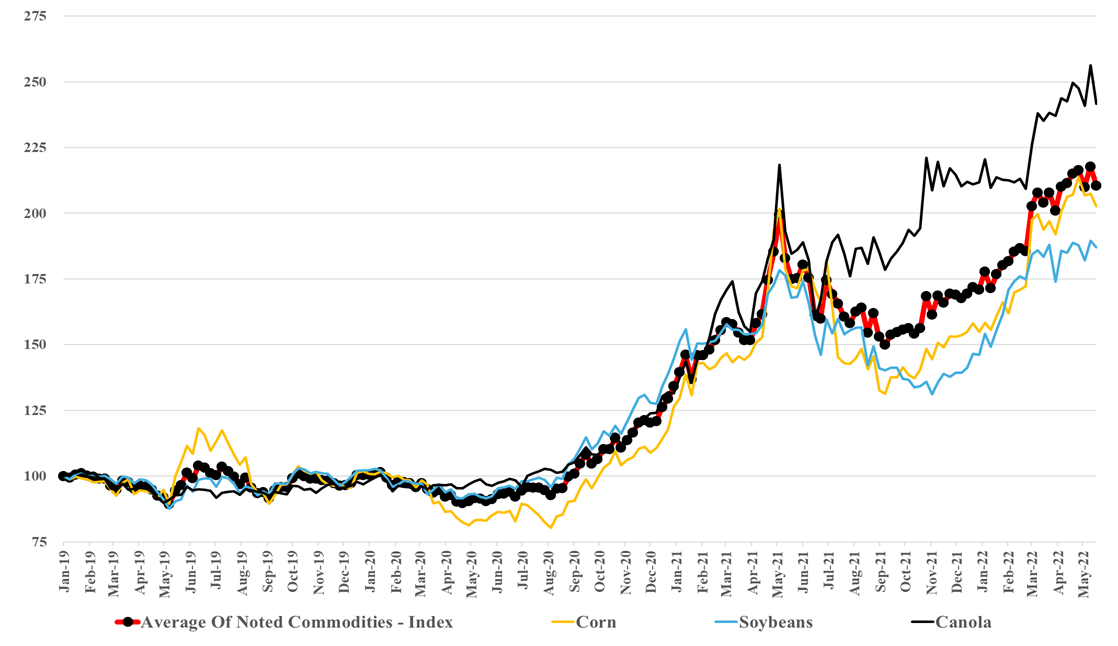

We have focused on agriculture this week with the ongoing announcements of new ammonia projects and the commodity crop prices and the overall index shown below are some of the key drivers of the activity in fertilizers but also are helping Ag equipment demand and we discuss the Deere results in today's daily report. We do not see how the trends in the chart below correct quickly and the profit through the farming, fertilizer, ag chemicals, and equipment chain should remain high in the US, at the expense of the consumer-facing high food prices (second chart below). We would need some coordinated medium-term policy to encourage moving more land in the US into agriculture, and this is especially necessary if we also intend to pursue bio-based fuels and materials. There has been much discussion around energy security over the last couple of months, but we think it is a much broader security discussion than just energy. Governments need to become much more accommodative around many aspects of production, food, energy, materials, etc. This accommodation can come with tighter emissions standards and emissions costs, but the primary objective should be to encourage more local production of many different things.

Food Price Inflation Is Eating Into Consumer Budgets, Limiting Other Spending

May 20, 2022 1:21:28 PM / by Cooley May posted in Chemicals, Energy, Inflation, commodity prices, materials, Agriculture, Deere, fertilizers, food cost, food inflation, farming

Higher Ag Commodity Prices Are Helping Crop Protection Demand

Feb 4, 2022 1:25:18 PM / by Cooley May posted in commodity prices, materials, crude oil, crude prices, Agriculture, fuels, agriculture commodities, soy prices, Soy, Corn, Canola, Corteva, Crop demand

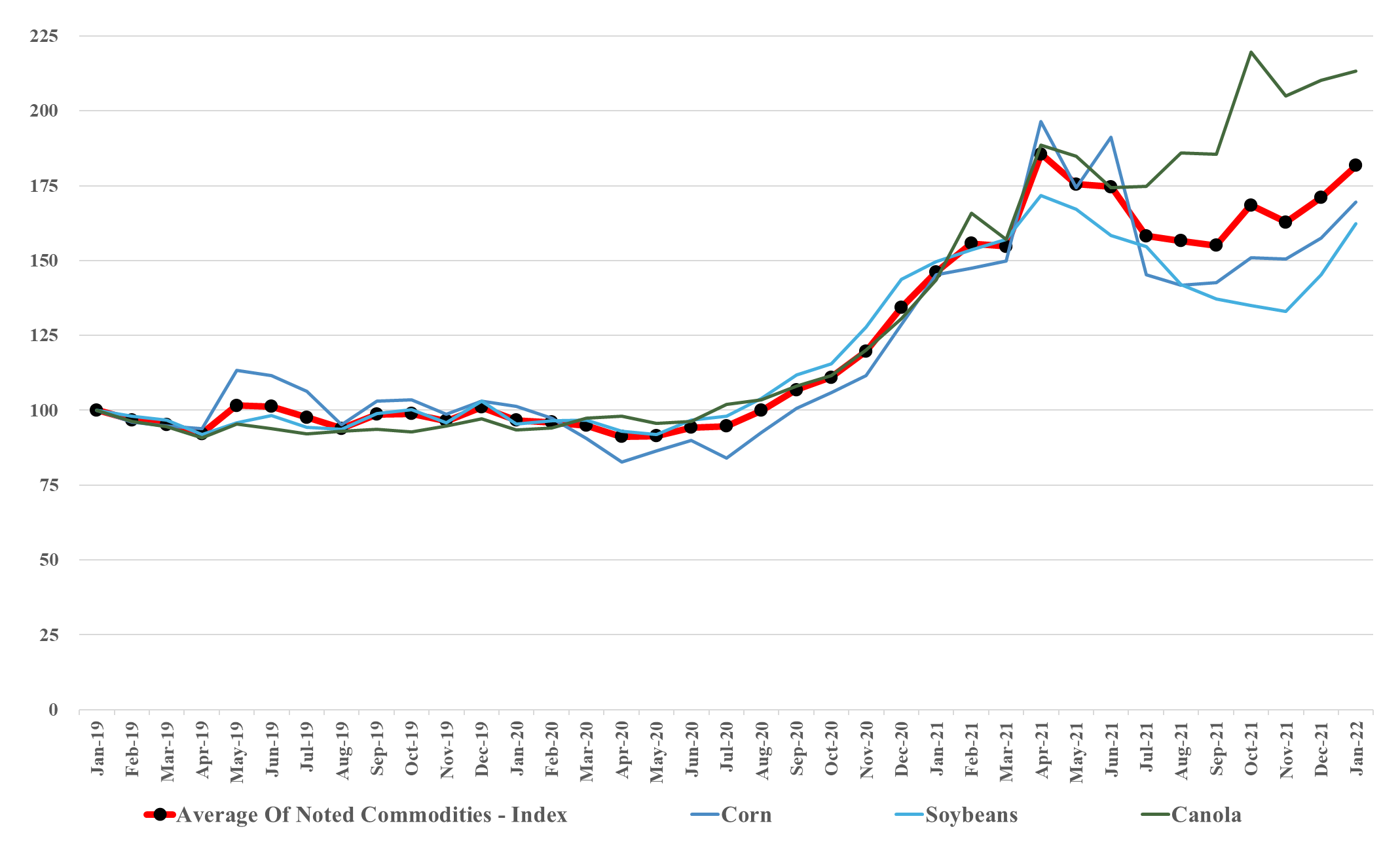

We show the correlation between soy prices and crude oil in Exhibit 1 in today's daily report, but note all the higher prices in the Exhibit below for corn, soy, and canola. This is providing a good backdrop for the crop protection industry, as seen in Corteva’s numbers. Farmers can afford to spend more to improve yields. We expect this trend to continue as demand for food will continue to grow and we will see incremental demand for fuels and materials.

Demand Momentum For Commodities In 2022 Could Exceed Expectations

Jan 21, 2022 1:15:53 PM / by Cooley May posted in Chemicals, Auto Industry, Chemical Industry, US Chemicals, oversupply, specialty chemicals, commodity prices, semiconductors, commodity chemicals, automotive, demand, commodity stocks, PPG

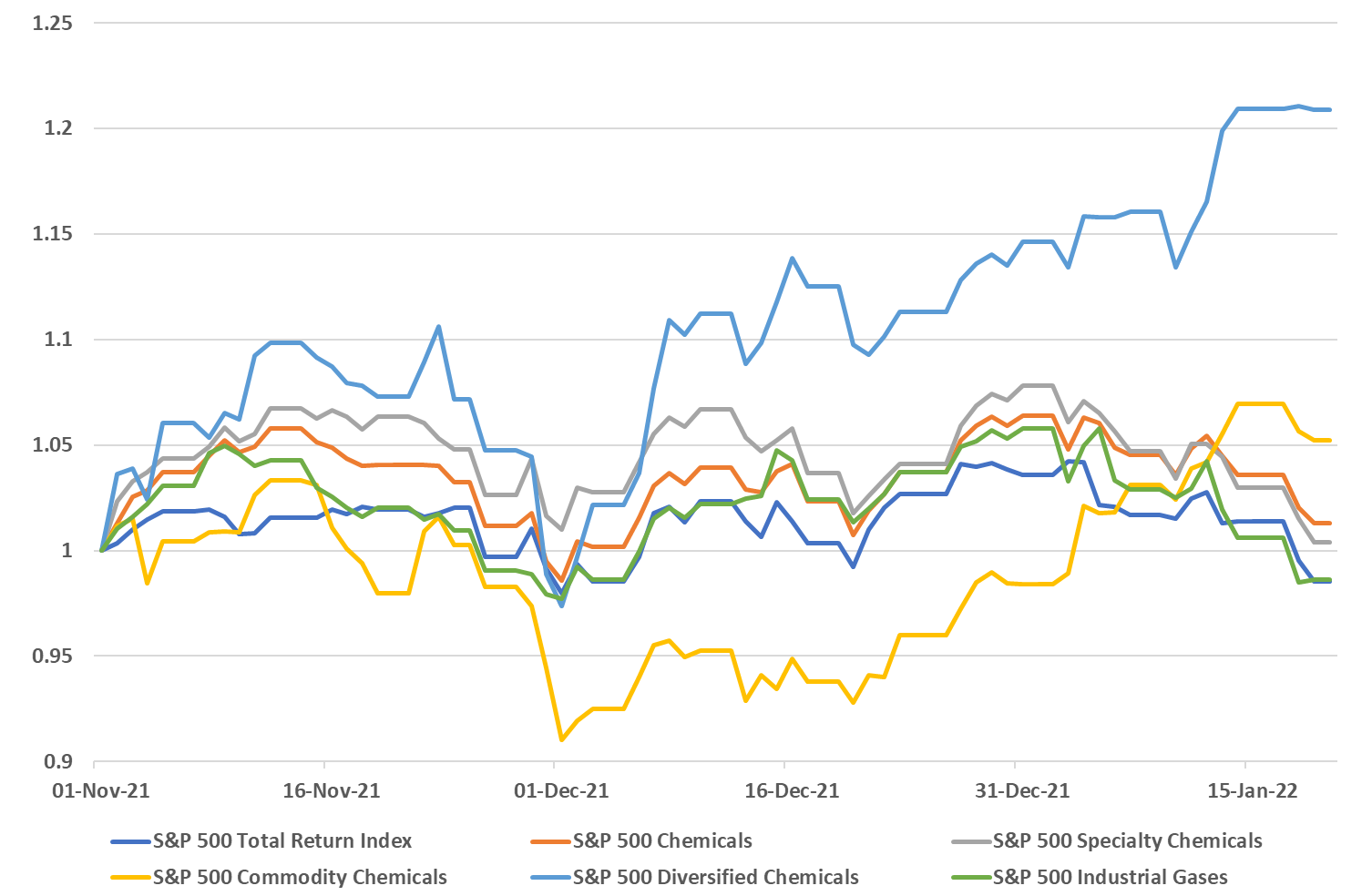

Following on from the core theme of today's daily report, demand could provide the lifeline that the US chemical industry needs to get through what looks like a potentially oversupplied 2022 – note the successful start-up of the ExxonMobil/SABIC facility in Texas, announced today. While we still think that the US market will be looser in 2022 than in 2021, barring any above-trend weather events, strong demand growth could offer some pricing protection for the industry – especially given the input inflationary pressures that we are seeing. If the customer base is looking for increases in deliveries, which we expect to be the case in 2022, it will be easier to defend pricing and gain pricing where costs are higher. Some of the momentum that we are seeing in the commodity stocks year to date is a function of a broader inflation trade, but some is likely in anticipation that 2022 will not be as bad as had been expected and on that basis, the sector looks particularly inexpensive – even today after the early year rally. It will be a little harder for the specialty and intermediate companies depending on how long they have to play a lagging catch-up game with costs. But if, and when, costs peak, they should see margin expansion as costs fall and will be able to keep some of the gains, especially if their demand is also growing.

High Prices Cause Behavioral Changes Throughout The Supply Chain

Nov 22, 2021 10:20:52 AM / by Cooley May posted in Chemicals, Sustainability, Commodities, Methanol, Supply Chain, commodity prices, low carbon, recycled material, supply shortages, renewable resources, renewable

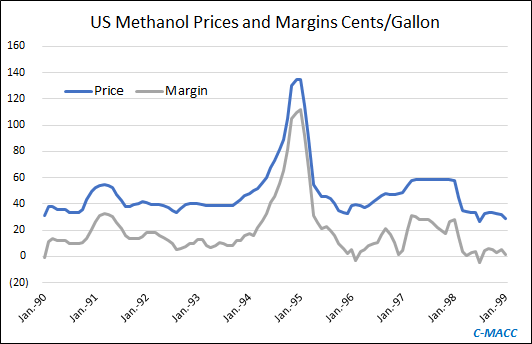

Another Lesson From The Past: Costs Will Matter

High prices are spurring behavioral changes throughout the supply chain. Per our analysis, it is causing buyers to look for alternatives and ways to use less material and increasing interest in new production, often without much thought about relative cost. In Exhibit 1 (from yesterday's report), we show the methanol peak of the mid-90s. This development resulted from supply shortages rather than high costs. It encouraged multiple projects to receive serious consideration – including methanol from wood chips – where costs looked good at the time but not on a historical basis, and as the chart shows, not on a forward basis. Most ideas never got past the planning stage. With sustainability driving a significant share of the growth investment decisions, we think several “renewable” ideas could encourage investment that rely on price premiums to keep returns attractive. While this setting might look supported today, it will likely look less tenable if traditional commodity prices retreat into a commodity trough or lower-cost competitive materials emerge.

Operating Leverage Spurs Downstream Profits, Combats Raw Material Cost Inflation

Aug 12, 2021 2:15:14 PM / by Cooley May posted in Chemicals, Propylene, Raw Materials, raw materials inflation, downstream, Basic Chemicals, Kuraray, specialty chemicals, commodity prices, basic chemical markets, commodity producers

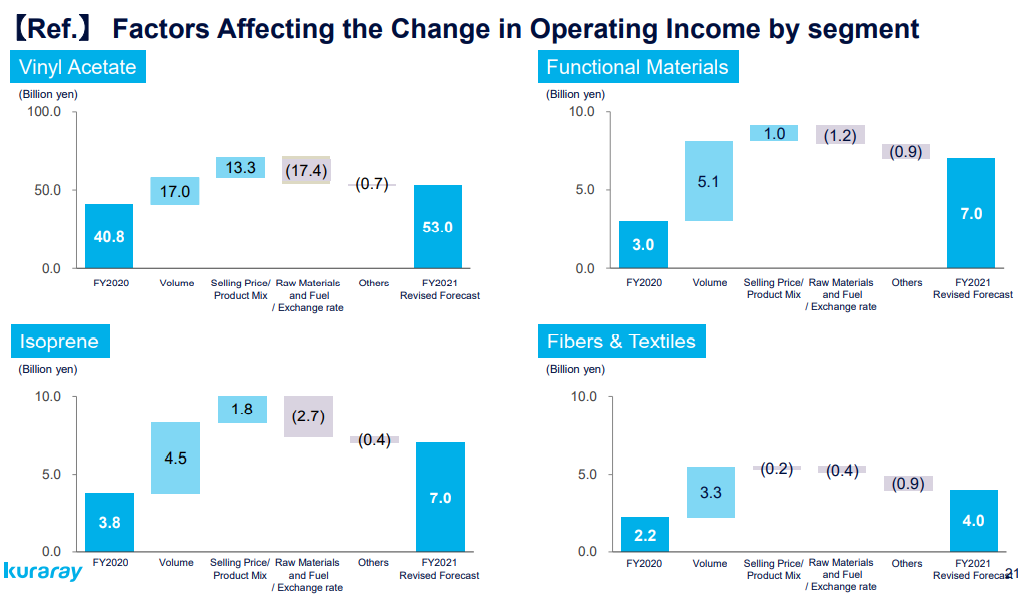

The 2Q volume driver of Kuraray’s earnings recovery was substantial, partly because end-market demand is strong and because this more mid-stream and specialty portfolio has significant operating leverage, much more than you would see from the commodity producers. We find this as a notable downstream sector trend to keep in mind. As seen below, increased selling prices are an important driver of Kuraray full-year profit growth expectations, but the volume piece is the most critical component, in our view. As discussed in our daily report today available in LINK, we continue to see volatile but elevated basic chemical prices.