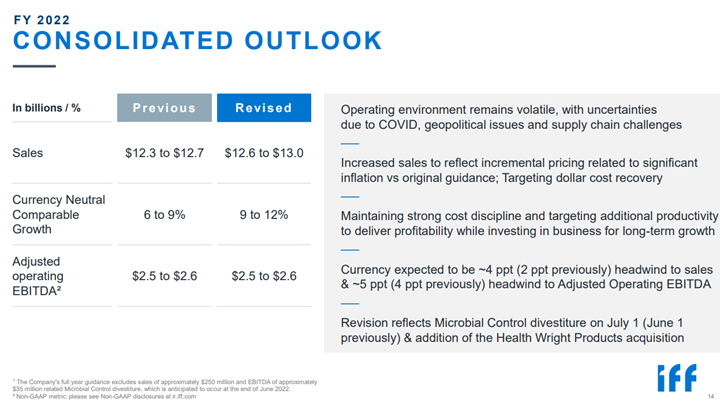

The pricing effect is very evident in the IFF results and projections, highlighted below. The company projected higher revenue expectations for the year but no increase in EBITDA with that higher revenue. We expect this trend to continue through at least the next couple of quarters, even if energy prices do not rise any further, as we believe that there is still some energy-related pass-through to come in many sectors. As the ammonia chart below shows, inputs in the agriculture/food industry keep rising.

In The Race Against Inflation Some Are Winning And Some Are Losing Badly

May 10, 2022 4:58:42 PM / by Cooley May posted in Chemicals, Energy, Ammonia, natural gas, EBITDA, blue ammonia, Agriculture, clean fuels, IFF, Armstrong, financial markets

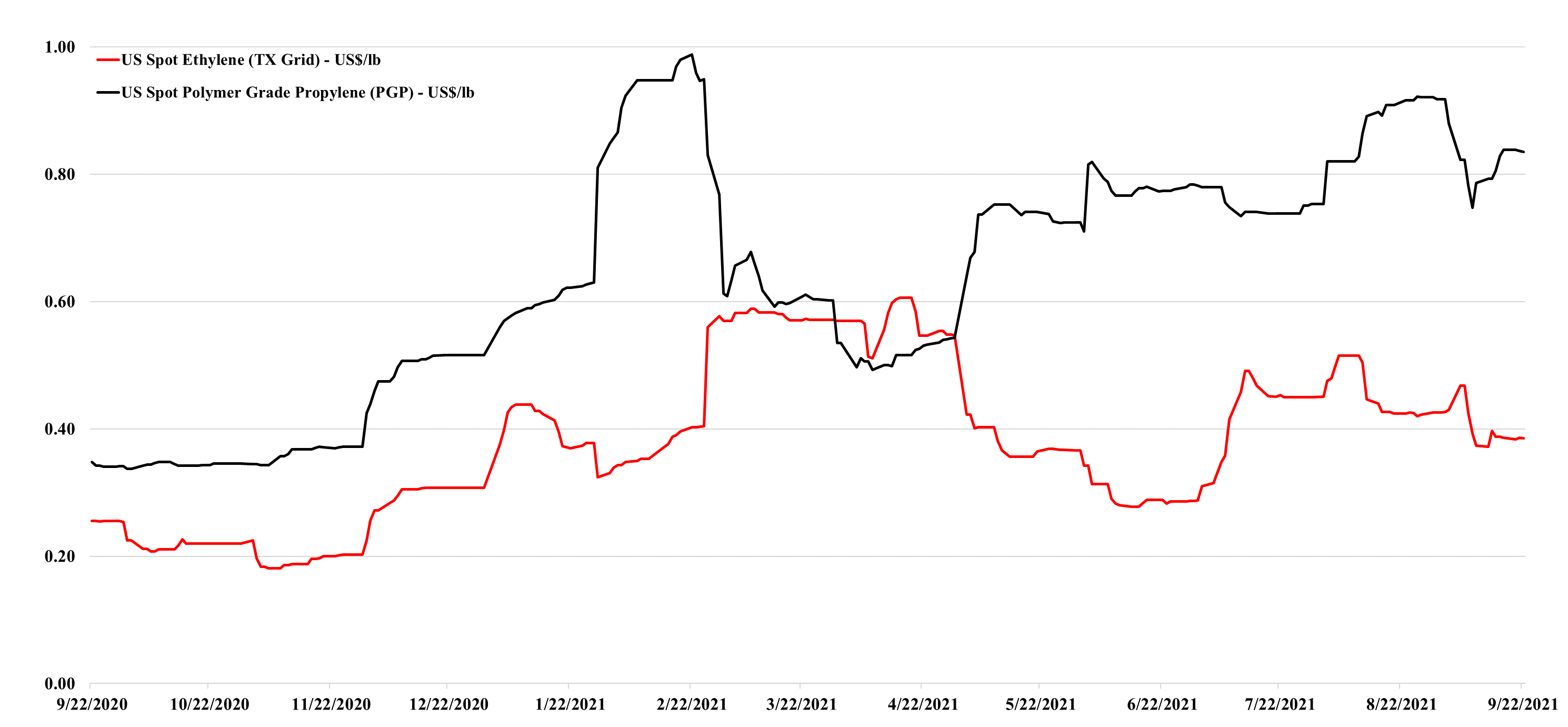

US Propylene Is A Very Different Market Than Ethylene

Apr 8, 2022 1:04:37 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Ethylene, Chemical Industry, Ammonia, Supply Chain, ethane, natural gas, natural gas prices, US ethylene, US propylene, fertilizer

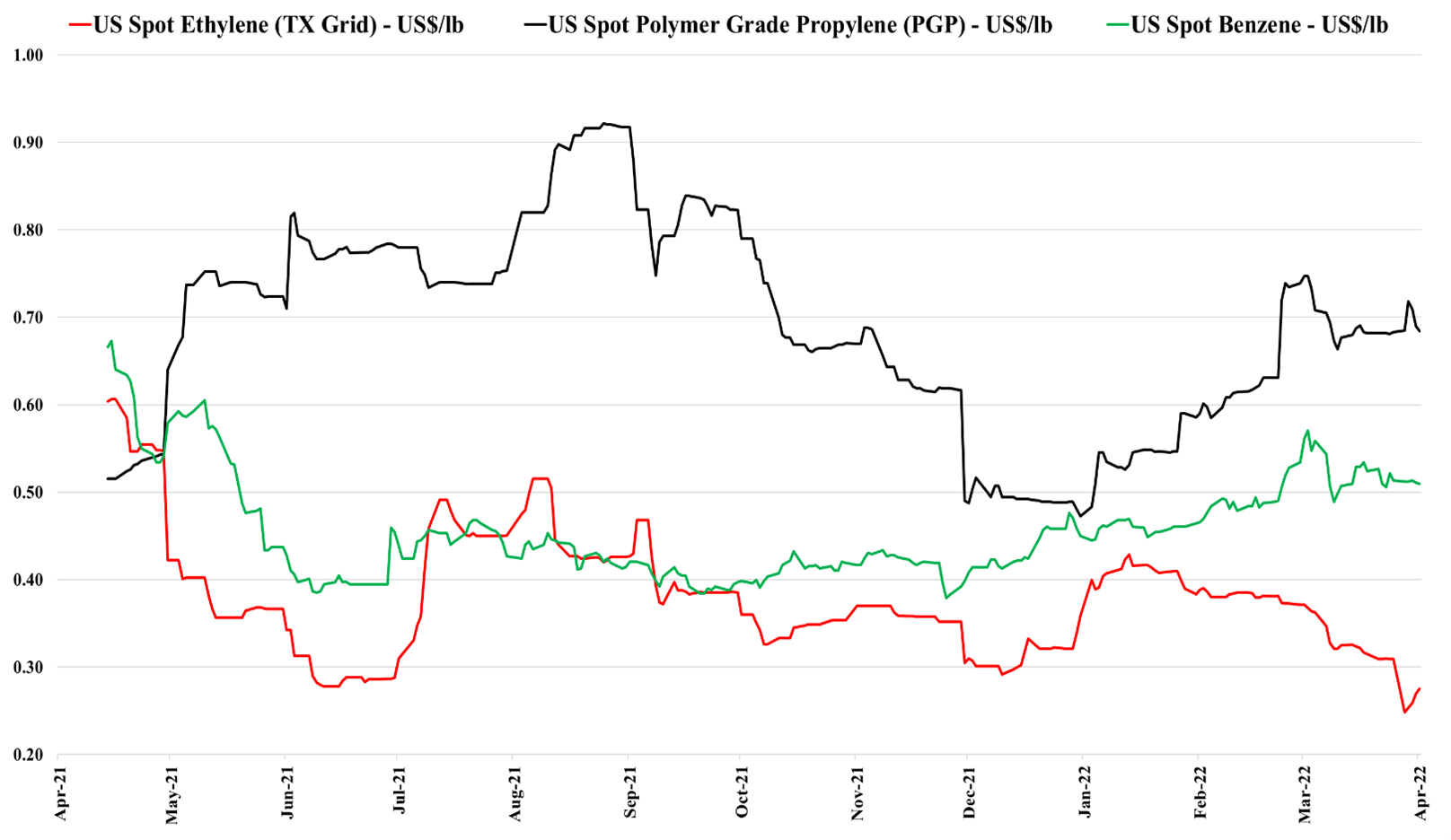

US ethylene prices have bounced off a low this week largely, in our view on the steep rise in natural gas and ethane. The drop in ethylene prices over the last couple of weeks signals an imbalance whereby production is more than enough to satisfy domestic demand and export demand. Export demand is limited by terminal capacity, and we have seen some domestic demand issues for polyethylene, not because of demand weakness, but because of export logistic bottlenecks, that are resulting in product (with homes to go to) backing up in the US ports. Given the timing of this build-up, we may see some higher end-quarter working capital from some of the chemical companies with sizeable export footprints for 1Q 2022. The sharp increase in US natural gas prices and the catch up that ethane has made to natural gas, should keep some upward pressure on spot ethylene prices if gas prices remain high. Propylene remains very supported by high propane prices.

Higher Costs And Inventory Increases Will Drive High Prices

Mar 25, 2022 2:51:04 PM / by Cooley May posted in Chemicals, Methanol, Ammonia, Supply Chain, natural gas, US Methanol, urea, Methanex, HB Fuller

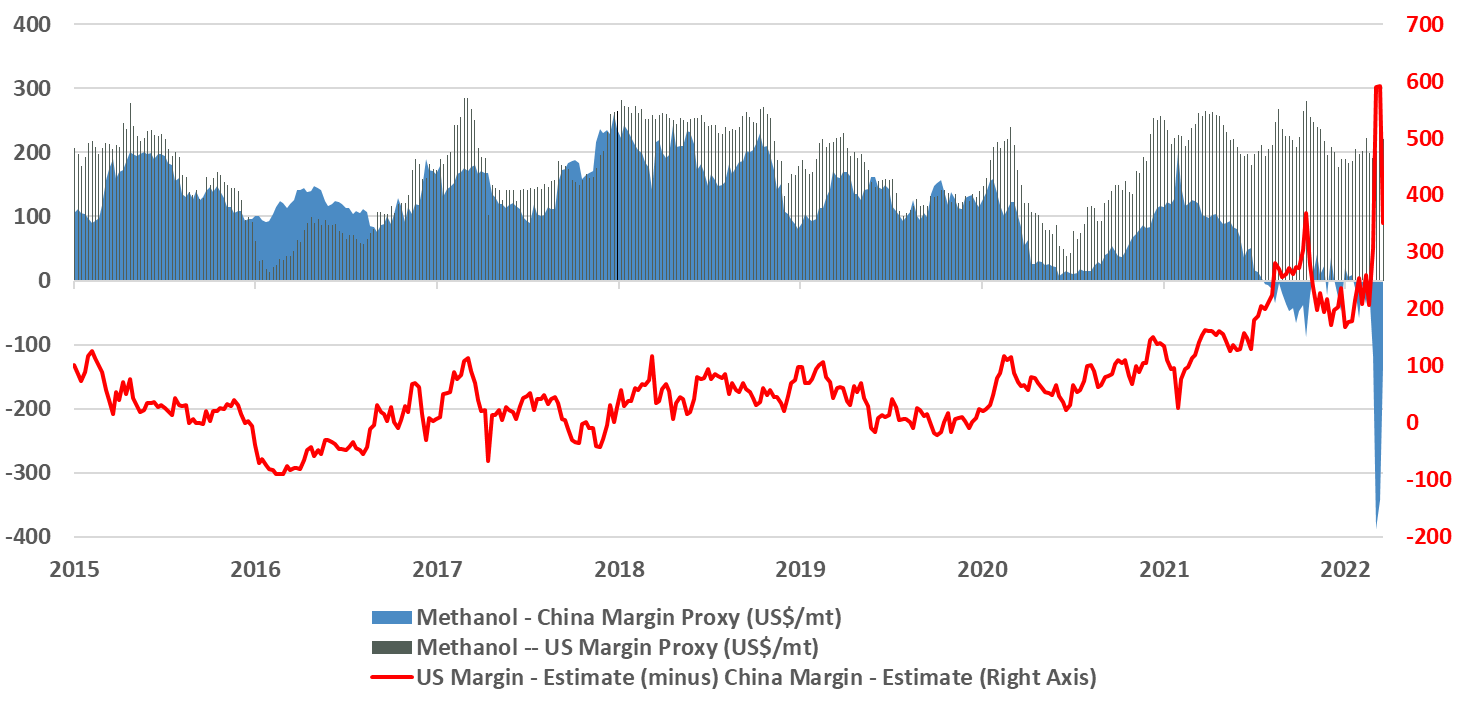

Methanol is one of a few chemicals that is directly impacted by the price of natural gas, and as the chart below shows, the pain in China (and in Europe) is extreme and it is unlikely that any facilities that require imported natural gas – or local gas with prices based on imports – are operating today. The volume and margin opportunities for those companies connected to low priced natural gas – the US, the Middle East, and other niche locations such as Trinidad, are as good as they have ever been and we are a little surprised that Methanex did not push a little harder with US pricing, given that export netbacks are likely surging. Urea and ammonia are in the same boat and prices are much higher, but the US is a net importer and international prices are directly impacting the US price.

Abundant Hydrocarbons Could Keep The US Advantaged, Even Considering Emission Goals

Feb 16, 2022 1:41:45 PM / by Cooley May posted in Chemicals, Carbon Capture, Coal, Methanol, CO2, Energy, Emission Goals, Ammonia, hydrocarbons, Oil, natural gas, urea, CF Industries, oil production, energy demand

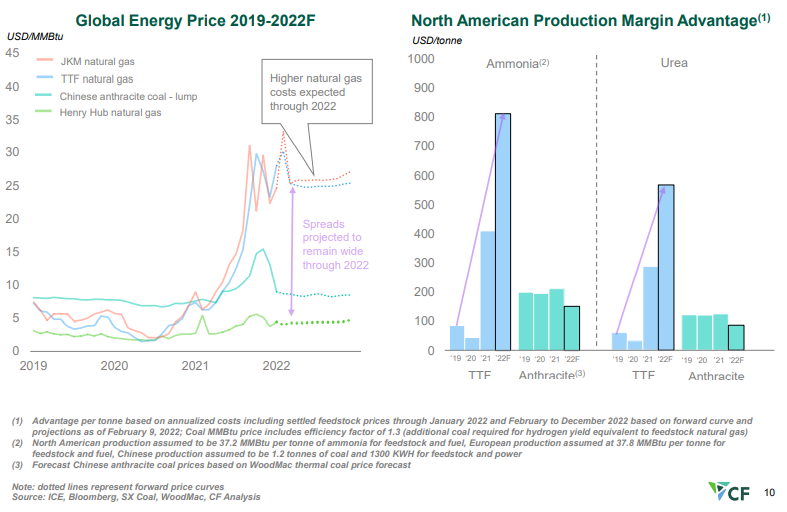

The CF slide below shows very clearly the US competitive edge when it comes to making anything that has a natural gas base, and while we tend to talk mostly about ethylene, ammonia, urea, other ammonia derivatives, and methanol are all seeing significant cost advantages. The Chinese coal-based costs are better than those in Europe and Asia based on natural gas but margins remain well below those in the US. The challenge with the coal-based chemistry in China is that it has substantial CO2 emissions, and the facilities were not designed for carbon capture. As China develops a carbon cap and trade market and as these facilities get included, costs will rise significantly.

Natural Gas Short, Ethylene & Propylene Not So Much...

Sep 22, 2021 3:15:00 PM / by Cooley May posted in Chemicals, Propylene, LNG, Methanol, CO2, Ethylene, Ammonia, natural gas

The major issue with the higher natural gas prices in Europe (and rising prices globally) is the knock-on inflationary impact it will have on products that have natural gas as a feed, rather than those buying it as a fuel. The fuel buyers will take some of the hit, but will also try to pass on some of the hit, as it is generally a small part of overall product or service costs. The focus has been on ammonia/urea production because of the knock-on effect on food-grade CO2. But other products, such as methanol, would also be impacted, although there is not much methanol capacity in Europe. Higher LNG prices in Asia could encourage more coal-based methanol production, which is precisely what the increased use of LNG was supposed to prevent – replacing a high carbon footprint route with a much lower one. In our view, it is imperative that the attendees of COP26 recognize the need for (cleaner) natural gas and LNG, and enact policies to support it. This inflationary lesson is well-timed.

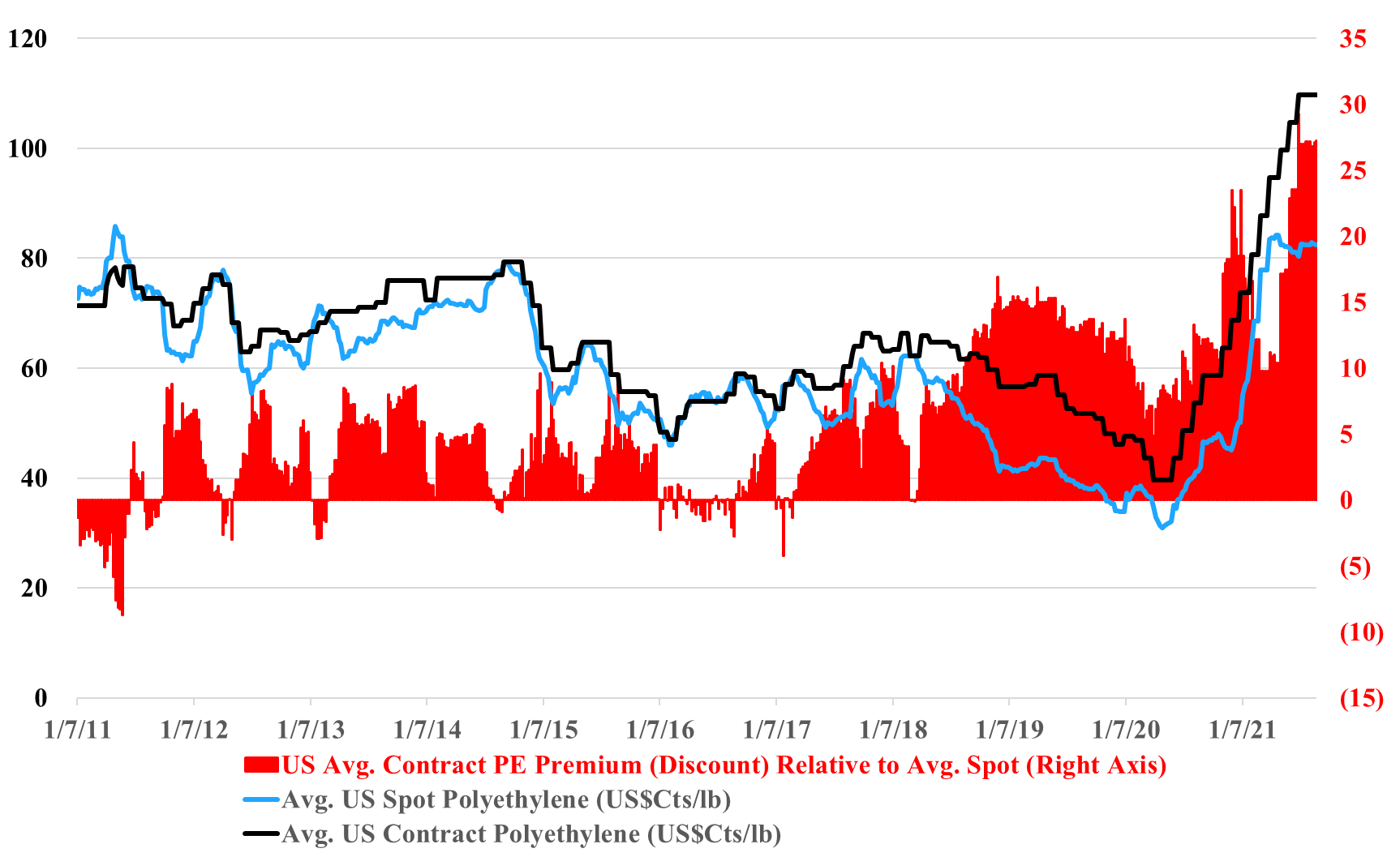

US Polyethylene Prices Reflect Support, In Part Due To High Freight Rates

Aug 31, 2021 2:31:51 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Ammonia, PE, freight, Polyethylene prices, US Polymers, container freight rates, US polyethylene, spot price, Hurricane Ida, distribution

We discuss recent historic highs reached in China to US container freight rates in our daily research today, and (absent Ida) we note that freight charges remain a major component in favor of US polymer price support. With current container rates so high, it is difficult for US consumers to get access to cheaper material from Asia, even if they are willing to try the untested grades in their equipment. Absent the freight extremes today, we would be much more definitive in declaring that the US's record spot/contract polyethylene price difference was unsustainable and would be corrected quickly. While there appear to be some surpluses of US polyethylene today, such that producers are testing the incremental export market, the same producers can hide behind the freight barrier as they make arguments to support domestic pricing. Some US buyers may be getting pricing relief because they have price mechanisms that partly reflect the spot price. It is also possible that large buyer discounts have risen through this period of very high pricing (this has happened before).