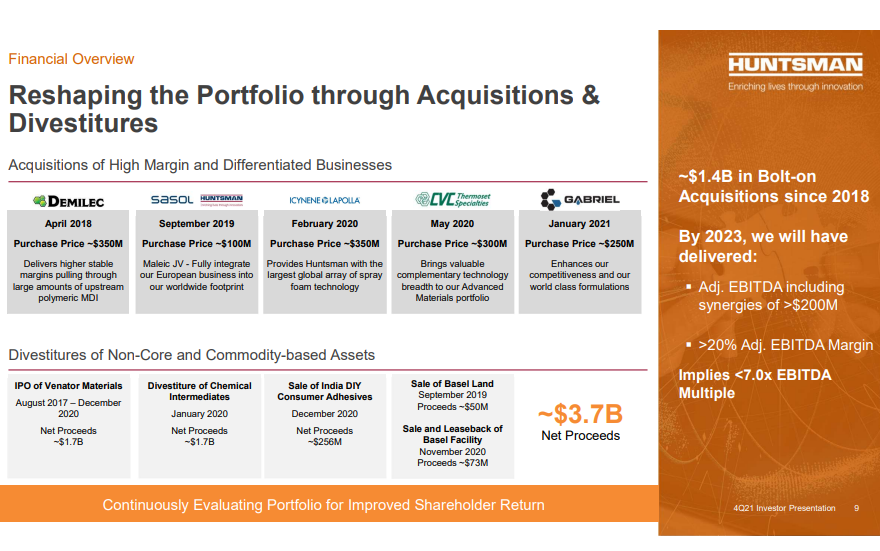

The Huntsman activist defense presentation highlighted below does a very good job of explaining why Starboard is focused on a set of concerns that the company has already addressed and while we would generally not comment on something like this, we agree with Huntsman’s assessment that the proposed Board changes bring nothing to the table. Where the Starboard activity may help is improving Huntsman’s communications, as while the company has done a good job, in our view, of repositioning, it has done a less good job, until now, of communicating what the changes mean. The presentation linked below does a much better job than anything we have seen from the company in the past. To be fairer to Huntsman, the chemical industry has always had trouble communicating strategy shifts and portfolio transformations to stakeholders and there have been several instances of good stories not turning into good businesses – Eastman had some false starts in the past but has not been alone with these problems. It often takes some time for investors to believe in a new business model and this is where good corporate communications strategies can help. This presentation is a good start for Huntsman.

Huntsman: Making All The Right Moves

Mar 3, 2022 1:46:01 PM / by Cooley May posted in Chemicals, Raw Materials, Chemical Industry, Supply Chain, downstream, Huntsman, strategy, performance products

Commodity Leadership Not Best For A Specialty Strategy

Jan 13, 2022 2:57:31 PM / by Cooley May posted in Chemicals, Commodities, Polyurethane, LyondellBasell, Dow, specialty chemicals, Huntsman, strategy

We have covered some of our Huntsman logic in today's daily report, but we would like to point out another concern that we find with Starboard’s proposal – the focus on operations and the nomination of Jim Gallogly as a potential board member. While we have nothing but great respect for Mr. Gallogly, and the work he did at LyondellBasell, we are concerned that Huntsman’s business model would not be best served with a “larger than life” board member with a very strong commodity background. We have seen several significant mistakes made in the past by commodity-minded companies and leadership, applying somewhat linear thinking to acquired businesses and we believe this could be a risk here. When Dow acquired Rohm and Haas one of the few mistakes that were made was looking at the acrylic acid business like a commodity and trying to drive more production through the units. The effect was to oversupply the markets and depress pricing and margins and it took a couple of years for the right management team to get the business back on track. Huntsman likely does not need more polyurethane and epoxy production if doing so creates a race to the bottom with competitors and destroys margins. The intermediate and specialty chemical business is as much about matching supply to demand as it is about plant throughput and efficiency. Every company can improve its operations and improve efficiency and costs but for some businesses, more material is not necessarily better. We believe that Huntsman’s stock would react negatively if the strategy changed to one of pushing as much volume as possible.