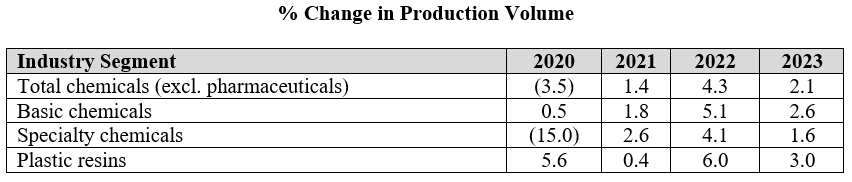

The ACC forecasts below leave us a little confused as the implication for specialty chemicals is that production declines in the US by an average of 2.0% per annum from 2019 to 2023. Given the demand that we are seeing for US manufacturing, as covered in our most recent Sunday Report, we would expect demand for all inputs to rise and it is unlikely that the gap would be filled by a swing in net imports. The lower demand from the Auto industry in 2020 and 2021 and broader manufacturing shutdowns in 2020 explains the 2020 and 2021 numbers to a degree, but it is not clear why there would not be a rebound as auto rates increase. We would also expect to see a stronger rebound in polymer production in 2022, assuming weather events are less impactful than in 2021, given substantial new capacity for polyethylene from ExxonMobil/SABIC, BayStar, and Shell.

The ACC Forecasts Look Too Conservative To Us

Dec 9, 2021 2:15:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, Ethylene, Auto Industry, Shell, ExxonMobil, petrochemicals, Sabic, natural gas, natural gas prices, Baystar, Basic Chemicals, manufacturing, polymer production, specialty chemicals, ACC, Polyethylene Capacity, US manufacturing, plastics resin

US Chemical Strength Persists, Ida Issues Add To Supply Chain Woes

Sep 1, 2021 1:04:08 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, ExxonMobil, Dow, ACC, Hurricane Ida, CAB, chemical producers

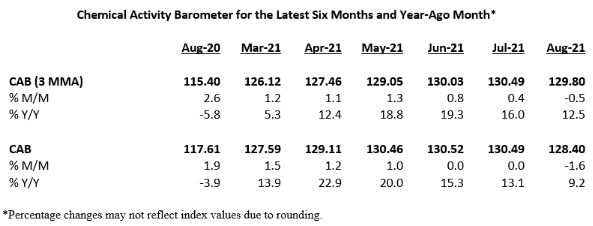

The ACC “chemical activity barometer” shown in the exhibit below is more impressive when you consider that by August of last year the demand recovery was in full swing and operating rates were high. There was some negative impact from the first hurricane, but this hit very late in August 2020 and would not have influenced the ACC reported activity significantly. We focus on price and margin in most of our commodity commentary and this is appropriate, given how much more important they are than incremental volume for all commodities, but it is worth noting that all of the chemical producers get decent cash flow gains from uninterrupted high (optimal) operating rates. The last two years have been a little plagued by more than expected unplanned stoppages, and this has helped keep the US market buoyant, but those that have been able to run at optimized rates for prolonged periods are benefiting. Prices have been the biggest contributor for Dow and ExxonMobil on the integrated polyethylene front in the US this year, but both have had the benefit of very strong operating performance, as have most others with a bias to Texas. Dow and ExxonMobil have large facilities that were in the path of Ida. LyondellBasell and CP Chem do not. See our daily report for more.

Upcoming Polyethylene Capacity Additions Are Unlikely To Go Unnoticed

Aug 27, 2021 12:58:28 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Shell, ExxonMobil, Sabic, Baystar, ACC, Polyethylene Capacity

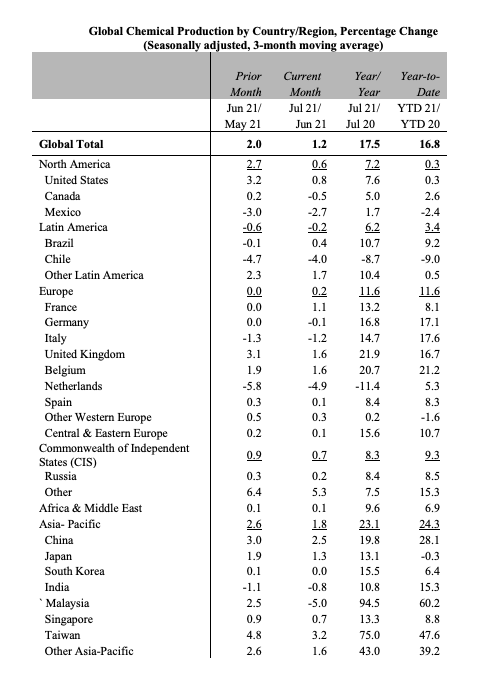

The advanced nature of the ExxonMobil/SABIC project, which we have discussed previously, is another cause for concern around US polyethylene market strength for a couple of reasons. First, it is only the first wave, with Baystar and Shell hot on the heels in 1H 2020. Second, it will add another ethylene seller in the US – SABIC – and this may be enough to cause some ripples. If you look at this in the context of the Asia production growth data provided by the ACC (below) there should be a significant cause for concern around the global balance for many products. Some of the specific Asia country growth, year on year and year to date, is driven by COVID-related shutdowns in 2020 – Taiwan and Malaysia for example – but the bulk of the China growth, which is more significant in absolute volume terms is from new capacity. China’s ability to sell surpluses internationally is hindered by the current logistic problems, but these will not last, and we should also factor in where the material will go that had been imported into China. The global polyethylene market could look very different in 2022, although all eyes will be focused on Hurricane Ida for the next week. See more in today's daily report.