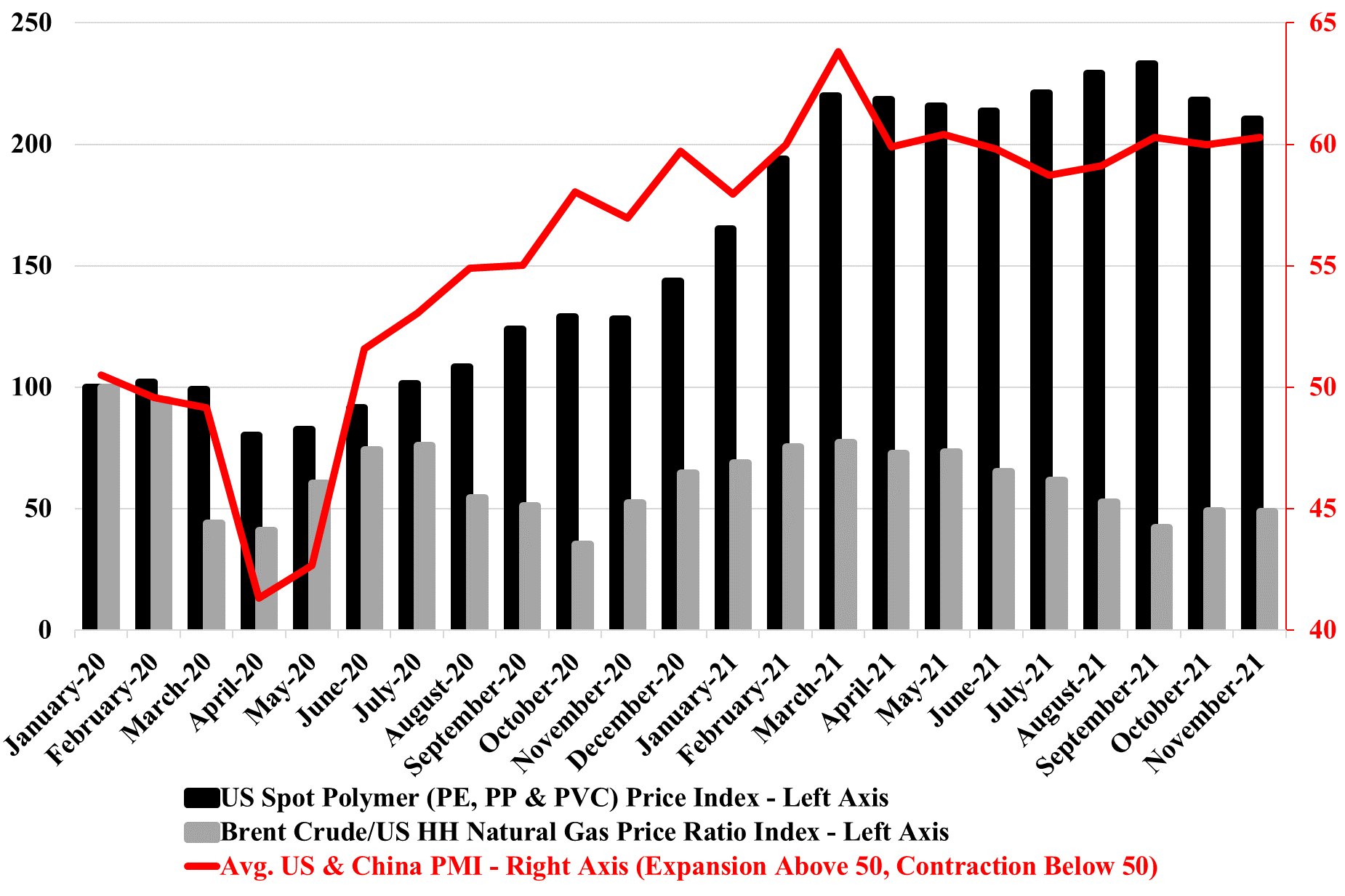

We have been asked a couple of times in the last week how US polymer (polyethylene in particular) pricing can remain so robust in a market where there is an inventory build going on. The PMI numbers are part of the answer. While we may be in the seasonally weaker part of the year, customers are still looking for more material than a year ago, and this makes the “we need a lower price” argument much harder, especially when the memory of 1H 2021 acute shortages is still fresh in the memory and when, more than likely, they are getting signals from their customers of a further step up in demand in 2022. We have done some traveling recently and the incremental demand for packaging polymers is very evident in the travel and leisure business, even if the number of travelers is still down. There is more packaging on airline and airport food and hotels are offering pre-packaged food for breakfast that would previously have not been individually packed. The reasons are obvious – safety and hygiene from the consumers' end and costs from the providers' end, as prepackaged food, can be bought in bulk and more cost-effectively and they likely have a longer shelf life.

Strong Demand Likely More Important For US Polymer Prices Than Inventory

Dec 16, 2021 2:00:29 PM / by Cooley May posted in Chemicals, Polyethylene, Inflation, Chemical Industry, Polyethylene prices, polymer producers, Sabic, packaging polymers, inventory, US Polymers, shortages, demand, plasticsindustry, US manufacturing

The ACC Forecasts Look Too Conservative To Us

Dec 9, 2021 2:15:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, Ethylene, Auto Industry, Shell, ExxonMobil, petrochemicals, Sabic, natural gas, natural gas prices, Baystar, Basic Chemicals, manufacturing, polymer production, specialty chemicals, ACC, Polyethylene Capacity, US manufacturing, plastics resin

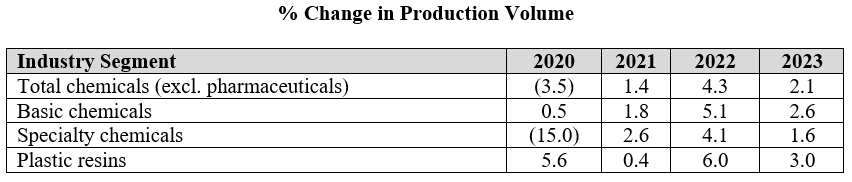

The ACC forecasts below leave us a little confused as the implication for specialty chemicals is that production declines in the US by an average of 2.0% per annum from 2019 to 2023. Given the demand that we are seeing for US manufacturing, as covered in our most recent Sunday Report, we would expect demand for all inputs to rise and it is unlikely that the gap would be filled by a swing in net imports. The lower demand from the Auto industry in 2020 and 2021 and broader manufacturing shutdowns in 2020 explains the 2020 and 2021 numbers to a degree, but it is not clear why there would not be a rebound as auto rates increase. We would also expect to see a stronger rebound in polymer production in 2022, assuming weather events are less impactful than in 2021, given substantial new capacity for polyethylene from ExxonMobil/SABIC, BayStar, and Shell.

Upcoming Polyethylene Capacity Additions Are Unlikely To Go Unnoticed

Aug 27, 2021 12:58:28 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Shell, ExxonMobil, Sabic, Baystar, ACC, Polyethylene Capacity

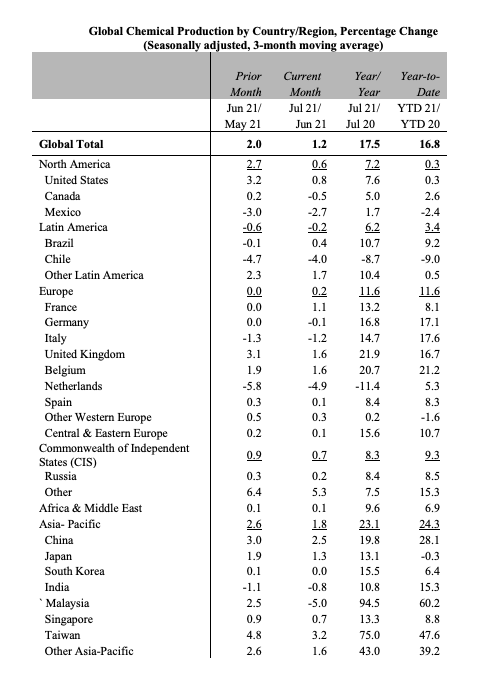

The advanced nature of the ExxonMobil/SABIC project, which we have discussed previously, is another cause for concern around US polyethylene market strength for a couple of reasons. First, it is only the first wave, with Baystar and Shell hot on the heels in 1H 2020. Second, it will add another ethylene seller in the US – SABIC – and this may be enough to cause some ripples. If you look at this in the context of the Asia production growth data provided by the ACC (below) there should be a significant cause for concern around the global balance for many products. Some of the specific Asia country growth, year on year and year to date, is driven by COVID-related shutdowns in 2020 – Taiwan and Malaysia for example – but the bulk of the China growth, which is more significant in absolute volume terms is from new capacity. China’s ability to sell surpluses internationally is hindered by the current logistic problems, but these will not last, and we should also factor in where the material will go that had been imported into China. The global polyethylene market could look very different in 2022, although all eyes will be focused on Hurricane Ida for the next week. See more in today's daily report.

ExxonMobil, SABIC JV Petrochemical Project Runs Ahead of Schedule

Jul 27, 2021 3:41:21 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Styrene, ExxonMobil, petrochemicals, petrochemical capacity, Dow, Sabic, Gulf Coast Growth Ventures, Aramco, Motiva, NPV, chemical plant, ethylene plant

ExxonMobil Chemicals has announced that its Corpus Christi JV project with SABIC is ahead of its original schedule – ExxonMobil is now targeting a start-up in 2H21, ahead of its previously targeted 1H22 expectation. It is unusual for projects in the US to be ready ahead of schedule these days, and start-up delays tend to be the norm. We also take a positive view of this development upon comparison to the Shell Pennsylvania project, which still has a vague 2022 start-up expectation though its construction began before ExxonMobil. One could argue that the remoteness of the location – well away from petrochemical infrastructure has been a constraint for Shell, but the Corpus Christi location is also a greenfield project for ExxonMobil/SABIC. This will be the largest ethylene plant built in the US, though it is likely that the recent 1.5 million ton units (Dow, ExxonMobil, CP Chem) are expandable to 2.0 million tons. Dow is already discussing such a move with a new polyethylene facility at Freeport. It will be interesting to see what impact this ExxonMobil/SABIC facility has on both the USGC ethane market and the polyethylene market – 1.3 million tons of polyethylene is a large increment and SABIC will have half of the capacity and will be a new market entrant with on-shore production. Aramco has ethylene, through Motiva’s purchase of Flint Hills, and SABIC owns half of the Cosmar styrene plant in Louisiana.

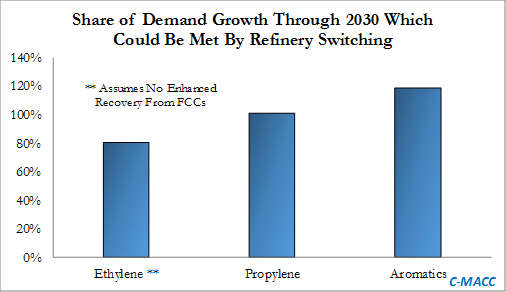

Could Big Oil Capital Reallocation Drive More Chemical Supply?

Jun 10, 2021 1:27:19 PM / by Cooley May posted in Chemicals, Polymers, Climate Change, Oil Industry, Ethylene, Carbon, ExxonMobil, fossil fuel, hydrocarbons, Dow, Base Chemicals, Sabic, JV, Engine No. 1

The ExxonMobil board headline linked has come up a couple of times since the Engine No.1 victory at the board meeting. There is no doubt that capital spending plans will be reviewed with the changes at the top, and we expect more management changes, which could also drive spending priorities. Over the last couple of years, several more macro studies have been done talking about oil demand in a climate change-centric world and all have highlighted chemicals as one of the likely longer-term growth avenues for fossil fuels. We would expect ExxonMobil and other oil majors to look at investments in chemicals as a route to more captive consumption of hydrocarbons and believe that this could ultimately keep basic chemical and polymer markets oversupplied through the balance of this decade – we have been writing about this risk consistently since early 2020. ExxonMobil is already building ethylene capacity in the US in a JV with SABIC, but more oil company investments could come in the US. The caveat is that, as Dow covered in its MDI press release yesterday, any new investment is likely to need a carbon plan to get stakeholder and regulatory approval.