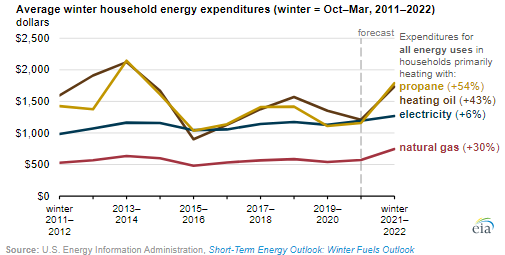

At this point, it has stopped being a story about how transient higher energy prices might be and instead become a story of how high could they go as well as how long the higher prices could last. With sentiment easing in the US because of an expected milder October, we also have the headline of the restart of Cove Point LNG, which should add to natural gas demand. The EIA, in the chart below, shows US prices peaking through the end of the year before falling again in early 2022. There remains an expectation that the rest of the world will be short of LNG and so we will either see the US natural gas competitive advantage remain strong, or the US LNG facilities will stretch their underutilized nameplate capacity and this could be supportive of higher US natural gas prices. New LNG capacity does not hit until late 2022 and how much is exported until them will be a function of the throughput of the existing terminals – which today look like they were very prudent investments.

Lack Of Consumer Goods Make Higher Energy Prices More Affordable…

Oct 14, 2021 3:42:08 PM / by Cooley May posted in Hydrogen, LNG, Air Products, natural gas, EIA, shortages, Consumer Goods, energy prices