The linked China polyethylene headline highlights a possible risk for US producers, as we link much of what is happening in China to logistic challenges. China has high production costs in a high oil environment, which is driving some of the cutbacks, but a portion is likely driven by an inability to move product and a huge disincentive to build inventory at break-even or negative margins. If the current shipping challenges in China roll over more aggressively into the rest of the world and container and vessel availability fall again, the US may face more challenges exporting polymers. As warehouse space fills, especially on the Gulf Coast, we may see some need to cut back rates, even if all of the material in storage currently has an agreed home and an agreed price. The US can afford to build inventory, as production costs still remain attractive relative to international prices, but if the supply chain is full there could be nowhere to put more material. One of Union Pacific's issues highlighted last week was too much inventory in rail cars, snarling up the system.

Logistic Problems Are Far From Over: 2Q May Still Throw Some Curveballs

Apr 22, 2022 2:57:06 PM / by Cooley May posted in Chemicals, Supply Chain, Dow, Logistics, specialty chemicals, labor shortages, PPG, supply chain challenges

Chasing Costs With Prices And Watching Your Peers

Apr 21, 2022 2:57:41 PM / by Cooley May posted in Chemicals, Polyethylene, raw materials inflation, Chemical Industry, Dow, specialty chemicals, intermediate chemicals, commodity chemicals, price inflation, AkzoNobel

We have discussed in several recent reports the very mixed fortunes in the intermediate and specialty chemical sector related to whether companies have been able to move prices fast enough to cover costs. The two large blue bars in the AkzoNobel chart below show that Akzo was close, but did not make it. We expect other examples like this over the coming weeks but we also expect some companies to have done better – some of this depends on mix and contract terms, but a lot has to do with how early you acted on the rising cost trend and how aggressive you were willing to be with customers. Dow is another example of a company struggling to get pricing high enough to cover cost increases, although Dow and others have aggressive price increase announcements in the market for polyethylene for April and May that would make a significant difference to US margins if successful.

If You Are In The Right Place With The Right Products, Times Are Good

Mar 18, 2022 12:19:25 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, LyondellBasell, Inflation, Dow, US Chemicals, natural gas, Basic Chemicals, Westlake, Braskem, US Polymers, commodity chemicals, demand strength, raw material, silicone

As we have been suggesting for some time, there are pockets of real strength in chemicals; identifying them is the hard part. It is not enough to have pricing strength in a market where raw material prices are volatile daily and we have seen plenty of examples of companies with very strong end demand dynamics missing earnings because of a cost squeeze. We continue to highlight the competitive strength in the US in basic chemicals because of the decoupled and relatively low natural gas price and this is likely a large piece of the Dow earnings strength – strong polyethylene demand against a backdrop of relatively stable and lower costs. While polypropylene (Braskem) remains extremely profitable in the US, it has seen more sequential weakness than polyethylene – as we show in Exhibit 1 of today's daily report. That said, both polyethylene and polypropylene margins in the US are significantly higher than was likely expected this year and certainly what has been reflected in stock valuations, even with the commodity chemicals rally. Dow is also seeing the benefit of a very strong silicones market – something that was covered in detail in Wacker’s release earlier this month.

Expectations From Dow Supportive Of Our Mega-Cycle Thesis

Jan 27, 2022 11:50:52 AM / by Cooley May posted in Chemicals, LNG, CCS, CO2, Ethylene, Chemical Industry, decarbonization, Dow, naphtha, CO2 footprint, ethylene production, oil prices, mega-cycle, Alberta

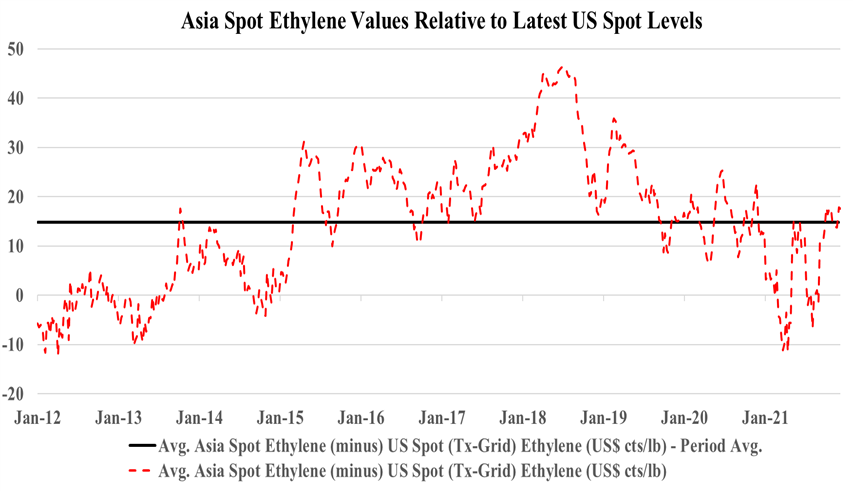

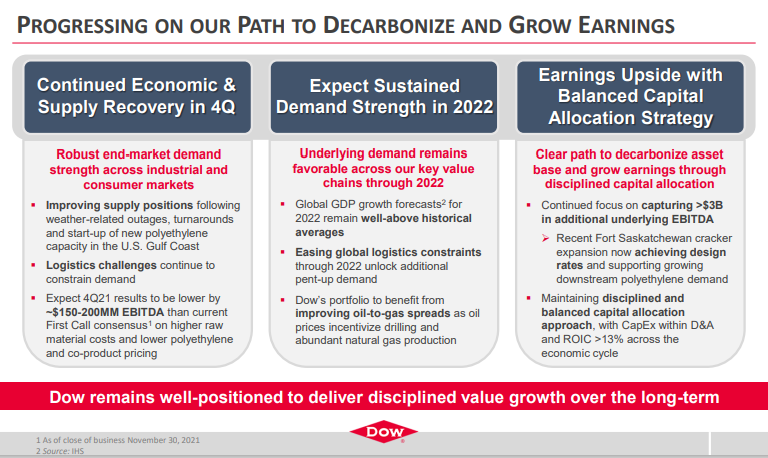

While it might be tempting (and perhaps easier) to focus on the negatives in the Dow earnings release – such as price declines in polyethylene and higher costs in Asia, we think it is much more interesting to focus on the positives. For a while now we have been suggesting that the industry is gearing up for a mega-cycle of profitability, perhaps as early as 2024 – see report – and we see nothing in the current macro environment or in Dow’s release to suggest we might be wrong. Demand growth is very robust across the industry, with consumer spending driving some quite impressive GDP growth numbers in the US in 4Q 2021, as an example. We often see companies suggest improving global operating rates in earnings calls, and while it is mostly hopeful and self-serving, the chart below, from Dow’s report may be conservative. The very high ratio of Asia costs versus US costs in the 2012 to 2014 period (second image below), because of high oil prices, effectively shutdown new naphtha based ethylene investment in Asia for several years and it is what prompted China’s move into coal-based and methanol chemicals (China has almost no ethylene capacity from methanol or coal in 2011, but close to 6 million tons by 2016). As the price of oil rises and the cost curve works against China and the rest of Asia again, the move to more coal is less attractive because of the environmental footprint – coal gasification creates a lot of CO2 emissions and elaborates CCS investment would be needed to justify further expansions, which increases the cost of ethylene production.

Commodity Leadership Not Best For A Specialty Strategy

Jan 13, 2022 2:57:31 PM / by Cooley May posted in Chemicals, Commodities, Polyurethane, LyondellBasell, Dow, specialty chemicals, Huntsman, strategy

We have covered some of our Huntsman logic in today's daily report, but we would like to point out another concern that we find with Starboard’s proposal – the focus on operations and the nomination of Jim Gallogly as a potential board member. While we have nothing but great respect for Mr. Gallogly, and the work he did at LyondellBasell, we are concerned that Huntsman’s business model would not be best served with a “larger than life” board member with a very strong commodity background. We have seen several significant mistakes made in the past by commodity-minded companies and leadership, applying somewhat linear thinking to acquired businesses and we believe this could be a risk here. When Dow acquired Rohm and Haas one of the few mistakes that were made was looking at the acrylic acid business like a commodity and trying to drive more production through the units. The effect was to oversupply the markets and depress pricing and margins and it took a couple of years for the right management team to get the business back on track. Huntsman likely does not need more polyurethane and epoxy production if doing so creates a race to the bottom with competitors and destroys margins. The intermediate and specialty chemical business is as much about matching supply to demand as it is about plant throughput and efficiency. Every company can improve its operations and improve efficiency and costs but for some businesses, more material is not necessarily better. We believe that Huntsman’s stock would react negatively if the strategy changed to one of pushing as much volume as possible.

Polymer Margin Declines Holding Back Commodity Chemical Stocks, For Now

Dec 28, 2021 11:54:49 AM / by Cooley May posted in Polyethylene, Plastics, LyondellBasell, Dow, US Polymers

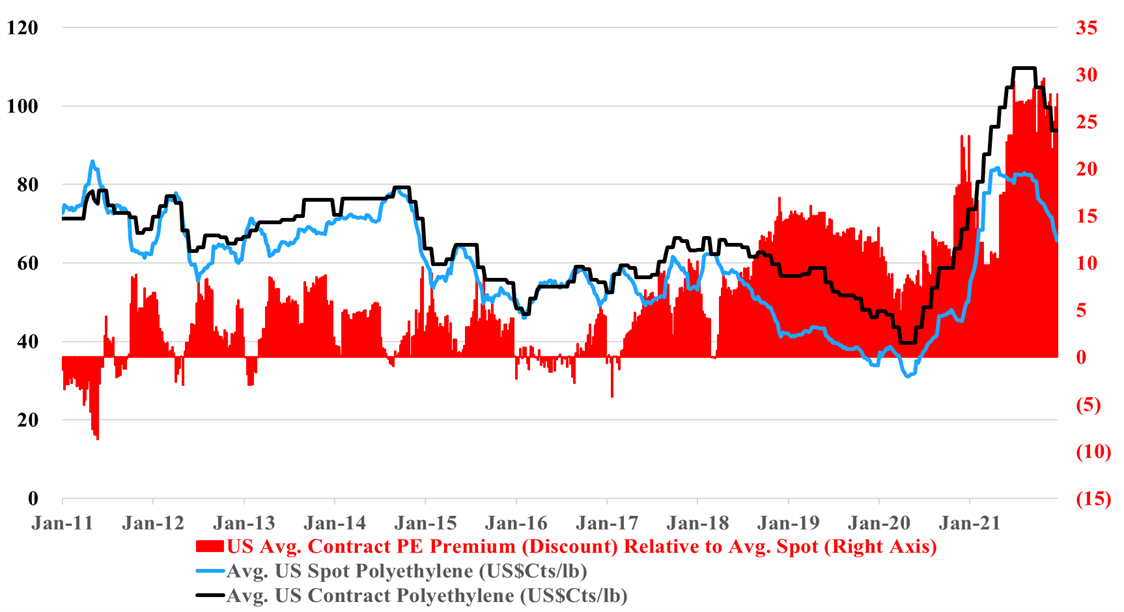

The negative momentum in US polymers prices is overwhelming all other factors in the eyes of public shareholders, with Dow and LyondellBasell share prices both down 6% since October 1st, underperforming the S&P500 by 16%. The data in our Daily Report and the exhibit below show that current industry profitability is very high and much higher than it was in 2019 when share prices were roughly where they are now. Our expectation is for profits to fall in 2022, but not to the levels seen in 2019 unless there is a significant increase in US natural gas and NGL pricing relative to crude oil (which is possible). But while these stocks look very attractive based on historic relationships to cash flow, we cannot ignore years of experience covering this sector which says that no one gets interested until the earnings revisions bottom out - so not yet, and likely not in 1H 2022. Complicating the story is the lack of clarity around what sort of EGS penalty is implied in current valuations and whether it could get worse as ESG funds grow, which they surely will in 2022. In our ESG and Climate report tomorrow we will look at some chemical stocks that could benefit from the rise in energy transition and infrastructure spending in 2022 and are less exposed to commodity polymer global oversupply.

Could Enterprise Beam Up Ethylene?

Dec 17, 2021 2:54:43 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Air Products, LyondellBasell, Chemical Industry, Dow, US ethylene, Basic Chemicals, ethylene exports, Enterprise Products, COP26, acquisitions

Following on from the Enterprise comments covered in our daily report, the company is more likely to acquire something in chemicals than build it in our view, especially if a move into ethylene or polymers is on the table. Today, building capacity will come with all sorts of emission-related restrictions most likely, and many of the new build announcements we have seen since COP26 have come with a carbon plan (Dow, Air Product, and Borouge). While it is not obvious today that any Gulf Coast ethylene capacity is up for sale, we would imagine that most companies are reviewing strategy and evaluating whether they have assets of entire businesses that may have a better owner. This would be especially true if a basic chemical business is holding back the valuation of a more interesting core. In the recent past, we have talked about the relative value arbitrage open to LyondellBasell from separating its compounding, licensing, and recycling business from the core. Maybe the core would fit well with Enterprise? As the chart below shows, there is money in buying ethylene for export, but there is more money in the US in making ethylene, as discussed in our daily report.

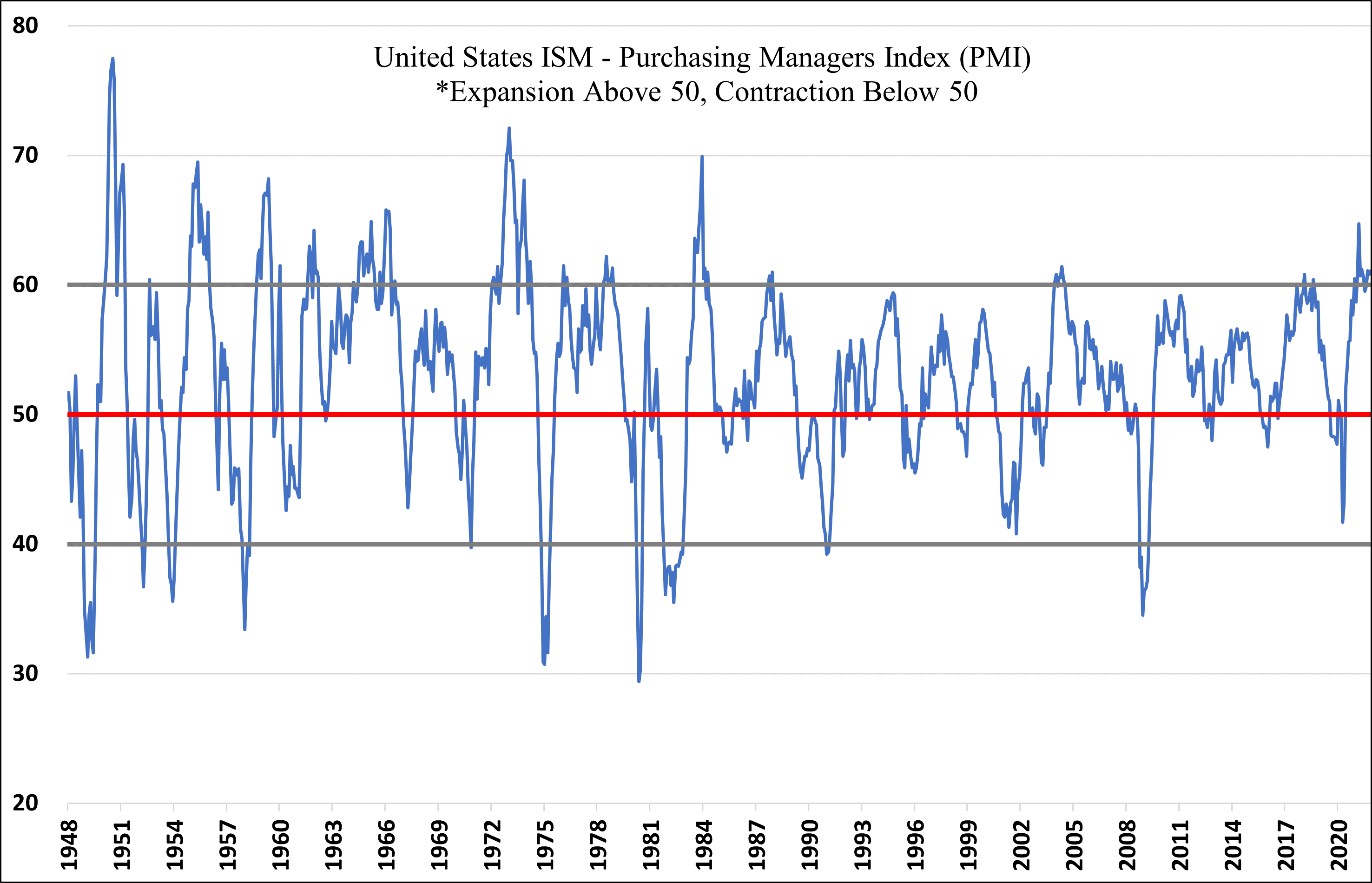

The Need For Manufacturing Support In The US: Enterprise Zones

Dec 6, 2021 1:31:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Dow, polymer producers, manufacturing, US polymer prices, COVID, commodity chemicals, chemicalindustry, plasticsindustry, ISM manufacturing, Enterprise Zones, reshoring, capital spending, chemical investments, PMI

Our latest Sunday Thematic research report titled, "Reshoring Should Remain Supportive of Chemicals in ’22" studied the investment in US enterprise zones, near and medium-term, and the broad-based benefits for domestic supply chains.

A Lack Of Good Research Will Lead To More Earnings Warnings

Dec 2, 2021 2:47:44 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, decarbonization, Dow, EBITDA, Investors, chemical companies, chemicalindustry, plasticsindustry, Earnings, stock market, polymers margins

The recent Dow guidance is worth some further comment as it is being heralded in the stock market as an earnings miss, or at least that is what is implied in the stock performance, even though the signals around margin squeezes in 4Q have been in place for weeks and have been covered extensively in our work. Some elements of modeling chemical company earnings are complex, but rising energy (and therefore feedstock) prices is not one of them. We have commented several times over the last couple of years about the lack of almost any effort being made by the sell-side to rethink estimates mid-quarter, choosing instead to take or interpret company guidance (generally in the first month of a quarter) and then wait until earnings are reported. This does a disservice to both the institutional investors and the chemical companies, as the investors quickly conclude that estimates are likely too high – simply looking broadly at what sectors get hurt by rising energy – but generally do not have a good measure of by how much earnings will be impacted, so they sit on the sidelines, expecting the surprise. That said, there are so many algorithms working today that the alternative of gradual negative revisions to a more reasonable target for the quarter is also likely to hurt stock performance.

Chemical Supply Increases And US Prices Weaken

Nov 19, 2021 12:35:27 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, ExxonMobil, polymer buyers, railcar shipments, Supply Chain, Dow, propane, PDH, ethylene capacity, US polymer prices, US Polymers, propylene prices, energy prices, chemicalindustry, plasticsindustry, spot market, cost arbitrage

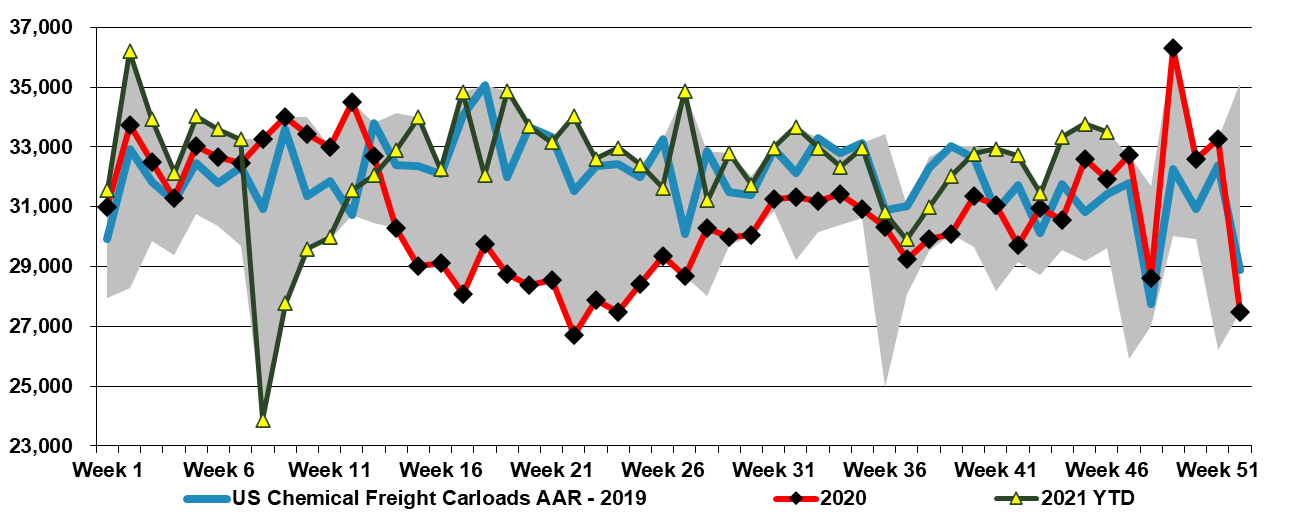

US rail data for chemicals remain at the 5-year highs and have been there for almost 2 months. This is working its way into the supply chain and we are seeing weakness in US polymer prices across the board, except for PVC. US spot polymer prices are in a bit of a “no man's land” right now as they would need to drop significantly to find incremental demand offshore, given US premiums to the rest of the world. We believe that most of the volume leaving the US is doing so within company-specific businesses – ExxonMobil supplying ExxonMobil customers, Dow supplying Dow customers, etc, and consequently, these shipments do not show up in the spot market.