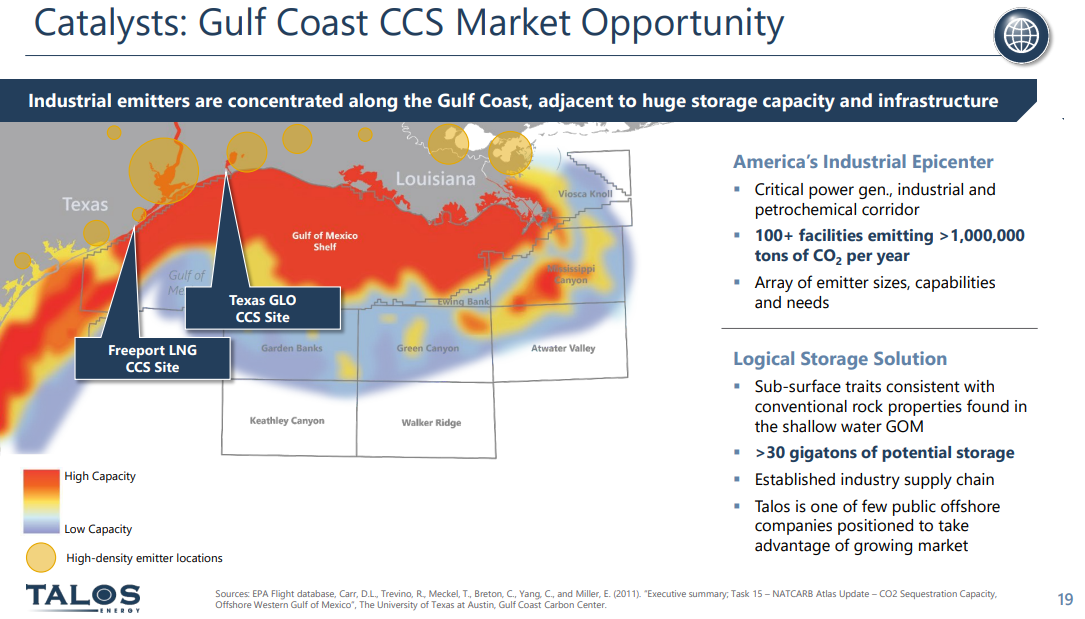

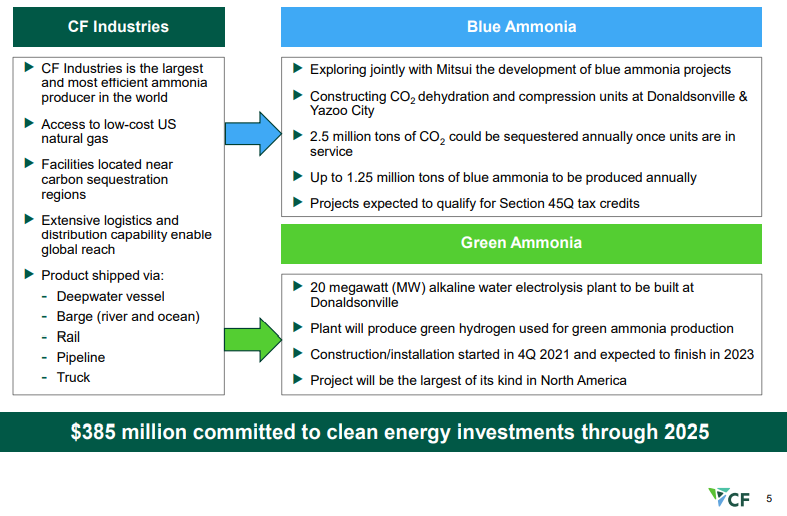

There should be little doubt that the US has a significant opportunity to decarbonize through CCS and if the US has a carbon value close to the level in Europe today we would be seeing investments announced almost weekly. While permitting would cause some significant lead time between announcement and construction/operation, the other uncertainty might be how best to capture the CO2. In its earnings release yesterday, CF talked about purifying CO2 streams at its two large Urea plants on the Gulf Coast, such that the CO2 would be ready to sequester, but the Urea process creates a relatively concentrated stream of CO2 and that makes separation much easier. For others, the better route might be hydrogen investments – driven by the relative ease of capturing the CO2, especially if it is part of the process design. If this route is more economic, the net new investment would be substantial, not just for the SMR, ATR, or fuel cell hydrogen generators, but also for the infrastructure and oxygen capacity for any ATR investment. This seems like a no-brainer bi-partisan opportunity for the US as there is broad support for CCS but incentives need to be higher. For more on this topic see our ESG and Climate research.

CCS In The US: The Potential Is Significant

Feb 17, 2022 12:55:54 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, CO2, decarbonization, carbon value, urea, CF Industries, Climate Goals, oxygen

Low Cost CCS Could Be A Game Changer For The US

Feb 16, 2022 1:41:38 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Climate Change, Sustainability, Green Hydrogen, CCS, CO2, Sequestration, Ammonia, blue ammonia, CF Industries, crude oil, low carbon, green ammonia, carbon intensity, carbon market

We continue to believe that the US has a cost advantage in CCS versus many of the other regions of the world and that when coupled with low natural gas prices the US should be able to take a lead in developing low carbon chemicals. CF is pushing the idea of both blue ammonia in the US as well as green ammonia, and while the company has yet to announce sequestration plans for the CO2 it is working to purify – see Exhibit - once dehydrated and compressed the incremental cost of storage should be low.

Water: The Less Discussed ESG Topic

Feb 15, 2022 12:14:52 PM / by Graham Copley posted in ESG, Sustainability, Renewable Power, renewable energy, energy transition, water, Agriculture, water supply, 3M, Michelin, water shortages, clean water, health, desalination

It is interesting to note both 3M and Michelin addressing water in their ESG narratives - Exhibits below. Water is not getting a lot of air time from the ESG crowd yet, but it is very much on our radar and we will publish our first water index in tomorrow’s ESG and Climate report.

Bloom Energy Could Win If Modular Hydrogen Is Economic

Feb 11, 2022 1:42:42 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, Methane, CCS, Blue Hydrogen, fuel cells, Bloom Energy

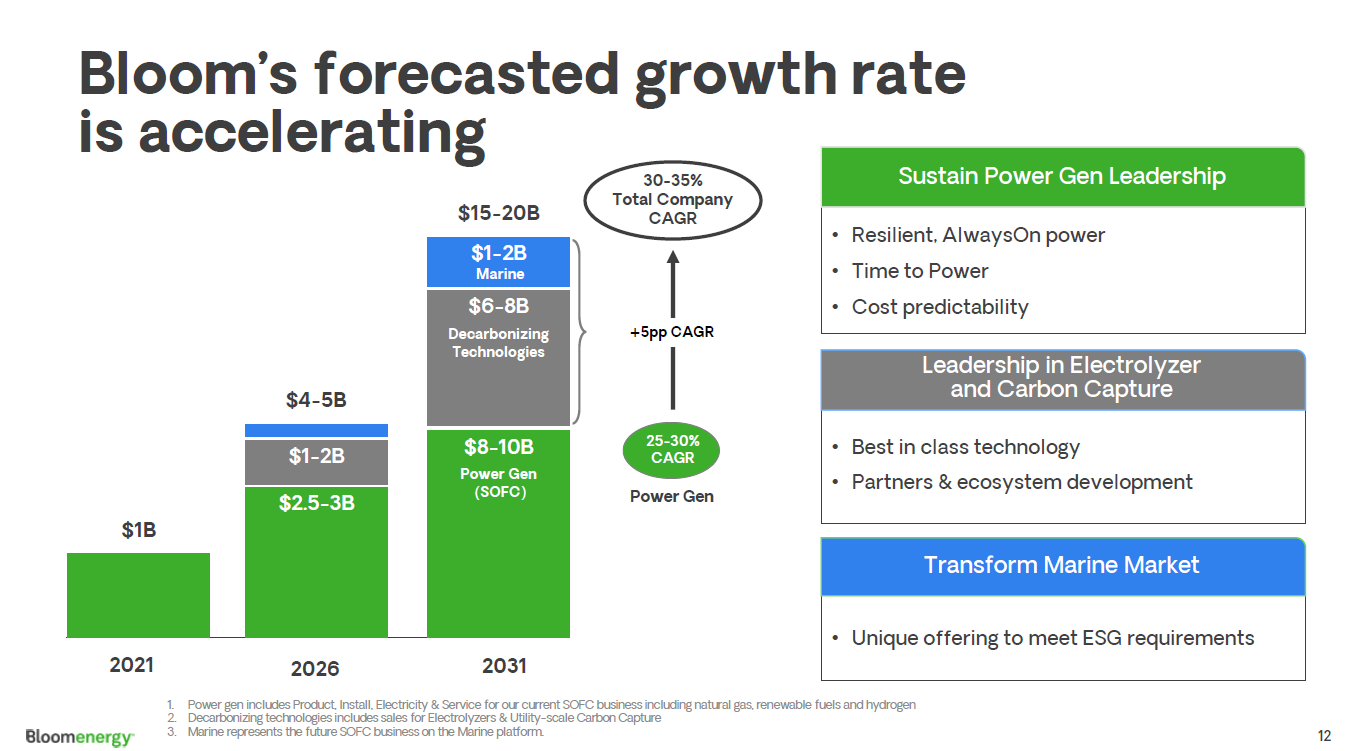

There is a lot in the ESG section of today's daily report and we will elaborate more in our ESG and Climate report next week (to be found here). The Bloom Energy results were strong and the modular nature of what Bloom is offering, in our view, should only increase the level of interest going forward. SMR and ATR base blue hydrogen projects are very large, requiring billions of dollars of capital and taking years to construct. The projects are further complicated by the likely need to build dedicated CCS with each unit. The methane fuel cells that Bloom offers are modular and can be much smaller and more incremental from an investment perspective. For blue hydrogen, they will still need CCS, but they offer a lower capital-based route to hydrogen and power today. We can see an opportunity to deploy these units, or something similar, everywhere there is CCS, as either an incremental source of hydrogen and power or a large source. Bloom still has work to do on lowering costs, but much less work than green hydrogen appears to have today, in our view.

Why A Hydrogen Credit Could Be Harmful & All Change At LyondellBasell

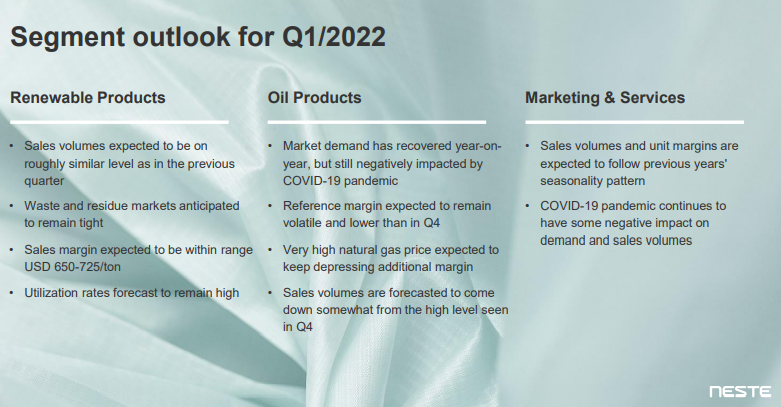

Feb 10, 2022 12:36:00 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Green Hydrogen, Blue Hydrogen, Energy, Emissions, LyondellBasell, decarbonization, renewable energy, tax credit, clean energy, renewable diesel, Neste, fuels, polymer recycling, energy companies

We view the hydrogen tax credit discussed in today's daily report as potentially very harmful, as it could give life to projects that will further increase demand on a renewable energy industry that has finite limits to its rate of growth. The credit could encourage inherently uneconomic projects – even with a longer-term “abundant power” view. If the incentives are used to back clean rather than green projects it would make more sense as blue hydrogen could be produced in very large quantities without breaking the bank and would allow constrained renewable power investments to focus on other harder to decarbonize power needs. If the hydrogen subsidy could be added to the 45Q sequestration credit we would likely see a wave of blue hydrogen investments in the US – primarily aimed at decarbonizing industrial applications and refining.

Polymer Producers Have Waste And Carbon Footprints To Consider

Feb 9, 2022 12:25:43 PM / by Graham Copley posted in ESG, Hydrogen, Recycling, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, decarbonization, hydrocarbons, polymer producers, climate, chemical producers, Covestro, waste, carbon footprints, fossil fuels

The linked Covestro headline from today's ESG & Climate report is a reminder that the chemicals and polymer makers are dealing with more than just recycling and product lifecycle management. Customers are equally focused on the carbon footprint of the products they buy and the green hydrogen move by Covestro (assuming that affordable green hydrogen is possible) would replace hydrogen made from fossil fuels and replace other fuels for heat in some cases. Germany has some considerable issues with decarbonizing, as the blue hydrogen route will be challenging in a country that will likely not allow onshore CCS. Covestro and others may have little choice but to buy green hydrogen and/or green power, even if supplies come up short of plan and costs are higher as a result. This is a good illustration of why we believe that the right policies in the US could drive some additional competitive edge while meeting climate objectives. Cheap hydrocarbons coupled with cheap CCS may only be matched in some parts of the Middle East.

Effective Global Energy Transition Will Need A Lot More LNG

Feb 8, 2022 2:59:48 PM / by Graham Copley posted in ESG, Sustainability, LNG, Coal, CO2, renewables, energy transition, climate, EIA

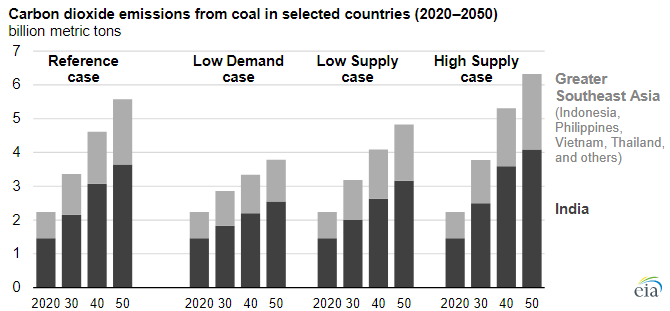

The coal data in the Exhibit below is likely not popular with the environmental lobby. However, the EIA analysis takes into account the alternatives for the countries involved and the fortunes of coal in these countries will be directly impacted by the help that other countries offer. If the region can be assured of abundant sources of alternative energy, whether renewables or more likely LNG, then the use of coal will fall. This is another example of where some of the global energy policies are coming up short in our view. The better solution is to champion (clean) LNG growth, wherever possible, to bridge the huge gap between the energy the world needs and the rate at which it can be supplied from renewables. See more in today's daily report.

No End In Sight For The Recent Rally In Lithium

Feb 3, 2022 1:33:58 PM / by Graham Copley posted in ESG, Sustainability, batteries, Lithium, climate, EVs, materials, Lithium demand

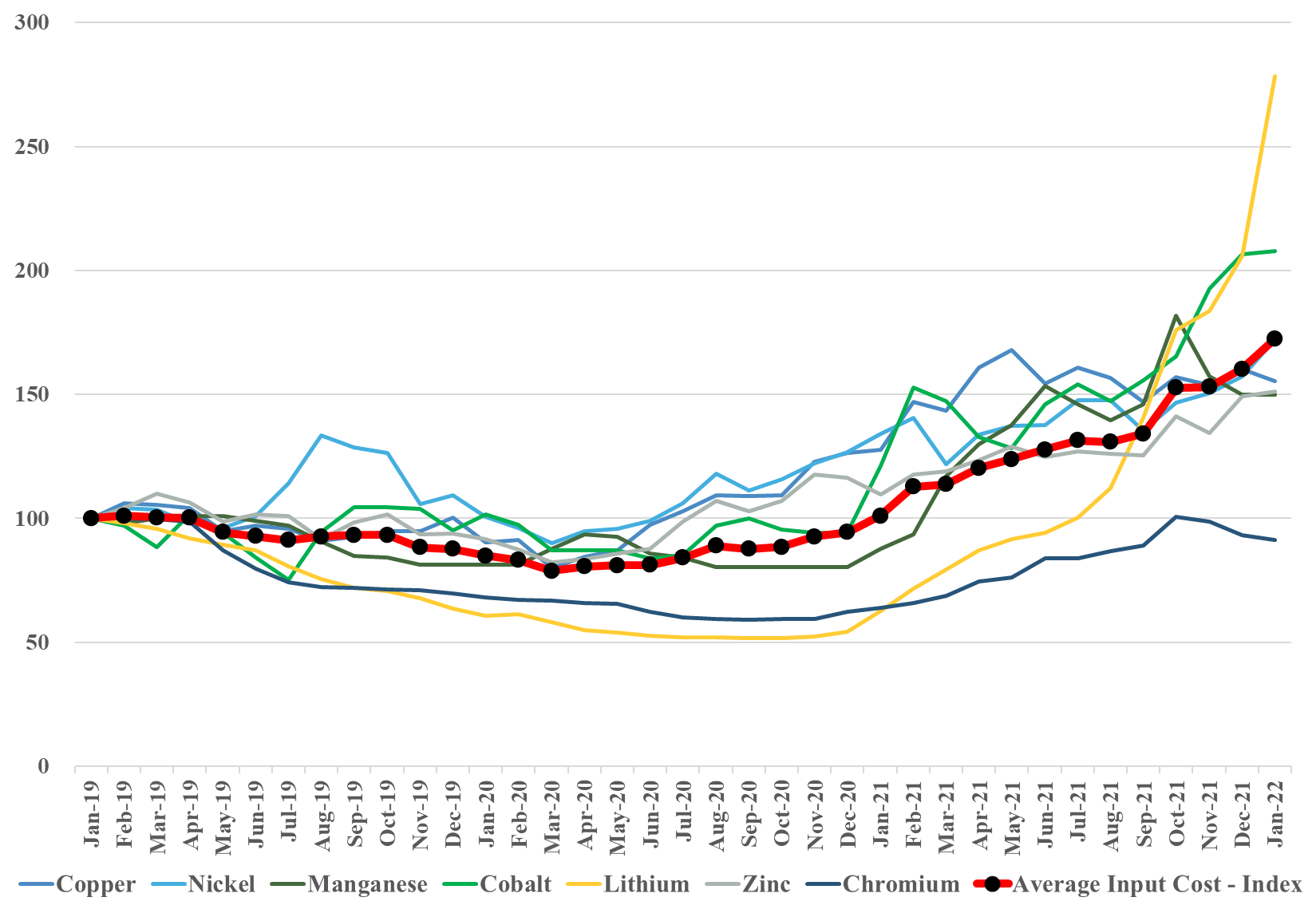

As the chart below shows, the demand, real and speculative, for lithium continues to drive prices materially higher. As new EV models prepare to launch this year and new battery facilities come online there is an inevitable supply chain impact to build inventory, whether it is the battery facilities building an inventory of lithium and other components or the automakers building an inventory of batteries. This will inflate lithium and other critical material demand relative to the vehicle output and this may be driving some of the demand panic for lithium. However, this dynamic is unlikely to be transitory in the near term, as there is a long wave of new EV capacity coming online, all of which will drive some incremental working capital build. We still believe that supply growth for lithium is very high and that the market could flip from famine to feast and back again quite quickly and frequently over the next few years although maybe not in 2022. Also see today's daily report and last week's ESG and Climate report for more on this topic.

Carbon Capture Plans Advance. US Incentives Remain Inadequate

Feb 2, 2022 12:38:58 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Renewable Power, Emissions, ExxonMobil, Pipeline, natural gas, carbon offsets, direct air capture, carbon offset, climate, DAC, chemical producers, Green Plains Institute

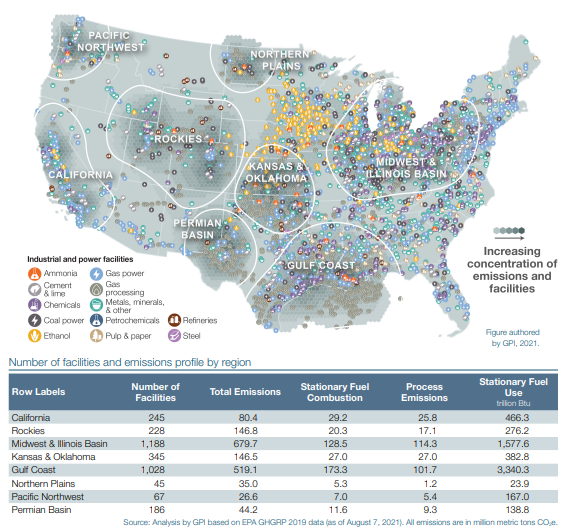

The Green Plains Institute analysis below draws heavily on the EPA emissions data by facility, but correctly, in our view, identifies where CCS makes the most sense in the US. We still struggle with the pipeline distances associated with some of these ideas as CO2 disposal is still a cost for emitters and in any attempt to reduce costs, pipeline distances will be key. We have discussed the opportunity recently for massive blue hydrogen investment (including CCS) to replace industrial heating fuel and this would apply in all of the regions below. Note our conclusions in today’s ESG and Climate report that we expect renewable power installation goals to fall short – requiring more use of natural gas (for power generation or hydrogen production) with accompanying CCS.

The Focus On Renewables Is Intensifying Everywhere

Feb 1, 2022 12:09:01 PM / by Graham Copley posted in ESG, Sustainability, LNG, CO2, Renewable Power, decarbonization, Gevo, carbon footprint, natural gas, power, renewables, climate, Freeport LNG, decarbonize LNG, Cheniere, RNG, RNG projects, natural gas market, Cameron LNG

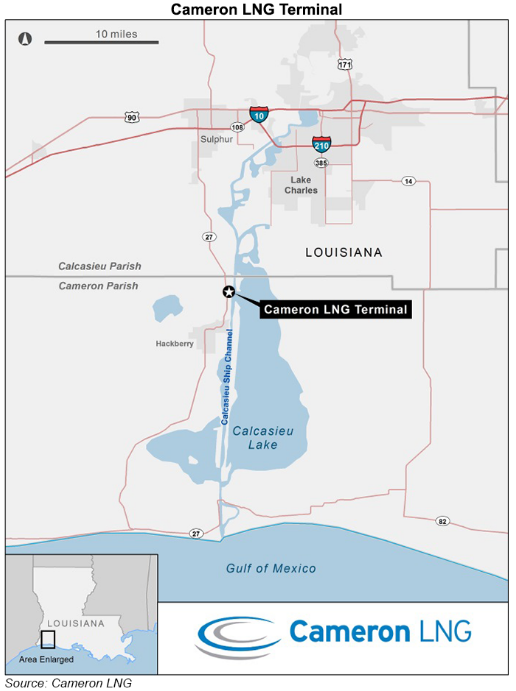

There are a handful of “renewable” headlines in today's daily report, and it is probably worthwhile discussing the differences. First; the linked Gevo RNG announcement is likely one of several RNG projects that we will see come online in 2022, as there are a number of farm-based RNG projects underway in the US and other parts of the world. The Gevo facility is based on farm manure and is expected to produce 355,000 MMBtu of RNG per year. As such it is not large, and all of the farm-based projects are small in the larger context of the natural gas markets. However, when focused on decarbonizing a specific product or process this RNG can be very important. Our take on the market is that there will likely be more demand for RNG than supply, as several companies are looking for RNG to make proposed investments make sense from a “green” perspective (Monolith would be a good example). This suggests that it will be better to be a seller than a buyer longer-term.