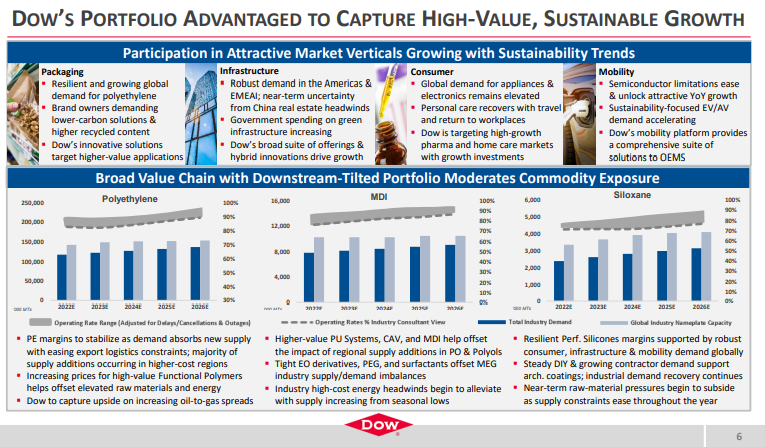

While it might be tempting (and perhaps easier) to focus on the negatives in the Dow earnings release – such as price declines in polyethylene and higher costs in Asia, we think it is much more interesting to focus on the positives. For a while now we have been suggesting that the industry is gearing up for a mega-cycle of profitability, perhaps as early as 2024 – see report – and we see nothing in the current macro environment or in Dow’s release to suggest we might be wrong. Demand growth is very robust across the industry, with consumer spending driving some quite impressive GDP growth numbers in the US in 4Q 2021, as an example. We often see companies suggest improving global operating rates in earnings calls, and while it is mostly hopeful and self-serving, the chart below, from Dow’s report may be conservative. The very high ratio of Asia costs versus US costs in the 2012 to 2014 period (second image below), because of high oil prices, effectively shutdown new naphtha based ethylene investment in Asia for several years and it is what prompted China’s move into coal-based and methanol chemicals (China has almost no ethylene capacity from methanol or coal in 2011, but close to 6 million tons by 2016). As the price of oil rises and the cost curve works against China and the rest of Asia again, the move to more coal is less attractive because of the environmental footprint – coal gasification creates a lot of CO2 emissions and elaborates CCS investment would be needed to justify further expansions, which increases the cost of ethylene production.

Expectations From Dow Supportive Of Our Mega-Cycle Thesis

Jan 27, 2022 11:50:52 AM / by Cooley May posted in Chemicals, LNG, CCS, CO2, Ethylene, Chemical Industry, decarbonization, Dow, naphtha, CO2 footprint, ethylene production, oil prices, mega-cycle, Alberta

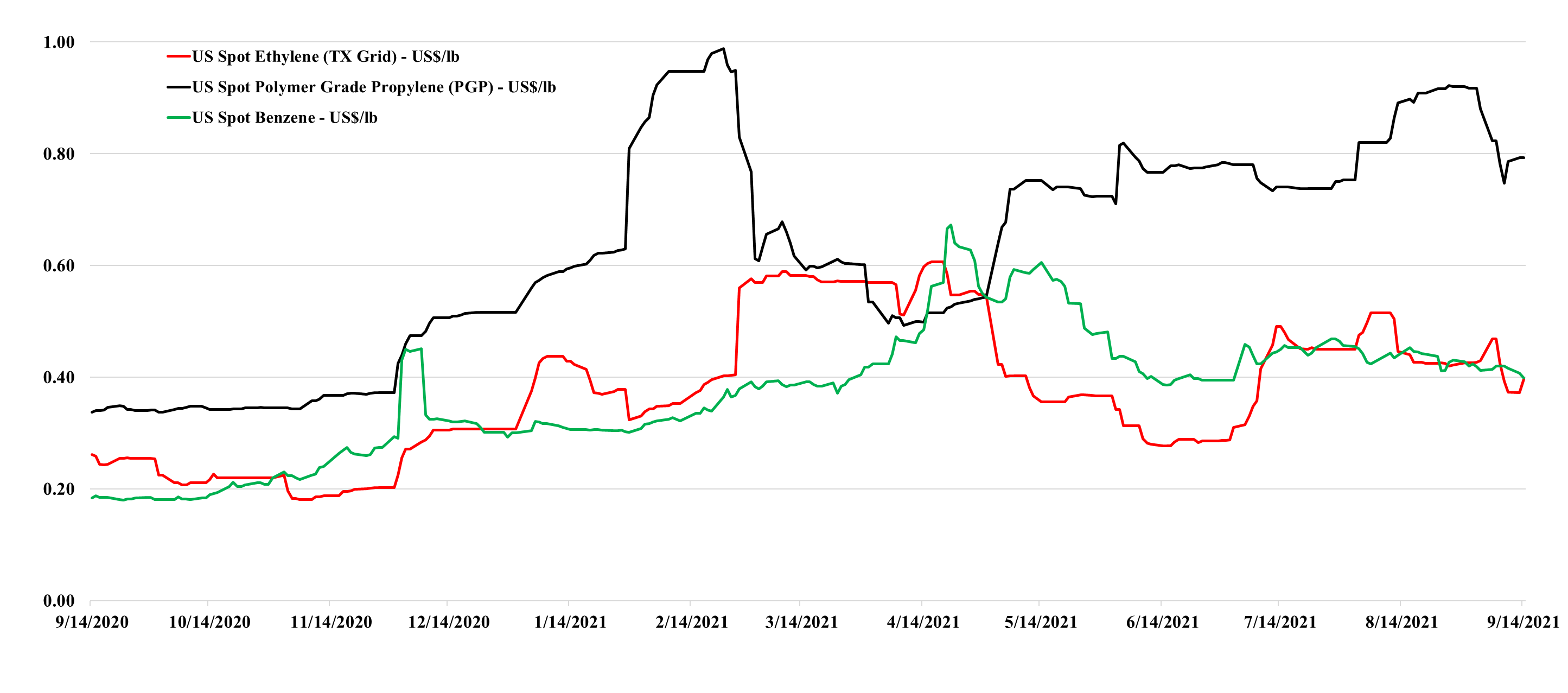

More Storm Related Volatility For Ethylene

Sep 14, 2021 1:24:12 PM / by Cooley May posted in Chemicals, Ethylene, supply and demand, US ethylene, Nicholas, ethylene production

What a difference a day makes – over the weekend we discussed how US ethylene pricing was approaching levels relative to Asia that could restart trade and today prices are jumping again in anticipation of possible lost production from the Tropical Storm. The risk from Nicholas is flooding, but it has already passed much of the South Texas capacity and the larger risk is to the capacity east of Houston and into Western Louisiana at this time. As with Ida, it will take several days to get a read on how much of the chemical and related capacity has been impacted and the likely impacts on supply/demand. See today's daily for more.