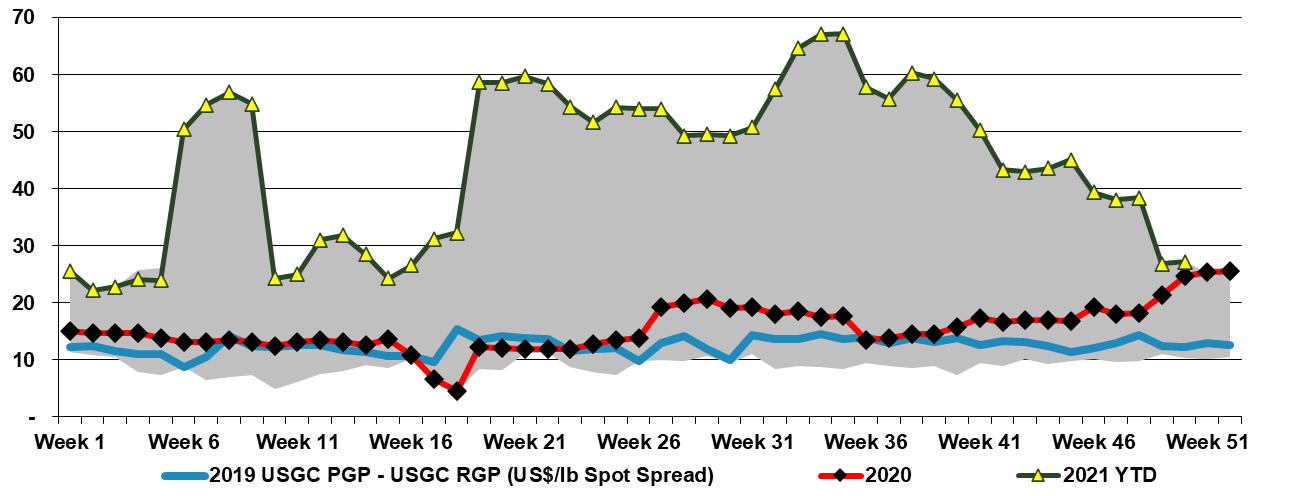

The CP Chem propylene splitter announcement linked suggests that CP Chem expects surplus refinery propylene to be around for the long-term, and likely has supply lined up from the parent companies. However, this is still a bit of a gamble unless both parents see a scenario where they would change catalysts on FCC units longer-term and run at higher severity for more propylene and more hydrogen. This project looked a lot better only a few weeks ago than it does today – based on the spread in the Exhibit below, but propylene demand continues to grow faster than ethylene demand in the US and with all incremental ethylene capacity based on ethane, propylene consumers either have to choose the path from refineries or invest in on purpose PDH. PDH is an energy-intensive process with a large carbon footprint, and splitting refinery propylene likely looks far less problematic from an emissions perspective, especially if there is surplus process heat on-site. In our ESG report today we talk about polymer recycling into new end markets, but polypropylene may see more direct substitution, especially if we see consumables related polypropylene recycled into durable polypropylene markets. This might dent demand growth for polypropylene going forward, but probably not meaningfully.

Refinery Propylene Remains A Cheap Source, If You Can Find It...

Dec 15, 2021 2:09:46 PM / by Cooley May posted in Hydrogen, Chemicals, Polymers, Propylene, Polypropylene, Emissions, CP Chemical, carbon footprint, ethane, PDH, ethylene capacity, polypropylene demand, refinery, Refinery Propylene, ethylene demand, surplus refinery propylene, polymer recycling, propylene splitter

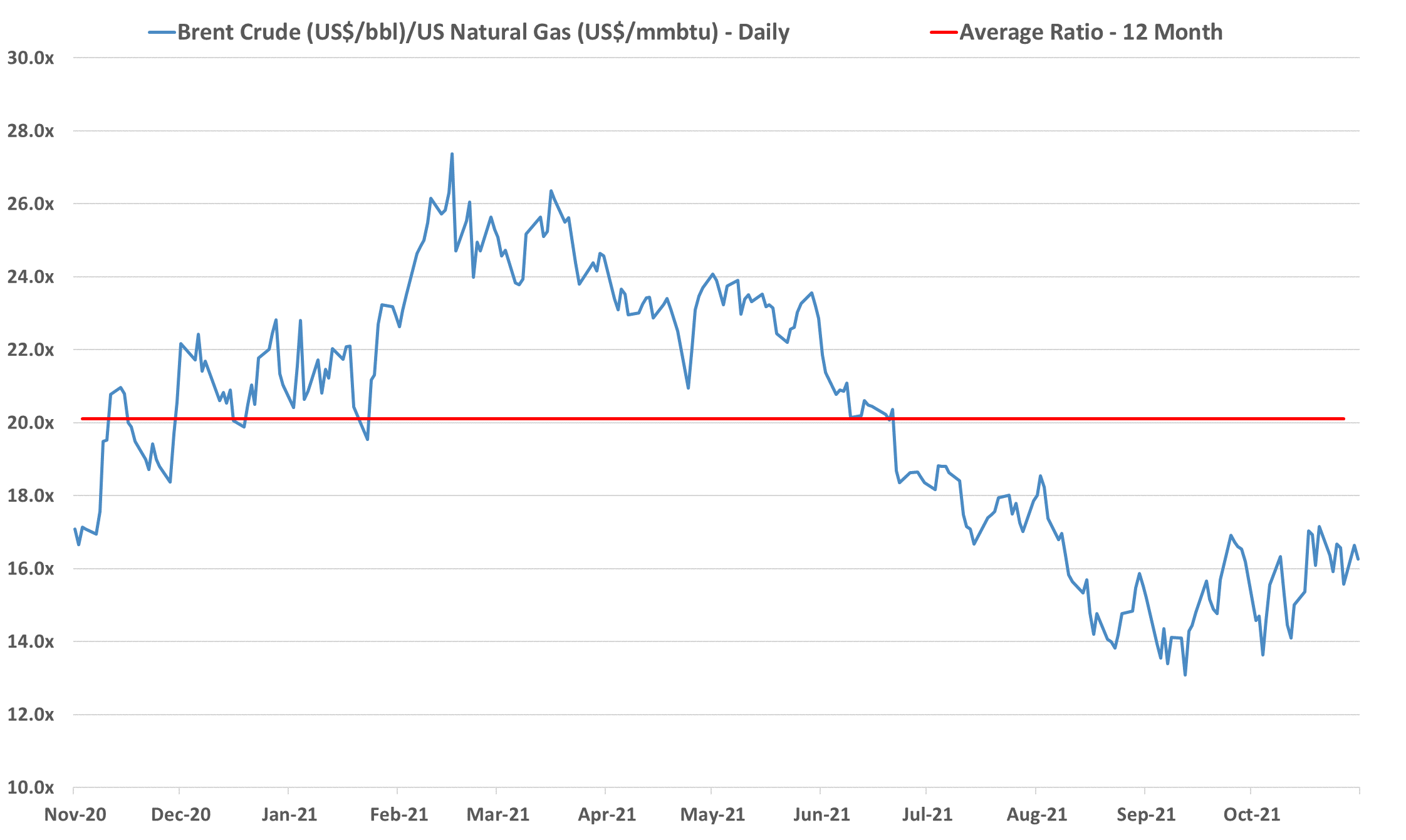

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.

Deserving The Benefit Of The Dow’t - Access Our Latest Reports

Oct 11, 2021 3:48:13 PM / by Graham Copley posted in ESG, Chemicals, Carbon Capture, Polymers, Polyethylene, biodegradable, CCS, Emissions, Mechanical Recycling, ExxonMobil, Dow, carbon footprint, carbon abatement, renewable polymers, ethane, natural gas, carbon emissions, Capacity, low carbon polyethylene, polymer capacity, feedstocks

Our latest Sunday Thematic report, "Damned if you Dow and Damned if you Down’t. Hard to win", centers around Dow's announced development of a new net-zero carbon emissions site in Alberta, Canada. It discusses company-specific and sector ramifications for Dow's strategic move to produce low-cost low carbon polyethylene in Canada while also expanding capacity.