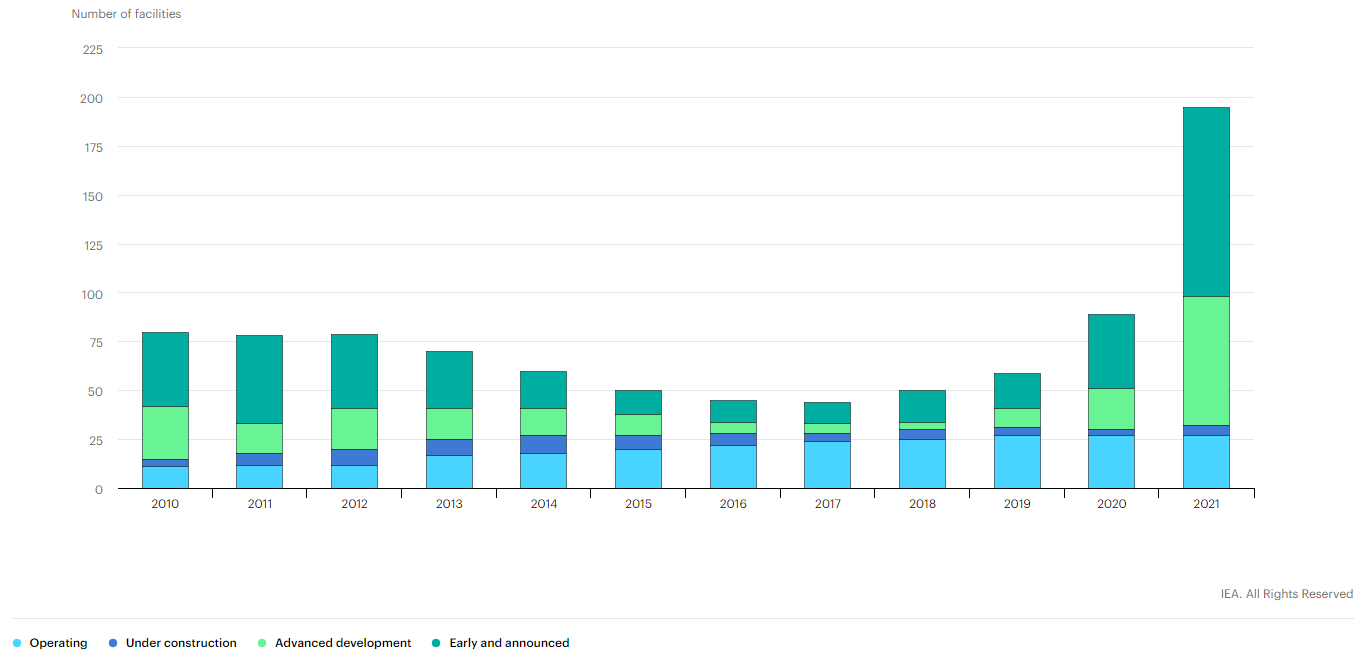

We note the IEA work on CCUS in several charts below and this is good timing relative to our ESG and climate report this week – which focused on carbon pricing, something we believe is necessary to promote more real activity in CCUS. In the Exhibit below, it is important to note how many projects are in “development” rather than operational or under construction. It is also worth noting that the number of projects under construction has not grown since 2019. One of the reasons for this is that increased activity at the planning stage is then followed by a delay associated with permitting, which depending on the region can take 2 plus years. The other constraint is uncertainty, with many of the projects under consideration waiting for something to change, either local values of CO2 or mandates or direct government support. For example, the large project planned for Houston and championed by several oil, power, and chemical companies is unlikely to move forward without a higher tax credit for CO2 sequestration or without some other incentive. The mid-West projects targeting the ethanol industry will also need permits, not just for the wells but also for the many hundreds of miles of proposed pipelines.

Global Hydrogen Ambitions Will Fail Without CCS: The US Needs A Plan

Nov 11, 2021 1:36:40 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Green Hydrogen, CCS, Blue Hydrogen, Renewable Power, Energy, Emissions, CCUS

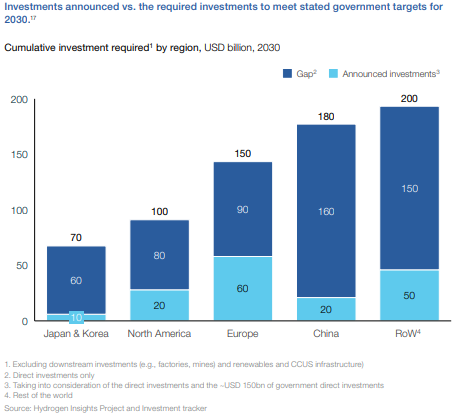

The hydrogen council chart below drags us away from 2050 and back to the more concerning near-term goals of 2030. The chart shows a significant gap in the current planned spend for hydrogen by region and the spending required to move far enough towards 2050 targets. This chart makes assumptions about the share of energy transition that will be met by hydrogen and given that it is the industry producing the chart, it is probably on the high side, but it is inclusive of both blue and green hydrogen. We have serious concerns about these totals being reached in general, but we see the target as completely unreachable without significant blue hydrogen (because of renewable power and electrolyzer capacity limits and we cannot rely on Canada to do all of the “heavy lifting” for blue hydrogen - see company section in today's daily report. The Biden administration may make more progress on emissions if the next order of business was just on CCUS rather than an omnibus bill that included CCUS but which could get held up in negotiations for months if it even gets passed.

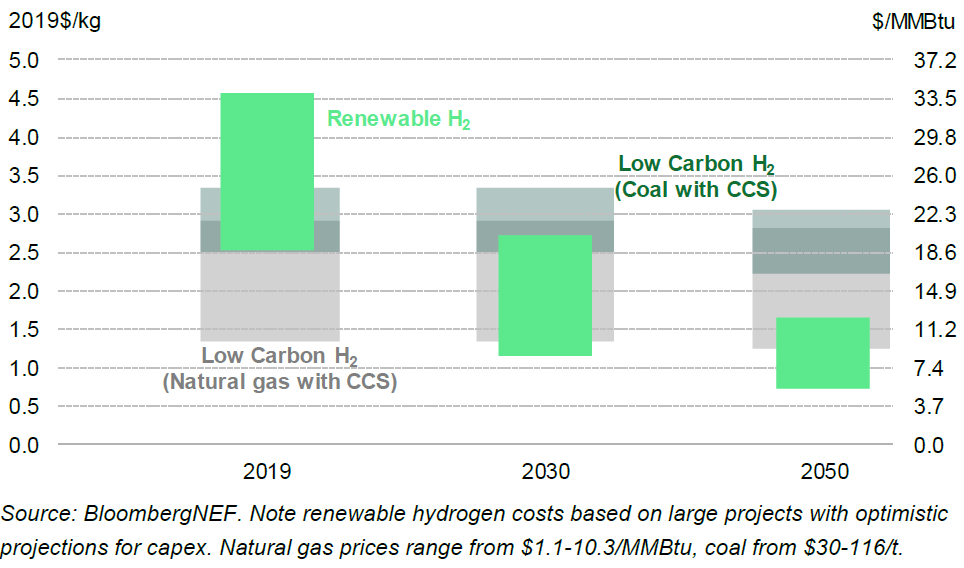

Green Hydrogen Plans Look Expensive, Blue Looks Easier

Nov 5, 2021 3:15:29 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, Energy, Air Products, Ammonia, carbon footprint, natural gas, solar, carbon pricing

Dow And Air Products Have Got The Ball Rolling, But How Fast?

Oct 21, 2021 1:54:22 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Polyethylene, Blue Hydrogen, Air Products, decarbonization, Dow, climate, low carbon polyethylene

The Dow chart below was included in the presentation around the Canada project and repeated today in the earnings call. We have talked about the Canada project at length as well as the more recently announced Air Products blue hydrogen project in the US. The more interesting debate from here is what will happen next. Are Dow’s and Air Product’s phones ringing off the hooks with potential customers saying “we want some of that”, or is it quieter? We suspect that the phones are ringing and ringing a lot. Perhaps because people genuinely want the low carbon polyethylene or hydrogen, but also perhaps because users of polyethylene and hydrogen are likely obligated to find out more so that they can explore both the opportunities of buying from Dow or Air Products, or evaluating what their alternatives might be. We suspect that a surge in genuine customer interest is likely, good for both Dow and Air Products, but also good for others either considering decarbonizing projects or offering a carbon-free alternative already. See our ESG and Climate piece from yesterday for more on this.

Air Products Is Right On Carbon Capture, Washington Needs To Get On Board

Oct 15, 2021 2:42:27 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Blue Hydrogen, Energy, Air Products, Net-Zero, carbon credit, natural gas, EIA, COP26, energy sources

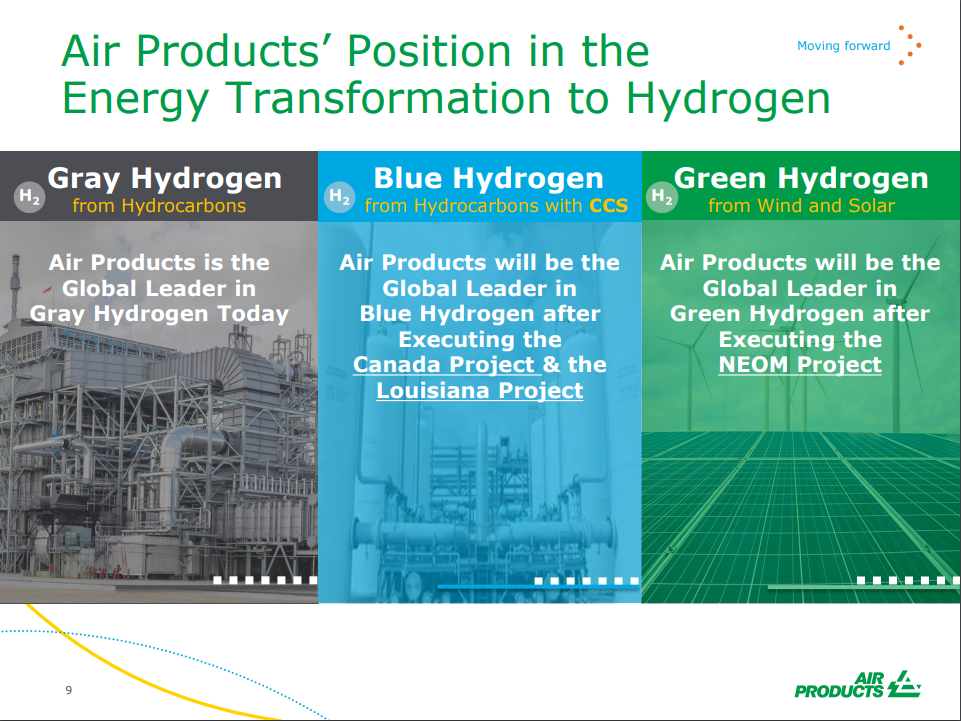

If you look back at our ESG and Climate piece this week (EIA View Suggests Natural Gas & CCS Critical To Net-Zero Goals), you will note that we focused on the recent EIA global energy outlook, and another chart from this outlook is shown below. In the ESG report, we talked about the global need to support increased “clean” natural gas use to offset as much of the coal predictions in the chart as possible and to drive additional hydrogen production to offset some of the petroleum product demand that the EIA still expects to be sued as a transport fuel in 2050. We also called for the broad and warm embrace of CCS so that some of the fossil fuel that the EIA is predicting – especially all of the fuel used for power in the exhibit below. Yesterday Air Products announced not only a large blue hydrogen complex for Louisiana but also the CCS to support it and made a very compelling argument in its presentation for the need for substantial volumes of blue hydrogen – something we fully agree with. We covered the subject in detail in yesterday’s daily. “Blue Is The Color, Hydrogen Is The Game…”

Air Products Claiming The Hydrogen Highground

Oct 14, 2021 3:04:12 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Blue Hydrogen, Air Products, Ammonia, natural gas, carbon values, blue ammonia, Carbon Sequestration

In our ESG piece yesterday we talked about the competitive edge that Canada now has with respect to both natural gas (because of lower prices versus the US) and CCS, both because of relatively low costs but also because of the clear value on carbon. Yet today we see an announcement in the US!

Everyone Wants A Hydrogen Project: Some Strategies Less Risky Than Others

Aug 18, 2021 12:20:35 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Green Hydrogen, CCS, Blue Hydrogen, Renewable Power, Emissions, Ammonia, natural gas, Neom

It is hard to ignore the number of headlines on hydrogen initiatives, today, highlighted in our ESG and climate report, as well as the acceleration in project announcements over the last several months. In the 80s in the UK, it was trendy to drive a VW Golf GTI – everyone had to have one – hydrogen has the same feel today – everyone has to have a project. The projects vary and fall into a handful of categories: