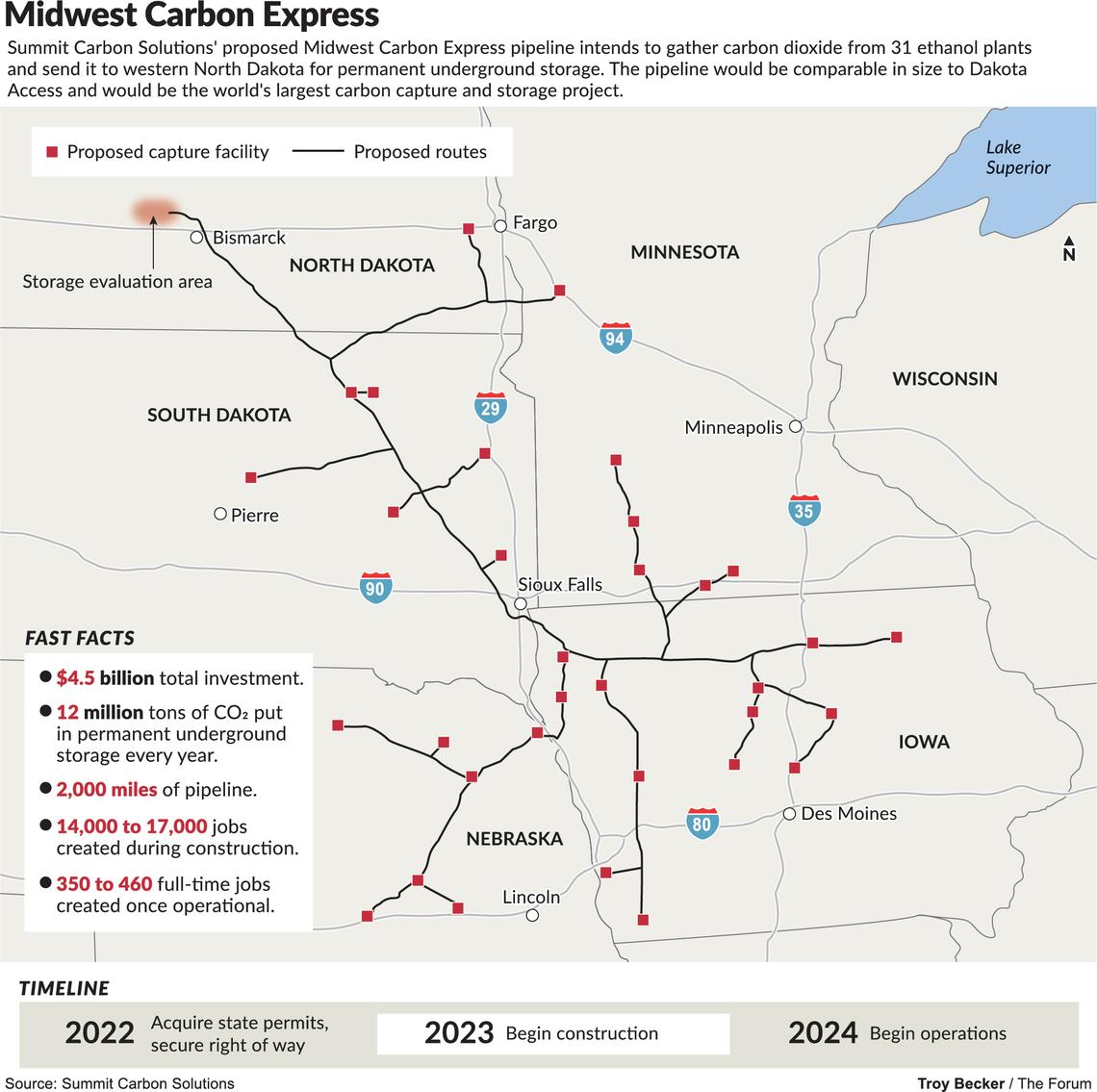

As we have mentioned before, we see a couple of major challenges with the CO2 pipelines proposed for the mid-West, one of which is summarized in the Exhibit below. The first issue is pipeline right-of-ways, as there are already activists determined to oppose the pipelines, and opposition to pipelines has been a core them of the last 10 years. The second issue is cost. Carbon abatement is a cost for all looking for solutions and even where incentives exist, such as the 45Q program or the LCFS fuels program, the challenge will still be creating a path with the lowest. Compression and pumping costs are high for CO2, especially if the pipeline wants a pressure that will allow for direct injection into a series of wells. Lower pressure transportation by pipe is inefficient and raises the capital cost of the pipeline – so it becomes a trade-off – CAPEX vs OPEX. $4.5 billion of investment – as suggested by Summit – is $375 per annual ton of carbon dioxide sequestered - $37per ton assuming 10-year straight-line payback – twice that if you want a 10% return. This is before a dollar of OPEX and pipeline costs could easily exceed another $30+ per ton, with separation and purification of the CO2 stream also not free. Unless the ethanol producers are paying Summit and Navigator to take the CO2, the math becomes very challenging. See today's daily report and our weekly ESG and Climate report for more.

CCS Is A Cost And Some Projects Look Too Expensive

Dec 15, 2021 1:53:44 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, carbon dioxide, carbon abatement, LCFS credit, climate, pipelines, 45Q, Carbon Sequestration, abatement costs, CAPEX, CO2 pipelines, OPEX, Summit Carbon Solutions

Investment Constraints On Solar Before We Even Start With Hydrogen

Dec 14, 2021 1:17:04 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Green Hydrogen, Renewable Power, ESG Investing, Materials Inflation, Inflation, solar, ESG investment, climate, solar energy, material shortages, product shortages, onshore wind

Much of the core focus of both our chemical industry and ESG and Climate research recently has been on inflation and materials shortages; we would point you to: Inaction, Caused By Inflation Fears, Is Driving More Inflation! and Coming Up Short: Materials Availability To Limit Climate Progress. This linked article suggests that, as we have predicted, cost and availability pressures are taking a toll on solar installation plans for 2022 in the US. While the inflation piece is real and the product shortages highlight some of the capacity constraints for materials and panels, the broader conclusions that can be drawn from the headline are more concerning. These shortages (and higher prices) are coming well before we see any step change in attempts to increase renewable power installations associated with all of the green hydrogen projects that have been announced over the last 6-9 months. All of these investments are relying on the deflationary trends continuing, especially for onshore wind and solar.

Carbon Black: By-Product Economics Pose A Threat To Incumbents

Dec 10, 2021 12:03:28 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, Carbon Black, Emissions, Renewable Sources, carbon footprint, natural gas, climate, Environment, Origin Materials, sustainable solutions, Monolith, natural gas feed, manufacturers, by-product

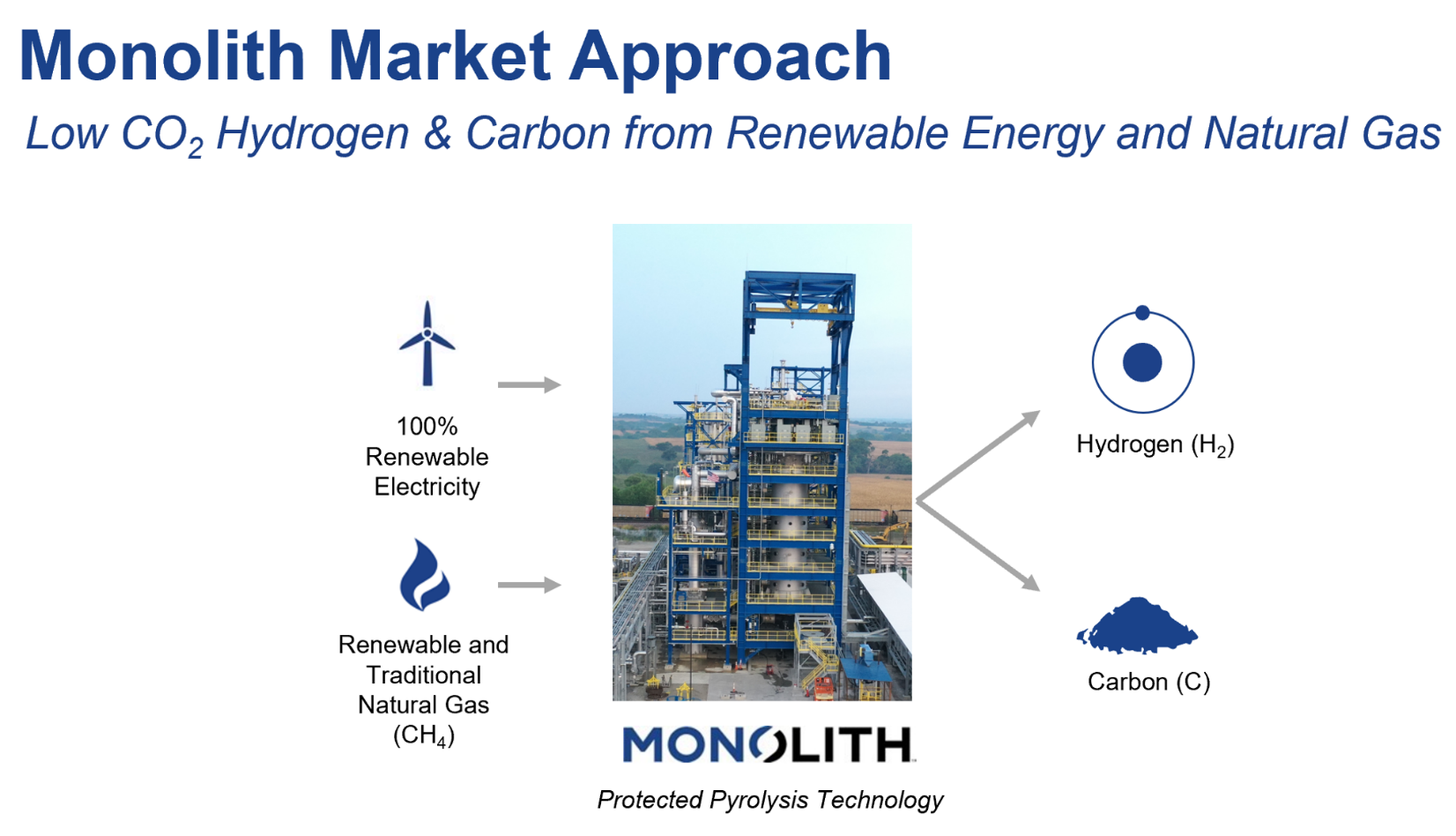

The Monolith announcement is not that surprising, as the auto industry is very focused on its carbon footprint and its suppliers, like Goodyear, are under pressure to look for more sustainable solutions. While Monolith uses natural gas as a feed, it’s carbon black is produced with very limited Scope 1 emissions, unlike the traditional route, used by the incumbents. It is not clear what the production economics are for Monolith because the co-product value of hydrogen could vary greatly depending on local needs, but the emergence of a competitor who sees carbon black potentially as a by-product is not likely to be good news for the traditional makers. A by-product that is more environmentally friendly is even more of a threat. Complicating the picture further could be the arrival of larger volume production from Origin Materials, which has a renewable based carbon black like material, which may also be seen as a by-product.

Different Net Zero Target Dates Will Create Competitive Risks

Dec 9, 2021 2:07:56 PM / by Graham Copley posted in ESG, Sustainability, LNG, CCS, CO2, Carbon, Emissions, Carbon Price, Carbon Neutral, Net-Zero, China, climate, CO2 footprint, Climate Goals

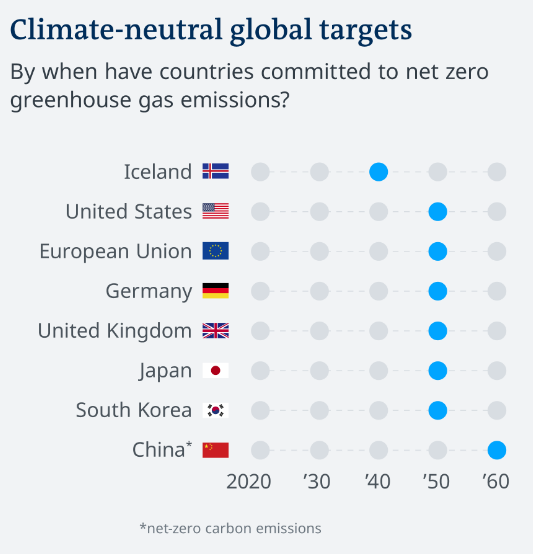

When China announced its 2060 net-zero goals we dedicated one of our ESG and Climate pieces to the topic - China: A Challenge With 2060 Goal But Also A Possible Edge - concluding that this would likely drive considerable competitive advantage for China assuming that others would bear the costs of new technology learning curves and China would get the solutions more cheaply. In interim China would have lower costs of manufacturing because of the delayed net-zero implementation. With the Biden administration now pushing for a coordinated 2050 commitment for the US, some of the burdens of early costs that China could benefit from also fall on the US. In one of the headlines (from today's report), there is criticism of the European CBAM and questions around whether it could work. The reality is that it, or something like it, has to work, otherwise asymmetric climate policies will create pockets of competitive advantage - potentially very damaging to those spending more.

Carbon Momentum Building

Dec 8, 2021 12:27:25 PM / by Graham Copley posted in ESG, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Carbon, IEA, climate, CCUS, carbon prices, solar capacity, wind capacity, hydrogen capacity

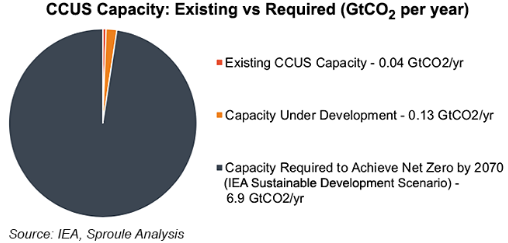

Most of the focus today is on carbon, in part because the CCS momentum is picking up, with more initiatives being announced daily all around the world, and partly because of the surge in European carbon prices as shown in Exhibit 1 from today's daily report. The IEA CCS projections in the Exhibit below, are likely low in our view, despite the significant investment needed to reach the target shown. In our ESG and climate report today we focus on many of the materials supply limitations that will likely emerge as the world tries to add wind and solar capacity at higher and higher rates. Our analysis of the IEA net-zero projections published earlier this year suggested that the IEA might be too ambitious on renewable power and that the balancing effect would likely be increased natural gas use versus its base case and more than forecast CCS. We have a long way to go to get there given the shortfall in the exhibit below, but at the same time, carbon prices are moving to make it happen. The European price has spiked again this week and is now slightly higher than $100 per ton of CO2, a level reached by the UK price late last week. At this level, we should see investments in Europe to abate carbon without additional local subsidies, or with minimal subsidies. The constraint in Europe will be finding inexpensive CCS locations. A $100 carbon price in the US would, in our opinion, drive a very significant investment in the US, not only in CCS capacity but also in new blue and green hydrogen capacity.

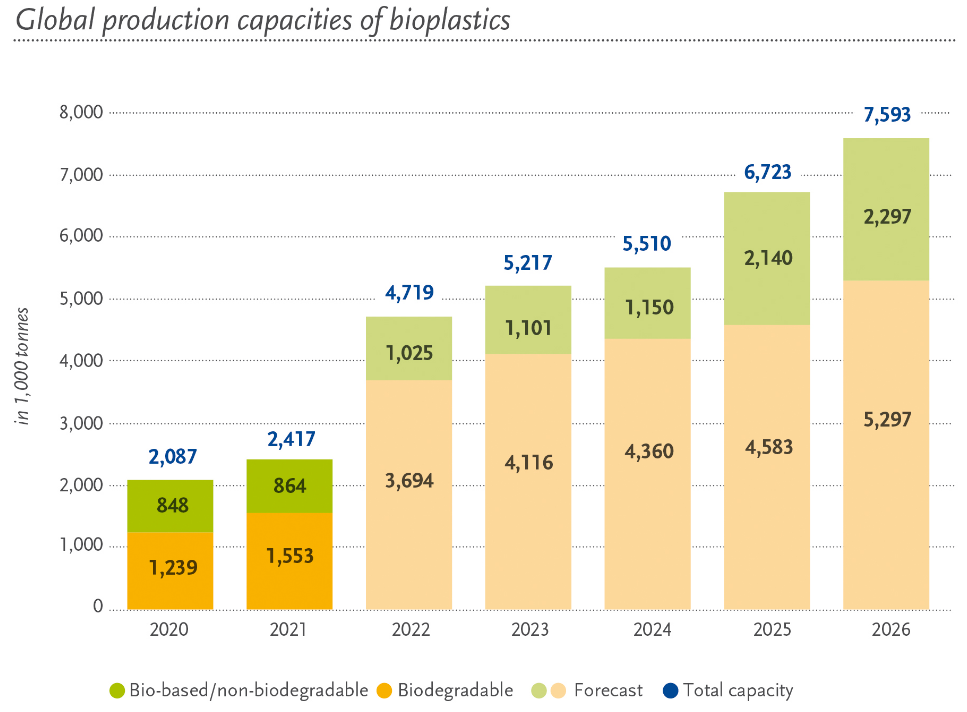

Bioplastics: Probably Important But Small For Now

Dec 7, 2021 2:50:00 PM / by Graham Copley posted in ESG, Recycling, Polymers, Sustainability, Plastics, biodegradable, ESG investment, climate, plastics industry, biodegradable polymers, biodegradable plastics, polymer demand, bioplastics

The bioplastics chart below (from today's daily report) is interesting from a couple of perspectives, the first being whether the projections are reasonable and the second being the significance of the investments. We believe that the volume targets are optimistic, given the capital requirements and that many of the companies pursuing bioplastics are relatively new and need to borrow most or all of the capital needs. The volumes would be easier to believe if the participants were large companies with strong balance sheets. The second point is just how small the volumes are in the grand scheme of plastics. Global demand for plastics exceeds 300 million tons and consequently, the 2026 projection would account for only 2.5% of global polymer demand. Note that in the article (linked here) around the uptake of biodegradable plastics – in this case in the UEA – one of the constraints to growth listed is availability. The other constraint, which likely faces producers in all markets is consumer education. Introducing a new polymer – or range of polymers – into an already confusing mix will require consumer education around what is biodegradable and what to do with the material. This topic follows on from the recycling theme in last week's ESG and Climate Report.

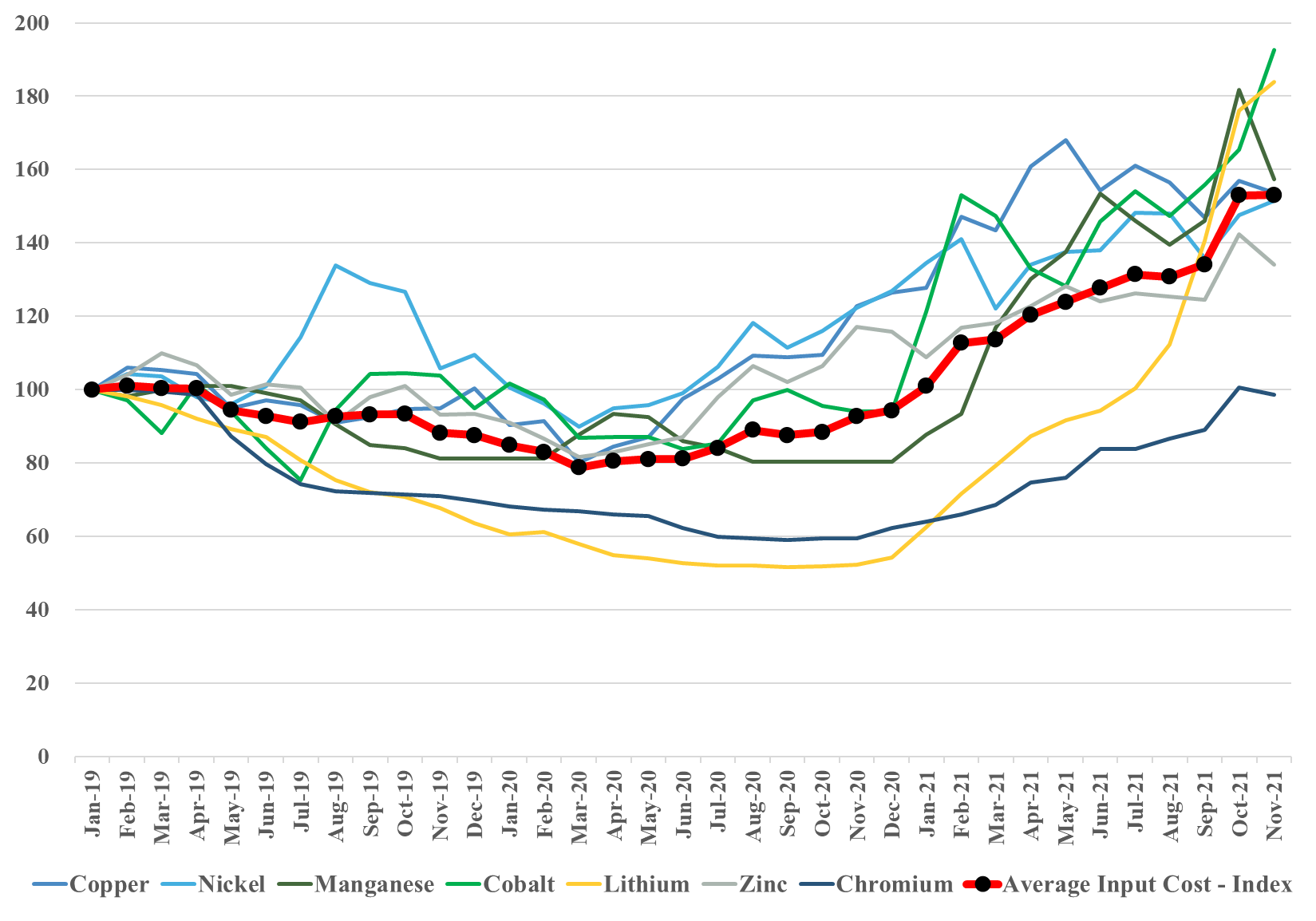

Materials Inflation Now A Concern Of The IEA

Dec 3, 2021 1:13:41 PM / by Graham Copley posted in ESG, Sustainability, Renewable Power, Materials Inflation, Raw Materials, renewable energy, manufacturing, climate, EVs, price index

We focus today on raw material inflation and use the IEA analysis of materials demand (excluding steel and aluminum) in EVs and renewable power, creating a price index for the materials in question. This index is a straight average, but we will develop indices for specific sub-industries and include these in our next ESG and climate report. What is important is that the index below is up over 50% since the beginning of 2019 and this is before many of the EV plans and power plans move from planning to construction. We have highlighted inflation risk for more than a year now and remain very concerned that when many of the new auto plants start and many of the incremental renewable power facilities move from planning to equipment purchasing, we will see bottlenecks and faster price increases. See more in today's daily report.

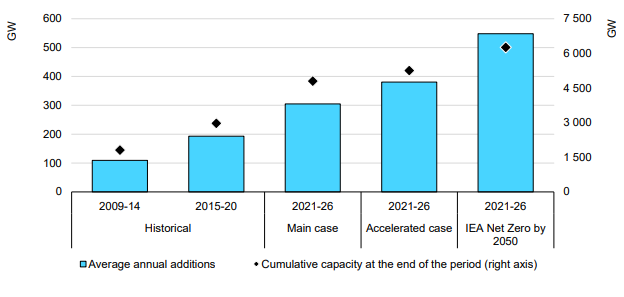

Are We Asking Too Much Of The Renewable Power Industry?

Dec 1, 2021 12:19:53 PM / by Graham Copley posted in ESG, Sustainability, Renewable Power, Emissions, Materials Inflation, Emission Goals, Inflation, Net-Zero, IEA, solar, wind, climate, renewable power inflation, commodity pricing

The core message of the IEA analysis published today is around how renewable power rates of investment remain far too low and need to more than double immediately to meet net-zero goals – see below. This analysis is very supportive of our renewable power inflation thesis, as none of the renewable power component manufacturers can double production either cheaply or quickly, and none of their suppliers has that much spare materials capacity. On the solar front, we may have the additional problem of regional production concentration. China has the largest share of capacity for solar module capacity and now has much more aggressive plans for solar power domestically. We could see China-based components stay in China, exaggerating shortages outside China. The IEA has an accompanying report today on the possible impact of commodity pricing on solar and wind pricing and it is also linked here – these reports were published this morning and we will cover them in more detail in next week's ESG and Climate report. More on this in today’s ESG and Climate report.

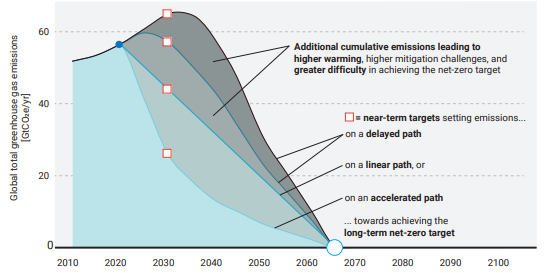

Uncertainty And ESG Pressure Likely To Cause More Energy Price Spikes

Nov 24, 2021 2:09:08 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Renewable Power, Energy, Emissions, ESG Investing, Net-Zero, carbon footprint, carbon abatement, carbon offset, energy transition, climate, energy inflation, energy prices, carbon pricing, ESG Pressure, fossil fuels

In a media interview earlier this week (more details to follow) we were involved in a discussion about inflation and specifically energy. The discussion covered much more than this, but the chart below is perhaps one of the easier ways of showing where our concern lies, and it ties directly to the behavioral patterns that are emerging concerning climate change and ESG focused investing. As noted in the title of the chart, the likelihood that the linear path from here to net-zero will work is very low, given that we would need global government coordination now, and we are far from it. The other scenarios are much more likely, at least in the early years, and they call for an increase in emissions, which implies growing demand for fossil fuels and other materials that have a high emissions footprint. If you are an oil or gas producer and you look at the chart you could quickly conclude that while your products are in demand today and likely to be in growing demand for several years, the longer-term outlook is very unclear. This might slow down your investment plans, or at least make you think twice about the shorter lead-time projects – such as on-shore and shale-based. However, it could kill any longer-term offshore/deepwater projects that take many years to bring on stream. Today we see energy investment hesitancy everywhere (see our Chemical Blog), but at the same time, we do not see the global coordination to drive a faster energy transition, assuming we had the materials and the investment dollars to move any faster. The risk that we run out of produced fossil fuels from time to time over the next 3-5 years is very high.

As The Focus On Carbon Increases, Fairness Will Become An Issue

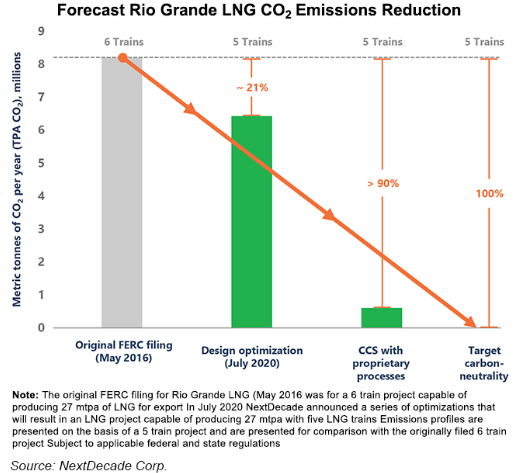

Nov 23, 2021 12:31:25 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, LNG, CCS, CO2, Emissions, Carbon Price, Air Products, decarbonization, BASF, carbon abatement, climate, Venture Global, Freeport LNG, Golden Pass, Cameron, NextDecade, decarbonize LNG, Cheniere

In our ESG and Climate report tomorrow we are focusing on the very wide range of carbon prices and the structures of the various emission reduction incentive schemes, with a focus on what it does to the competitive landscape within the impacted markets. For example, with the government subsidy being offered to BASF and Air Liquide for the CCS project in Antwerp, some level of competitive edge will be granted to the companies, because similar subsidies might not be available to others. Last week we discussed the very wide range of potential carbon abatement costs for companies in the same business, driven by technology and geography. If we add to that the potential for some projects to attract subsidies, while others do not, we change the landscape of the competitive playing field. Could we, for example, see BASF shutter production in Germany, where abatement costs are high, and move more manufacturing to Antwerp – something likely to be very unpopular with the German government and trade unions. This is more problematic in Europe because of the open trade policy. For Germany to give the same benefit that BASF has at Antwerp to chemical manufacturers in Germany could be prohibitively expensive given the much higher inland costs of CCS in Europe, assuming any permits would be issued. Alternatives to CCS, such as the electrification of industrial heating processes or the use of hydrogen as fuel might be equally expensive. We see some of the select European subsidies possibly causing discord between the member states.