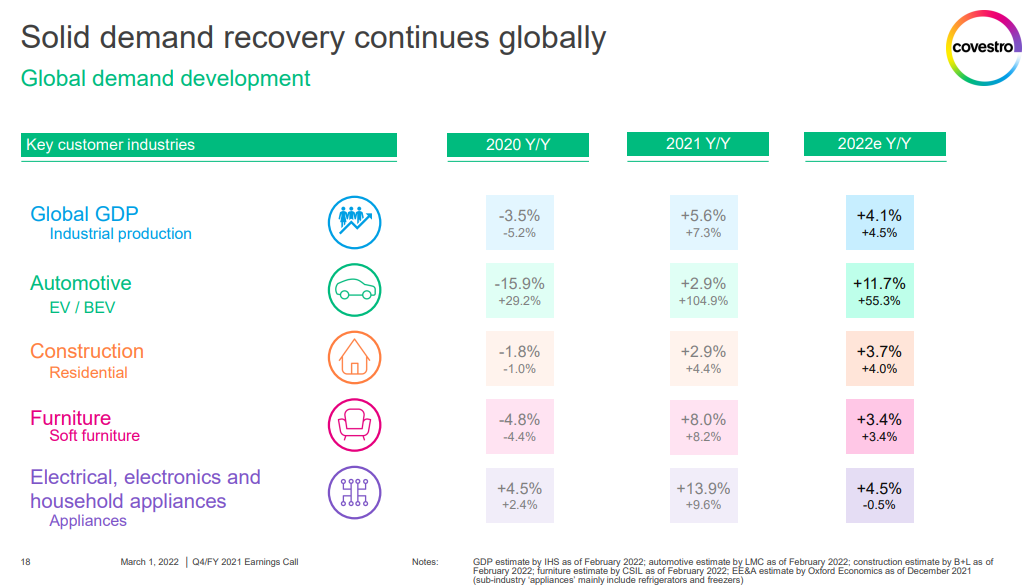

More confirmation from Covestro that global demand growth is strong, supporting reports that we have seen from most companies over the last few weeks. Some have struggled with raw material cost squeezes and either late attempts to raise prices or pricing lags in contract agreements, but almost all have pointed to very strong demand outside of auto OEM. We have questioned how much of this strong demand is inflation-driven, but it is very hard to tell as the last time we had significant inflation we did not have such an interwoven global supply chain as we have today, and consequently, it is harder to assess how much pre-buying may be going on, not because of fear of higher prices but because of fear of supply. Note that we have at least two European automakers (VW and Renault) shutting down facilities this week because they cannot key parts from Ukraine. This adds to the already problematic path for parts from China as well as the semiconductor shortage. If everyone is looking for a little bit more it would explain the very high 1Q 2022 demand that all are talking about and it likely means that inflationary pressures will continue as chemical and polymer makers try to make more, against a backdrop of higher raw materials and find it easier to increase their prices because their customers are as concerned about availability as they are prices.

Is Demand Growth Driving Inflation? Or Vice Versa?

Mar 1, 2022 2:13:44 PM / by Cooley May posted in Chemicals, Polymers, LNG, Methanol, Energy, Raw Materials, Inflation, Chemical Industry, Supply Chain, polymer market, Covestro, energy shortages, Supply, demand strength, supply chain challenges, semiconductor, VW, Renault, semiconductor shortage

European Energy Prices Likely Rise With Any Russia Conflict

Jan 25, 2022 1:48:37 PM / by Cooley May posted in Chemicals, LNG, Energy, natural gas, natural gas prices, energy inflation, energy prices, energy shortages, fuels, Russia, European energy prices, energy supply, power generators, price inflation, LPG, Industry cutbacks

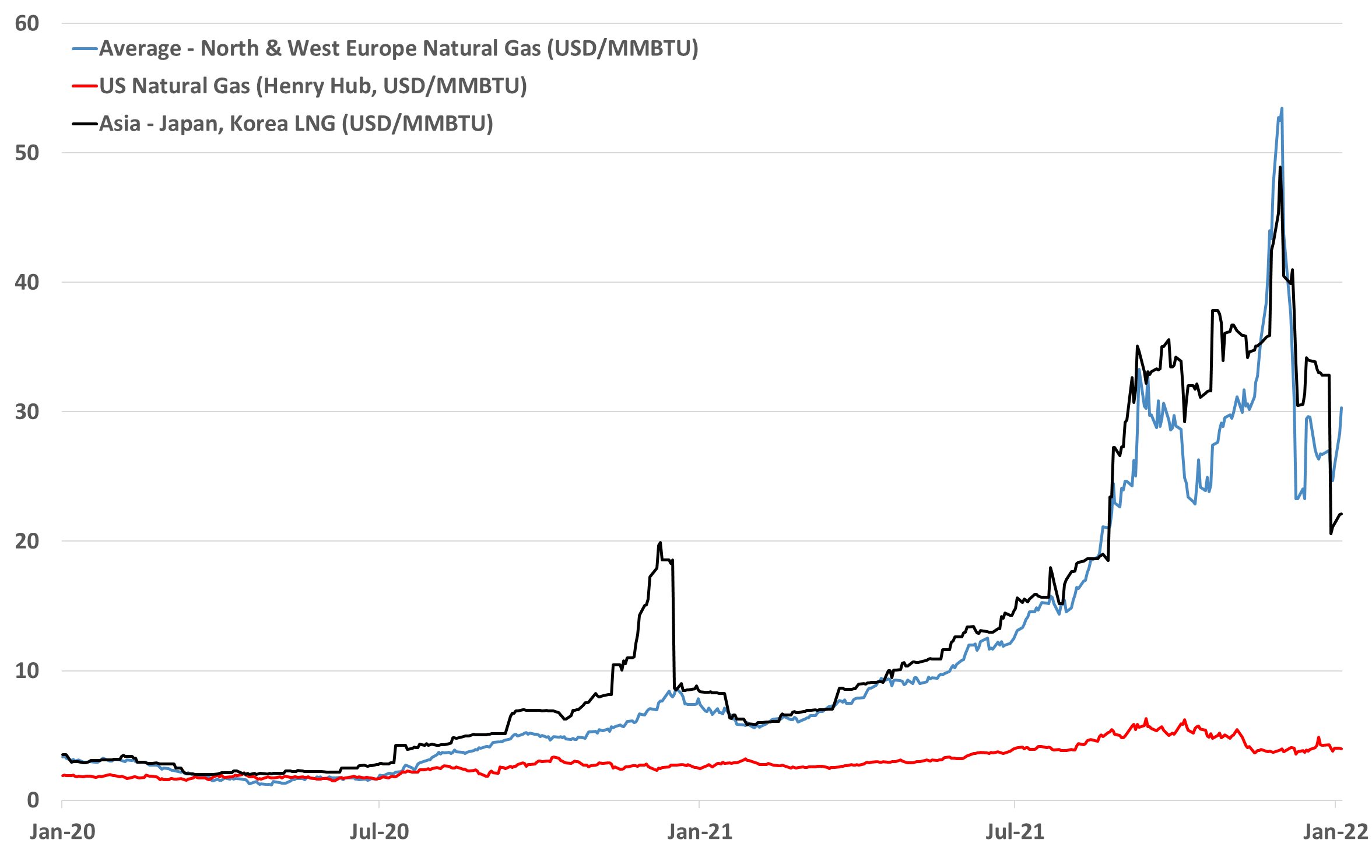

There are a couple of related topics in the charts below from today's daily report, as any conflict with Russia would almost inevitably impact European energy supply, raising prices for natural gas and pulling on as much LNG as possible. That said, we suspect that part of the recent run-up in prices has likely been to build a cushion of inventory, as much as that is possible with limited storage relative to demand.

EU Ambitions Require More Natural Gas, Supply Readiness In Question

Nov 3, 2021 1:44:26 PM / by Cooley May posted in LNG, Energy, natural gas, oil producers, energy shortages, green energy, nuclear power

The EU revision to its green energy plans to include both nuclear and natural gas-based power is a direct response to the current energy shortage and price inflation that is evident in the exhibit below. While high natural gas pricing is part of the problem, Europe's renewed willingness to include natural gas in its forward energy planning may drive local investment to produce more gas and foreign investment to provide more LNG. The move indicates that the EU does not see the current natural gas shortage as a short-term issue. The nuclear inclusion is likely aimed at delaying any further planned nuclear closures and we have seen recent delays in closing older US facilities for the same reason - closures will put too much strain on an already challenged power grid and prices for power could be pushed higher by even higher natural gas prices.

More LNG For The US, But Less Gasoline!

Oct 21, 2021 2:20:32 PM / by Cooley May posted in Chemicals, LNG, natural gas, Sinopec, energy shortages, US refining rates, gasoline, refinery capacity

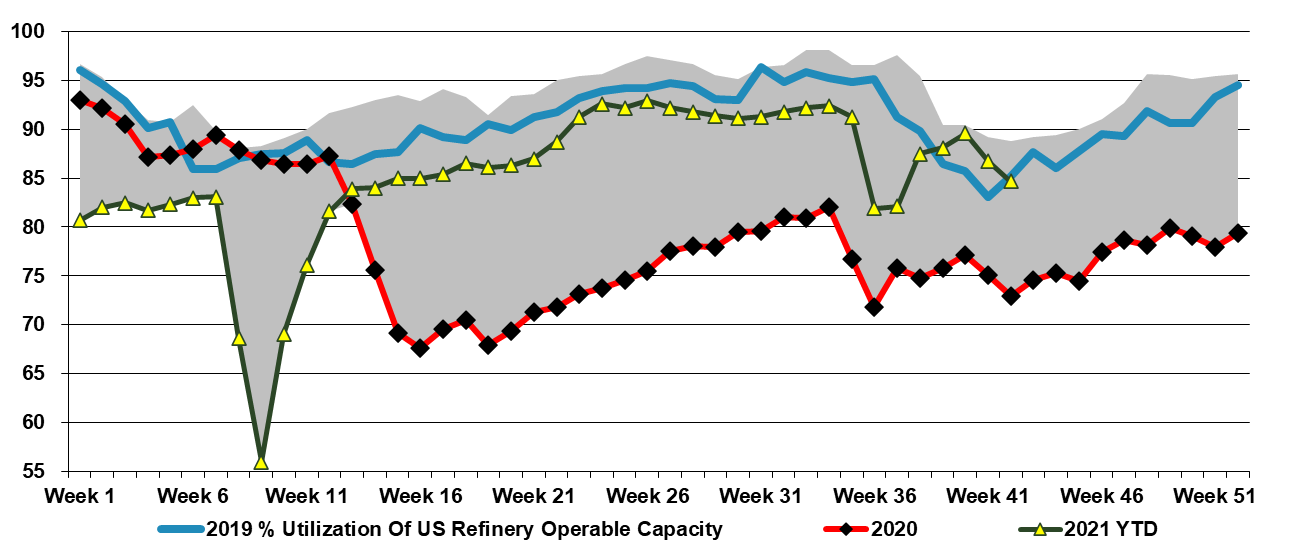

The Venture Global LNG contracts with Sinopec are likely the big energy news of the day, as is the expectation that the West Louisiana terminal is close to completion and could begin shipping as soon as late 2021, according to a report in the Financial Times today. This would be earlier than prior guidance and will add demand pressure to a US natural gas balance that is already tight (distracted in the immediate term in our view by a wave of mild weather). With Venture Global now likely to go ahead with its second LNG facility, as well as other capacities under construction, we will likely see greater inflation in US natural gas prices without increased E&P spending.