Our concern with the very encouraging charts below is that it is easy to join the group today, as there is no requirement to have a granular plan as to how you achieve net-zero. Many of the companies on the list may have the best intentions, but to get to their targets many need technology advances that are at best in laboratories today, and many need pricing structures – either incentives or penalties that make the right path forward more obvious. A lot of this does not exist today and the timeline to getting some of it done is being extended by political log-jams and differences of opinions. As time passes, the 100 or so companies that have signed the pledge are going to have to, at a minimum, explain what they are going to do and shortly thereafter, start committing capital.

Easy To Join The ESG Club, Harder To Stay In

Sep 24, 2021 1:12:50 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Emissions, Net-Zero, ESG investment, NDAs, carbon plan

Are We Heading For Fuels/Power Crisis?

Sep 23, 2021 1:25:31 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Carbon Fuels, CCS, CO2, Renewable Power, fossil fuel, carbon footprint, power, synthetic fuels, aviation fuel

In our ESG and Climate report yesterday we focused on sustainable aviation fuel, discussing a recent report from Shell and Deloitte, which shows some of the challenges with getting the aerospace industry to net zero. The report focused on the need for sustainable aviation fuel now, and in large volumes, as this is the only thread that the industry can pull on today – synthetic fuels (from CO2 and hydrogen will be uneconomic for decades, and neither electric powered or hydrogen-powered aircraft are going to be a solution before 2050). The bp, Delta, and Boeing linked headline is one of many that we expect to see as the need for near-term progress is urgent, given the scale of investment required. See yesterday’s report for more detail.

How Can We Have Too Much & Too Little CO2 At The Same Time?

Sep 22, 2021 2:04:48 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Emissions, Carbon Price, Inflation, Ammonia, natural gas, European Carbon price, urea, CF Industries

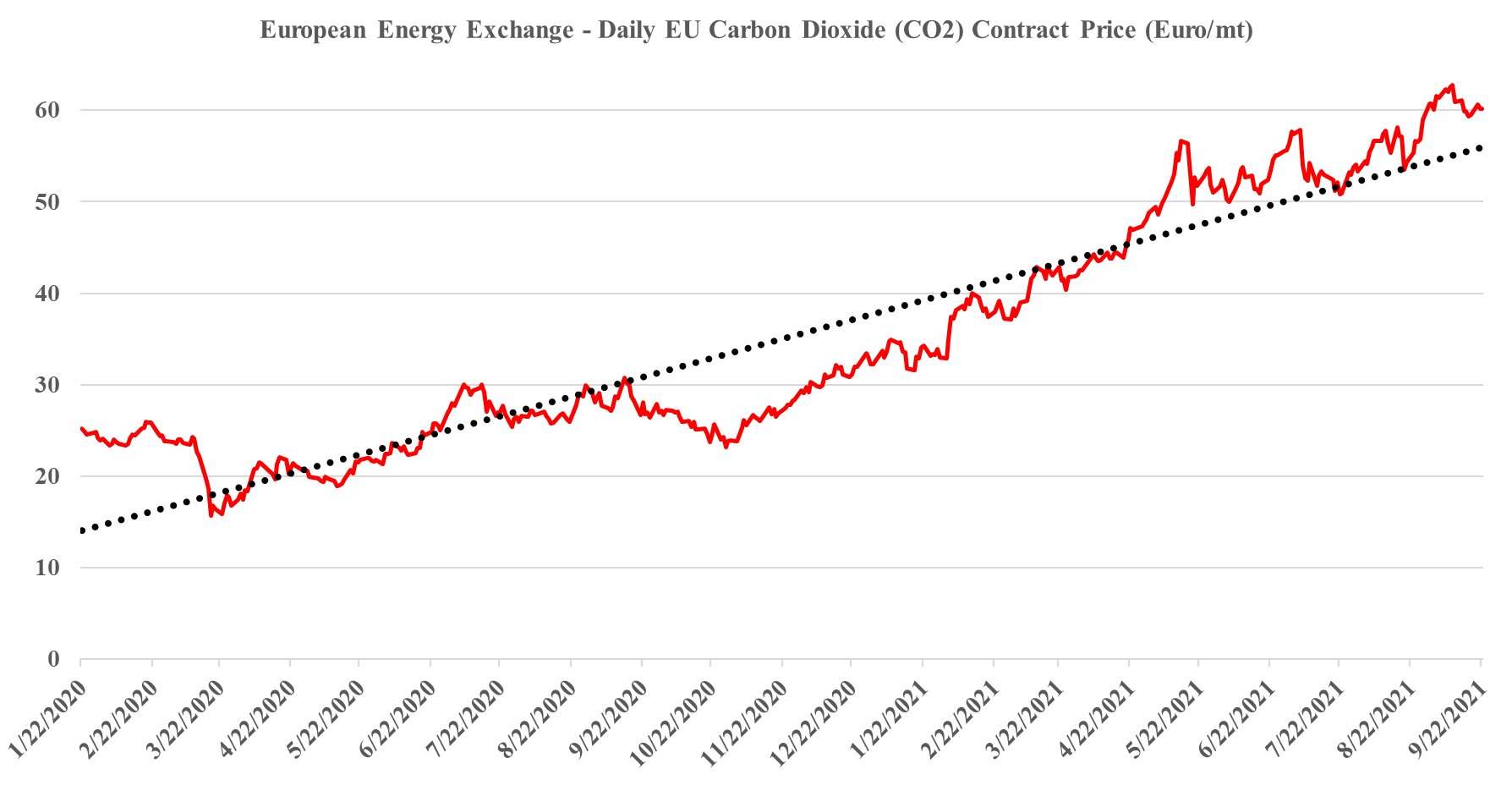

It is worth a short explanation of what is going on with European CO2, given the mixed signals of shortages in headlines today and then the slight weakness in pricing shown in the image below. These are two very different markets, with the food, beverage, medical and nuclear industries looking for pure streams of CO2 rather than the contaminated streams that make up the bulk of emissions. Historically, the food and beverage industry looked to fermentation – so alcohol production – as its source of a pure CO2 stream, but as demand grew, the next best place became ammonia production, which also has a pure CO2 stream as a by-product. Most ammonia is further converted into urea, which is a consumer of CO2 and there is not enough CO2 produced in a natural gas-based ammonia plant to convert all of the ammonia to urea. You sometimes see urea facilities also selling ammonia, but more frequently they take the carbon monoxide by-product of the syngas reaction and convert that to CO2. The result is enough CO2 to convert all of the ammonia to Urea and surplus CO2 to sell. Because of this more dominant supply of food and beverage grade CO2, and shutdowns caused in this case by runaway natural gas prices, have an immediate impact on the industries that rely on the CO2.

CCS: US Government Funding Expectations Seem Very Low

Sep 15, 2021 12:15:49 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, ExxonMobil, carbon credit, carbon value, 45Q

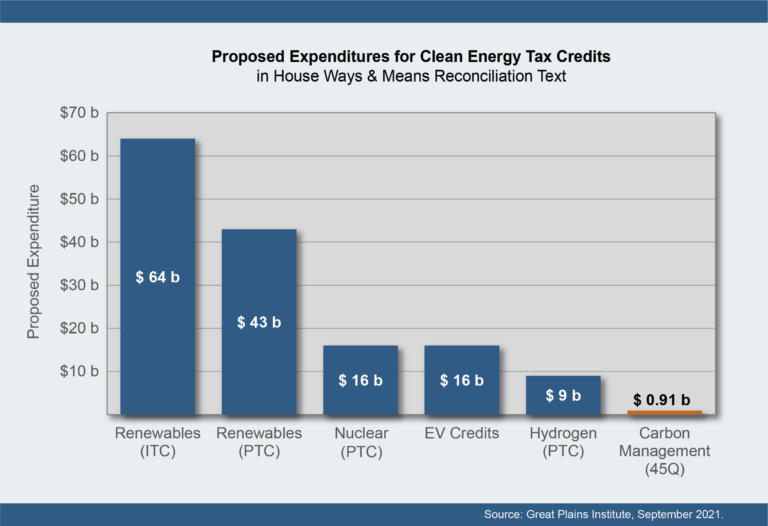

The tax credits suggested for 45Q in the budget reconciliation plan – see Exhibit below – would pay for roughly 18 million tons of CO2 sequestered or used in EOR over the life of the budget, assuming a credit value of $50 per ton of carbon. While this may seem huge in the context of the current levels of CCS in the US, the country had around 2.5 billion tons of emissions in 2019 that could be addressed with CCS (power and industrials), and if we assume 10% of that needs to be dealt with through CCS, the 45Q provisions in the budget reconciliation would cover less than 8% of the volume for one year and the percentage will be even lower if the “CATCH” act is successful in driving the 45Q value to $85 per ton of CO2. So the numbers are either inadequate, or the government is assuming that the levels of CCS in the US will be much lower than the potential – note that the ExxonMobil proposal for a hub in and around Texas talked about the maximum size for the one project being as much as 100 million tons per annum which should equate to $5 billion of tax credits – per annum. See our ESG & Climate report for much more on carbon markets today.

Direct Air Capture Is Expensive, But Demand Is There

Sep 10, 2021 1:43:32 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CO2, Emission Goals, carbon dioxide, carbon offsets, direct air capture, greenwashing, DAC, carbon neutral hydrocarbons

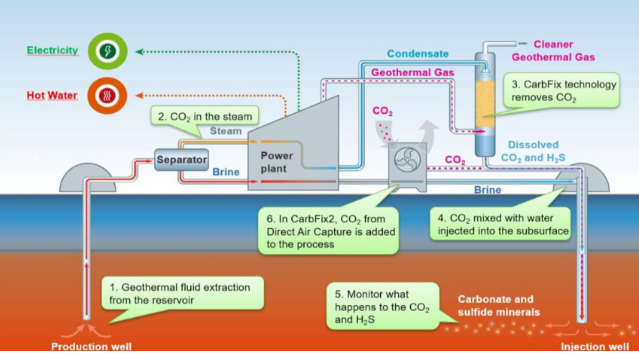

The most notable news from the Iceland CO2 direct air capture (DAC) project, illustrated in the Exhibit below, is not that it is working and how energy efficient it is, but that the CO2 capture costs are extremely high and yet all of the offsets are sold. One report talks about the costs per credit approximating $1000 per ton of CO2, which is likely accurate given that the facility is relatively small scale, at 4 thousand metric tons per year. The same report also states that the credits are almost sold out for the 12 years that they are being offered. We believe that this is indicative of the marginal demand for uncontestable carbon offsets, and this is a topic we have covered at length in our ESG and climate work. Shell, bp, and others are selling what they claim to be carbon neutral hydrocarbons around the world and are buying offsets to do so, but they are coming under quite a lot of “greenwashing” fire because of the less tangible/auditable nature of the credits they are buying – often related to agricultural or specific tree conservation/planting initiatives that are questioned because of the validity of the capture claim or the vulnerability of the credit to weather, fires, and forest maintenance years in the future.

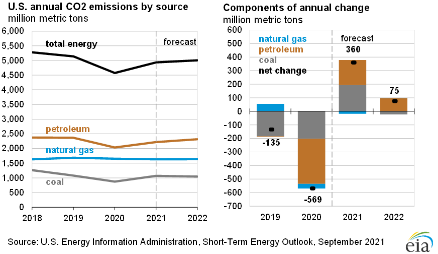

US CO2 Footprint Shrinking, But Not Fast Enough

Sep 9, 2021 1:00:13 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, carbon footprint, climate, EIA, CO2 footprint

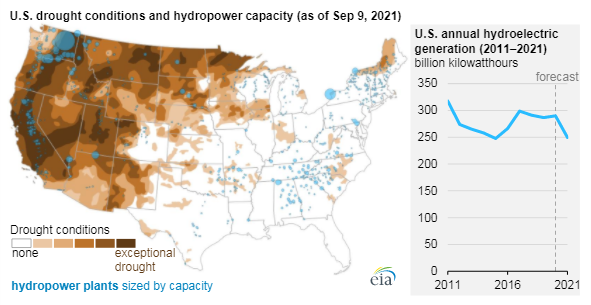

The CO2 emissions chart from the EIA should not be a surprise as the step-up in 2021 and 2022 is a recovery from the economic contraction and habit changes associated with COVID, and the projected increases in 2021 and 2022 are combined lower than the step down in 2020, suggesting that the trend is still negative. The problem is that the trend is not negative enough and as we have written about at length, it will not trend lower fast enough without all corrective opportunities at play – more renewable power, more conservation, and a lot of CCS. See our ESG and Climate work for more.

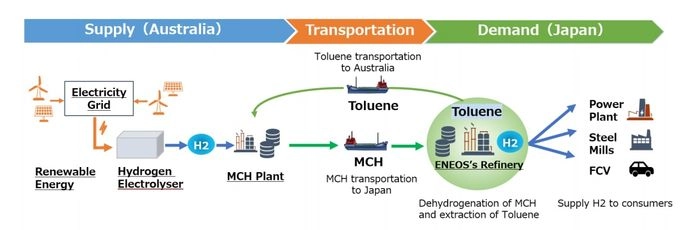

Shipping Hydrogen: Expensive Anyway You Do It

Aug 31, 2021 2:09:19 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, Green Hydrogen, Renewable Power, Air Products, Ammonia, renewable energy, solar energy, shipping, transportation, nitrogen, hydrogen electrolyser, toluene, methylcyclohexane

The exhibit below highlights one of the more significant constraints for green hydrogen, which is that the abundant low-cost power opportunities (strong wind and lots of sunshine) are often not where demand for hydrogen exists and the challenge is how to transport it. The problem with reacting it to make something else and then recovering it at the point of use or a distribution hub is that hydrogen is very light and you end up moving a lot of something else to get a little hydrogen. Air Products is looking at making ammonia in Saudi Arabia and shipping the liquid ammonia and the project below is looking at using toluene as a carrier in what appears to be a closed-loop with toluene moving one way and methylcyclohexane moving the other way. The liquid shipping would be cheap, but with the MCH route, only 5% of what you would be moving to Japan would be the green hydrogen. Using ammonia the green hydrogen content is slightly less than 18%, but you have to make the nitrogen on-site. The cost of making the nitrogen would be a function of the local cost of power and these remote locations should have very low-cost renewable power. In the example below, the opportunity is likely unique to the refinery structure and shipping opportunity and we doubt that it is easily replicated in a way that would be more economic than shipping ammonia or shipping compressed hydrogen itself.

Source: H2 Bulletin, August 2021

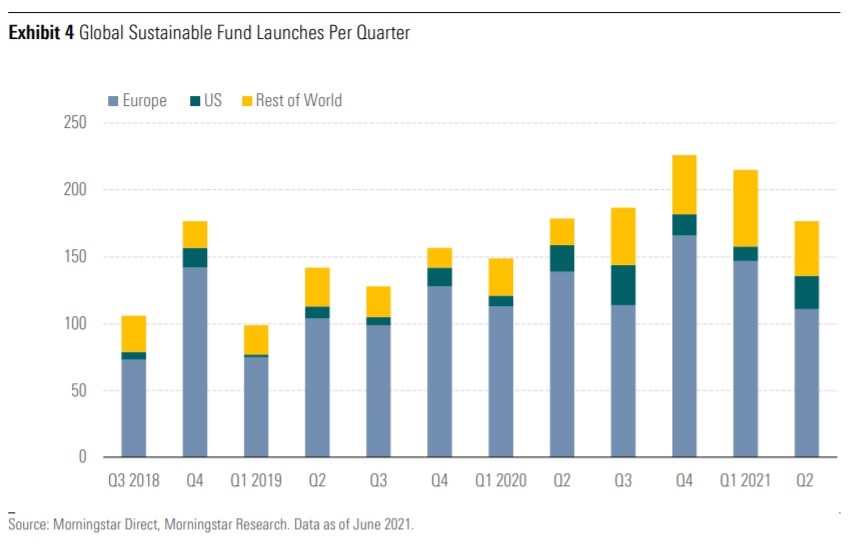

Is ESG Investing Making A Difference?

Aug 24, 2021 12:57:09 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, ESG Investing, ESG funds

There is a significant increase in the number of commentators taking a swing at ESG investing and suggesting that it is neither effective nor in the best interest of investors as it likely puts them at risk of underperformance. The performance piece has largely been a moot point until now as the funds flowing into the ESG space have been high enough to ensure outperformance from a simple supply/demand perspective, see chart below. However, should the flow of funds slow and investments be judged on their own merits many fund managers are going to find that they own some egregiously expensive stocks with fundamentals that do not support the valuation. If this then leads to a rotation out of a sub-set of names, the future outperformance of the class is far from guaranteed.

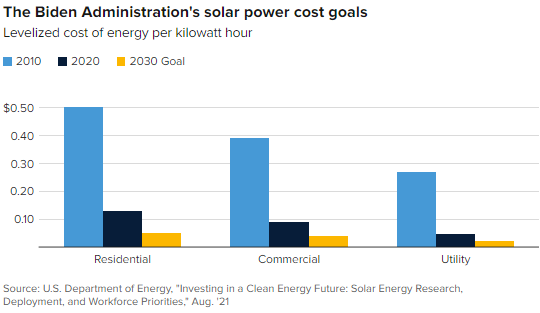

It's Hard To Bet On Deflation When You Are Dependent On Commodity Pricing

Aug 19, 2021 11:57:02 AM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Renewable Power, Raw Materials, solar, copper, silver, wind, Lithium, solar energy, steel, basic polymers, semiconductors, renewable power goals, aluminum, EV batteries, rare earths

We are back on one of our pet topics today which is the reasonableness around some of the assumptions around the future cost of renewable power. We reference, work done by the US Department of Energy in the Exhibit below, and see two potential pitfalls with the assumptions around continuous improvement in solar, wind, and hydrogen costs, although there is a slight twist for hydrogen. The first is around the dynamics of learning curves. As the exhibit shows, in the early stages of any product development, there are huge leaps in cost improvements, driven by scale, better know-how, more efficient manufacturing, and in the case of solar power, both better processes for installation and some technology improvements. However, as you drive costs lower, the cost of raw materials becomes a much larger component of overall costs, and your ability to lower costs further can be overwhelmed by moves in material costs. Any inability to pass on the costs will result in economics that do not justify additional capital and you find yourselves in a commodity cycle. This is something that we have seen in basic polymers for decades, and no buyer of polyethylene today can claim that they are benefiting from a learning curve improvement. Closer to home for solar, we are seeing the same issue today in semiconductors – not enough margin to invest as everyone has been trying to push costs lower. The expectation in the DOE study and highlighted in the CNBC take on the study below is that annual solar installations in the US need to rise by 3-4X to meet some of the renewable power goals the Biden Administration is looking for by 2030, while similar growth is expected in other markets – the solar panel and other component makers have to be making good money to achieve this.

A Long Road Ahead To Better ESG Standards

Aug 11, 2021 2:09:15 PM / by Graham Copley posted in ESG, Sustainability, Emissions, ESG Investing, carbon footprint, C02, ESG Metrics, environmental footprints, ESG funds, ESG Standards, social impact, Environmental

Our meetings over the last couple of weeks confirm several developments within the ESG investing world, all of which have been the focuses of our prior work. The first is a very significant step up in ESG oversight among most fund managers, with dedicated ESG teams at many companies scrutinizing sustainability reports and other releases, looking for red flags either from inconsistencies in reporting or from departures from the fund managers standards. Second, there remains a lack of real empirical analysis that allows for accurate comparisons between companies and this stems from the fuzzy reporting frameworks that we have today and the lack of clear and actionable guidance from regulators. As we have discussed several times, the huge inflows into ESG funds and the proportion of overall funds market that now has a “social impact” overlay could lead to real disruptions and some rapid valuation changes if and when the regulators provide tighter guidance on both corporate reporting and fund labeling.