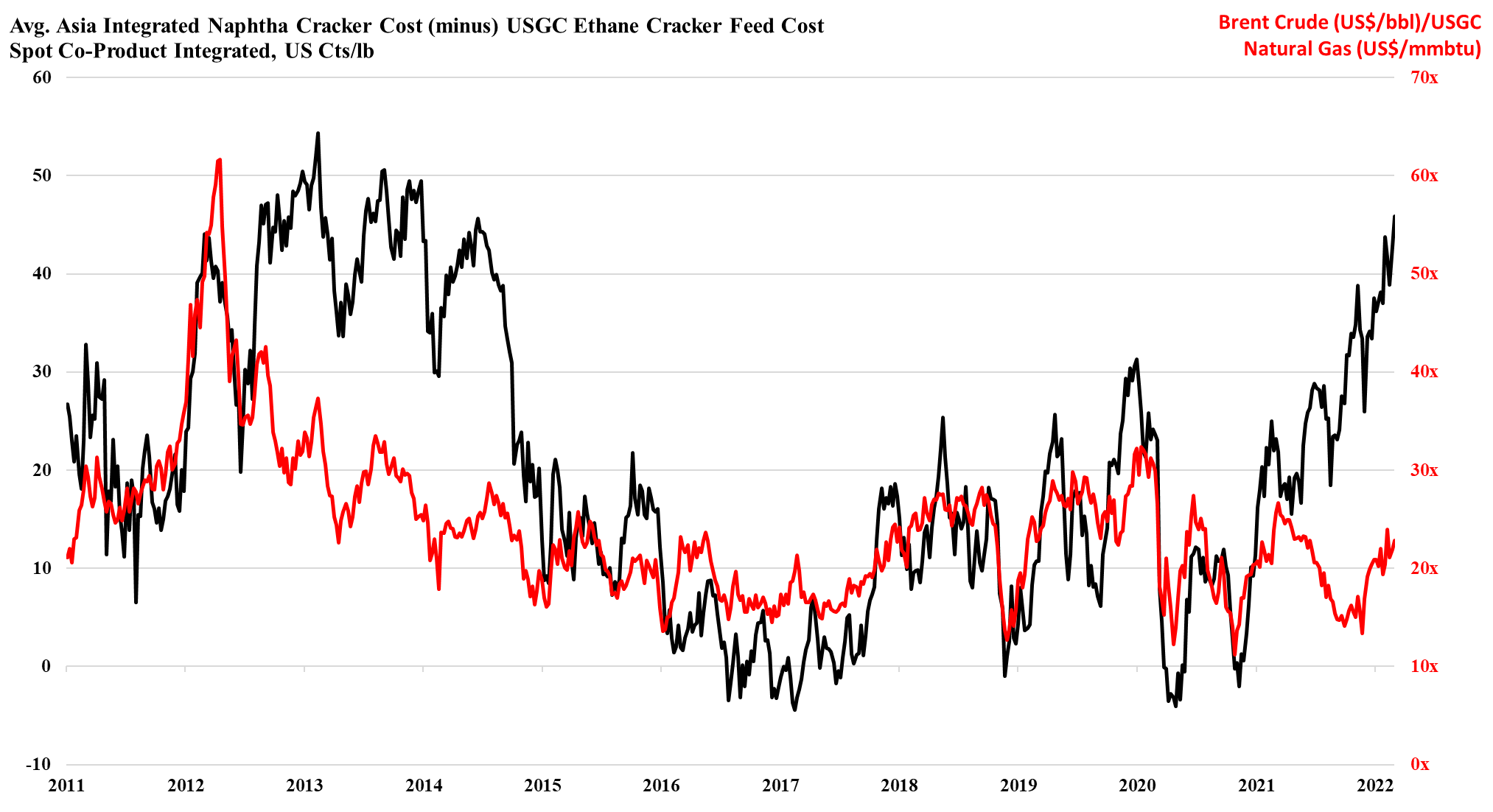

As the ratio of pricing between Brent crude and US natural gas rises, the US ethylene cost advantage is spiking, and as long as the US is producing enough natural gas to feed domestic demand and allow the LNG facilities to run at capacity, the advantage can remain. This gives the US a significant cost advantage and assuming that there is spare capacity the US industry can step up and support Europe if needed. However, it is not clear that there is much spare capacity, either in the production units or in the logistics to get the product to ports or across the Atlantic. There is a surplus of liquid and gas carriers today, but the container problems are global and the inflation and supply chain issues that we seem to be stuck with are likely to keep containers tied up in excess inventory that consumers will want to keep building as a cushion for a less certain supply outlook. The shipping issues are only part of the problem for Asia, as even with better opportunities to export, the region is seeing escalating production costs because of the movement in crude oil and naphtha pricing. We are in an unusual position where strong demand in the US is keeping domestic prices higher than in Asia, despite costs in the US that are low enough, especially for polyethylene to move material to Asia at costs well below the cost of manufacture in Asia. This dynamic can last for a lot longer in our view as long as oil prices remain elevated versus US natural gas. An abrupt turn will occur if US natural gas production falls below domestic demand and LNG demand – this would cause a spike in US natural gas prices. For more see today's daily report.

The US Cost Advantage Is Increasing Daily

Mar 4, 2022 1:59:01 PM / by Cooley May posted in Chemicals, LNG, Polyethylene, Ethylene, Inflation, Supply Chain, natural gas, US ethylene, naphtha, US natural gas, crude oil, Brent Crude, cost advantage

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

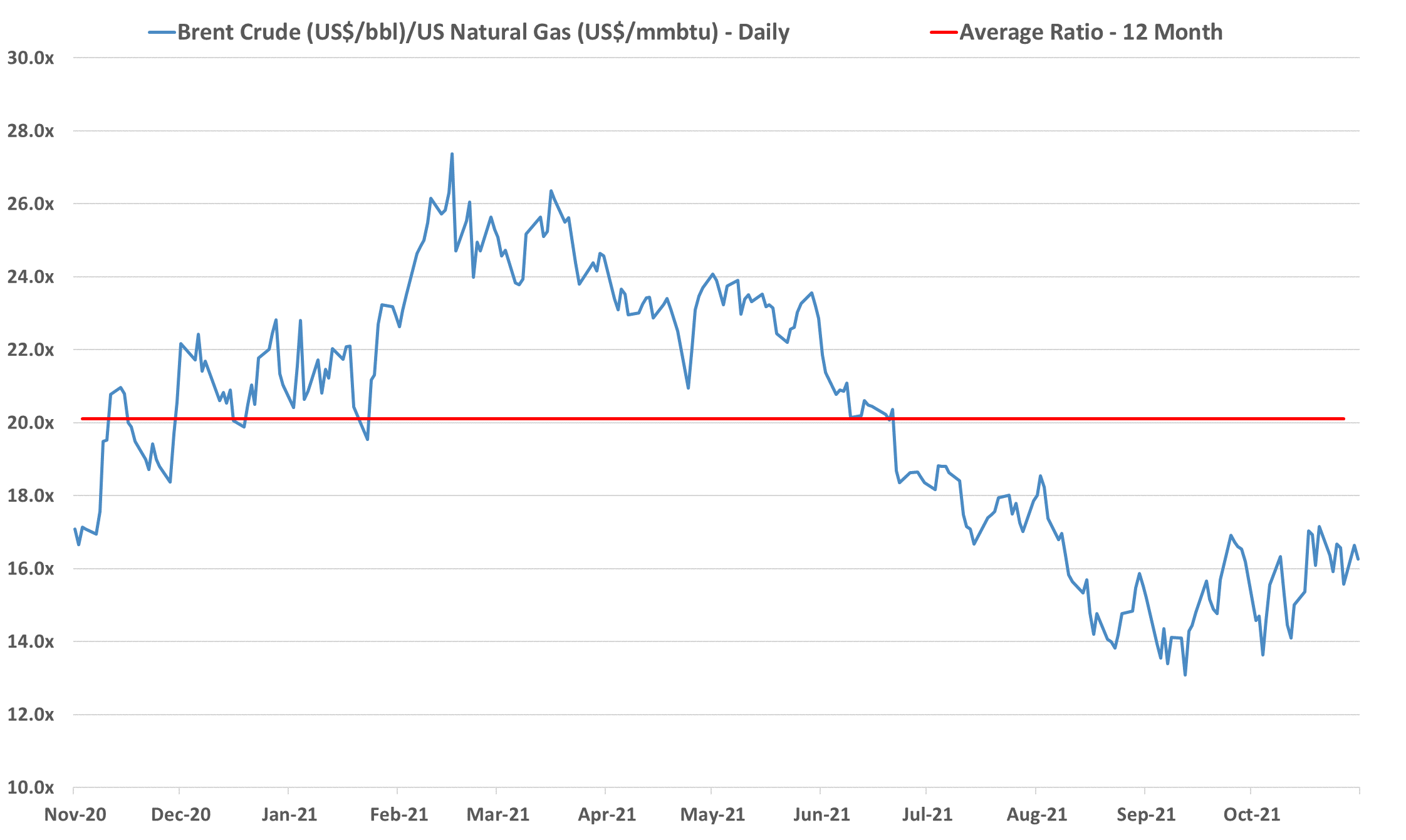

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.