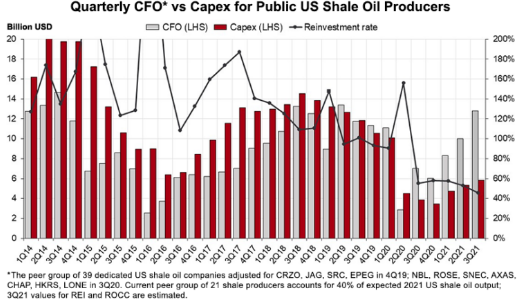

We should probably link the message in the exhibit below with the write-ups in both today's daily report and today's ESG and Climate report. The drop in E&P spending relative to cash flows and the shortage signals that are evident from the current oil and natural gas prices is likely to bump into rising hydrocarbon demand for the next several years, while the rate of renewable investment tires to catch up with energy growth before it can focus on energy substitution as meaningfully as the climate agenda would like. We also cannot look at the chart below and say that it does not matter because oil is less important in energy transition than natural gas. The oil-based investments in the Permian and Eagleford plays, in particular, have significant volumes of associated gas, and much of the natural gas supply growth in the US has come from these oil-centric investments. As they slow down, natural gas supply and NGL supply will be impacted, and while we are seeing increased rig counts in the natural gas biased regions, such as the Marcellus, the potential declines from the other fields will be hard to make up for.

More Evidence That Higher Energy Prices Could Linger

Nov 24, 2021 2:08:46 PM / by Cooley May posted in Chemicals, Energy, petrochemicals, Oil, natural gas, NGL, climate, US Gasoline, EVs, crude oil, energy prices, chemicalindustry, petrochemicalindustry, hydrocarbon demand