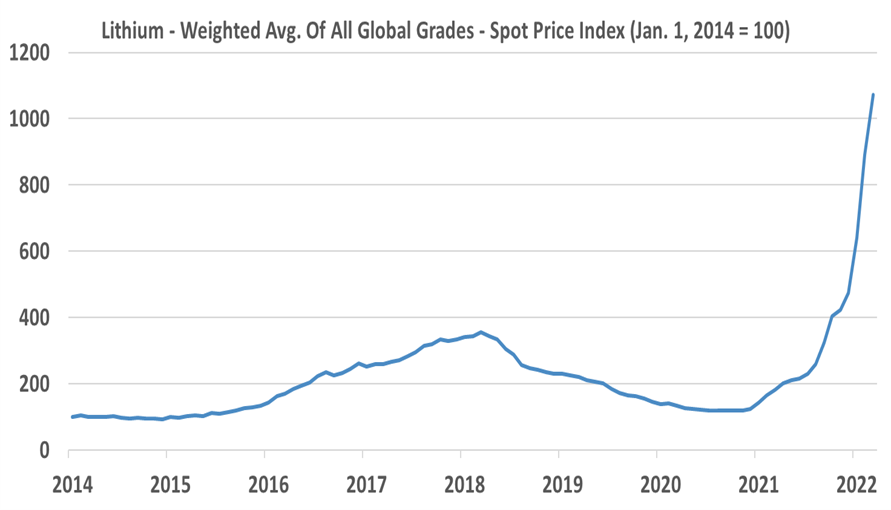

Lithium prices keep rising. We refer back to some work we did on the subject several months ago, where we predicted that lithium was likely to be a cyclical commodity - eventually. Right now we see demand for new EVs, demand to fill the supply chain for new EVs, and demand to fill the supply chain for new battery factories – and consequently, demand is likely overstated relative to the number of EVs leaving production lines. In lithium’s favor, EVs are surprising on the upside in production and sales, but this will add to the need to fill supply chains. We do not see the lithium bubble bursting soon, but we do not see enough barriers to entry for lithium to protect the product from overbuilding. There are many dilute lithium sources, and high prices could allow for some high-cost options to move up the learning curve and become future low-cost options.

Lithium Supply Fails To Keep Pace With Demand - A Familiar Commodity Story

Apr 12, 2022 12:20:28 PM / by Cooley May posted in Chemicals, Commodities, Supply Chain, Lithium, EVs, Supply, capital spending, Lithium supply

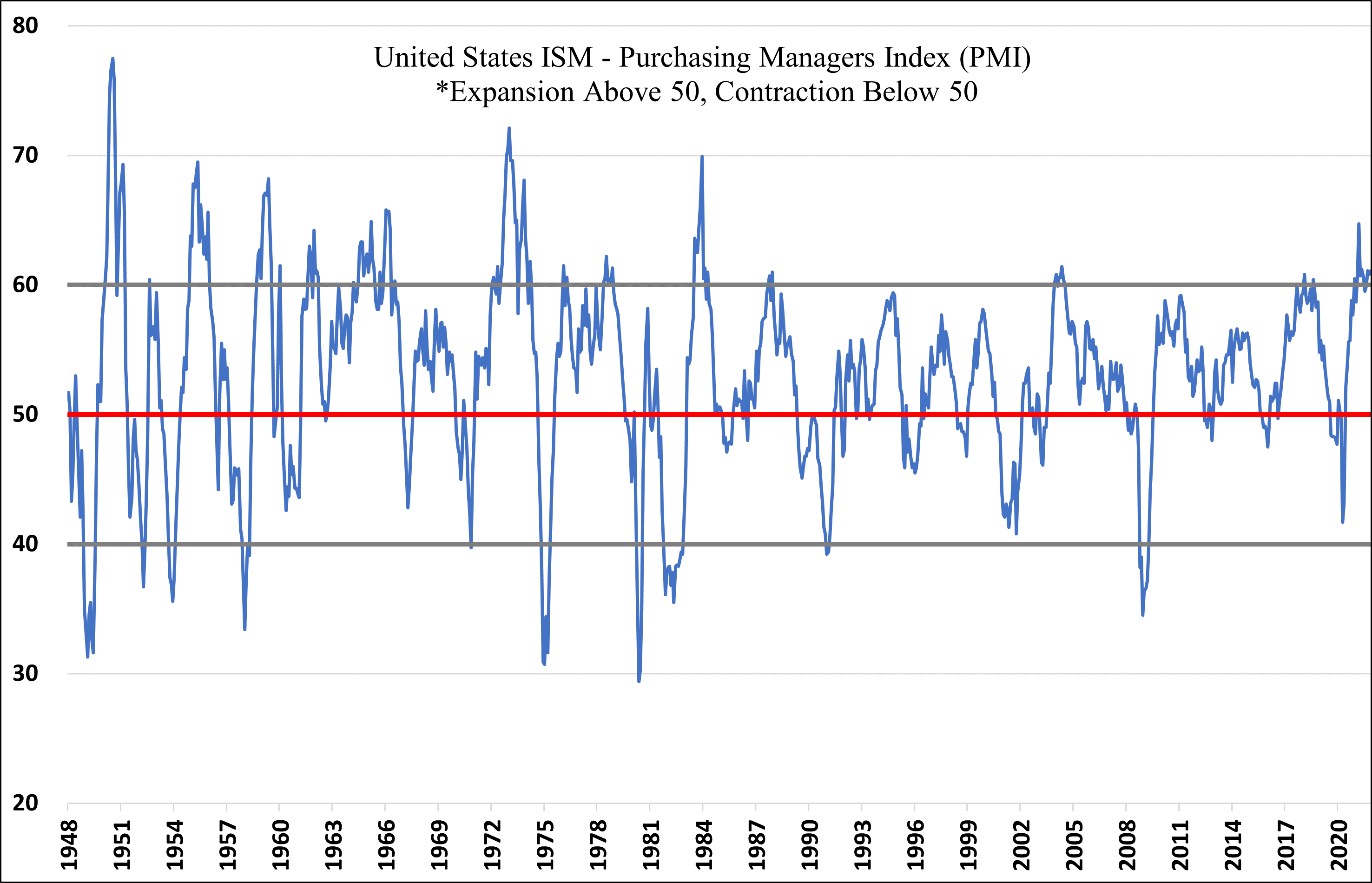

The Need For Manufacturing Support In The US: Enterprise Zones

Dec 6, 2021 1:31:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Dow, polymer producers, manufacturing, US polymer prices, COVID, commodity chemicals, chemicalindustry, plasticsindustry, ISM manufacturing, Enterprise Zones, reshoring, capital spending, chemical investments, PMI

Our latest Sunday Thematic research report titled, "Reshoring Should Remain Supportive of Chemicals in ’22" studied the investment in US enterprise zones, near and medium-term, and the broad-based benefits for domestic supply chains.