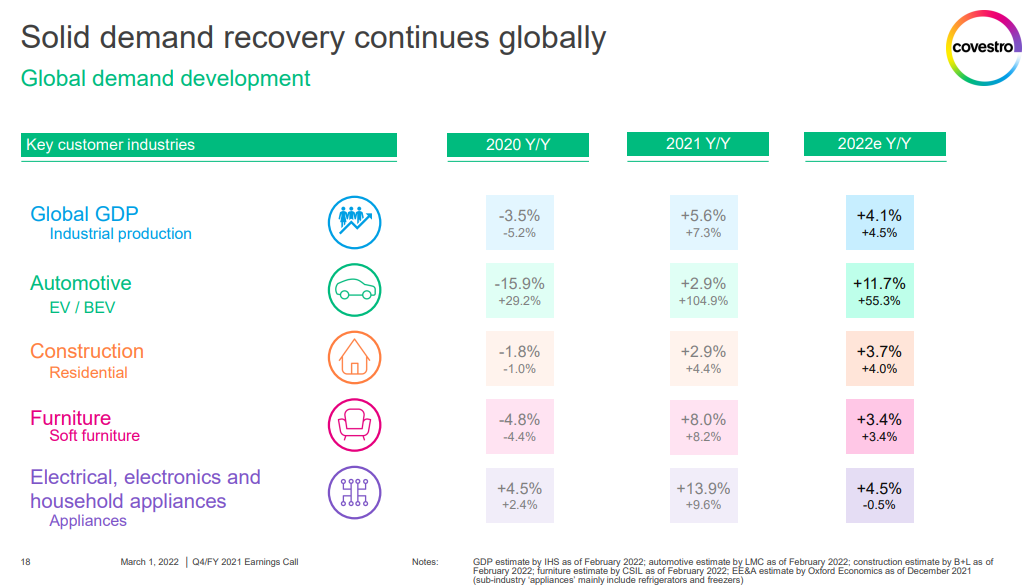

More confirmation from Covestro that global demand growth is strong, supporting reports that we have seen from most companies over the last few weeks. Some have struggled with raw material cost squeezes and either late attempts to raise prices or pricing lags in contract agreements, but almost all have pointed to very strong demand outside of auto OEM. We have questioned how much of this strong demand is inflation-driven, but it is very hard to tell as the last time we had significant inflation we did not have such an interwoven global supply chain as we have today, and consequently, it is harder to assess how much pre-buying may be going on, not because of fear of higher prices but because of fear of supply. Note that we have at least two European automakers (VW and Renault) shutting down facilities this week because they cannot key parts from Ukraine. This adds to the already problematic path for parts from China as well as the semiconductor shortage. If everyone is looking for a little bit more it would explain the very high 1Q 2022 demand that all are talking about and it likely means that inflationary pressures will continue as chemical and polymer makers try to make more, against a backdrop of higher raw materials and find it easier to increase their prices because their customers are as concerned about availability as they are prices.

Is Demand Growth Driving Inflation? Or Vice Versa?

Mar 1, 2022 2:13:44 PM / by Cooley May posted in Chemicals, Polymers, LNG, Methanol, Energy, Raw Materials, Inflation, Chemical Industry, Supply Chain, polymer market, Covestro, energy shortages, Supply, demand strength, supply chain challenges, semiconductor, VW, Renault, semiconductor shortage

How Durable Is Polypropylene?

Sep 15, 2021 12:22:50 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Surplus, propane, polymer, propane prices, polymer market, ethylene feedstocks, US polypropylene

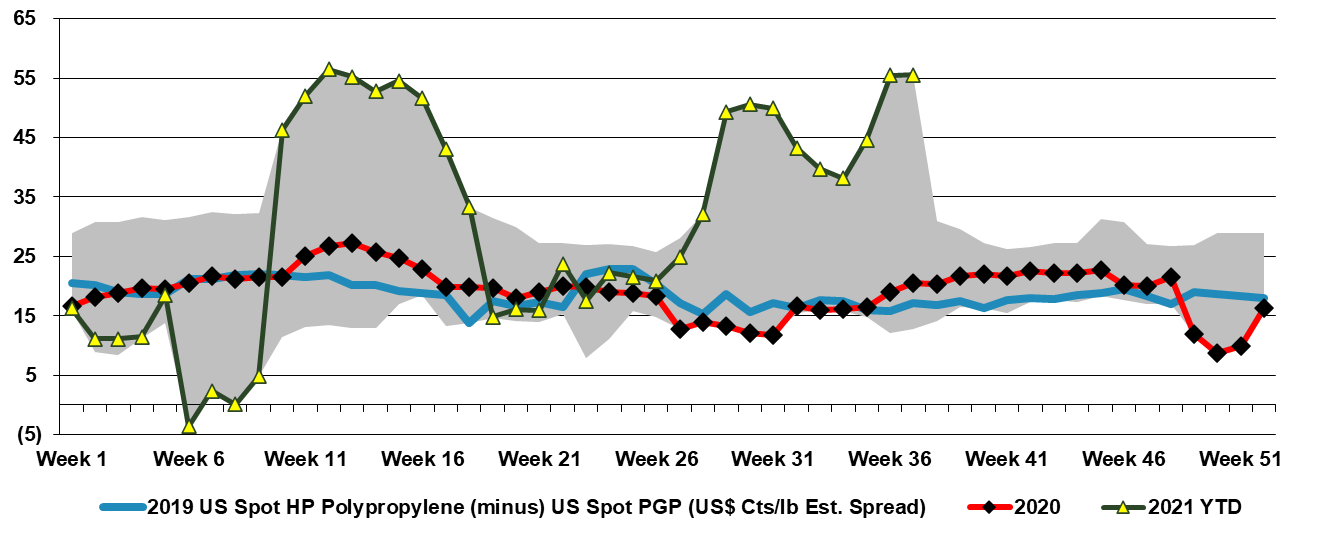

The crack in US polypropylene prices is probably worth some comments as the polymer has shown extraordinary strength since the middle of last year, in the face of new capacity that was expected to push the US market into surplus. In the chart below we show that the spread over propylene has not fallen, but this is because propylene is falling lock-step with polypropylene for the most part. Those companies integrated back to PDH economics will see a significant margins squeeze as polymer prices fall while propane prices increase. We have written recently about a concern that lower auto production rates in the US will back up into parts and that this will impact materials. In the early days of the auto cutbacks, we assumed that the automakers and their suppliers would simply build inventory, with the expectation of a bounce-back in demand once the chip shortage was over. As the chip shortage has dragged on and become more significant, we have likely hit any limit of inventory build, and we are concerned that polypropylene pricing could collapse if auto-related demand does not recover quickly. While autos are not a dominant demand category for polypropylene the sector is certainly large enough to swing the polymer market from shortage to surplus. With the rise in propane prices and other ethylene feedstocks, polypropylene profits could fall meaningfully. See today's daily for more comments on the propane markets.