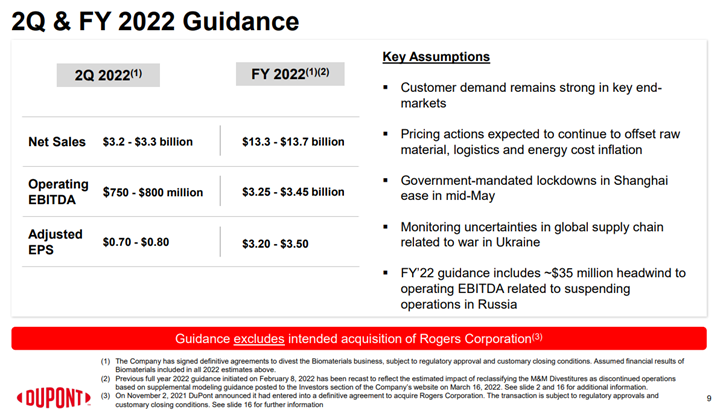

Like many of the European producers, DuPont has taken a risk in our view by holding guidance flat in the face of inflation, weakness in China, and a potential further economic slowdown in Europe and the US. We struggle with what an alternative approach should be for DuPont and others, given that it would be challenging to map out a credible downside scenario today. What we would note, however, is that when things turn negative for the materials industries they tend to fall quickly and sharply. For all of the base chemical and specialty chemical companies what might upset things for 2022 are largely outside of their control, and it is hard to second guess cutbacks in customer demand until they happen, especially in an environment where all are looking at volatile costs from energy and consumer spending uncertainty because of inflation. For more see today's daily report.

DuPont: Too Optimistic But Hard To See An Alternative

May 4, 2022 2:20:10 PM / by Cooley May posted in Chemicals, Energy, Inflation, Base Chemicals, specialty chemicals, chemical producers, materials, DuPont

Chemical And Polymer Prices Are Moving Higher

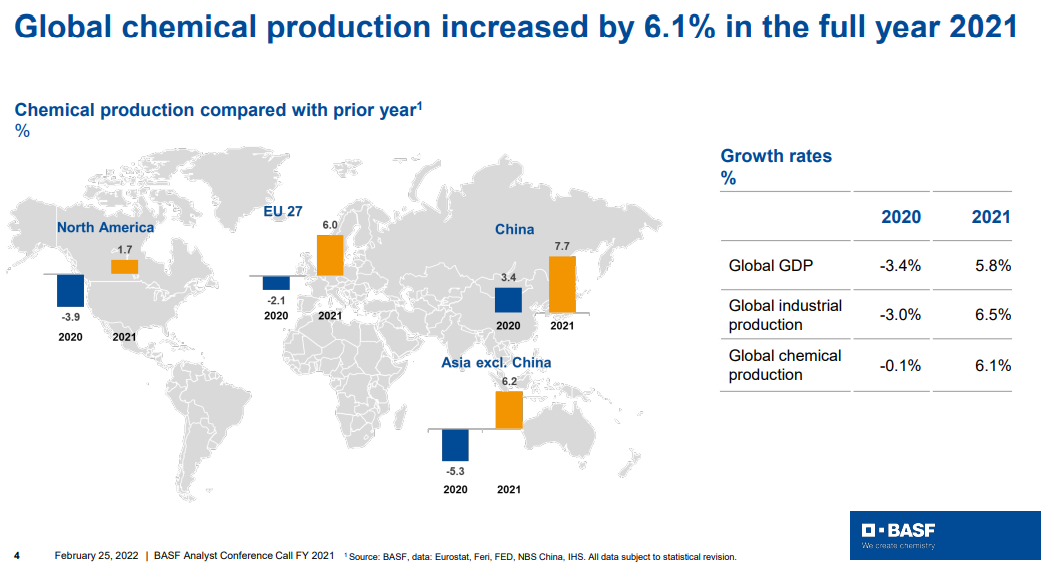

Feb 25, 2022 1:59:11 PM / by Cooley May posted in Chemicals, Commodities, Energy, Raw Materials, Inflation, Chemical Industry, intermediates, specialty chemicals, commodity producers, chemical producers, materials, shortages, intermediate chemicals, energy prices, European energy prices, polymer industry

Fear of shortages is the one factor that is most supportive in terms of helping to push through pricing and the events in Europe and their associated impact on energy prices should be all the support that the chemical and polymer industry needs to push pricing through that will cover cost inflation. Buyers of raw materials and intermediate products will naturally look to buy a little more than they need in the near term, both to ensure that they get something ad to try to build a bigger inventory cushion. This will have the effect of pushing apparent demand higher, making the pricing initiatives easier. Few will push back on pricing if their primary concern is availability. Looking at the BASF results summarized in the chart below, demand is already very robust and this will lead to higher utilization rates and higher volumes for chemical producers as well as high pricing. The commodity producers are likely more interesting here as they can move prices much more quickly than the specialty companies who might see margins squeezed over the next couple of months. None of this is good for inflation. See more in today's daily report.

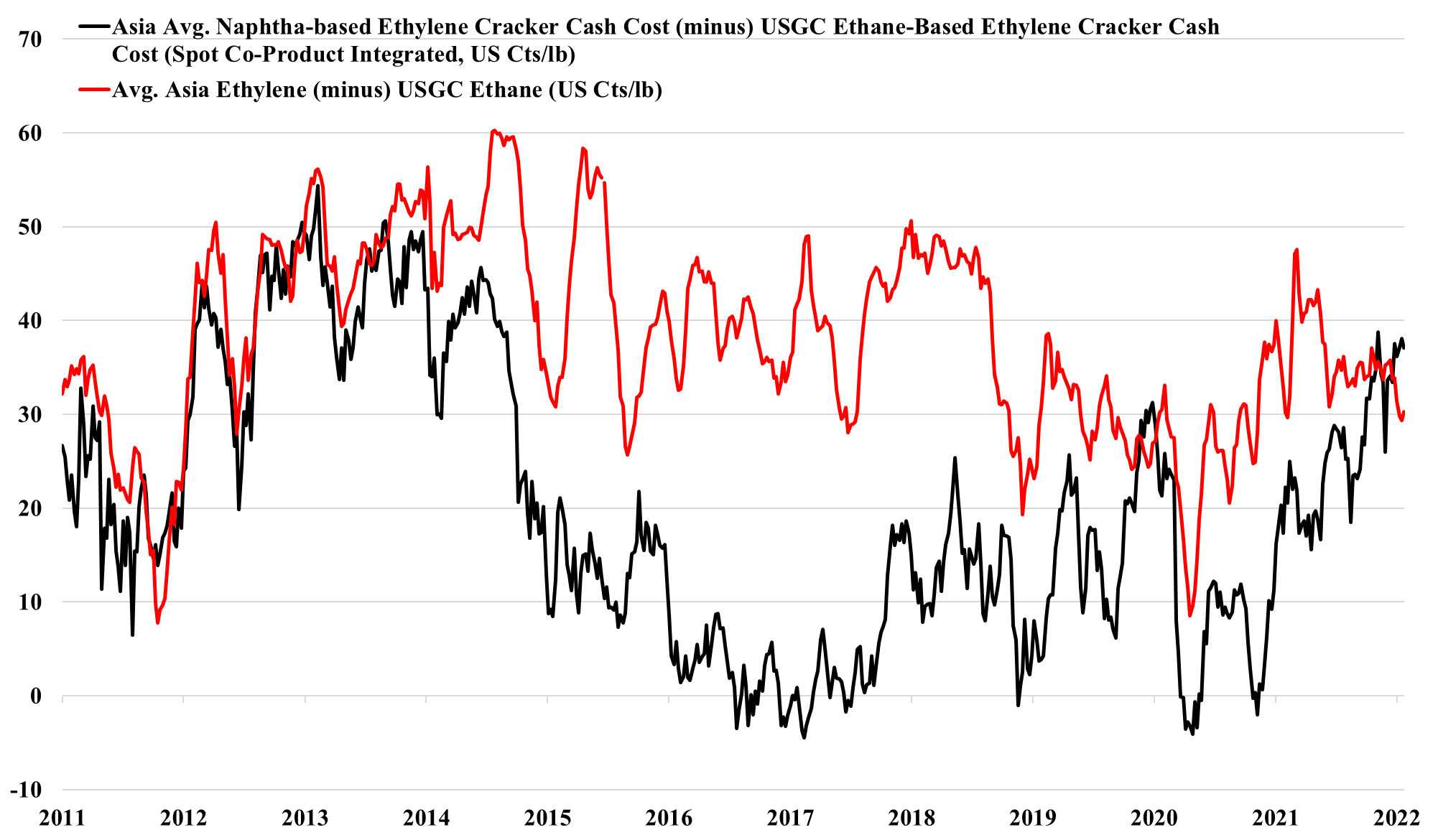

The US Is Benefiting From Strong Growth And A Significant Cost Advantage

Feb 1, 2022 12:18:39 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Axalta, US Chemicals, polymer producers, ethane, US Ethane, US Polymers, exports, chemical producers, OEM, cost advantage, Auto OEM, Ethylene cracker

2022 has started very strongly for US chemical and polymer producers, in part because demand growth remains very robust based on early reads from those that have reported earnings, and in part because of the ever-increasing competitive edge that the US is enjoying over Asia – see exhibit below. US producers can maintain strong margins in the US, while easily pushing any surpluses into export markets where local suppliers cannot compete. At the same time, higher production costs and very high logistic costs make it almost impossible for those regions with capacity surpluses to move products into the US, and it is challenging also to move products into Europe. If this production and logistic cost environment persist, not only should US prices stabilize, but for select companies – those with a strong US production bias – we should see estimates for 2022 start to rise.

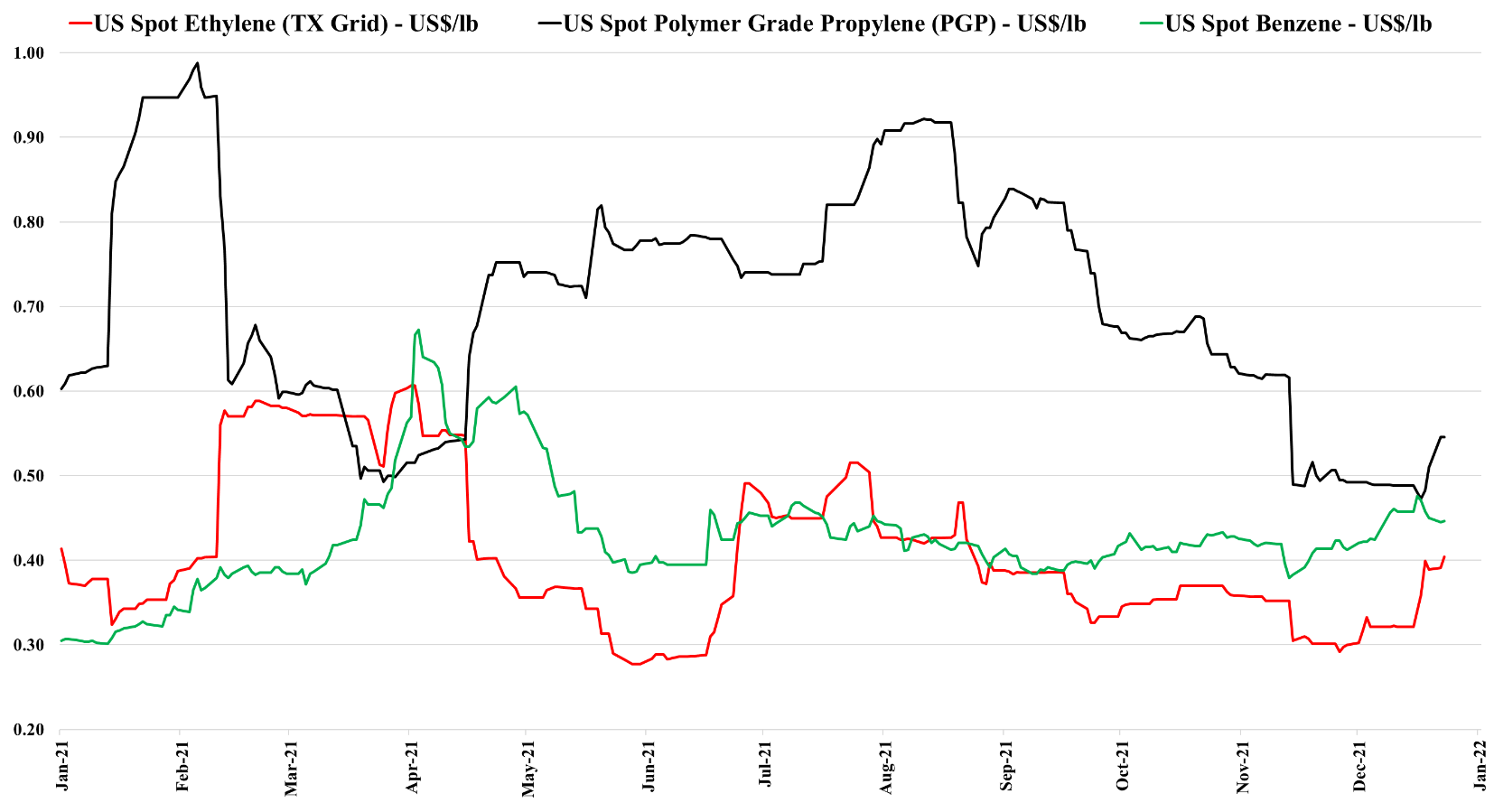

Some Chemical Producer Price Initiatives Will Fare Better Than Others

Jan 11, 2022 3:10:34 PM / by Cooley May posted in Chemicals, Polyolefins, Polyethylene, Raw Materials, LyondellBasell, Chemical Industry, polyethylene producers, oversupply, Basic Chemicals, Westlake, chemical producers, Huntsman, Building Products, price initiatives, demand strength, Sika, monomer prices

We are seeing pockets of real demand strength in some areas of chemicals, such as building products, and this is allowing producers to push through price increases to reflect higher costs and most likely add some margin. In other areas where the fundamentals might not be quite as supportive, we are still seeing attempts to pass on higher costs. Sika has supported what we have heard from many over the last few weeks, which is that the building products chain remains tight, as demand is strong, capacity is running hard and logistic issues continue to cause problems in some cases from a raw materials perspective and in others from getting finished products to market. Where there is limited ability to increase supply, those selling into the building products space are likely to make more money as they should have strong pricing power – in the US chemical space, we would favor Westlake as a potential big winner from this trend, but Huntsman should also be on the list.

US Chemical Strength Persists, Ida Issues Add To Supply Chain Woes

Sep 1, 2021 1:04:08 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, ExxonMobil, Dow, ACC, Hurricane Ida, CAB, chemical producers

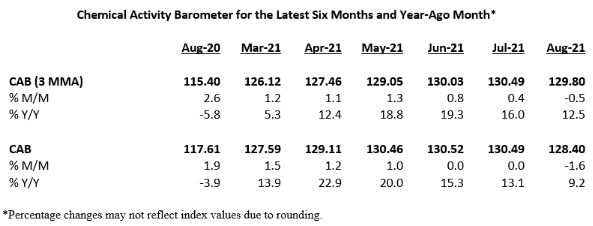

The ACC “chemical activity barometer” shown in the exhibit below is more impressive when you consider that by August of last year the demand recovery was in full swing and operating rates were high. There was some negative impact from the first hurricane, but this hit very late in August 2020 and would not have influenced the ACC reported activity significantly. We focus on price and margin in most of our commodity commentary and this is appropriate, given how much more important they are than incremental volume for all commodities, but it is worth noting that all of the chemical producers get decent cash flow gains from uninterrupted high (optimal) operating rates. The last two years have been a little plagued by more than expected unplanned stoppages, and this has helped keep the US market buoyant, but those that have been able to run at optimized rates for prolonged periods are benefiting. Prices have been the biggest contributor for Dow and ExxonMobil on the integrated polyethylene front in the US this year, but both have had the benefit of very strong operating performance, as have most others with a bias to Texas. Dow and ExxonMobil have large facilities that were in the path of Ida. LyondellBasell and CP Chem do not. See our daily report for more.