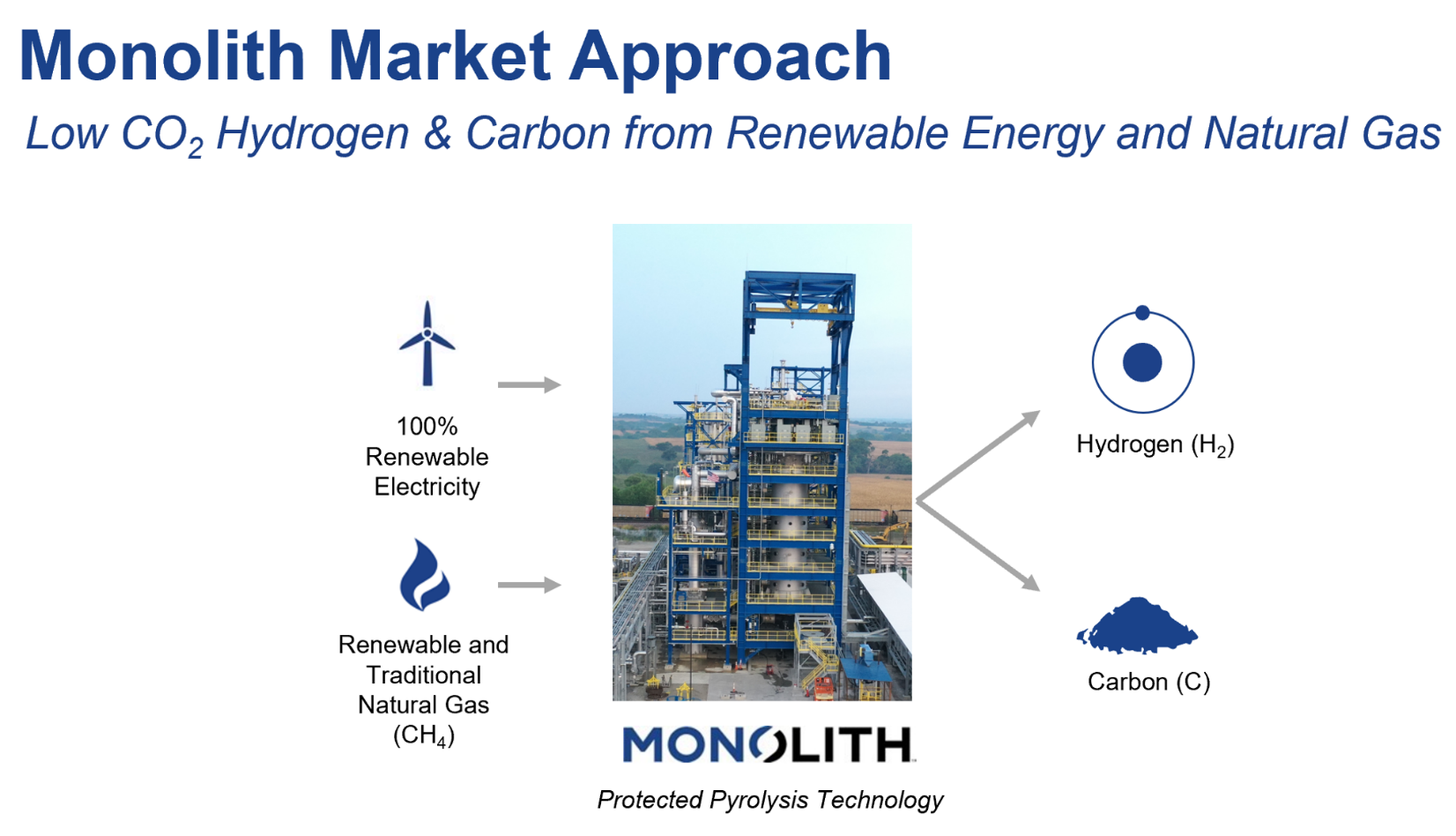

The Monolith announcement is not that surprising, as the auto industry is very focused on its carbon footprint and its suppliers, like Goodyear, are under pressure to look for more sustainable solutions. While Monolith uses natural gas as a feed, it’s carbon black is produced with very limited Scope 1 emissions, unlike the traditional route, used by the incumbents. It is not clear what the production economics are for Monolith because the co-product value of hydrogen could vary greatly depending on local needs, but the emergence of a competitor who sees carbon black potentially as a by-product is not likely to be good news for the traditional makers. A by-product that is more environmentally friendly is even more of a threat. Complicating the picture further could be the arrival of larger volume production from Origin Materials, which has a renewable based carbon black like material, which may also be seen as a by-product.

Carbon Black: By-Product Economics Pose A Threat To Incumbents

Dec 10, 2021 12:03:28 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, Carbon Black, Emissions, Renewable Sources, carbon footprint, natural gas, climate, Environment, Origin Materials, sustainable solutions, Monolith, natural gas feed, manufacturers, by-product

Different Net Zero Target Dates Will Create Competitive Risks

Dec 9, 2021 2:07:56 PM / by Graham Copley posted in ESG, Sustainability, LNG, CCS, CO2, Carbon, Emissions, Carbon Price, Carbon Neutral, Net-Zero, China, climate, CO2 footprint, Climate Goals

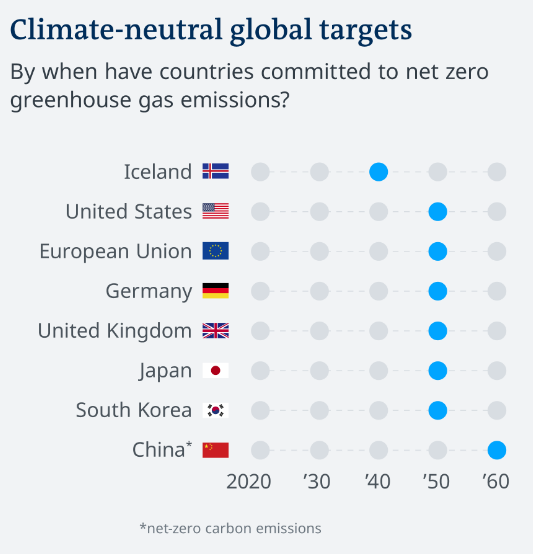

When China announced its 2060 net-zero goals we dedicated one of our ESG and Climate pieces to the topic - China: A Challenge With 2060 Goal But Also A Possible Edge - concluding that this would likely drive considerable competitive advantage for China assuming that others would bear the costs of new technology learning curves and China would get the solutions more cheaply. In interim China would have lower costs of manufacturing because of the delayed net-zero implementation. With the Biden administration now pushing for a coordinated 2050 commitment for the US, some of the burdens of early costs that China could benefit from also fall on the US. In one of the headlines (from today's report), there is criticism of the European CBAM and questions around whether it could work. The reality is that it, or something like it, has to work, otherwise asymmetric climate policies will create pockets of competitive advantage - potentially very damaging to those spending more.

Carbon Momentum Building

Dec 8, 2021 12:27:25 PM / by Graham Copley posted in ESG, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Carbon, IEA, climate, CCUS, carbon prices, solar capacity, wind capacity, hydrogen capacity

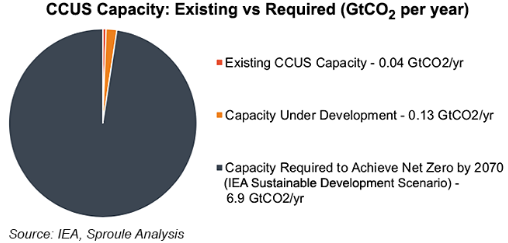

Most of the focus today is on carbon, in part because the CCS momentum is picking up, with more initiatives being announced daily all around the world, and partly because of the surge in European carbon prices as shown in Exhibit 1 from today's daily report. The IEA CCS projections in the Exhibit below, are likely low in our view, despite the significant investment needed to reach the target shown. In our ESG and climate report today we focus on many of the materials supply limitations that will likely emerge as the world tries to add wind and solar capacity at higher and higher rates. Our analysis of the IEA net-zero projections published earlier this year suggested that the IEA might be too ambitious on renewable power and that the balancing effect would likely be increased natural gas use versus its base case and more than forecast CCS. We have a long way to go to get there given the shortfall in the exhibit below, but at the same time, carbon prices are moving to make it happen. The European price has spiked again this week and is now slightly higher than $100 per ton of CO2, a level reached by the UK price late last week. At this level, we should see investments in Europe to abate carbon without additional local subsidies, or with minimal subsidies. The constraint in Europe will be finding inexpensive CCS locations. A $100 carbon price in the US would, in our opinion, drive a very significant investment in the US, not only in CCS capacity but also in new blue and green hydrogen capacity.

CCS Can't Afford Long Pipelines

Dec 2, 2021 2:20:56 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Emissions, Carbon Price, Net-Zero, LCFS credit, climate, pipelines, carbon storage, carbon prices

In our ESG and Climate piece yesterday we briefly discussed the mid-west carbon capture projects, questioning their economic viability. Two of the most expensive components of any CCS project are pipelines and compression costs and we cannot see how a long network of pipe in the mid-west to pick up what are essentially small volumes can work economically. These projects are reliant on very high LCFS-like credits, and as we showed in last week’s report, LCFS credits have fallen this year and could fall further. The pipeline right of way issue is another major hurdle and we have seen growing resistance to pipelines of any sort over the last few years. Those who oppose CCS in principle could cripple these mid-west plans simply by co-opting enough land-owners on the path of the proposed pipelines and refusing access. We are supporters of CCS, but have done substantial work on economics and show that the process only begins to make economic sense if the sequestration is close to the emissions. Relying on possible artificially high carbon prices to justify the projects will only lead to pain, assuming the pipeline right of ways can be obtained.

More Evidence To Suggest Material Shortages For Energy Transition

Nov 30, 2021 1:34:42 PM / by Graham Copley posted in ESG, Hydrogen, Coal, CCS, Renewable Power, Energy, hydrocarbons, natural gas, solar, wind, energy transition, energy sources, fossil fuels, nuclear, bioenergy, hydro, geothermal, material shortages

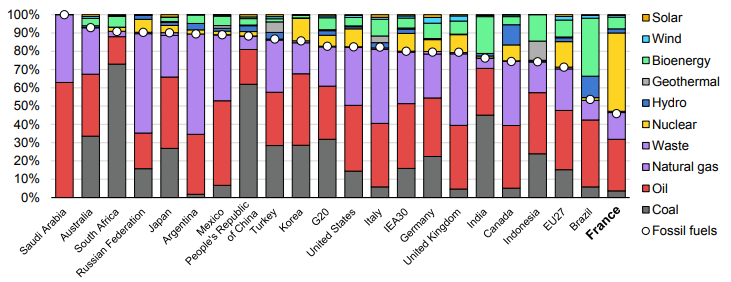

The fuel use data in the Exhibit below is very much a function of geology and the good and bad luck associated with it. The large hydrocarbon users' consumption patterns are a function of what they have – if you have a lot of coal, you use a lot of coal. The significant build-out of nuclear in France is partly because of Frances’ exceptional track record with the technology but also because the country does not have anything else to fall back on. Japan’s nuclear component was much higher before Fukashima. It is, however, worth noting the almost insignificant share of wind and solar anywhere, and then to put this into context with the collective ambitions, not just for 2050, but for the much shorter 2030 targets.

More CCS Plans Than Action Until We Get Proper Carbon Pricing

Nov 26, 2021 12:37:02 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, CCS, Blue Hydrogen, CO2, IEA, carbon footprint, tax credit, blue ammonia, climate, CO2 value, chemical companies, carbon pricing, CCUS, Power companies, oil companies, greenfield investment

We note the IEA work on CCUS in several charts below and this is good timing relative to our ESG and climate report this week – which focused on carbon pricing, something we believe is necessary to promote more real activity in CCUS. In the Exhibit below, it is important to note how many projects are in “development” rather than operational or under construction. It is also worth noting that the number of projects under construction has not grown since 2019. One of the reasons for this is that increased activity at the planning stage is then followed by a delay associated with permitting, which depending on the region can take 2 plus years. The other constraint is uncertainty, with many of the projects under consideration waiting for something to change, either local values of CO2 or mandates or direct government support. For example, the large project planned for Houston and championed by several oil, power, and chemical companies is unlikely to move forward without a higher tax credit for CO2 sequestration or without some other incentive. The mid-West projects targeting the ethanol industry will also need permits, not just for the wells but also for the many hundreds of miles of proposed pipelines.

As The Focus On Carbon Increases, Fairness Will Become An Issue

Nov 23, 2021 12:31:25 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, LNG, CCS, CO2, Emissions, Carbon Price, Air Products, decarbonization, BASF, carbon abatement, climate, Venture Global, Freeport LNG, Golden Pass, Cameron, NextDecade, decarbonize LNG, Cheniere

In our ESG and Climate report tomorrow we are focusing on the very wide range of carbon prices and the structures of the various emission reduction incentive schemes, with a focus on what it does to the competitive landscape within the impacted markets. For example, with the government subsidy being offered to BASF and Air Liquide for the CCS project in Antwerp, some level of competitive edge will be granted to the companies, because similar subsidies might not be available to others. Last week we discussed the very wide range of potential carbon abatement costs for companies in the same business, driven by technology and geography. If we add to that the potential for some projects to attract subsidies, while others do not, we change the landscape of the competitive playing field. Could we, for example, see BASF shutter production in Germany, where abatement costs are high, and move more manufacturing to Antwerp – something likely to be very unpopular with the German government and trade unions. This is more problematic in Europe because of the open trade policy. For Germany to give the same benefit that BASF has at Antwerp to chemical manufacturers in Germany could be prohibitively expensive given the much higher inland costs of CCS in Europe, assuming any permits would be issued. Alternatives to CCS, such as the electrification of industrial heating processes or the use of hydrogen as fuel might be equally expensive. We see some of the select European subsidies possibly causing discord between the member states.

Carbon Footprints Matter, For Polymers And LNG

Nov 18, 2021 1:55:23 PM / by Graham Copley posted in ESG, Hydrogen, Recycling, Polymers, LNG, Polyethylene, CCS, Ethylene, decarbonization, HDPE, carbon abatement, ethane, naphtha, climate, carbon footprints, recycled polymers, virgin polymers, fuel, Freeport LNG

It is interesting to watch the pivot between recycled versus virgin polymer to the carbon footprint of the various options as outlined in the chart below. We are assuming that the numbers in the chart are averages as there is a sizeable range for everything. As we note in today's daily report, ethylene feedstock will impact the carbon footprint of ethylene and consequently, the footprint of polyethylene – HDPE made from ethane based ethylene in the US where the ethylene producer is recycling hydrogen back into the furnaces, will have a much lower carbon footprint than HDPE made from naphtha based ethylene in Europe, for example. On the recycling side, there will also be a range based on transportation costs for collection and sorting and then distribution to a customer.

ExxonMobil: Going Heavy On CCS (The Right Move), But Pushing For Support

Nov 12, 2021 2:07:37 PM / by Graham Copley posted in Hydrogen, CCS, Carbon, Emissions, ExxonMobil, Emission Goals, carbon footprint, carbon abatement, biofuel, carbon offsets, carbon trading, greenwashing

ExxonMobil is seriously upping its lower-carbon game with the CCS announcements over the last few weeks and the release this week that states the company will spend $15 billion over the next 6 years on lower carbon initiatives. In this linked headline ExxonMobil states that it will meet its 2025 emission goals this year – we are assuming that this must be correct as the company would not want to risk the accusation of greenwashing. Either way, the critics will weigh in, either claiming “greenwashing” or suggesting that the targets were not high enough, to begin with. The ExxonMobil focus is very much on CCS, which makes sense for an oil and gas-centric company whose only real play right now is to lower the carbon footprint of its fuel portfolio. In the release linked above, ExxonMobil also talks about biofuel and hydrogen initiatives, but again calls for supportive policies from governments and we suspect that the underlying push here is towards the US government. ExxonMobil and others have indicated that $100 per ton is the right incentive to drive CCS and other carbon abatement strategies and we would agree with this estimate as it backs up much of the work that we have done over the last year. See - Carbon: Trading, Offsets, and CCS as a Service – It’s All Coming! and - Carbon Games – Appetite, But Not Enough Hunger Yet. The other reason why ExxonMobil and others would like to see the US act is because other jurisdictions in which they operate will likely take a lead from the US.

Global Hydrogen Ambitions Will Fail Without CCS: The US Needs A Plan

Nov 11, 2021 1:36:40 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Green Hydrogen, CCS, Blue Hydrogen, Renewable Power, Energy, Emissions, CCUS

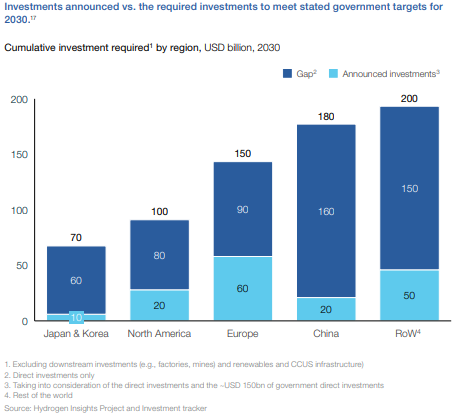

The hydrogen council chart below drags us away from 2050 and back to the more concerning near-term goals of 2030. The chart shows a significant gap in the current planned spend for hydrogen by region and the spending required to move far enough towards 2050 targets. This chart makes assumptions about the share of energy transition that will be met by hydrogen and given that it is the industry producing the chart, it is probably on the high side, but it is inclusive of both blue and green hydrogen. We have serious concerns about these totals being reached in general, but we see the target as completely unreachable without significant blue hydrogen (because of renewable power and electrolyzer capacity limits and we cannot rely on Canada to do all of the “heavy lifting” for blue hydrogen - see company section in today's daily report. The Biden administration may make more progress on emissions if the next order of business was just on CCUS rather than an omnibus bill that included CCUS but which could get held up in negotiations for months if it even gets passed.