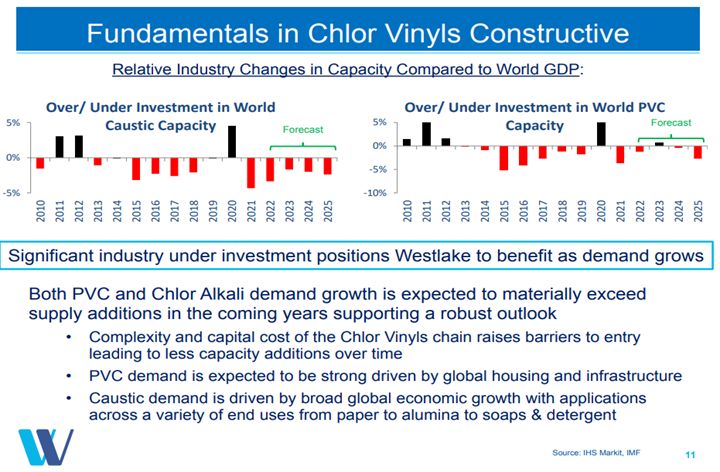

The margin weakness in PVC, as shown in Exhibit 1 from today's daily report, suggests that the market might be weakening, but higher prices would suggest that it is not. The integrated margin weakness is mostly the result of rising costs, and the US PVC market may be strong enough to allow producers to pass on these costs fully over time. We still see PVC as the least risky way to play the US polymers market as infrastructure and manufacturing investments should keep demand strong even if we see a decline in consumer durable related spending. The Westlake chart below highlights one of the primary drivers behind our mega-cycle view – no new capacity. The supply shortfalls that are implied in the chart will be mirrored in other basic chemicals in our view but PVC is likely the most acute example – creating what could be a prolonged period of strong margins for the industry.

The PVC Market Is Compelling - One Of The Most Attractive Global Polymer Stories

Apr 7, 2022 1:39:50 PM / by Cooley May posted in Chemicals, Polymers, PVC, Basic Chemicals, Westlake, US Polymers, mega-cycle

A Chemical Mega-Cycle Is Coming

Mar 22, 2022 12:55:58 PM / by Cooley May posted in Hydrogen, Chemicals, Polymers, Ethylene, polymer pricing, downstream, renewables, EV, Aramco, monomers, crude oil, fuels, mega-cycle

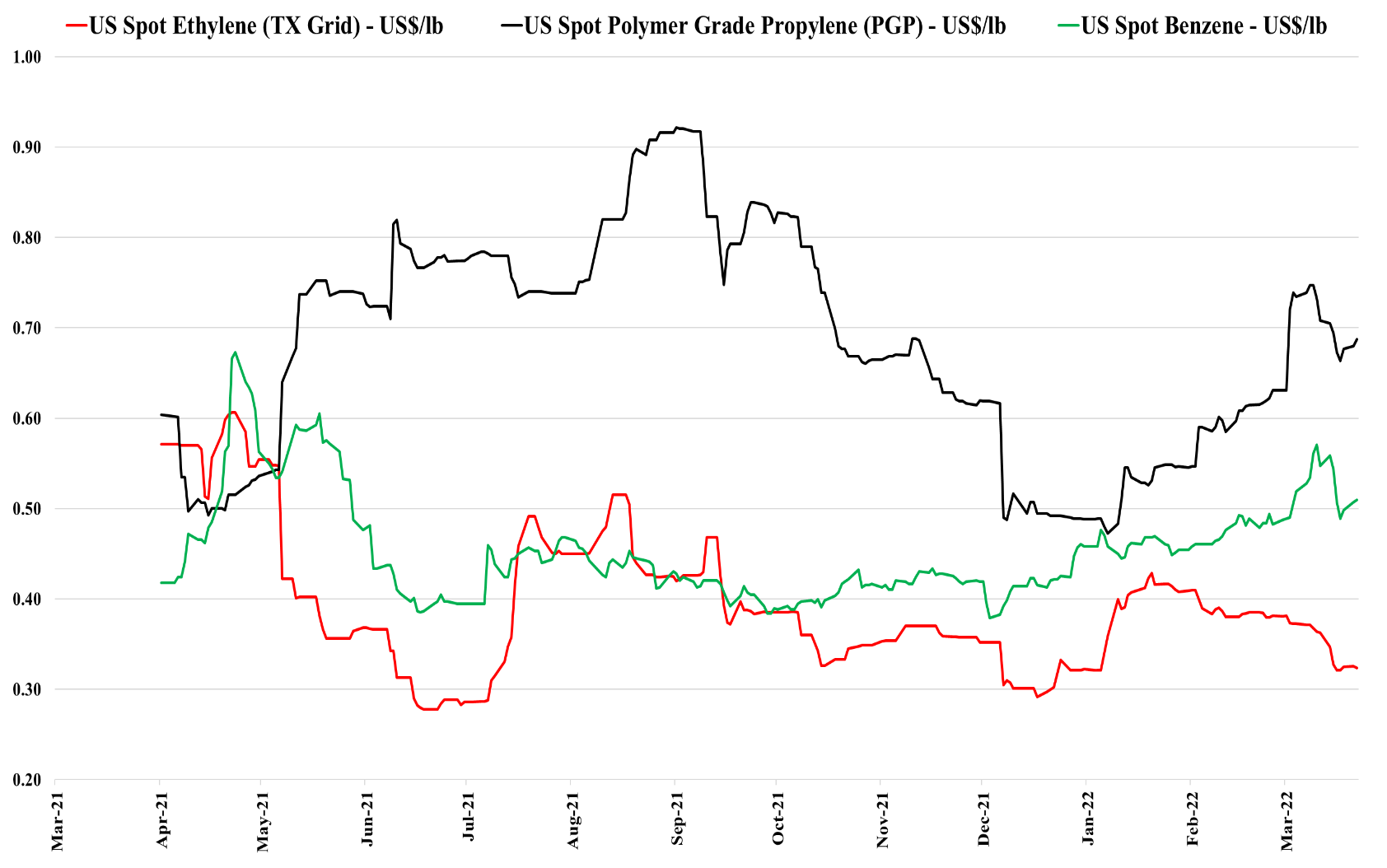

We have talked at length in today's daily and recent Sunday recaps about our expectation for a mega-cycle in chemicals because of an unwillingness to deploy capital as uncertainty rises. The exception is likely to be large oil producers looking at long-term downstream integration plans, with the primary objective of consuming captive crude oil. The Aramco ambitions in China bear some similarities to the ExxonMobil investment announced for China last year. While the crude oil market may be tight and prices may be high today, few oil producers believe that demand will not ultimately be hurt by renewable penetration and EV and hydrogen growth as transport fuels. Looking for captive crude oil demand is a logical step for the major and it is likely that the Aramco ambitions include refining as well as chemicals in China.

Chemical Sector Reports Suggest Inflation Is Here For A While

Feb 10, 2022 1:23:56 PM / by Cooley May posted in Chemicals, Polymers, Inflation, Supply Chain, feedstocks, Trinseo, Earnings, US chemical rail, demand strength, mega-cycle

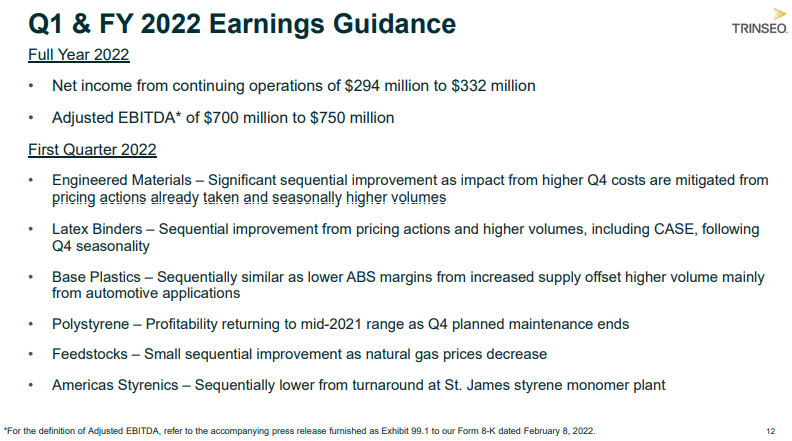

Part of our confidence/concern that prices can continue to rise in the chemical space in general stems from what seems to be very strong demand – again confirmed in earnings reports overnight, as well as in the rail data from today's daily report, as well as inventory data that suggest we are below recent ratios to shipment trends. The inventory piece is the great unknown here because the supply chain shocks of the last 20 months will have reset expectations around “safe” levels of inventory and it is hard to judge whether the new “comfort” normal will be back to the trend in the chart or 50% higher! If the new comfort level is materially higher than in the past, demand growth will remain strong and price momentum could continue through 2022. Our expectations for a mega-cycle in basic chemicals and polymers – targeting late 2023 and 2024 could be dragged forward because of higher apparent demand the time to buy the equities could be now, on that basis.

More Signs That Shortages Of Chemicals Are Likely

Jan 28, 2022 3:27:25 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, Metals, solar, EV, wind, polymer demand, materials, shortages, Olin, ESG Pressure, mega-cycle, chemicals shortage, chlor-alkali, underinvestment

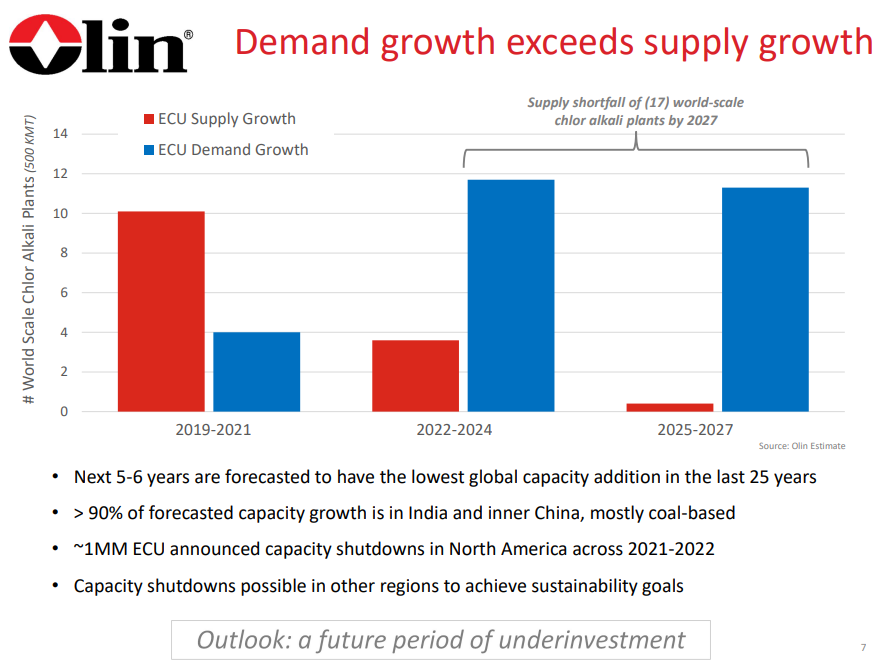

We are already seeing the impact of ESG-pressure related underinvestment in many commodities, and the picture that Olin paints around chlor-alkali is not dissimilar to some of the analyses that could be done around some metals today – especially those that are critically important to the EV, Solar, and Wind industries – this is a topic that we have covered at length. While chlor-alkali may be a pressing very near-term example of how underinvestment could impact chemicals, we suspect that the issue may be much broader, just not yet apparent in other sectors because of the wave of new investment from 2017 through 2022. The polyethylene equivalent chart to the one below would show more balanced supply/demand in the 22 – 24 period than for chlor-alkali but the same deficit thereafter. Many of the other base chemicals would look the same. This supports our expectation of an industry mega-cycle, possibly starting as early as 2023. Of course, there is time to add new capacity by 2025/26, but most companies are more focused today on how they comply with tighter environmental standards today than they are on their next expansion. Further hindering new expansion-driven capital investment decisions is the uncertainty around polymer demand (how much will be recycled, will there be more bans, will there be a substitution from other materials). Our view is that base polymer demand will continue to grow and that we will run short as a consequence of underinvestment. See our report titled - Waiting For The Big One – Is A Chemical Mega-Cycle Ahead?

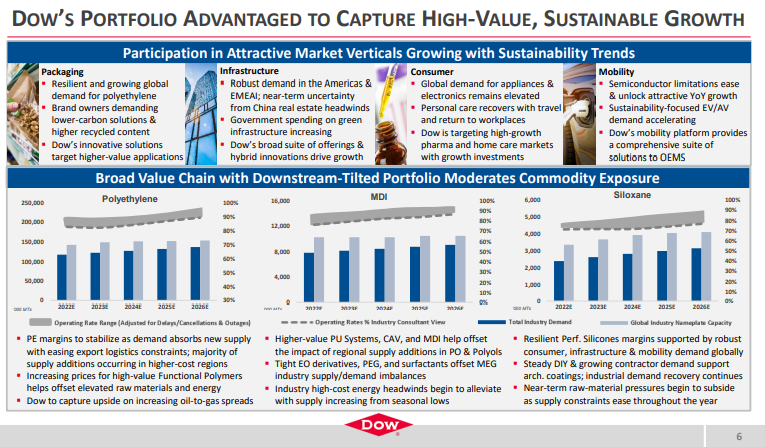

Expectations From Dow Supportive Of Our Mega-Cycle Thesis

Jan 27, 2022 11:50:52 AM / by Cooley May posted in Chemicals, LNG, CCS, CO2, Ethylene, Chemical Industry, decarbonization, Dow, naphtha, CO2 footprint, ethylene production, oil prices, mega-cycle, Alberta

While it might be tempting (and perhaps easier) to focus on the negatives in the Dow earnings release – such as price declines in polyethylene and higher costs in Asia, we think it is much more interesting to focus on the positives. For a while now we have been suggesting that the industry is gearing up for a mega-cycle of profitability, perhaps as early as 2024 – see report – and we see nothing in the current macro environment or in Dow’s release to suggest we might be wrong. Demand growth is very robust across the industry, with consumer spending driving some quite impressive GDP growth numbers in the US in 4Q 2021, as an example. We often see companies suggest improving global operating rates in earnings calls, and while it is mostly hopeful and self-serving, the chart below, from Dow’s report may be conservative. The very high ratio of Asia costs versus US costs in the 2012 to 2014 period (second image below), because of high oil prices, effectively shutdown new naphtha based ethylene investment in Asia for several years and it is what prompted China’s move into coal-based and methanol chemicals (China has almost no ethylene capacity from methanol or coal in 2011, but close to 6 million tons by 2016). As the price of oil rises and the cost curve works against China and the rest of Asia again, the move to more coal is less attractive because of the environmental footprint – coal gasification creates a lot of CO2 emissions and elaborates CCS investment would be needed to justify further expansions, which increases the cost of ethylene production.