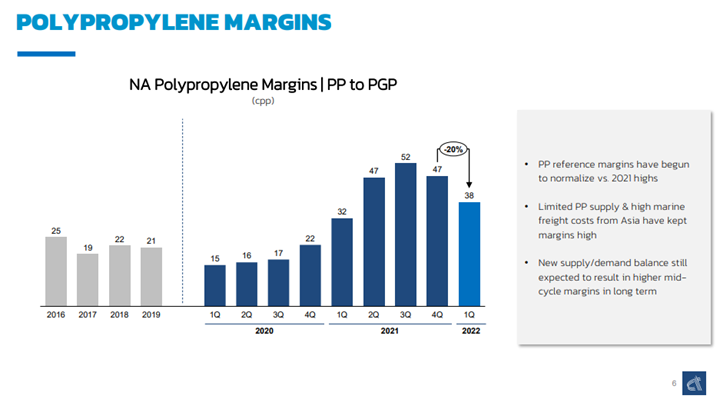

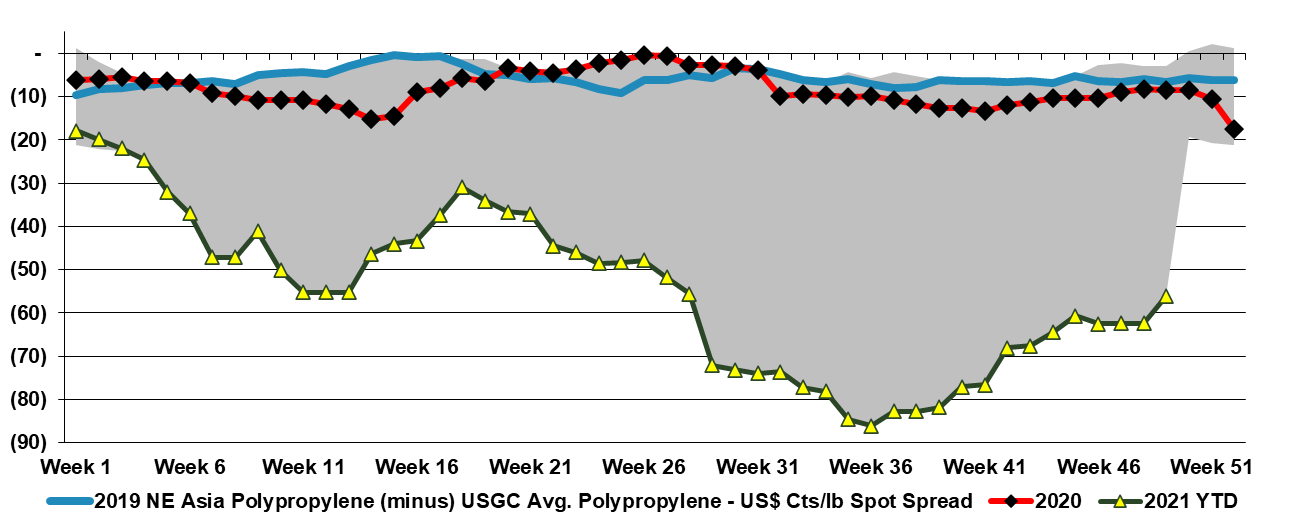

While Alpek shows a decline in the polypropylene to propylene spread in the exhibit below, it is important to note how high margins remain in the US. It is also important to note that the company points to high freight costs from Asia as one of the key drivers. China has significant polypropylene surpluses, and the price delta with the US is very high and, on paper, looks high enough to encourage imports into the US. But it is not that simple. The freight rates for containers from Asia are just one of many roadblocks, including wait time – on the water and the docks – and product quality. A US converter will likely not risk buying a few spot containers from China if focused on a product spec for a US customer. One way to get more material into the US would be for the end-user to buy the product – durable manufacturer or packager – and then ask its supplier to effectively toll-process. That way the product quality and logistic risk sit with the end consumer rather than the converter in the middle. The longer US domestic polypropylene prices remain inflated versus Asia, the more end-users may look at this option.

US Polypropylene & PVC: Both Benefiting From Logistic Challenges

Apr 27, 2022 12:32:52 PM / by Cooley May posted in Chemicals, Propylene, PVC, Polypropylene, freight, Logistics, US polypropylene, Alpek

Many Adjustments Ahead For LyondellBasell

Dec 14, 2021 1:27:36 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Propylene, Polyethylene, Polypropylene, LyondellBasell, Chemical Industry, energy transition, US Exports, specialty chemicals, Polyethylene Capacity, US polyethylene, US polypropylene, commodity chemicals, refinery, commodity polymer

Following on from the LyondellBasell commentary in today's daily report, we would make one further, but very important point. With its refinery (granted the company is exploring opportunities to exit) and its huge commodity polyethylene, polypropylene, and propylene oxide business, any attempt to pursue a “specialty” strategy that encompasses the whole portfolio will be seen (crudely) as trying to put some lipstick on a pig! This rarely works in the chemical sector and the real transformation stories involve wholesale portfolio shifts, many of which have taken notable periods of time to develop. We still believe that the right path for LyondellBasell is to spin off the good piece – recycling, licensing, and compounding, or even better, find someone they can sell the business to through a Reverse Morris Trust. This strategy would likely allow the company to pay down (or shift) a significant amount of debt. The commodity business can then focus on the best strategy for a commodity polymer business in the face of energy transition, which might involve taking the business private or merging with another.

US Polypropylene: Very Expensive But Clearly In Demand

Dec 7, 2021 2:55:45 PM / by Cooley May posted in Chemicals, Polypropylene, Chemical Industry, polymer, inventory, Logistics, polypropylene margins, US polypropylene, polypropylene demand

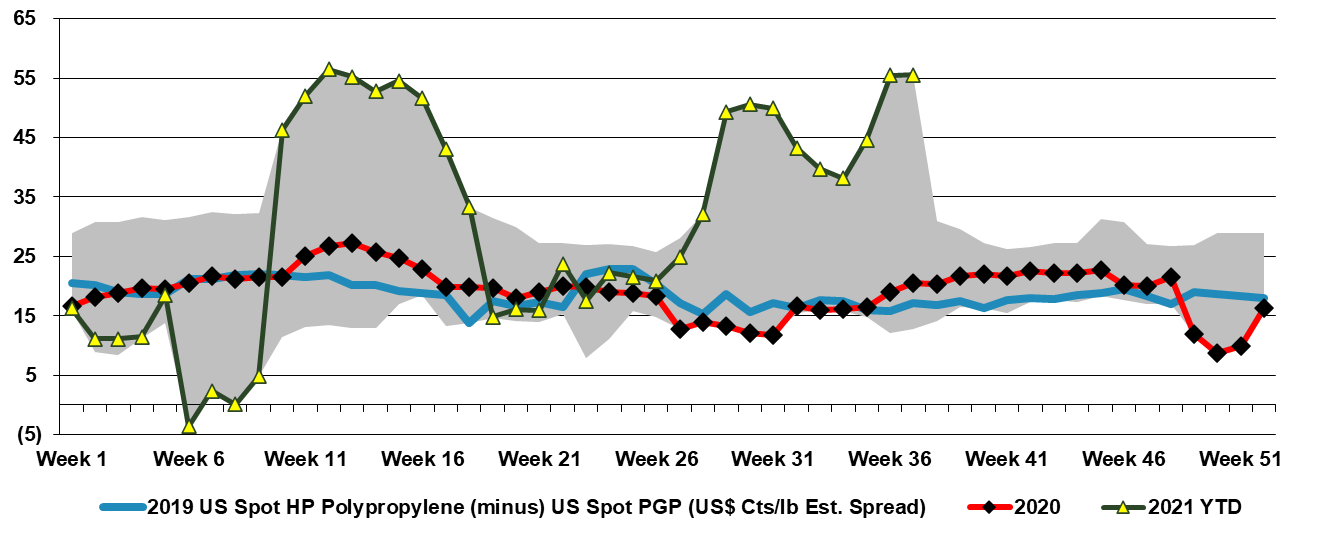

The polypropylene chart below, shows just how much of an impact the polymer has on the “average” in Exhibit 1 from today's daily report. Polypropylene is the only large volume polymer that can afford the freight rates to move surpluses from Asia to the US today and while some material is moving, volumes remain limited by the high cost of shipping and some of the additional logistic hurdles getting truck-based materials to US consumers that generally take the product by rail. The very high polypropylene margin in the US is a function not only of very strong demand but also demand that is likely growing faster than expected, giving buyers little negotiating room to get materially lower pricing. A year-end inventory correction from polymer buyers might send prices lower more quickly, but we have yet to see much evidence. We remain surprised by the apparent demand for polypropylene in the US given the lower automotive throughputs in 2021.

US Polymers Holding On To A More Fragile Premium, Mostly Storm Driven

Sep 21, 2021 2:01:48 PM / by Cooley May posted in Polymers, Polypropylene, polyethylene producers, ethane, natural gas, US polyethylene, US polypropylene, polypropylene arbitrage, spot pricing

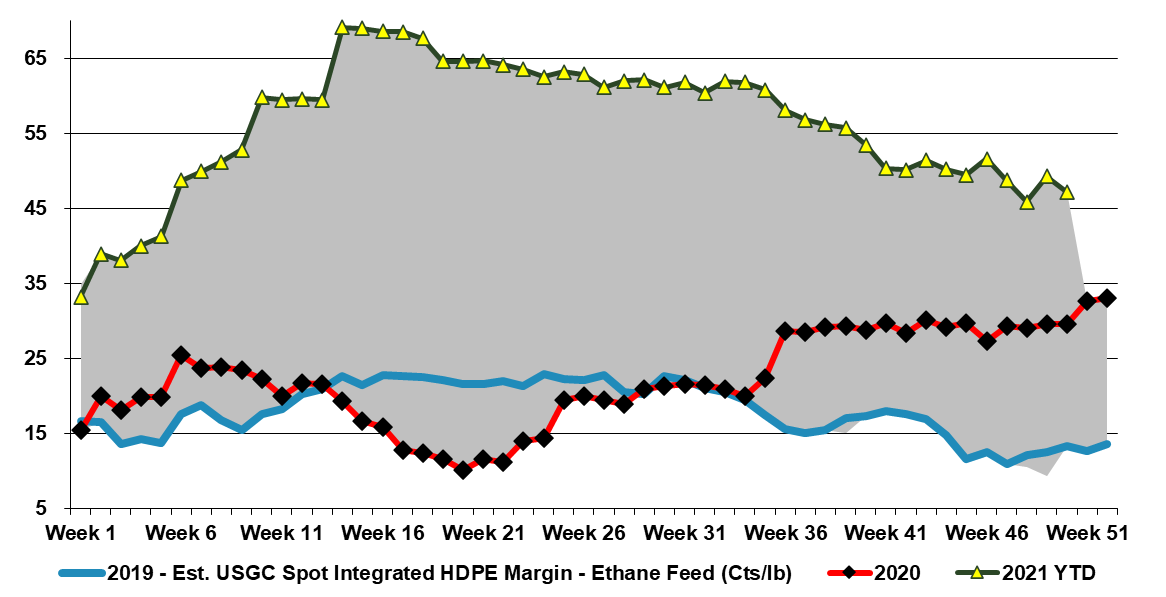

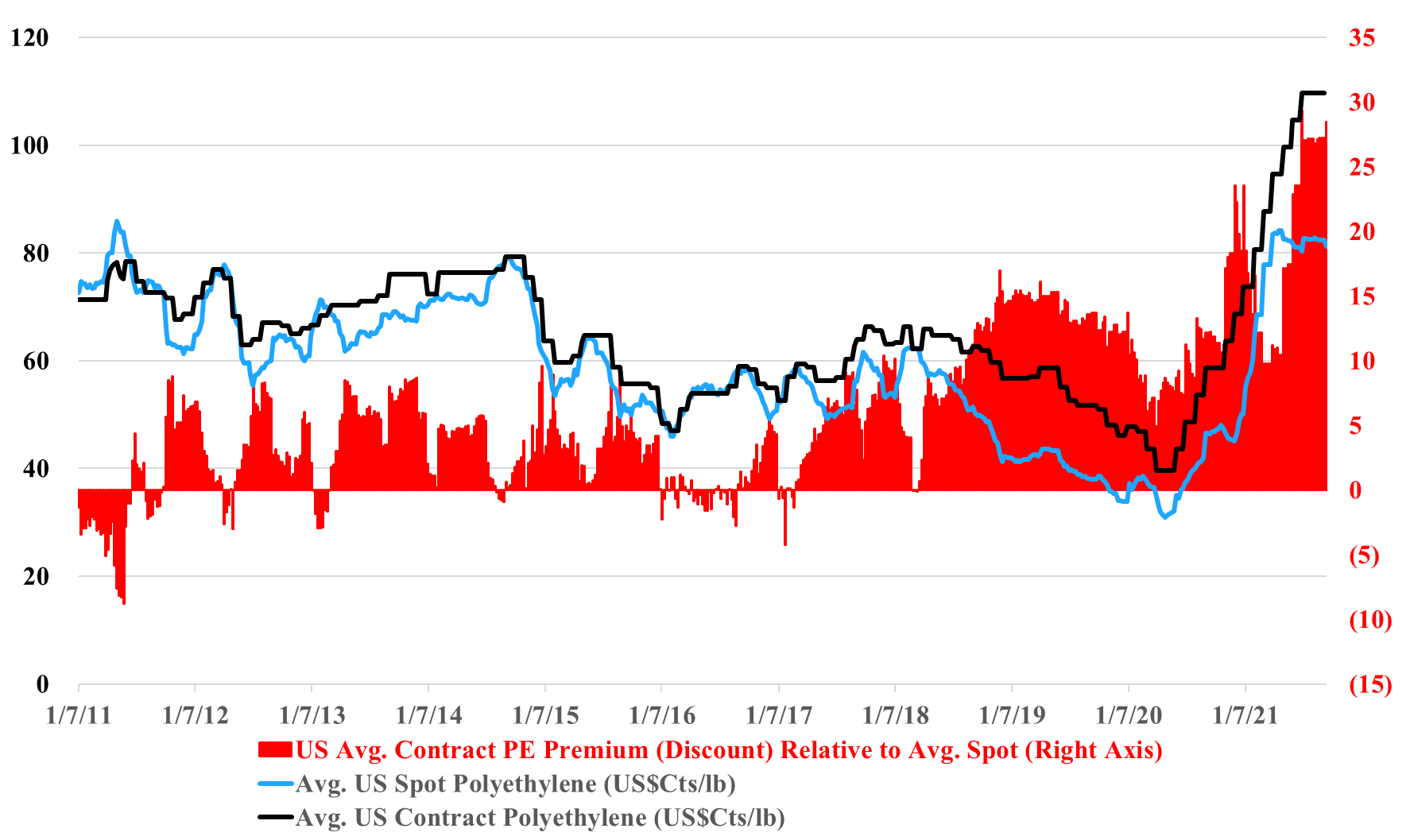

US polyethylene producers are pushing for September price increases and their arguments center around lost production, because of Ida and Nicholas, and rising costs because of the much firmer natural gas and ethane markets. Working against them are the very high margins and what appears to be a stubborn spot market, both covered in the charts below. A contract increase in September would maintain an unprecedented gap between US contract and spot pricing, and while it is likely that the spot market is very thin, it is a very strong push back against producers for a contract hike.

How Durable Is Polypropylene?

Sep 15, 2021 12:22:50 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Surplus, propane, polymer, propane prices, polymer market, ethylene feedstocks, US polypropylene

The crack in US polypropylene prices is probably worth some comments as the polymer has shown extraordinary strength since the middle of last year, in the face of new capacity that was expected to push the US market into surplus. In the chart below we show that the spread over propylene has not fallen, but this is because propylene is falling lock-step with polypropylene for the most part. Those companies integrated back to PDH economics will see a significant margins squeeze as polymer prices fall while propane prices increase. We have written recently about a concern that lower auto production rates in the US will back up into parts and that this will impact materials. In the early days of the auto cutbacks, we assumed that the automakers and their suppliers would simply build inventory, with the expectation of a bounce-back in demand once the chip shortage was over. As the chip shortage has dragged on and become more significant, we have likely hit any limit of inventory build, and we are concerned that polypropylene pricing could collapse if auto-related demand does not recover quickly. While autos are not a dominant demand category for polypropylene the sector is certainly large enough to swing the polymer market from shortage to surplus. With the rise in propane prices and other ethylene feedstocks, polypropylene profits could fall meaningfully. See today's daily for more comments on the propane markets.