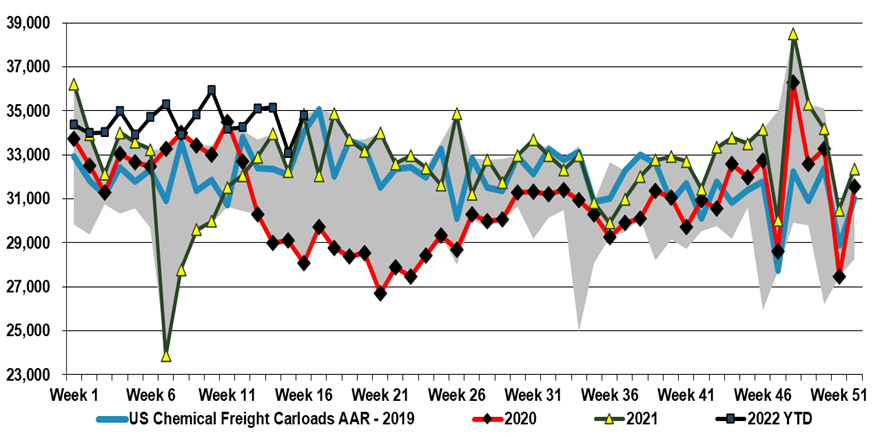

Chemical railcar volumes remain very strong in the US, despite some issues with exporting polymers, which has led to inventory builds on the coast, especially the Gulf Coast, and despite the implied consumer volume purchase decline in 1Q GDP estimates (sales grew but prices rose 500 basis points more than sales growth – suggesting an equivalent decline in volumes). As we noted yesterday, some companies closer to the consumer are indicating demand weakness and are more cautious about 2Q outlooks. If a higher than usual proportion of rail freight is moving into inventory, either at customers or stuck in rail cars – something Union Pacific has signaled – we could see a correction.

Overall Inventory Worries Hide Some Interesting Focused Upside

Apr 28, 2022 4:24:25 PM / by Cooley May posted in Chemicals, Polymers, Methanol, Energy, freight, US Methanol, US Polymers, Methanex

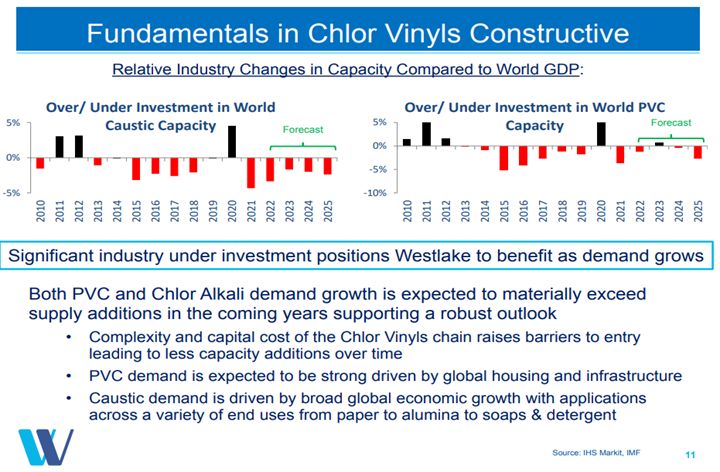

The PVC Market Is Compelling - One Of The Most Attractive Global Polymer Stories

Apr 7, 2022 1:39:50 PM / by Cooley May posted in Chemicals, Polymers, PVC, Basic Chemicals, Westlake, US Polymers, mega-cycle

The margin weakness in PVC, as shown in Exhibit 1 from today's daily report, suggests that the market might be weakening, but higher prices would suggest that it is not. The integrated margin weakness is mostly the result of rising costs, and the US PVC market may be strong enough to allow producers to pass on these costs fully over time. We still see PVC as the least risky way to play the US polymers market as infrastructure and manufacturing investments should keep demand strong even if we see a decline in consumer durable related spending. The Westlake chart below highlights one of the primary drivers behind our mega-cycle view – no new capacity. The supply shortfalls that are implied in the chart will be mirrored in other basic chemicals in our view but PVC is likely the most acute example – creating what could be a prolonged period of strong margins for the industry.

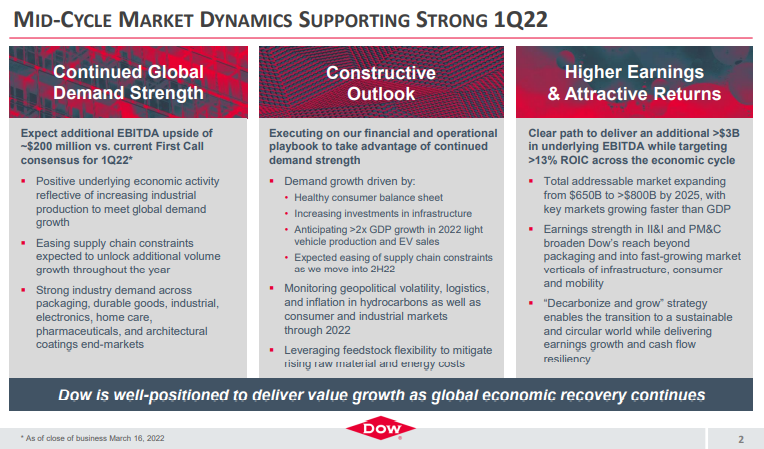

If You Are In The Right Place With The Right Products, Times Are Good

Mar 18, 2022 12:19:25 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, LyondellBasell, Inflation, Dow, US Chemicals, natural gas, Basic Chemicals, Westlake, Braskem, US Polymers, commodity chemicals, demand strength, raw material, silicone

As we have been suggesting for some time, there are pockets of real strength in chemicals; identifying them is the hard part. It is not enough to have pricing strength in a market where raw material prices are volatile daily and we have seen plenty of examples of companies with very strong end demand dynamics missing earnings because of a cost squeeze. We continue to highlight the competitive strength in the US in basic chemicals because of the decoupled and relatively low natural gas price and this is likely a large piece of the Dow earnings strength – strong polyethylene demand against a backdrop of relatively stable and lower costs. While polypropylene (Braskem) remains extremely profitable in the US, it has seen more sequential weakness than polyethylene – as we show in Exhibit 1 of today's daily report. That said, both polyethylene and polypropylene margins in the US are significantly higher than was likely expected this year and certainly what has been reflected in stock valuations, even with the commodity chemicals rally. Dow is also seeing the benefit of a very strong silicones market – something that was covered in detail in Wacker’s release earlier this month.

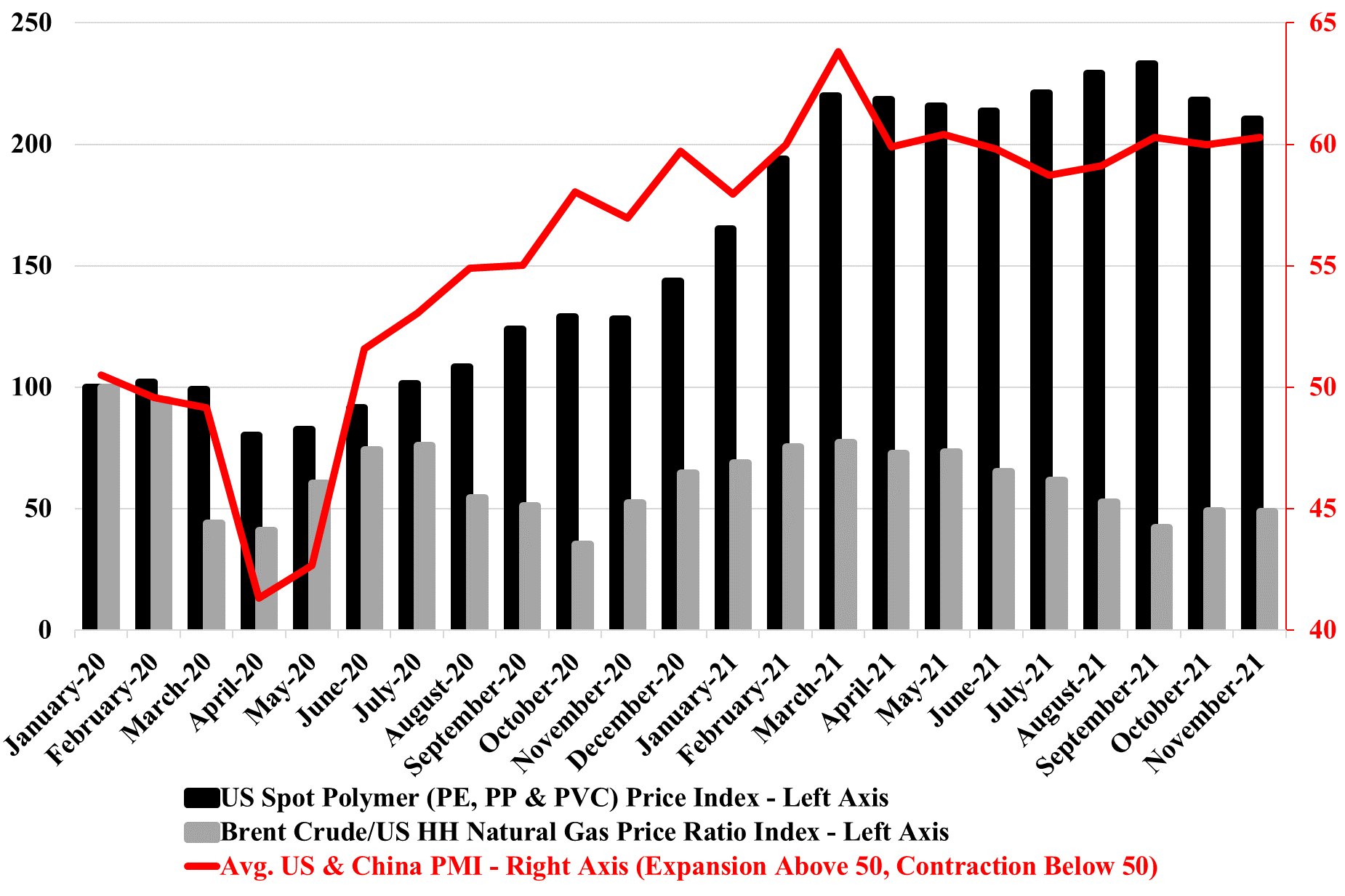

Polymer Prices Are Responding To Higher Costs, But Asia Remains Challenged

Mar 2, 2022 1:23:57 PM / by Cooley May posted in Chemicals, Polymers, Polypropylene, Ethylene, polymer pricing, ethylene producers, Propylene Derivatives, PDH, US polymer prices, US propylene, US Polymers, propane prices, crude oil, propylene prices

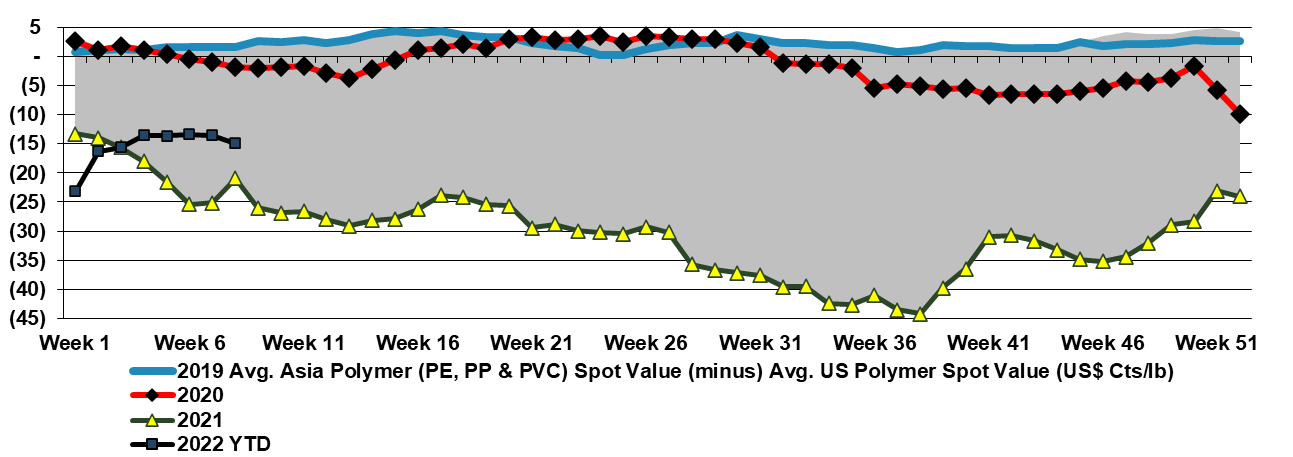

The upwards pressure on crude oil prices will likely drive propane prices much higher in the near term and this will significantly impact propane dehydrogenation (PDH) costs in the US and put further upward pressure on propylene prices and prices for propylene derivatives. Note in the exhibit below that US polymer prices are turning slightly more positive relative to Asia again. While some of this will be cost-based issues in the US, especially for polypropylene, higher freight rates (again) continue to make it difficult for producers in Asia to maintain attractive operating rates and make it harder to push prices higher to reflect what are now rapidly escalating costs. The oil moves today may result in more capacity closures in Asia, which should lead to better pricing, but as we noted in our Weekly on Monday (and likely more extreme today) outside of US ethane-based ethylene producers, no one is making money producing ethylene today. Prices are going higher.

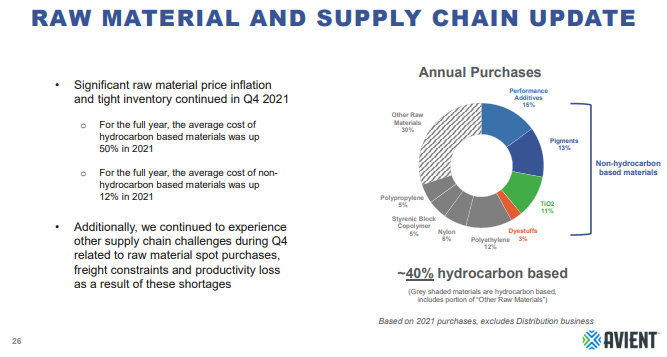

Raw Materials Inflation Not Over For Specialty Materials

Feb 8, 2022 3:04:30 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, raw materials inflation, Chemical Industry, petrochemicals, US Chemicals, Avient, US Polymers, specialty chemicals, materials, DuPont, plasticsindustry, supply chain challenges, logistic inflation

As Avient and the linked paint article remind us, there are sectors of the US chemical industry that rely on imported products – in these cases pigments, and the supply chain challenges and logistic delays have caused production problems in the US and price increases in 2021. The automotive segment of the paint industry has seen lower demand because of the auto OEM production slowdown, and pigment shortages and price spikes would likely have been worse if automakers had been running at full rates. There is no sense of impending relief in the logistic issues as we go through 4Q earnings reports and we could continue to see issues for a while. This should be good for US-based pigment suppliers, but while Chemours, Venator, and Tronox all have capacity in the US, they also have capacity outside the US which likely faces some supply chain challenges.

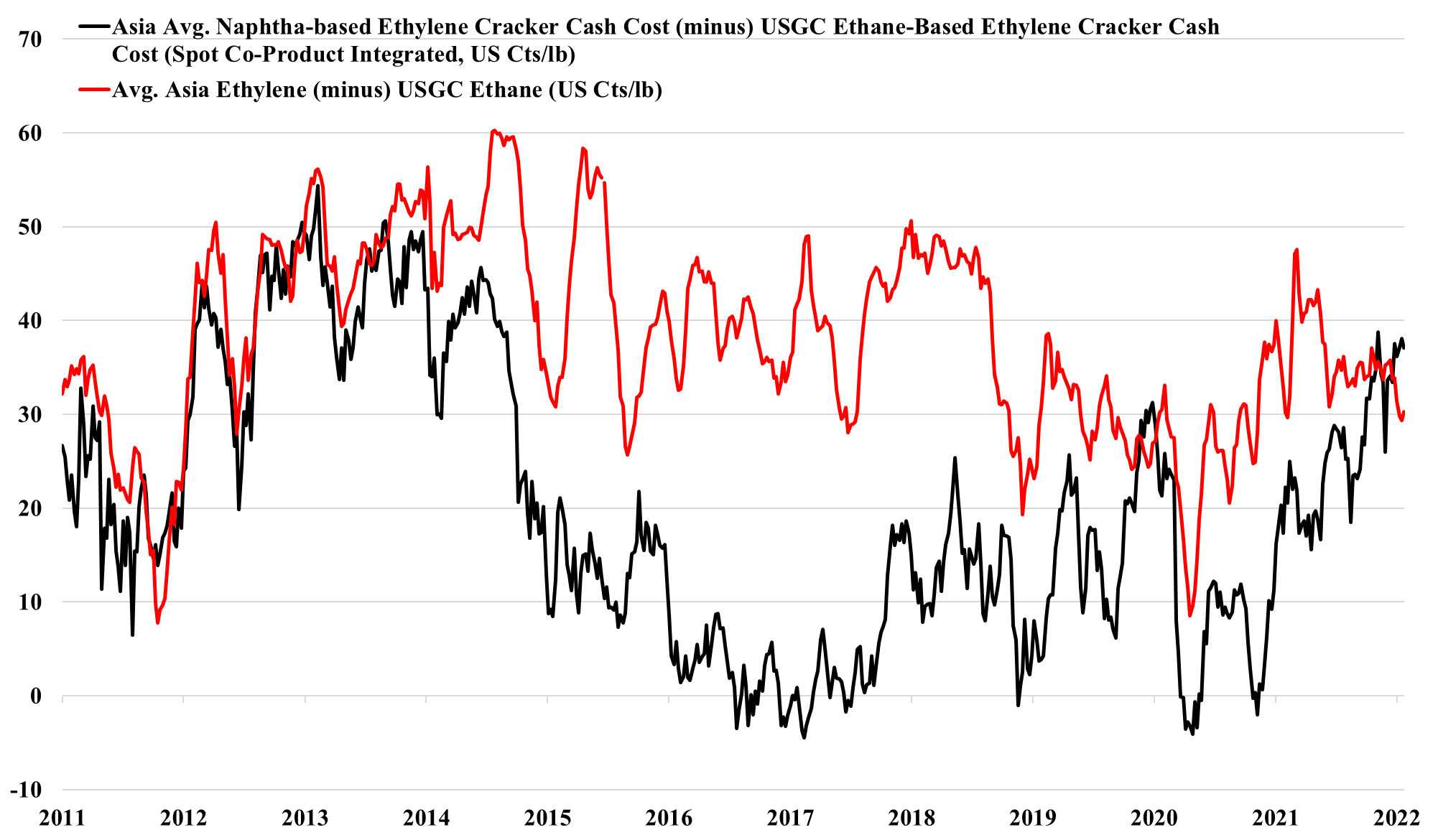

The US Is Benefiting From Strong Growth And A Significant Cost Advantage

Feb 1, 2022 12:18:39 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Axalta, US Chemicals, polymer producers, ethane, US Ethane, US Polymers, exports, chemical producers, OEM, cost advantage, Auto OEM, Ethylene cracker

2022 has started very strongly for US chemical and polymer producers, in part because demand growth remains very robust based on early reads from those that have reported earnings, and in part because of the ever-increasing competitive edge that the US is enjoying over Asia – see exhibit below. US producers can maintain strong margins in the US, while easily pushing any surpluses into export markets where local suppliers cannot compete. At the same time, higher production costs and very high logistic costs make it almost impossible for those regions with capacity surpluses to move products into the US, and it is challenging also to move products into Europe. If this production and logistic cost environment persist, not only should US prices stabilize, but for select companies – those with a strong US production bias – we should see estimates for 2022 start to rise.

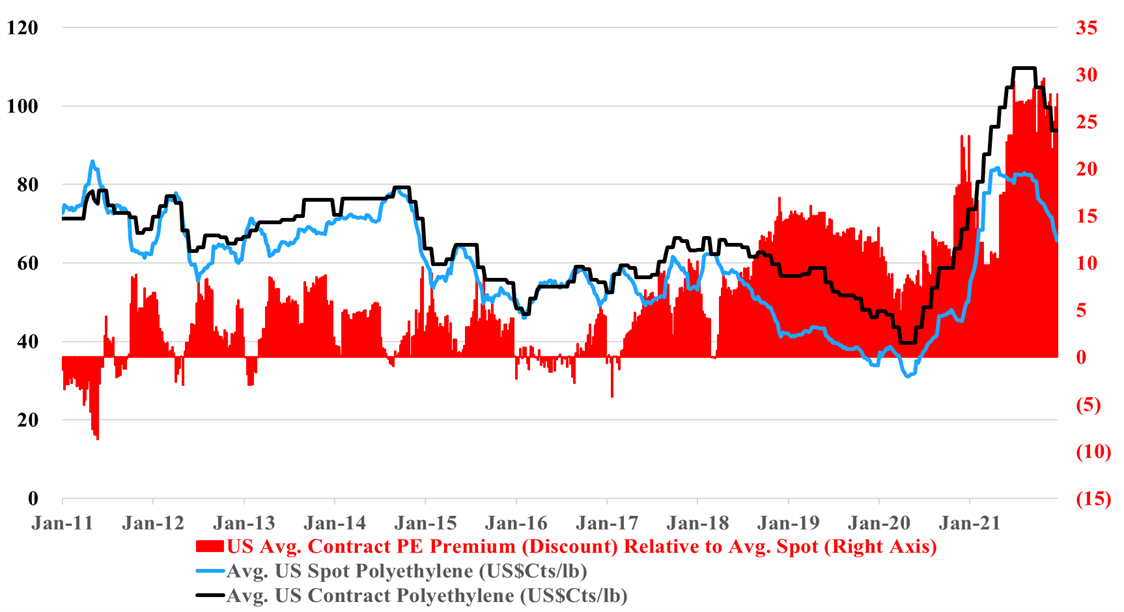

Polymer Margin Declines Holding Back Commodity Chemical Stocks, For Now

Dec 28, 2021 11:54:49 AM / by Cooley May posted in Polyethylene, Plastics, LyondellBasell, Dow, US Polymers

The negative momentum in US polymers prices is overwhelming all other factors in the eyes of public shareholders, with Dow and LyondellBasell share prices both down 6% since October 1st, underperforming the S&P500 by 16%. The data in our Daily Report and the exhibit below show that current industry profitability is very high and much higher than it was in 2019 when share prices were roughly where they are now. Our expectation is for profits to fall in 2022, but not to the levels seen in 2019 unless there is a significant increase in US natural gas and NGL pricing relative to crude oil (which is possible). But while these stocks look very attractive based on historic relationships to cash flow, we cannot ignore years of experience covering this sector which says that no one gets interested until the earnings revisions bottom out - so not yet, and likely not in 1H 2022. Complicating the story is the lack of clarity around what sort of EGS penalty is implied in current valuations and whether it could get worse as ESG funds grow, which they surely will in 2022. In our ESG and Climate report tomorrow we will look at some chemical stocks that could benefit from the rise in energy transition and infrastructure spending in 2022 and are less exposed to commodity polymer global oversupply.

Strong Demand Likely More Important For US Polymer Prices Than Inventory

Dec 16, 2021 2:00:29 PM / by Cooley May posted in Chemicals, Polyethylene, Inflation, Chemical Industry, Polyethylene prices, polymer producers, Sabic, packaging polymers, inventory, US Polymers, shortages, demand, plasticsindustry, US manufacturing

We have been asked a couple of times in the last week how US polymer (polyethylene in particular) pricing can remain so robust in a market where there is an inventory build going on. The PMI numbers are part of the answer. While we may be in the seasonally weaker part of the year, customers are still looking for more material than a year ago, and this makes the “we need a lower price” argument much harder, especially when the memory of 1H 2021 acute shortages is still fresh in the memory and when, more than likely, they are getting signals from their customers of a further step up in demand in 2022. We have done some traveling recently and the incremental demand for packaging polymers is very evident in the travel and leisure business, even if the number of travelers is still down. There is more packaging on airline and airport food and hotels are offering pre-packaged food for breakfast that would previously have not been individually packed. The reasons are obvious – safety and hygiene from the consumers' end and costs from the providers' end, as prepackaged food, can be bought in bulk and more cost-effectively and they likely have a longer shelf life.

US Polymer Price Weakness Inevitable Without Supply Issues, Despite Strong Demand

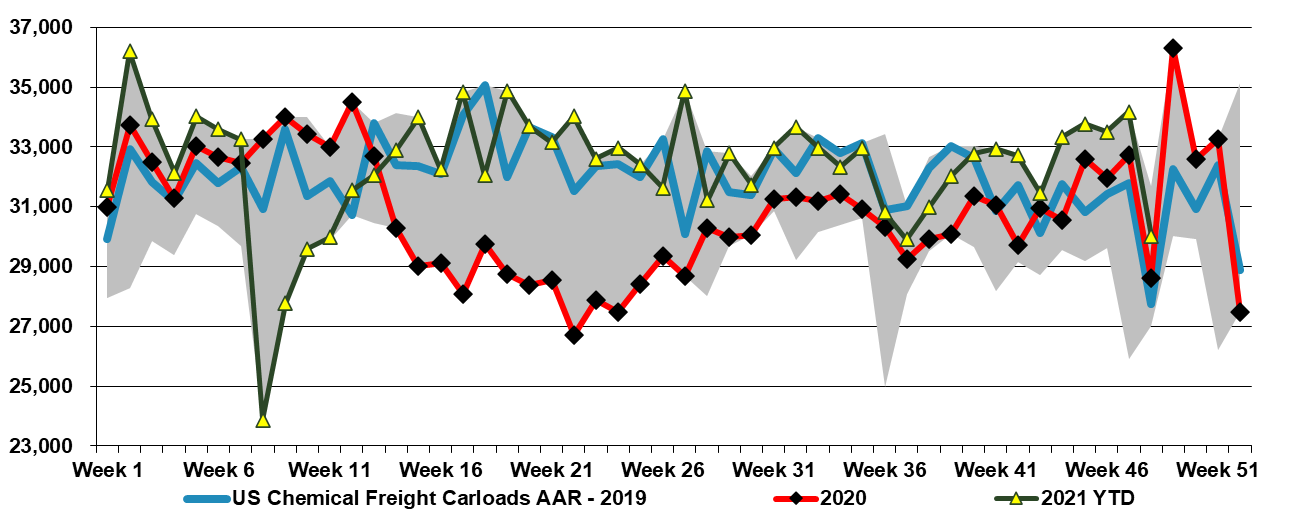

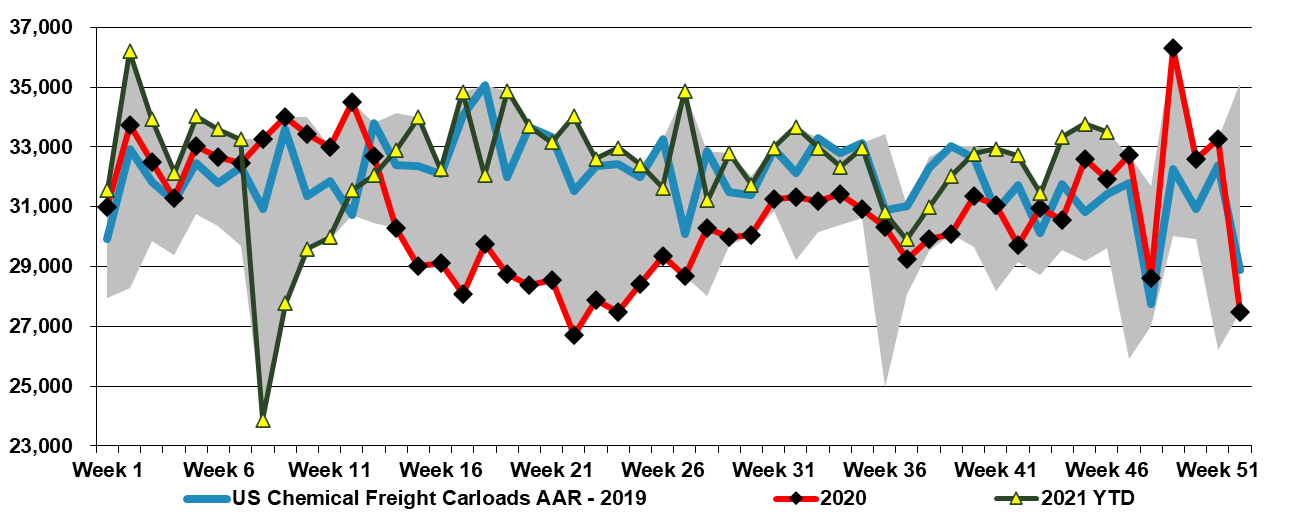

Dec 3, 2021 3:05:38 PM / by Cooley May posted in Chemicals, Polymers, Energy, polymer pricing, petrochemicals, US Polymers, Chemical pricing, Gas prices, energy prices, demand, chemicalindustry, plasticsindustry, petrochemicalindustry, oil prices, ISM manufacturing, US chemical rail, Supply

The decline in US and global chemical pricing this week (as discussed in today's daily) is a function of oversupply in the US and lower costs in the rest of the world. The US has had an incentive to produce everything for most of the year and has had essentially full capacity to do so since the beginning of the 4th quarter. This will have collided with seasonally weaker incremental demand in December and the recent abrupt drop in oil and gas prices to swing momentum very much in favor of buyers. Polymer prices have to date been more stubborn in the US, but we expect continued weakness here also through the end of the year.

Chemical Supply Increases And US Prices Weaken

Nov 19, 2021 12:35:27 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, ExxonMobil, polymer buyers, railcar shipments, Supply Chain, Dow, propane, PDH, ethylene capacity, US polymer prices, US Polymers, propylene prices, energy prices, chemicalindustry, plasticsindustry, spot market, cost arbitrage

US rail data for chemicals remain at the 5-year highs and have been there for almost 2 months. This is working its way into the supply chain and we are seeing weakness in US polymer prices across the board, except for PVC. US spot polymer prices are in a bit of a “no man's land” right now as they would need to drop significantly to find incremental demand offshore, given US premiums to the rest of the world. We believe that most of the volume leaving the US is doing so within company-specific businesses – ExxonMobil supplying ExxonMobil customers, Dow supplying Dow customers, etc, and consequently, these shipments do not show up in the spot market.