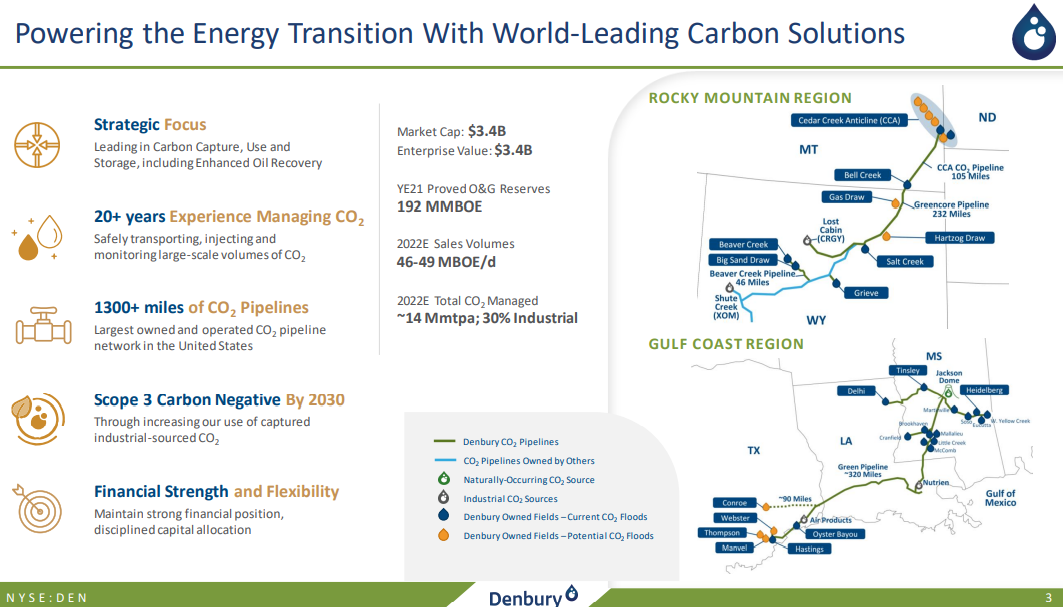

The Denbury release is a great example of something that we discussed in our ESG and Climate piece yesterday. The company is putting stakes in the ground concerning carbon capture and storage but is only really spending on its EOR opportunities, which of course look really interesting today. While the 45Q credit for EOR helps, the main driver is the incremental crude oil volumes that you can pull out of the ground because of the CO2 injection – the higher the price of crude oil the greater the value of EOR. Regardless of the tax credit, the economics of EOR should look very good today and it is not surprising to see several initiatives from Denbury given that it has a lot of existing infrastructure for CO2. The CCS plans are no different than some of the projects we discussed yesterday – they are stakes in the ground – marking territory – but unlikely to move forward without higher incentives. One of the core topics of our report yesterday is whether the conflict in central Europe will turn attention away from energy transition and energy security for tomorrow, because of the acute distraction of both energy and national security today.

Lots Of Carbon Opportunities At The Right Price

Feb 24, 2022 1:42:02 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Energy, energy transition, crude oil, Denbury, EOR, carbon capture and storage

Plenty Of ESG Opportunities In Agriculture

Feb 18, 2022 2:22:18 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, CO2, Climate Goals, CO2 emissions, Agriculture, Deere, machinery, CO2 capture, equipment

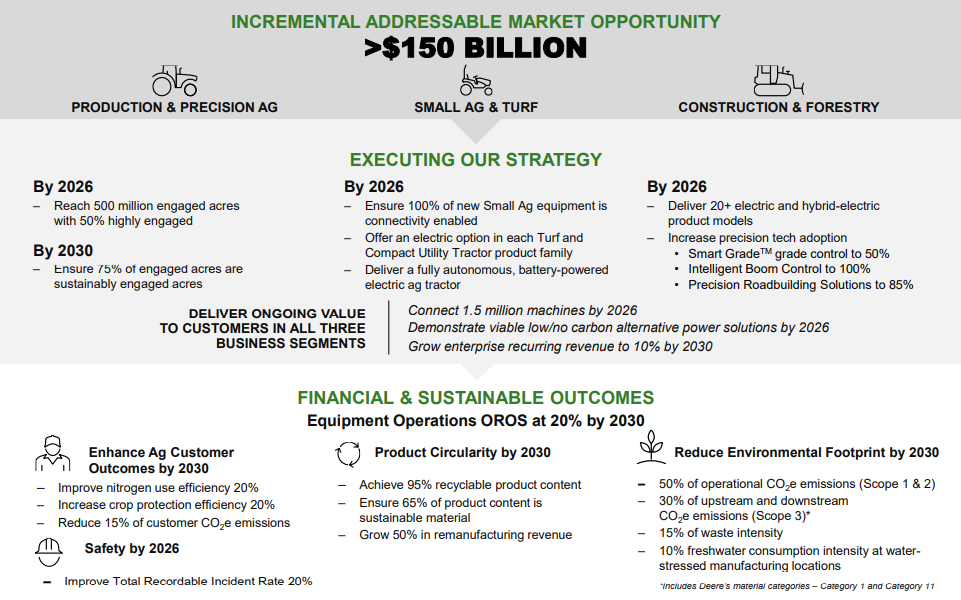

When we highlighted the Ag equipment names as interesting in our daily report earlier in the week, we had not realized that a Deere earnings announcement was imminent. The high farm profitability in the US is giving farmers some freedom with spending at a time when the equipment makers are hitting the market with some exciting new products – especially autonomous machinery – which can save on labor costs. The ESG angle here is further advances in precision agriculture, which can allow for more output for fewer inputs. There is also a very strong push towards low-till and no-till farming (to lower net CO2 emissions or increase CO2 capture) and this is an opportunity for the equipment makers to sell new equipment.

CCS In The US: The Potential Is Significant

Feb 17, 2022 12:55:54 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, CO2, decarbonization, carbon value, urea, CF Industries, Climate Goals, oxygen

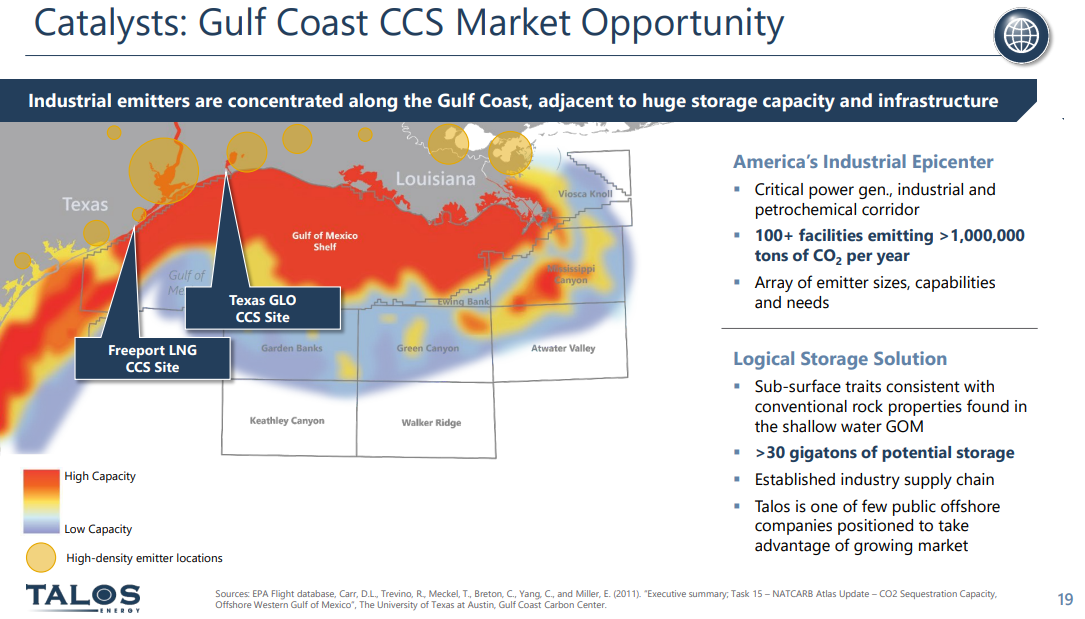

There should be little doubt that the US has a significant opportunity to decarbonize through CCS and if the US has a carbon value close to the level in Europe today we would be seeing investments announced almost weekly. While permitting would cause some significant lead time between announcement and construction/operation, the other uncertainty might be how best to capture the CO2. In its earnings release yesterday, CF talked about purifying CO2 streams at its two large Urea plants on the Gulf Coast, such that the CO2 would be ready to sequester, but the Urea process creates a relatively concentrated stream of CO2 and that makes separation much easier. For others, the better route might be hydrogen investments – driven by the relative ease of capturing the CO2, especially if it is part of the process design. If this route is more economic, the net new investment would be substantial, not just for the SMR, ATR, or fuel cell hydrogen generators, but also for the infrastructure and oxygen capacity for any ATR investment. This seems like a no-brainer bi-partisan opportunity for the US as there is broad support for CCS but incentives need to be higher. For more on this topic see our ESG and Climate research.

Low Cost CCS Could Be A Game Changer For The US

Feb 16, 2022 1:41:38 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Climate Change, Sustainability, Green Hydrogen, CCS, CO2, Sequestration, Ammonia, blue ammonia, CF Industries, crude oil, low carbon, green ammonia, carbon intensity, carbon market

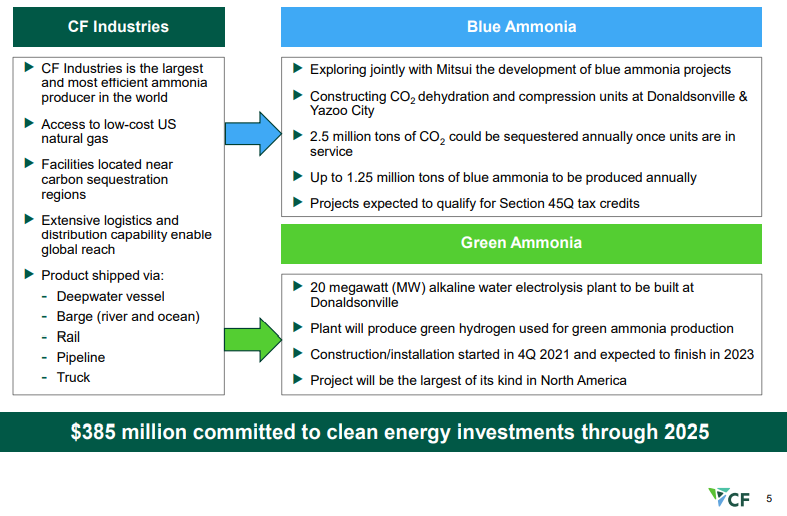

We continue to believe that the US has a cost advantage in CCS versus many of the other regions of the world and that when coupled with low natural gas prices the US should be able to take a lead in developing low carbon chemicals. CF is pushing the idea of both blue ammonia in the US as well as green ammonia, and while the company has yet to announce sequestration plans for the CO2 it is working to purify – see Exhibit - once dehydrated and compressed the incremental cost of storage should be low.

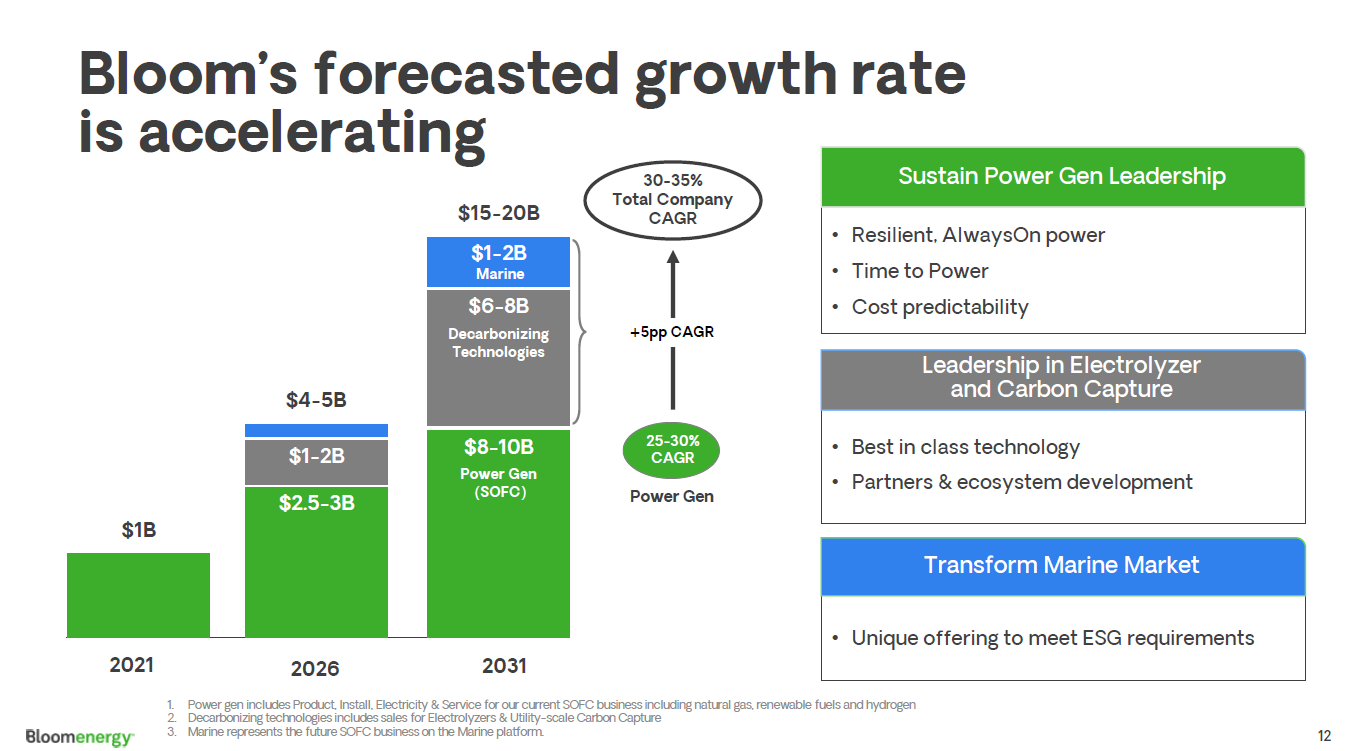

Bloom Energy Could Win If Modular Hydrogen Is Economic

Feb 11, 2022 1:42:42 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, Methane, CCS, Blue Hydrogen, fuel cells, Bloom Energy

There is a lot in the ESG section of today's daily report and we will elaborate more in our ESG and Climate report next week (to be found here). The Bloom Energy results were strong and the modular nature of what Bloom is offering, in our view, should only increase the level of interest going forward. SMR and ATR base blue hydrogen projects are very large, requiring billions of dollars of capital and taking years to construct. The projects are further complicated by the likely need to build dedicated CCS with each unit. The methane fuel cells that Bloom offers are modular and can be much smaller and more incremental from an investment perspective. For blue hydrogen, they will still need CCS, but they offer a lower capital-based route to hydrogen and power today. We can see an opportunity to deploy these units, or something similar, everywhere there is CCS, as either an incremental source of hydrogen and power or a large source. Bloom still has work to do on lowering costs, but much less work than green hydrogen appears to have today, in our view.

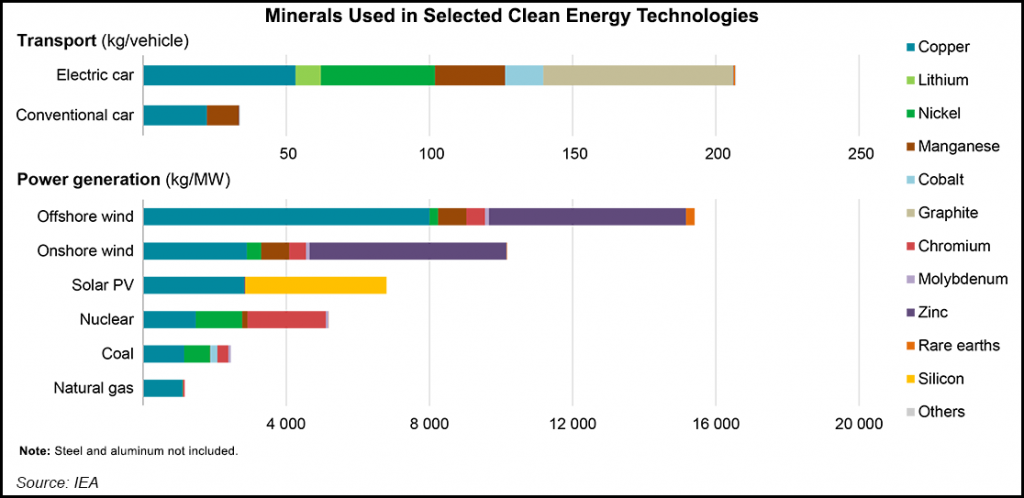

Turbulent Times For The Wind Industry

Feb 4, 2022 1:17:36 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Wind Power, CCS, Renewable Power, natural gas, solar, renewable energy, wind, energy transition, material shortages, wind capacity, onshore wind, price inflation, Siemens Gamesa, logistic issues, offshore wind, solar industry, wind industry

The linked Siemens Gamesa news could not have been a more clear example of one of our key research themes of the last year – backlog up, suggesting strong demand for new wind power capacity – deliveries and profits down because of material shortages – price inflation and logistic issues. While the company is getting squeezed because of higher costs on contracts that have limited opportunity to pass through the cost, at the same time slide 8 of the earnings release deck shows that selling prices rose in fiscal 1Q 2022. This breaks a declining trend in pricing and one of the core assumptions behind many energy transition plans – that renewable power prices can keep falling. Onshore wind orders are falling, but offshore orders are rising – and these come with higher costs and the need for more materials as we showed in a chart in yesterday’s daily. The added costs burden of more offshore wind projects may only serve to tighten markets for materials further, leading to further increases in installed costs.

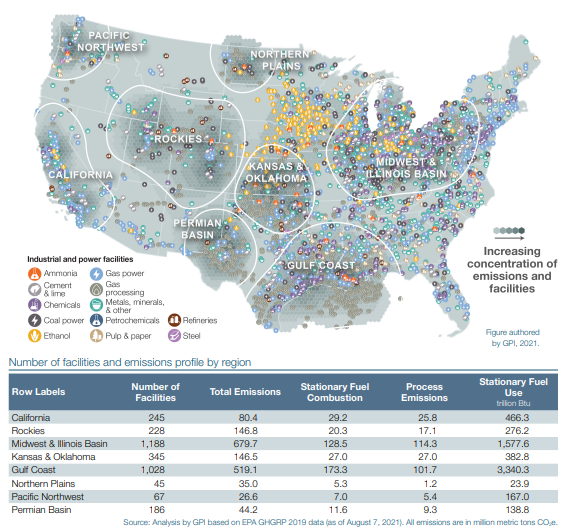

Carbon Capture Plans Advance. US Incentives Remain Inadequate

Feb 2, 2022 12:38:58 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Renewable Power, Emissions, ExxonMobil, Pipeline, natural gas, carbon offsets, direct air capture, carbon offset, climate, DAC, chemical producers, Green Plains Institute

The Green Plains Institute analysis below draws heavily on the EPA emissions data by facility, but correctly, in our view, identifies where CCS makes the most sense in the US. We still struggle with the pipeline distances associated with some of these ideas as CO2 disposal is still a cost for emitters and in any attempt to reduce costs, pipeline distances will be key. We have discussed the opportunity recently for massive blue hydrogen investment (including CCS) to replace industrial heating fuel and this would apply in all of the regions below. Note our conclusions in today’s ESG and Climate report that we expect renewable power installation goals to fall short – requiring more use of natural gas (for power generation or hydrogen production) with accompanying CCS.

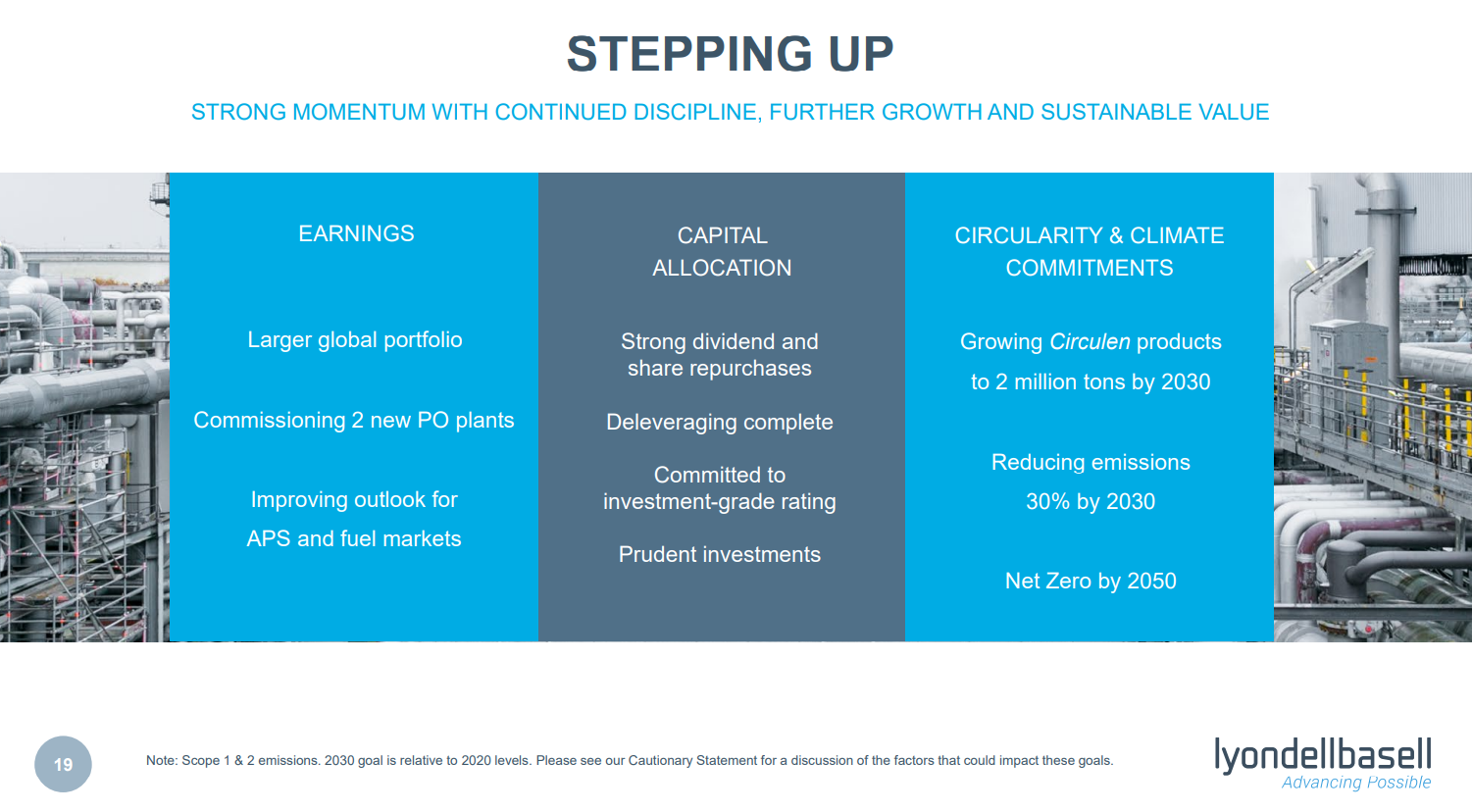

Emission Pledges Will Need To Become Emission Investments Soon

Jan 28, 2022 3:35:32 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Emission Goals, LyondellBasell, Chemical Industry, Dow, climate, materials, Investments, 2022

2022 is the year in which the rubber will need to meet the road for many of the chemical and other material and industrial companies who have made 2030 emission pledges. In the Dow release yesterday, the company used the call as an opportunity to remind investors about the Canada investment and tie that into the 2030 emission goals. We note LyondellBasell’s 30% emission reduction goal by 2030 and like others, LyondellBasell will not be able to get there without substantial investment. LyondellBasell and others do not necessarily have to spend in 2022 (neither does Dow), but unless there are some concrete plans by the end of the year stakeholders will likely start to question whether the emission goals are real. We suspect that most companies are trying to work out whether investments in hydrogen (likely blue hydrogen because of the volumes needed) are a better solution than trying to capture CO2 from a natural gas furnace. Any large hydrogen investment with associated CCS will take 5-6 years from concept to production. Like Dow, we would expect others to focus emission-reduction investments in countries/states that have a clear value on CO2. See today's daily report for more.

Could Cutting Emissions Give ExxonMobil A Competitive Edge?

Jan 19, 2022 2:11:51 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Sustainability, LNG, Plastics, CCS, CO2, Renewable Power, Emissions, ExxonMobil, Net-Zero, carbon abatement, climate, carbon neutral hydrocarbons, Climate Goals

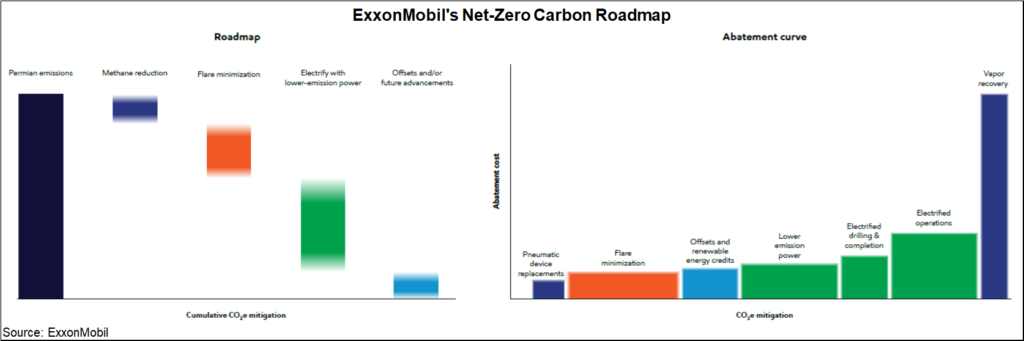

One piece of big news early this week was ExxonMobil’s announcement that it is developing plans that will drive net-zero emissions by 2050 and the company shared a detailed overview. We have picked some charts from the report, some of which can help us draw conclusions for ExxonMobil, but others are more general. The company is banking on a lot of emission reduction and CCS to get to the 2030 target and a large part of the goal is likely to come from the plans for the Permian and the previously stated net-zero target that the company has for 2030 – detail on how this will be achieved is shown in the Exhibit below, see more in today's ESG report.

Carbon Offsets: Definitions Are More Important Than Trading Architecture

Dec 16, 2021 1:51:21 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CO2, Emissions, ESG Investing, carbon credit, carbon offsets, direct air capture, carbon offset, climate, carbon credits, carbon prices

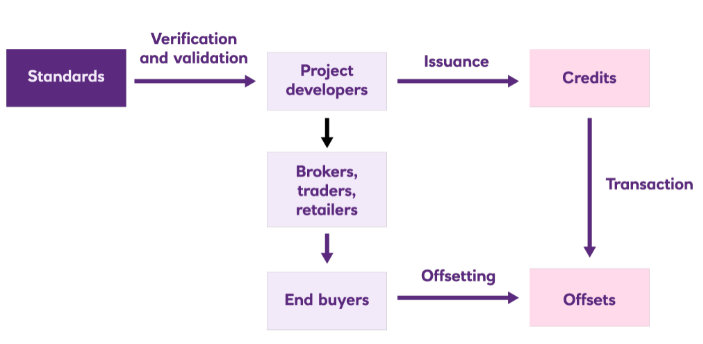

The carbon credit schematic below helps understand the mechanics, but the diagram does not sufficiently emphasize the critical importance of the “Verification and Validation” step. This is a great example of a mechanism that should work logically, but if the input is wrong the output will be also. Potential buyers and sellers of carbon credits understand the process well, but they are more concerned about what goes in the front end as the value of the credit will be very dependent on the quality. Today the only “sure thing” carbon offset is direct air capture, as all of the agriculture-based offsets need much tighter definitions. See research - Carbon Prices – Inequitable and Uncertain – Not What We Need