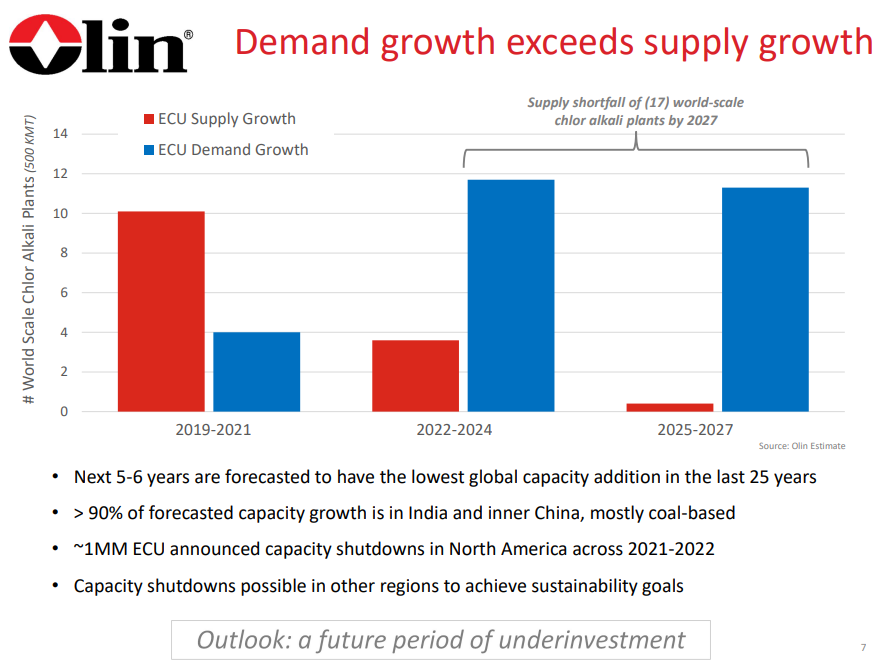

We are already seeing the impact of ESG-pressure related underinvestment in many commodities, and the picture that Olin paints around chlor-alkali is not dissimilar to some of the analyses that could be done around some metals today – especially those that are critically important to the EV, Solar, and Wind industries – this is a topic that we have covered at length. While chlor-alkali may be a pressing very near-term example of how underinvestment could impact chemicals, we suspect that the issue may be much broader, just not yet apparent in other sectors because of the wave of new investment from 2017 through 2022. The polyethylene equivalent chart to the one below would show more balanced supply/demand in the 22 – 24 period than for chlor-alkali but the same deficit thereafter. Many of the other base chemicals would look the same. This supports our expectation of an industry mega-cycle, possibly starting as early as 2023. Of course, there is time to add new capacity by 2025/26, but most companies are more focused today on how they comply with tighter environmental standards today than they are on their next expansion. Further hindering new expansion-driven capital investment decisions is the uncertainty around polymer demand (how much will be recycled, will there be more bans, will there be a substitution from other materials). Our view is that base polymer demand will continue to grow and that we will run short as a consequence of underinvestment. See our report titled - Waiting For The Big One – Is A Chemical Mega-Cycle Ahead?

More Signs That Shortages Of Chemicals Are Likely

Jan 28, 2022 3:27:25 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, Metals, solar, EV, wind, polymer demand, materials, shortages, Olin, ESG Pressure, mega-cycle, chemicals shortage, chlor-alkali, underinvestment

Olin Cutting Capacity, Celanese Adding; Both Strategies Can Work

Oct 22, 2021 2:32:02 PM / by Cooley May posted in Chemicals, Methanol, Capacity, chlorine, Olin, Celanese

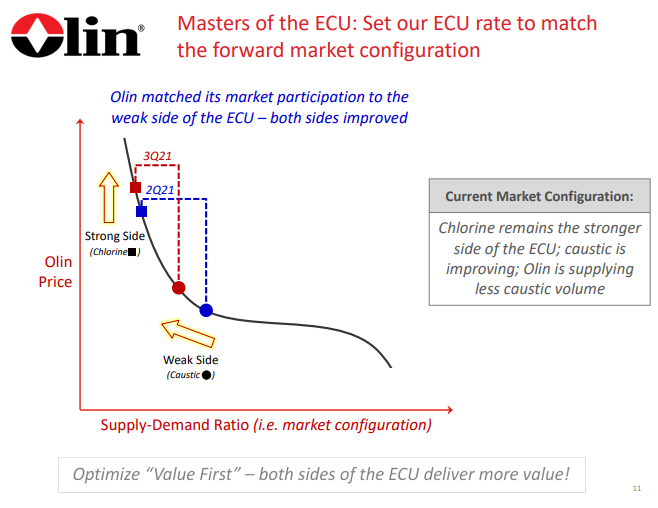

We will expand on the Olin results and some of the benefits and potential pitfalls of the revised strategy in our Sunday piece as we can draw some comparisons (some good and some bad) from other corporate examples over time. For now, it is working and few would have predicted a $50+ stock for Olin a year ago. Some market fundamentals are working in Olin’s favor, but much of the success is coming from a more radical approach to customer engagement and avoidance of customers generating minimal returns, regardless of what that means for production. So far this is a great first act from the new leadership of Scott Sutton – we will talk about what a second act may need to look like on Sunday.

Higher Global Energy Costs - A Real Problem For Most

Oct 12, 2021 3:07:57 PM / by Cooley May posted in Chemicals, Polymers, PVC, Ethylene, Energy, natural gas, Westlake, PVC producer, energy inflation, Occidental, Formosa, Shintech, Olin

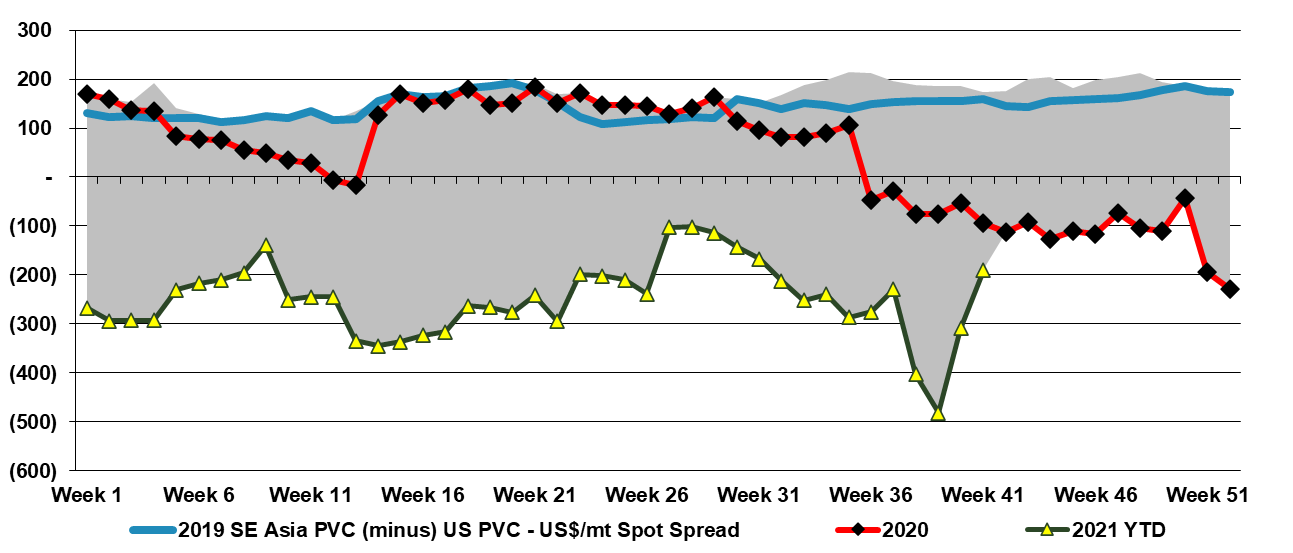

With the rapid rise in energy prices, we are seeing price increase announcements for many intermediate chemicals, especially in regions of the world where margins were already very slim. The energy inflation issue is hard to call, with more and more commentators suggesting that it could be prolonged (which generally means it will be short), but lots of dislocations support duration. We would certainly be pushing prices today on the back of energy costs that could move higher again, and given that many chemical and polymer buyers have price protection in their contracts (for at least a month), producers could face a margin squeeze and an uphill climb to get adequate price coverage. Seasonally, demand for chemicals and polymers is at its weakest for the next couple of months, so the price hikes may be difficult. However, because of supply chain constraints, buyers may feel less confident and concede more easily. We could see a significant swing in sentiment from the chemical companies on 3Q earnings calls over the coming weeks as they talk about how good results were in 3Q but throw up all sorts of cautionary statements concerning 4Q.