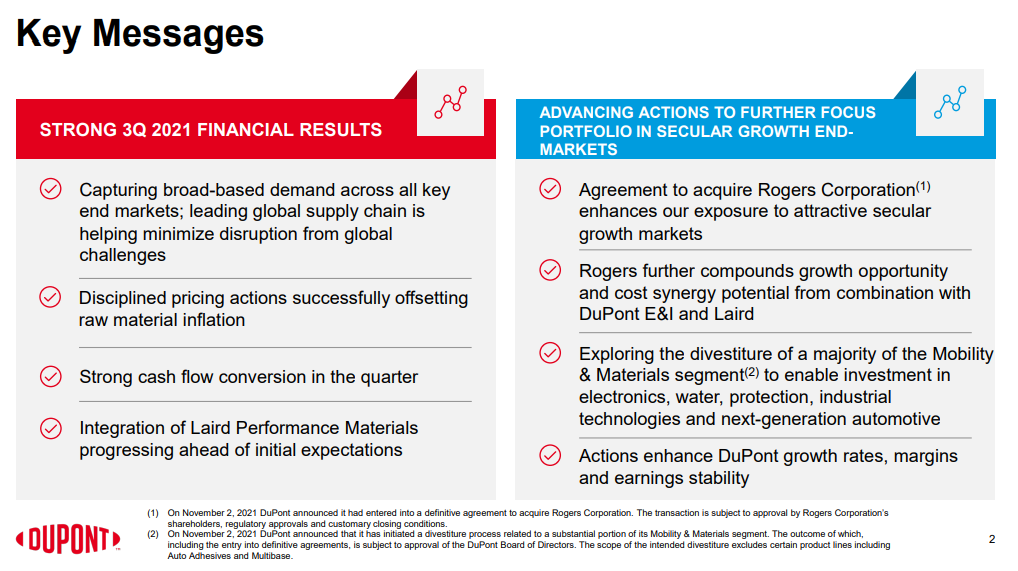

We are not surprised by some of the DuPont stories this morning. We had predicted a long time ago that Mr. Breen was far from done on the restructuring of the company and that COVID might have caused a delay in some of the plans but not changed them. Mr. Breen did a very value-enhancing job of taking Tyco from a slightly out of control, then GE wannabe, to a group of focused companies, separated from the whole. What he has panned for DuPont comes from the same playbook in our view. The divestments and acquisitions announced today will create a core at DuPont – focused on electronics, water, protection, industrial technologies, and “next generation” automotive. Given some of the recent industry moves, we would expect significant interest in the engineering polymers and other resins platforms. After these moves are complete, while not yet obvious from a valuation perspective, we could see a further split, carving out an ESG friendly piece focused around water and protection, although the moves announced today may be enough to get the company an earnings multiple boost.

DuPont: More Value From More Actions

Nov 2, 2021 3:44:19 PM / by Cooley May posted in ESG, Chemicals, Polymers, Chemical Industry, COVID, DuPont, acquisitions, electronics, industrial technologies, automotive, divestments, water, resins