The very strong Wacker results and bullish outlook make sense for a company very exposed to the solar industry. The solar companies themselves may be struggling to make money, but their demand is very high and their thirst for raw materials equally high. In bp’s annual review of world energy, the company is forecasting a three-fold increase in the rate of annual renewable power investment and all of this will require more materials – setting up polysilicon suppliers like Wacker very well. The negative for Wacker, of course, is the high European footprint and the current increase in energy costs in Europe. Given the strong demand for polysilicon, Wacker should be able to raise prices – adding to the woes of the solar panel makers. See more in today's daily report.

Wacker - Well Placed With Polysilicon Business

Mar 15, 2022 2:37:02 PM / by Cooley May posted in Chemicals, Renewable Power, Energy, Raw Materials, solar, polysilicon, Wacker, renewable energy, renewable power investments, energy costs, solar industry

Another Example Of Materials Inflation For Renewable Power - Good For Chemicals

Jan 26, 2022 3:56:25 PM / by Cooley May posted in Chemicals, Renewable Power, Materials Inflation, Inflation, natural gas, polysilicon, Wacker, silicon, solar module, materials, solar installations, US natural gas prices, solar panel, equipment supply

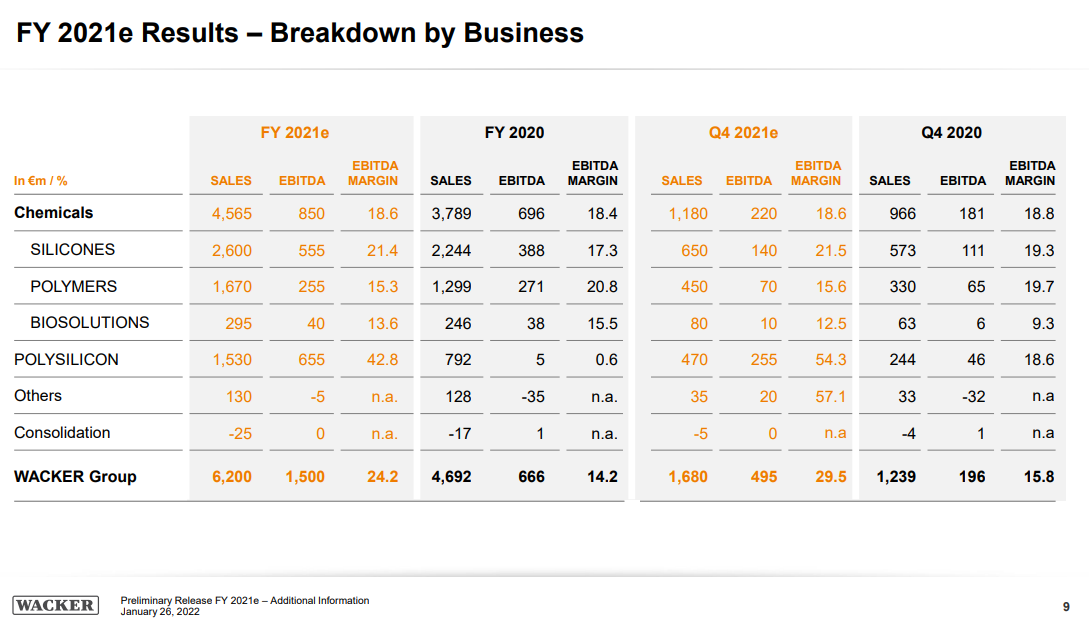

While this is covered in more detail in our ESG report today as well as our daily report, we highlight the Wacker results below. This confirms a key inflation fear for renewable power, as we see the rapid increase in silicon and polysilicon sales at Wacker – Exhibit below. Wacker has certainly seen significant volume growth between the periods highlighted, but the step-up in demand will have allowed the company to move prices up., something we have been noting for months, but it is good to have confirmation. This is additional cost pressure for the solar panel manufacturers and is driving solar module prices higher. Given the expected demand growth for solar installations, we see no reason why this demand-pull should ease any time soon. While this is a problem for the solar industry, their materials suppliers could do very well for many years.