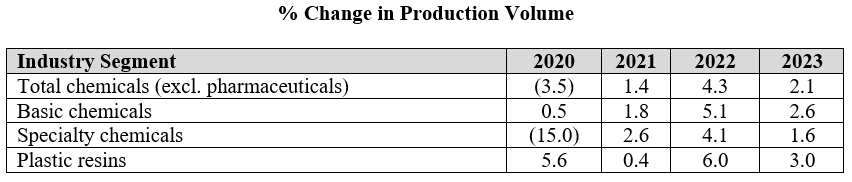

The ACC forecasts below leave us a little confused as the implication for specialty chemicals is that production declines in the US by an average of 2.0% per annum from 2019 to 2023. Given the demand that we are seeing for US manufacturing, as covered in our most recent Sunday Report, we would expect demand for all inputs to rise and it is unlikely that the gap would be filled by a swing in net imports. The lower demand from the Auto industry in 2020 and 2021 and broader manufacturing shutdowns in 2020 explains the 2020 and 2021 numbers to a degree, but it is not clear why there would not be a rebound as auto rates increase. We would also expect to see a stronger rebound in polymer production in 2022, assuming weather events are less impactful than in 2021, given substantial new capacity for polyethylene from ExxonMobil/SABIC, BayStar, and Shell.

The ACC Forecasts Look Too Conservative To Us

Dec 9, 2021 2:15:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, Ethylene, Auto Industry, Shell, ExxonMobil, petrochemicals, Sabic, natural gas, natural gas prices, Baystar, Basic Chemicals, manufacturing, polymer production, specialty chemicals, ACC, Polyethylene Capacity, US manufacturing, plastics resin

US Ethane Markets To Tighten In 2022 Amid Greater Demand

Nov 11, 2021 1:47:28 PM / by Cooley May posted in Chemicals, LNG, Plastics, Ethylene, ExxonMobil, petrochemicals, hydrocarbons, ethane, natural gas, US Ethane, Baystar, ethylene plants, Braskem, chemicalindustry, ethane imports, oilandgasindustry, plasticsindustry, petrochemicalindustry

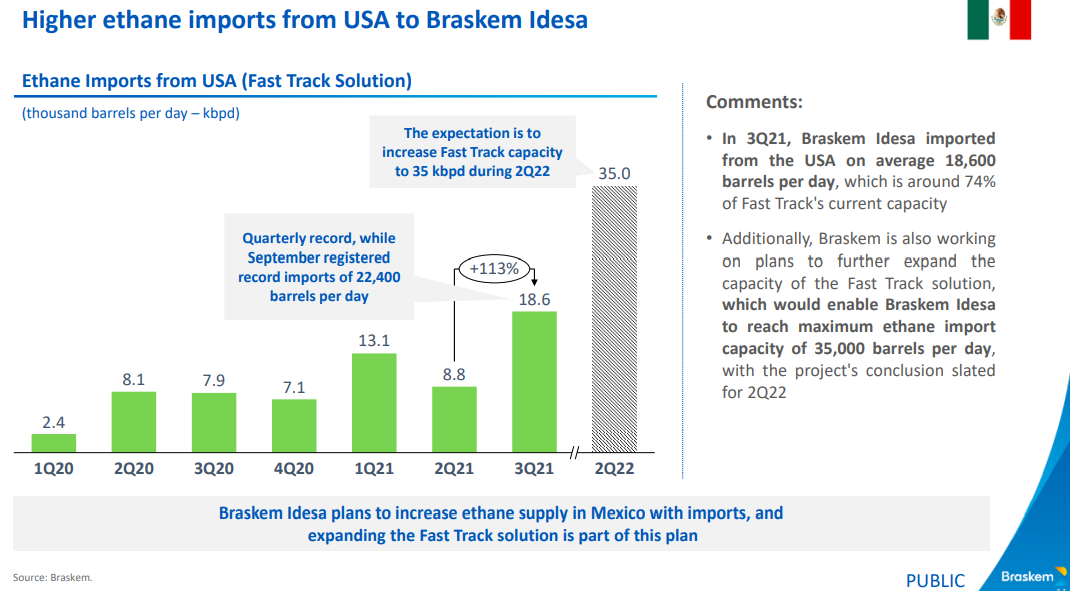

With ExxonMobil and Baystar’s ethylene plants in start-up and Shell expected to come online in Pennsylvania in 1H 2022, the news that Braskem wants to double its ethane imports from the US in 2022, adds to concern that the US may struggle to meet ethane needs at peak demand rates in 2022. We would be less concerned if we saw natural gas production rising, which is unclear for 2022, despite the expected new LNG capacity. Ethane is likely to follow any upward movement in natural gas pricing as there will be a need to bid the product away from heating alternatives. The increment suggested by Braskem in the Exhibit below is not larger in the overall scheme of US ethane demand, but every gallon may matter in 2022. See today's daily report for more.

Upcoming Polyethylene Capacity Additions Are Unlikely To Go Unnoticed

Aug 27, 2021 12:58:28 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Shell, ExxonMobil, Sabic, Baystar, ACC, Polyethylene Capacity

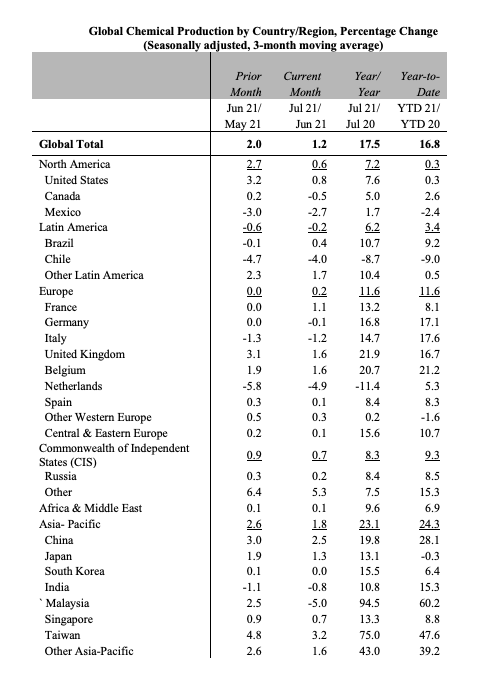

The advanced nature of the ExxonMobil/SABIC project, which we have discussed previously, is another cause for concern around US polyethylene market strength for a couple of reasons. First, it is only the first wave, with Baystar and Shell hot on the heels in 1H 2020. Second, it will add another ethylene seller in the US – SABIC – and this may be enough to cause some ripples. If you look at this in the context of the Asia production growth data provided by the ACC (below) there should be a significant cause for concern around the global balance for many products. Some of the specific Asia country growth, year on year and year to date, is driven by COVID-related shutdowns in 2020 – Taiwan and Malaysia for example – but the bulk of the China growth, which is more significant in absolute volume terms is from new capacity. China’s ability to sell surpluses internationally is hindered by the current logistic problems, but these will not last, and we should also factor in where the material will go that had been imported into China. The global polyethylene market could look very different in 2022, although all eyes will be focused on Hurricane Ida for the next week. See more in today's daily report.

US Ethylene & Propylene: Very Different Markets!

Jun 23, 2021 3:22:37 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Ethylene, Monomer, polymer pricing, Baystar, US ethylene pricing, propane pricing, Ethylene Surplus

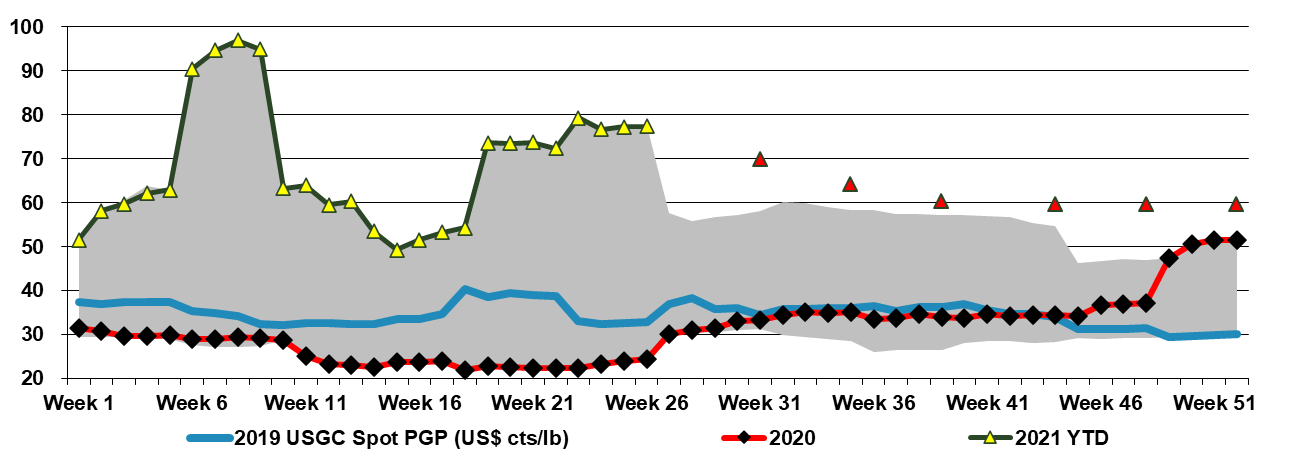

The Baystar polyethylene start-up date is consistent with the guidance that the company has been providing for a while, but it still leaves the venture with an ethylene surplus until that time and while the ethylene has been placed, according to the company, the ethylene that it has displaced will likely keep some downward pressure on US ethylene pricing until the polymer plant starts up (all things being equal). Even when the polymer plant starts, the US is expected to have a net ethylene surplus and we would expect exports to continue and prices to reflect levels to make the exports possible.