The linked article looks at the chemical inflationary cycle of the 70s, which has some relevant indicators for what we are seeing today, but there were also some stark differences. Rising raw material prices is a common theme and while it is convenient to blame OPEC+ this time, the group is not nearly as much to blame today as it was in the 70s. Consumers were facing not just higher oil prices, but also genuine shortages because of the OPEC cutbacks and the multi-year lead times that it took non-OPEC producers to ramp up E&P and ultimately production. This time the oil is there and relatively easy to get to, especially in the US, but the capital spending decisions of the US oil producers – mostly because of ESG related pressure – are holding back the production.

Relative To The Chemical Inflationary Cycle Of The ’70s, Present Times Reflect Similarities But Some Major Differences

Nov 17, 2021 2:47:40 PM / by Cooley May posted in Chemicals, Polymers, LNG, Plastics, Ethylene, ExxonMobil, raw materials inflation, Inflation, feedstock, Borealis, ethylene capacity, crude oil, shortages, chemicalindustry, plasticsindustry, Adnoc, OPEC+, oil prices, Investments

Borouge Complex Under Review; US Commodity Chemical Weakness Likely Near Term

Nov 16, 2021 2:51:19 PM / by Cooley May posted in Carbon Capture, Polymers, Propylene, Polypropylene, CO2, Ethylene, polymer grade propylene, PGP, carbon abatement, blue ammonia, Basic Chemicals, Borealis, monomers, chemicalindustry, Adnoc, Borouge

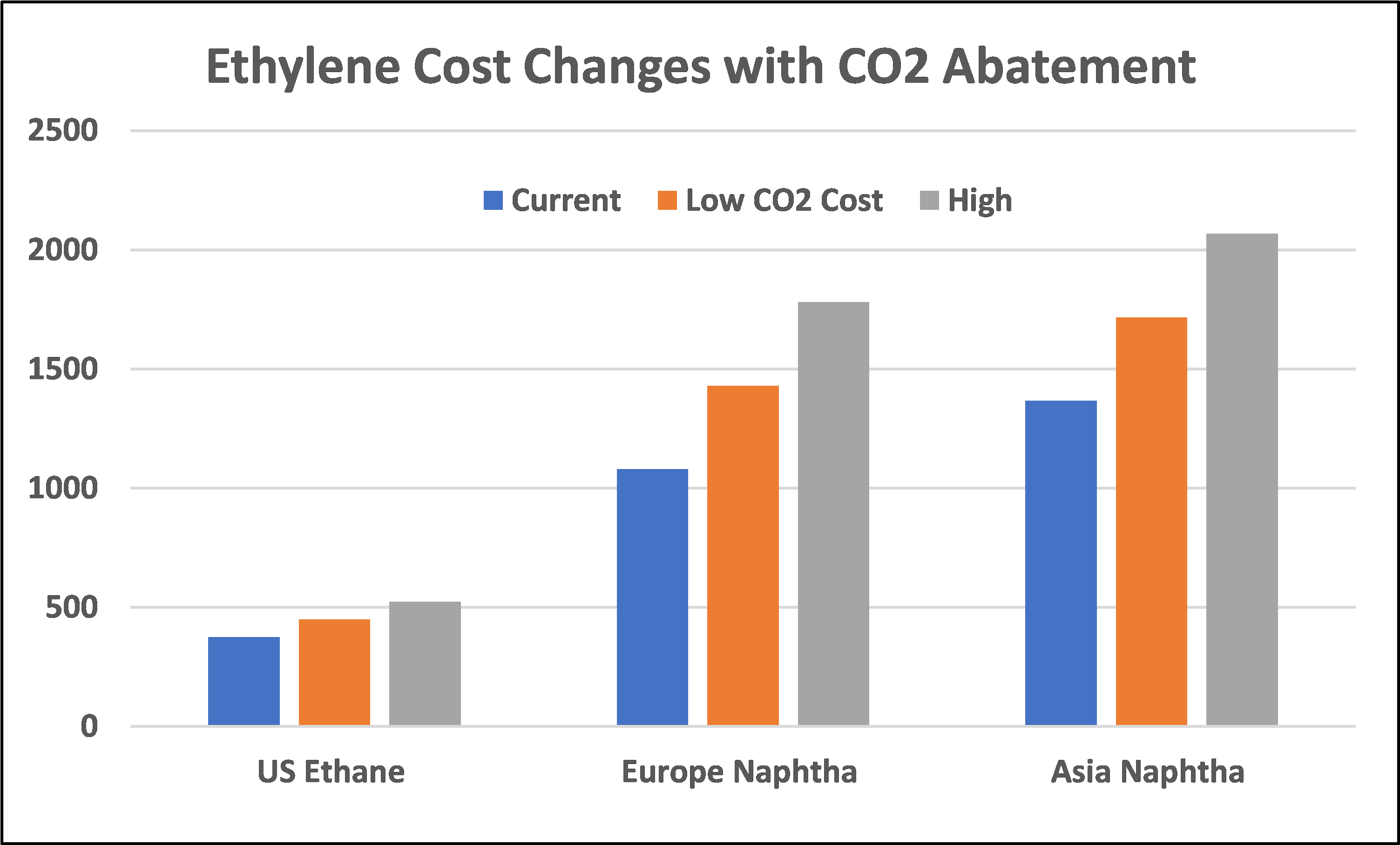

In an important, but inevitable, change in tone, it is worth noting that the Borouge ethylene expansion announcement includes the idea that the complex will explore the possibility of a major carbon capture facility that will take much of the CO2 from the existing complex as well as the new plant. We have stated previously that the mood has changed sufficiently such that large industrial investments without a carbon abatement plan will not get approval from stakeholders and this is a prime example of what we expect. Locations with low-cost CCS will see disproportionate investment in our view and Abu Dhabi already has CCS in place as Adnoc is selling blue ammonia already to Japan. As we noted in a recent Sunday Piece, we expect carbon abatement challenges to slow expansions in basic chemicals and, despite this announcement by Borealis, see a market shortage in 2024/25 as a consequence.