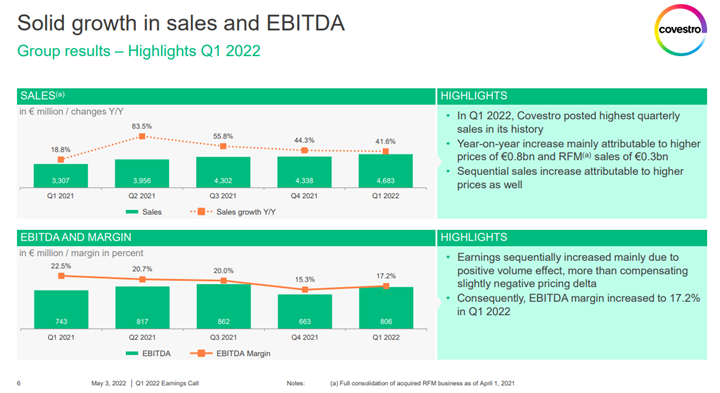

We reflect back on our BASF comments of last week and see Covestro falling into the same trap, by underestimating the potential slowdown in discretionary spending in Europe (and the US) and consequently putting too much hope into revised guidance. At the same time, we are not sure what would be gained by painting a picture of doom and gloom, but we would hedge much more overtly if we were offering guidance around the business outlook today.

Good Results But Too Much Optimism In Europe

May 3, 2022 1:24:48 PM / by Cooley May posted in Chemicals, Westlake, nitrogen, Covestro, materials, commodity chemicals, Agriculture, fuels, Building Products, corporate guidance, crops, Nutrien, fertilizers

A Chemical Mega-Cycle Is Coming

Mar 22, 2022 12:55:58 PM / by Cooley May posted in Hydrogen, Chemicals, Polymers, Ethylene, polymer pricing, downstream, renewables, EV, Aramco, monomers, crude oil, fuels, mega-cycle

We have talked at length in today's daily and recent Sunday recaps about our expectation for a mega-cycle in chemicals because of an unwillingness to deploy capital as uncertainty rises. The exception is likely to be large oil producers looking at long-term downstream integration plans, with the primary objective of consuming captive crude oil. The Aramco ambitions in China bear some similarities to the ExxonMobil investment announced for China last year. While the crude oil market may be tight and prices may be high today, few oil producers believe that demand will not ultimately be hurt by renewable penetration and EV and hydrogen growth as transport fuels. Looking for captive crude oil demand is a logical step for the major and it is likely that the Aramco ambitions include refining as well as chemicals in China.

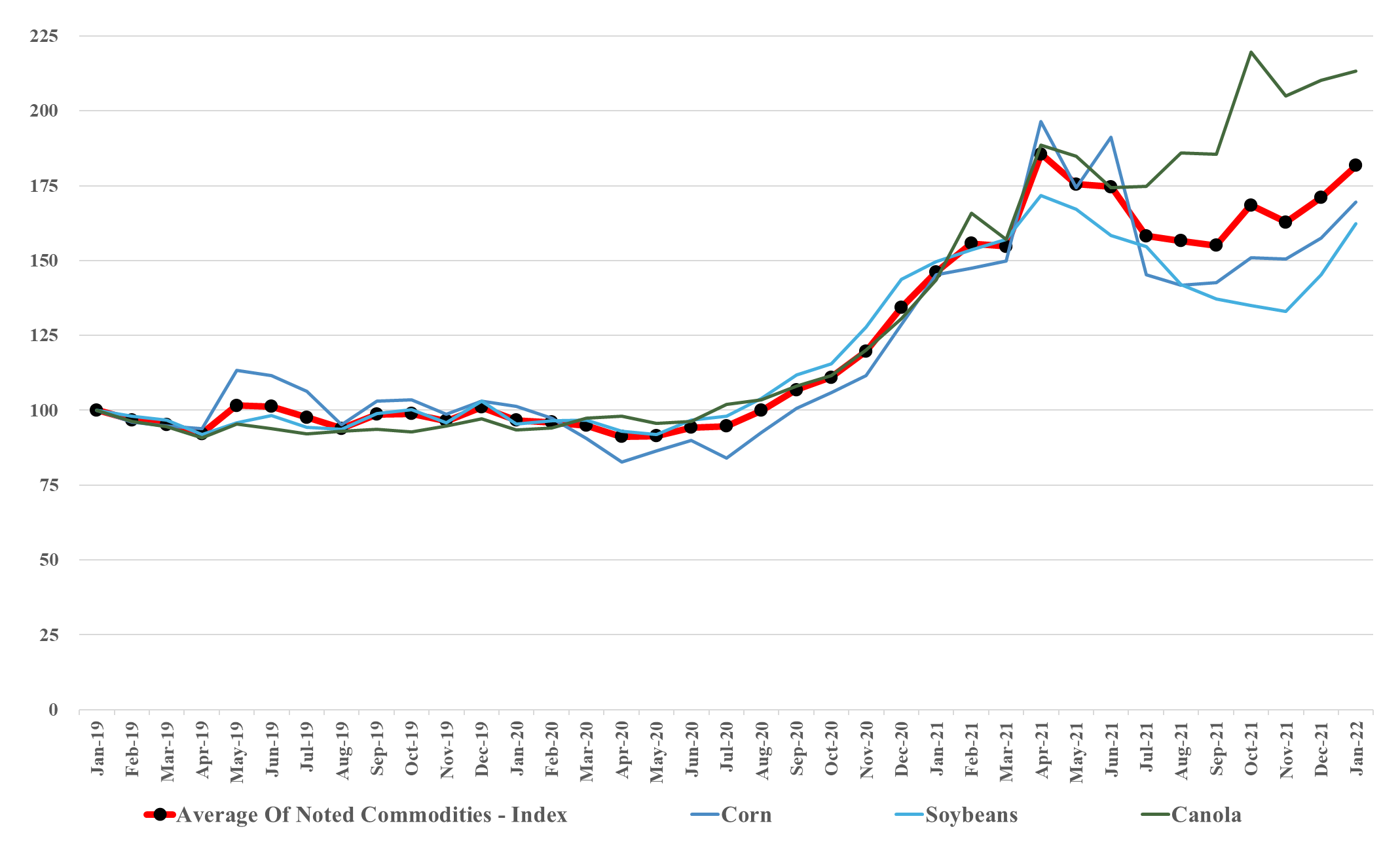

Higher Ag Commodity Prices Are Helping Crop Protection Demand

Feb 4, 2022 1:25:18 PM / by Cooley May posted in commodity prices, materials, crude oil, crude prices, Agriculture, fuels, agriculture commodities, soy prices, Soy, Corn, Canola, Corteva, Crop demand

We show the correlation between soy prices and crude oil in Exhibit 1 in today's daily report, but note all the higher prices in the Exhibit below for corn, soy, and canola. This is providing a good backdrop for the crop protection industry, as seen in Corteva’s numbers. Farmers can afford to spend more to improve yields. We expect this trend to continue as demand for food will continue to grow and we will see incremental demand for fuels and materials.

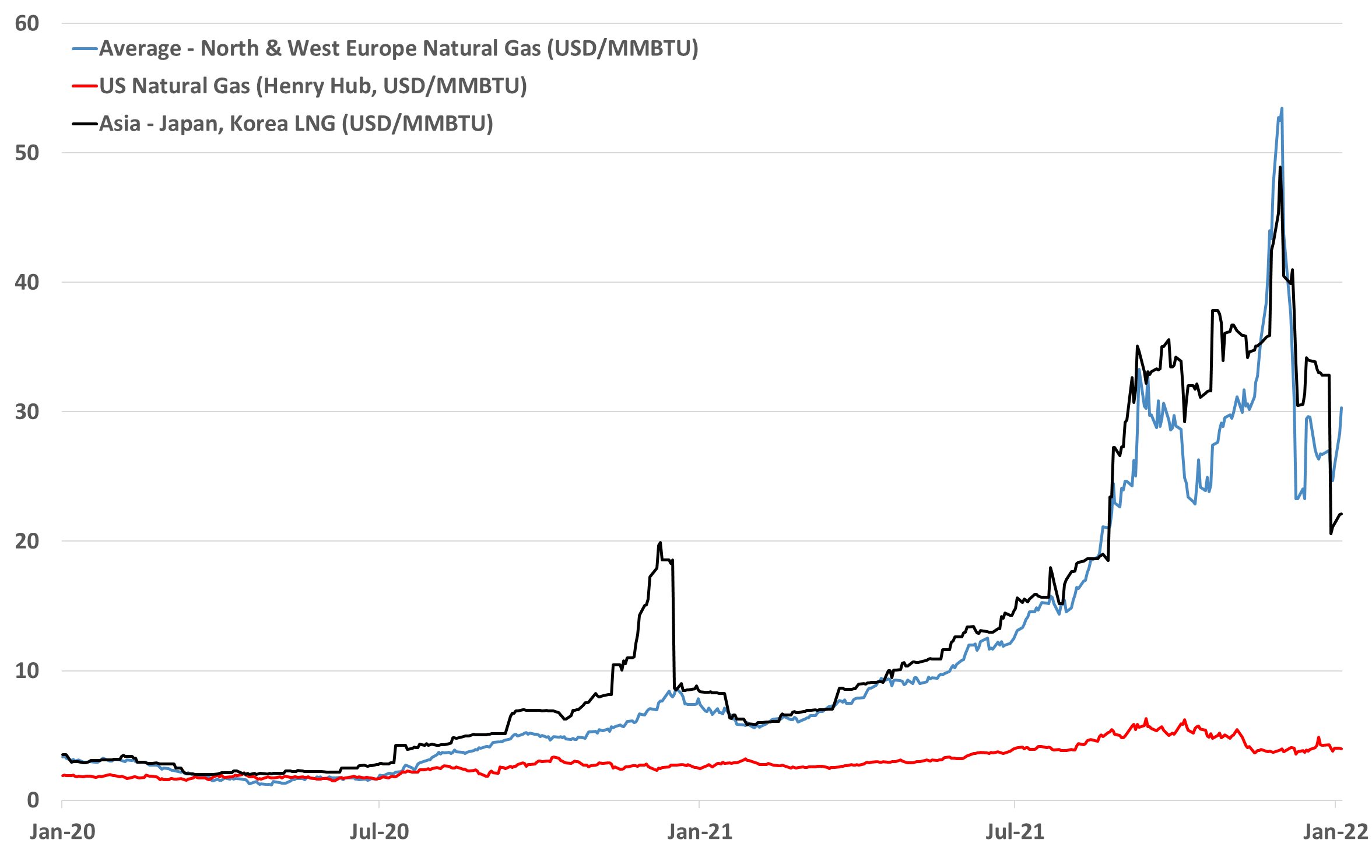

European Energy Prices Likely Rise With Any Russia Conflict

Jan 25, 2022 1:48:37 PM / by Cooley May posted in Chemicals, LNG, Energy, natural gas, natural gas prices, energy inflation, energy prices, energy shortages, fuels, Russia, European energy prices, energy supply, power generators, price inflation, LPG, Industry cutbacks

There are a couple of related topics in the charts below from today's daily report, as any conflict with Russia would almost inevitably impact European energy supply, raising prices for natural gas and pulling on as much LNG as possible. That said, we suspect that part of the recent run-up in prices has likely been to build a cushion of inventory, as much as that is possible with limited storage relative to demand.

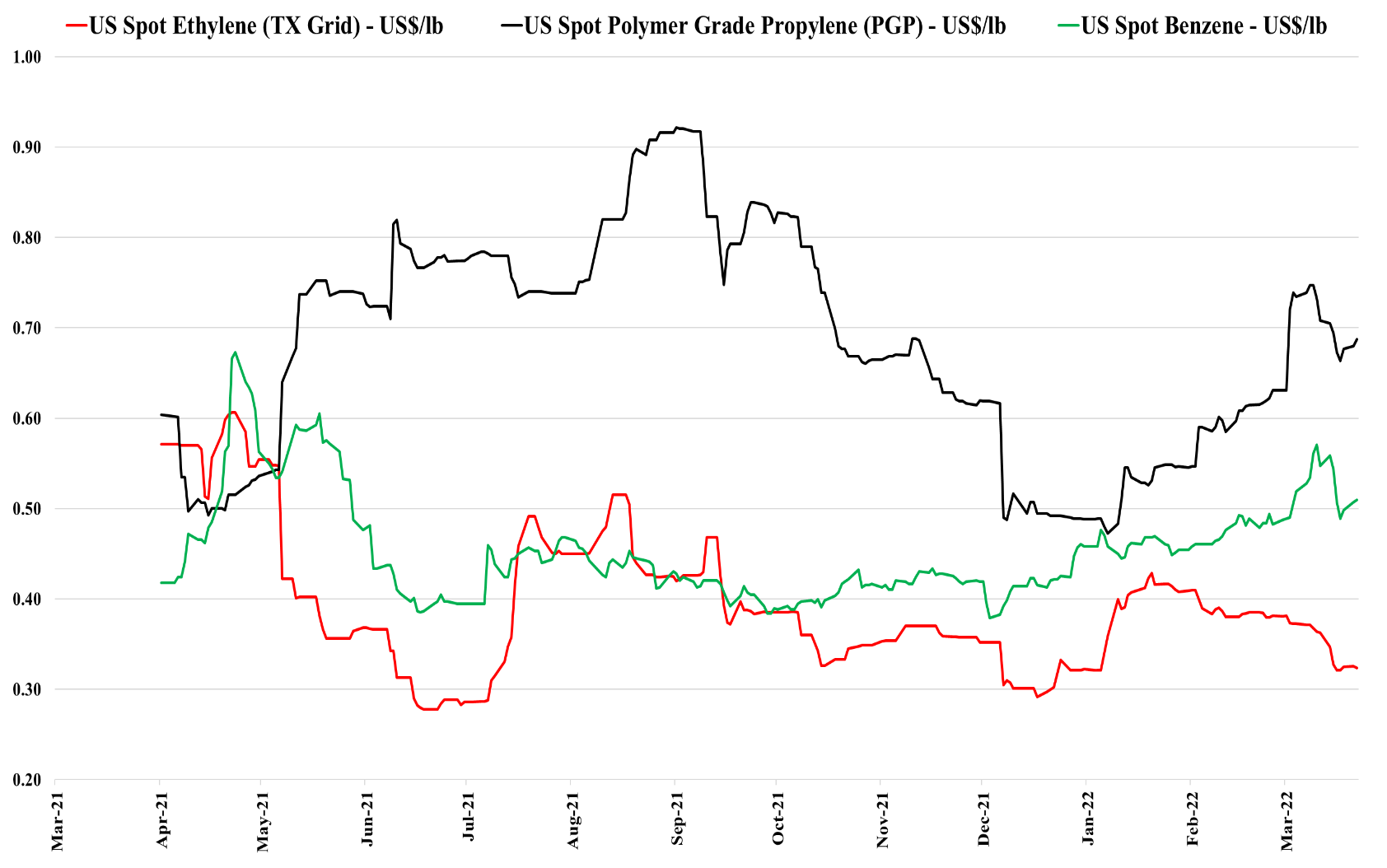

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

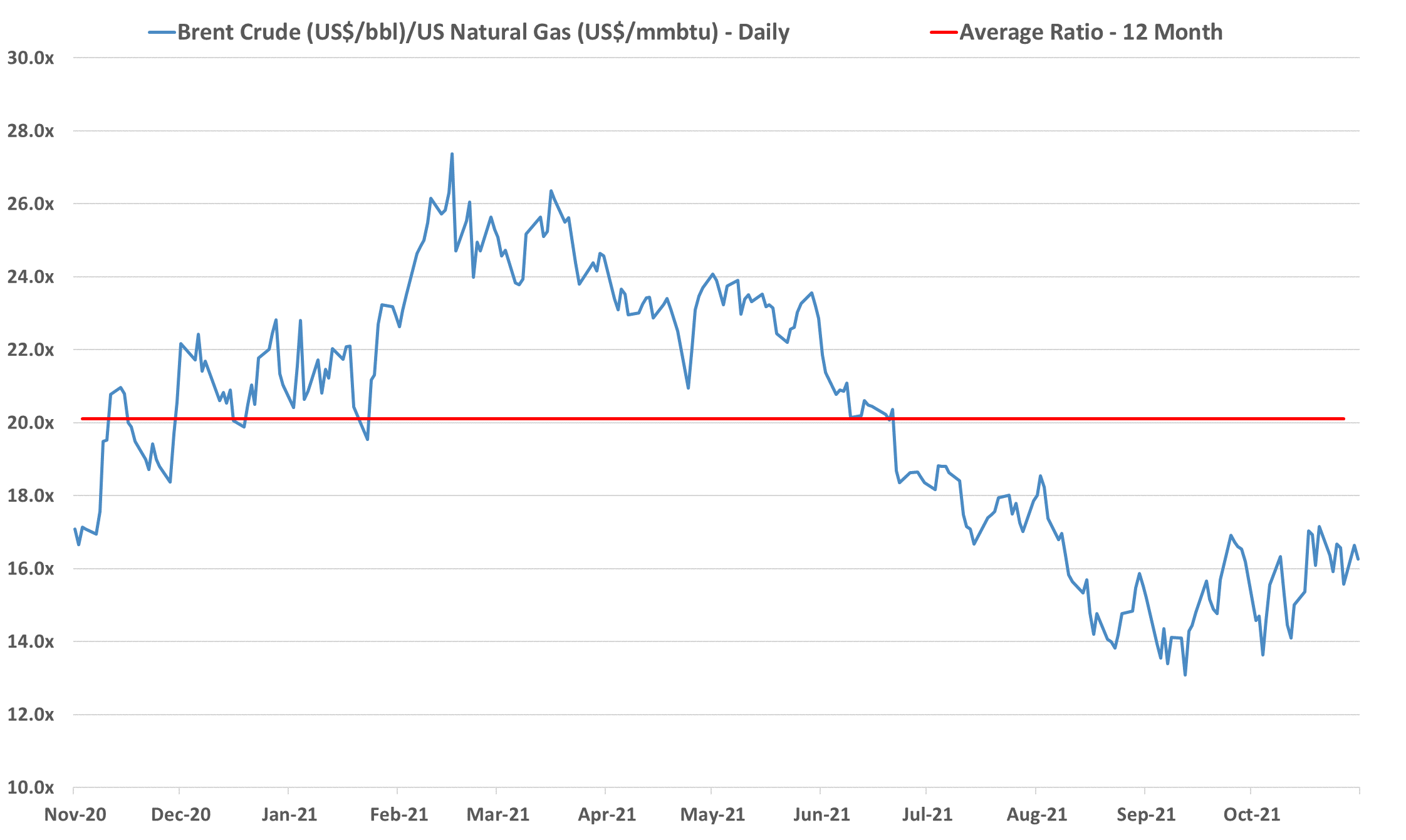

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.