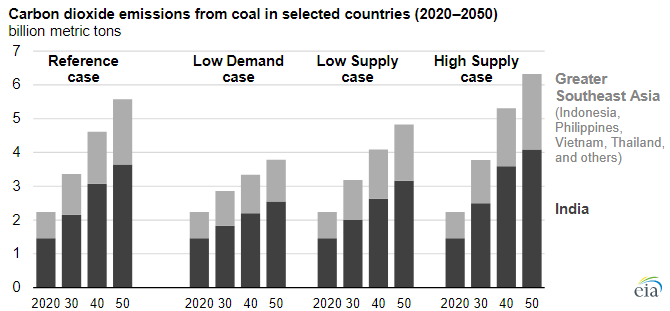

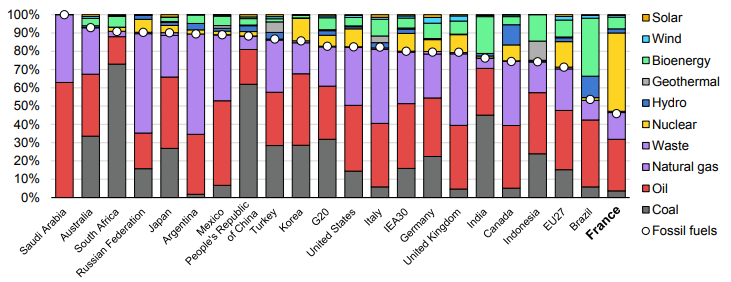

The coal data in the Exhibit below is likely not popular with the environmental lobby. However, the EIA analysis takes into account the alternatives for the countries involved and the fortunes of coal in these countries will be directly impacted by the help that other countries offer. If the region can be assured of abundant sources of alternative energy, whether renewables or more likely LNG, then the use of coal will fall. This is another example of where some of the global energy policies are coming up short in our view. The better solution is to champion (clean) LNG growth, wherever possible, to bridge the huge gap between the energy the world needs and the rate at which it can be supplied from renewables. See more in today's daily report.

Effective Global Energy Transition Will Need A Lot More LNG

Feb 8, 2022 2:59:48 PM / by Graham Copley posted in ESG, Sustainability, LNG, Coal, CO2, renewables, energy transition, climate, EIA

Turbulent Times For The Wind Industry

Feb 4, 2022 1:17:36 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Wind Power, CCS, Renewable Power, natural gas, solar, renewable energy, wind, energy transition, material shortages, wind capacity, onshore wind, price inflation, Siemens Gamesa, logistic issues, offshore wind, solar industry, wind industry

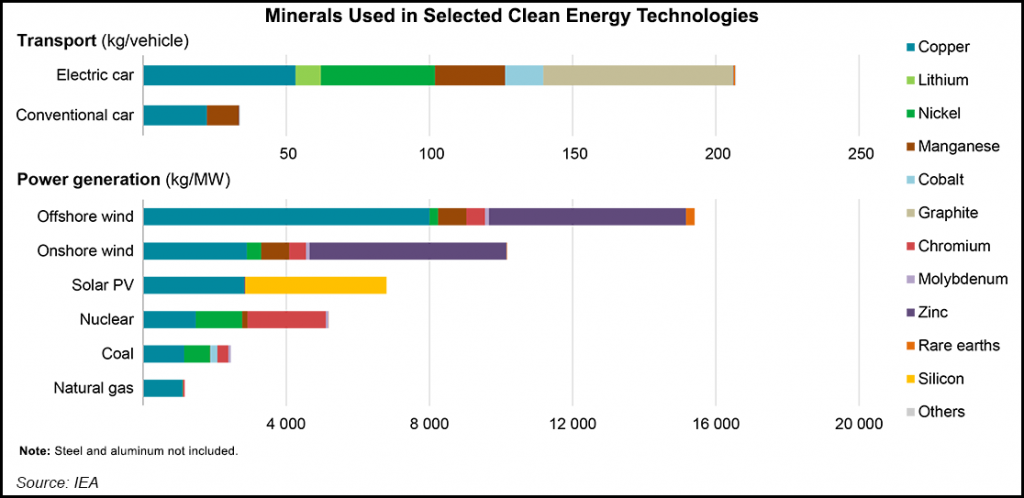

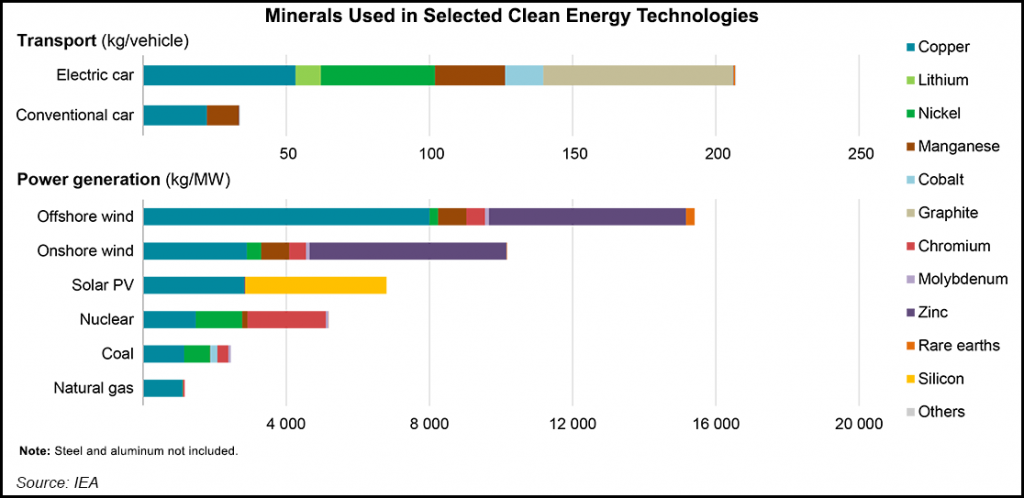

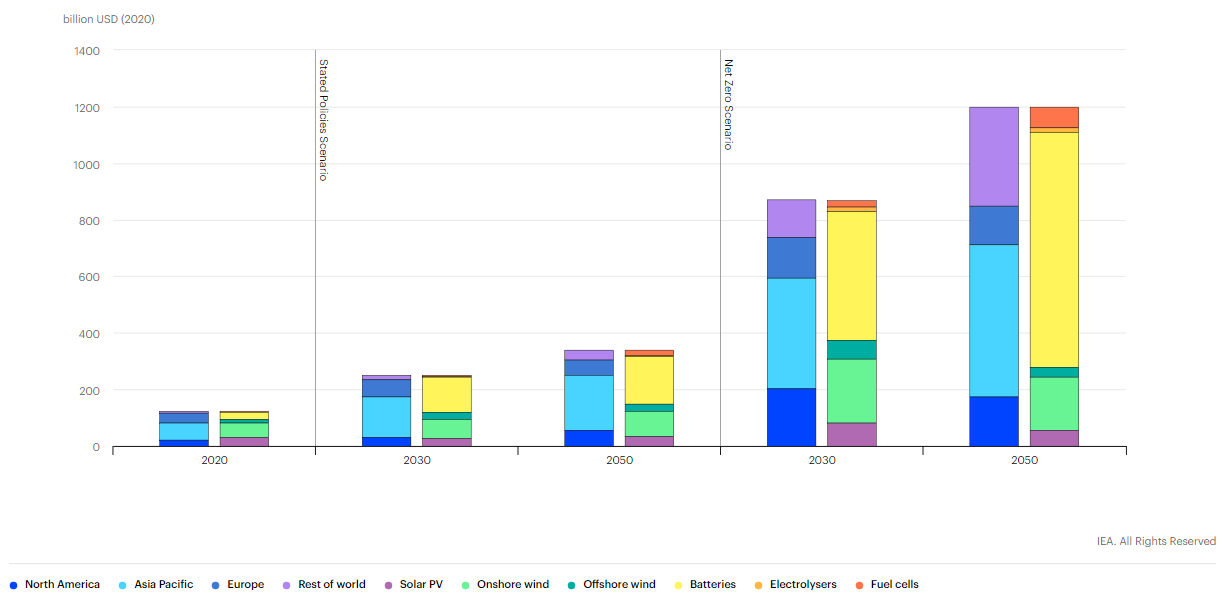

The linked Siemens Gamesa news could not have been a more clear example of one of our key research themes of the last year – backlog up, suggesting strong demand for new wind power capacity – deliveries and profits down because of material shortages – price inflation and logistic issues. While the company is getting squeezed because of higher costs on contracts that have limited opportunity to pass through the cost, at the same time slide 8 of the earnings release deck shows that selling prices rose in fiscal 1Q 2022. This breaks a declining trend in pricing and one of the core assumptions behind many energy transition plans – that renewable power prices can keep falling. Onshore wind orders are falling, but offshore orders are rising – and these come with higher costs and the need for more materials as we showed in a chart in yesterday’s daily. The added costs burden of more offshore wind projects may only serve to tighten markets for materials further, leading to further increases in installed costs.

As Solar Installations Disappoint, Natural Gas Demand Rises

Jan 25, 2022 1:39:27 PM / by Graham Copley posted in Commodities, Renewable Power, Materials Inflation, natural gas, solar, clean energy, energy transition, commodity prices, US natural gas, supply shortages, solar capacity, natural gas demand, solar installations, commodity index, solar modules, power supply, material cost inflation, US natural gas prices, minerals

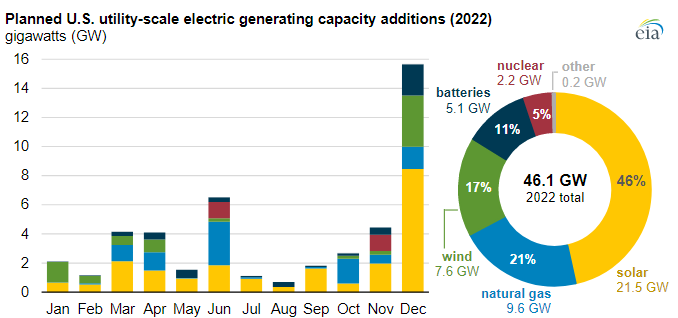

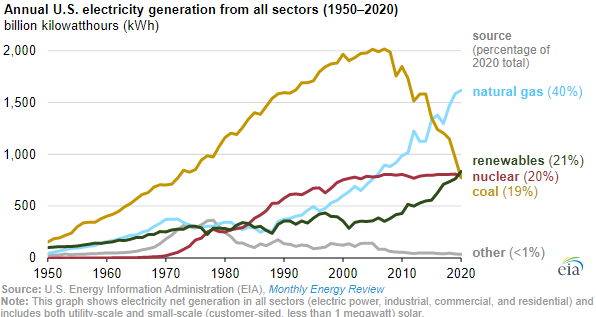

A couple of things worth noting today that reflects our commodity index in today's daily report but also looks at some of the results below. The linked solar headline is confirmation of one of the topics that we have probably worn out over the last few months, which is that renewable power ambitions have not taken into account real limitations in the rate of equipment supply, especially solar modules. New forecasts suggest that the US expected installations of solar capacity could come in 25% short in 2022, which has implications for energy transition ambition, but also overall power supply as the shortfall will have to be made up elsewhere. It is not just a function of solar module availability but also solar module costs, because of some of the material cost inflation illustrated in exhibit 1 (see today's daily report). These shortfalls will have implications for natural gas demand in the US if it needs to fill the gap, and we have already noted that we think US natural gas prices could spike in 2022, much higher than we saw in 2021.

Another Illustration Of How Important Metals Are To Energy Transition

Jan 21, 2022 1:07:16 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Renewable Power, Metals, Raw Materials, solar, renewable energy, wind, energy transition, Lithium, climate, advanced recycling, materials, low carbon, material shortages, low carbon economy, renewable power production

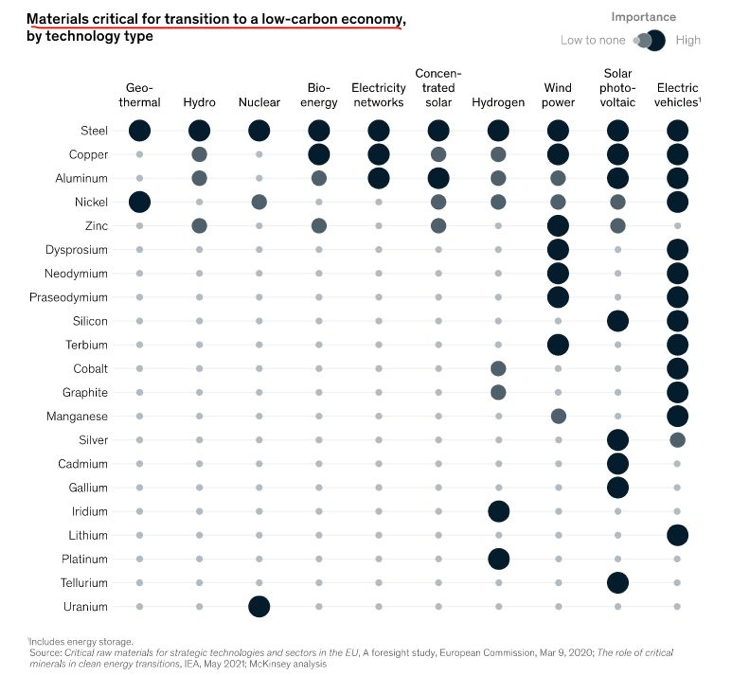

The materials chart in the exhibit below from today's daily report, is worth noting as it highlights all of the materials that are needed to advance the production of equipment required to drive renewable power production and demand. We would make one change to the chart in that lithium should also be added to the wind and solar categories to account for storage that needs to be built, although this could be done through hydrogen production or hydraulically, depending on location. One of our primary concerns concerning renewable power projections is the availability of some of these materials and we have written about the topic at length – most comprehensively in - 2022 – Policy Key, But Inflation Will Distract – Maybe Beneficially.

2022 Power Additions Look Ambitious - More Upward Pressure On Natural Gas?

Jan 11, 2022 2:01:38 PM / by Graham Copley posted in LNG, Coal, Renewable Power, Energy, natural gas, power, energy transition, greenwashing, fossil fuels, material shortages, energy industry, power capacity, natural gas demand

First, it is going to be an uphill struggle to get some common sense around the continued use of fossil fuels during any period of energy transition if the activists take away all resources from the energy industry – banking, PR, etc. While there is plenty of work to be done to minimize greenwashing, there is also plenty of work that needs to be done to explain why fossil fuels are still needed and how we can use them as cleanly as possible. If it becomes a business risk to bank or advise any company in the fossil fuel industry, while there will inevitably be workarounds, the net effect will be continued underinvestment, in production and in cleaning up the fuels and the concerns that we raised for natural gas in our Sunday Thematic will happen.

Is There A Place For Coal In Energy Transition?

Dec 23, 2021 12:35:22 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Coal, CCS, Blue Hydrogen, Net-Zero, fossil fuel, IEA, carbon footprint, natural gas, energy transition, climate, carbon storage, Climate Goals, material shortages, clean fossil fuel, coal gasification, Build Back Better

In yesterday's ESG and Climate report, we looked at an extreme example of how the right support for clean fossil fuel use through a long period of energy transition, could create economic growth, support job growth, and not require subsidies – coal gasification to produce low-cost hydrogen. With the opposition to the “Build Back Better” bill, there is a clear opportunity for the fossil fuel industry to step up and suggest compromises, and we are seeing increasing interest in large scale CCS, despite its cost, in part because it is a path that will allow natural gas and other fossil fuels to meet increasing demand in a way that has a much lower carbon footprint, and in part, because it will still be cheaper than some of the heavily subsidized ideas to try and accelerate investments in renewable power that will inevitably fall foul of equipment and material shortages – something we have written about at length in past research – linked here. The EIA has already noted that coal use in 2021 has risen globally and it is likely that it will rise again, given the increasing demand for electric power and the lack of supply elasticity in the renewable power and natural gas-based systems – coal is a large part of the swing capacity these days. Many of the CCS projects proposed for the US are not much more than proposals today, but we are seeing some initial investment to prove that subsurface storage opportunities are feasible.

European Natural Gas: The Price Of Impractical Energy Transition Policy

Dec 21, 2021 2:13:22 PM / by Graham Copley posted in ESG, Sustainability, LNG, PVC, Coal, Methanol, ESG Investing, Inflation, Ammonia, natural gas, natural gas prices, energy transition, climate, renewable power investments, Climate Goals, shortages, fossil fuels, Europe, low carbon LNG

International natural gas prices are hitting new highs this week, both on an absolute basis and relative to the US - see both charts below. At the same time, we see new contracts being signed for US LNG to move to China and Europe, but mainly China. This is happening despite significant renewable power investments globally in 2021 and it would appear that many have underestimated energy demand growth in projections and policy. The other net effect of the supply/demand imbalance this winter and possibly through 2022 will be increased coal use in Europe and the US, with local governments unable to meet near-term climate goals, especially in Europe, but also in parts of Asia and, at the same time keep the people warm and the lights on. In our ESG and Climate piece tomorrow we will focus on one highly unpopular but likely very practical opportunity for coal as part of a planned energy transition program, and it is likely that, while climate goals may not need to change, some socially unpopular decisions around the use of fossil fuels will be needed to prevent even more socially unpopular inflation or absolute shortages.

More Evidence To Suggest Material Shortages For Energy Transition

Nov 30, 2021 1:34:42 PM / by Graham Copley posted in ESG, Hydrogen, Coal, CCS, Renewable Power, Energy, hydrocarbons, natural gas, solar, wind, energy transition, energy sources, fossil fuels, nuclear, bioenergy, hydro, geothermal, material shortages

The fuel use data in the Exhibit below is very much a function of geology and the good and bad luck associated with it. The large hydrocarbon users' consumption patterns are a function of what they have – if you have a lot of coal, you use a lot of coal. The significant build-out of nuclear in France is partly because of Frances’ exceptional track record with the technology but also because the country does not have anything else to fall back on. Japan’s nuclear component was much higher before Fukashima. It is, however, worth noting the almost insignificant share of wind and solar anywhere, and then to put this into context with the collective ambitions, not just for 2050, but for the much shorter 2030 targets.

Uncertainty And ESG Pressure Likely To Cause More Energy Price Spikes

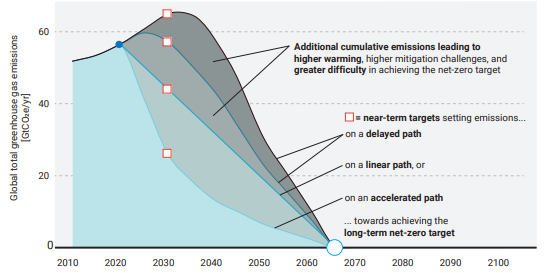

Nov 24, 2021 2:09:08 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Renewable Power, Energy, Emissions, ESG Investing, Net-Zero, carbon footprint, carbon abatement, carbon offset, energy transition, climate, energy inflation, energy prices, carbon pricing, ESG Pressure, fossil fuels

In a media interview earlier this week (more details to follow) we were involved in a discussion about inflation and specifically energy. The discussion covered much more than this, but the chart below is perhaps one of the easier ways of showing where our concern lies, and it ties directly to the behavioral patterns that are emerging concerning climate change and ESG focused investing. As noted in the title of the chart, the likelihood that the linear path from here to net-zero will work is very low, given that we would need global government coordination now, and we are far from it. The other scenarios are much more likely, at least in the early years, and they call for an increase in emissions, which implies growing demand for fossil fuels and other materials that have a high emissions footprint. If you are an oil or gas producer and you look at the chart you could quickly conclude that while your products are in demand today and likely to be in growing demand for several years, the longer-term outlook is very unclear. This might slow down your investment plans, or at least make you think twice about the shorter lead-time projects – such as on-shore and shale-based. However, it could kill any longer-term offshore/deepwater projects that take many years to bring on stream. Today we see energy investment hesitancy everywhere (see our Chemical Blog), but at the same time, we do not see the global coordination to drive a faster energy transition, assuming we had the materials and the investment dollars to move any faster. The risk that we run out of produced fossil fuels from time to time over the next 3-5 years is very high.

Carbon Use: Important But Not As Impactful As Sequestration

Oct 19, 2021 1:45:27 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Methanol, CCS, CO2, fossil fuel, carbon footprint, carbon abatement, energy transition, Celanese, Carbon Use

We want to focus on carbon use today, in part because we have written extensively on sequestration recently, in part because of the headline highlighted below, and in part, because we need something fresh for our ESG and Climate report tomorrow! Carbon use does not get much press beyond EOR, but there are emerging technologies and there is a lot of R&D spending – on how to collect CO2 more efficiently and on what it might then be used for. We suspect that almost everything being looked at will have some application, but that there will be limits to those applications and they will likely be niches in nature, but not necessarily unprofitable.