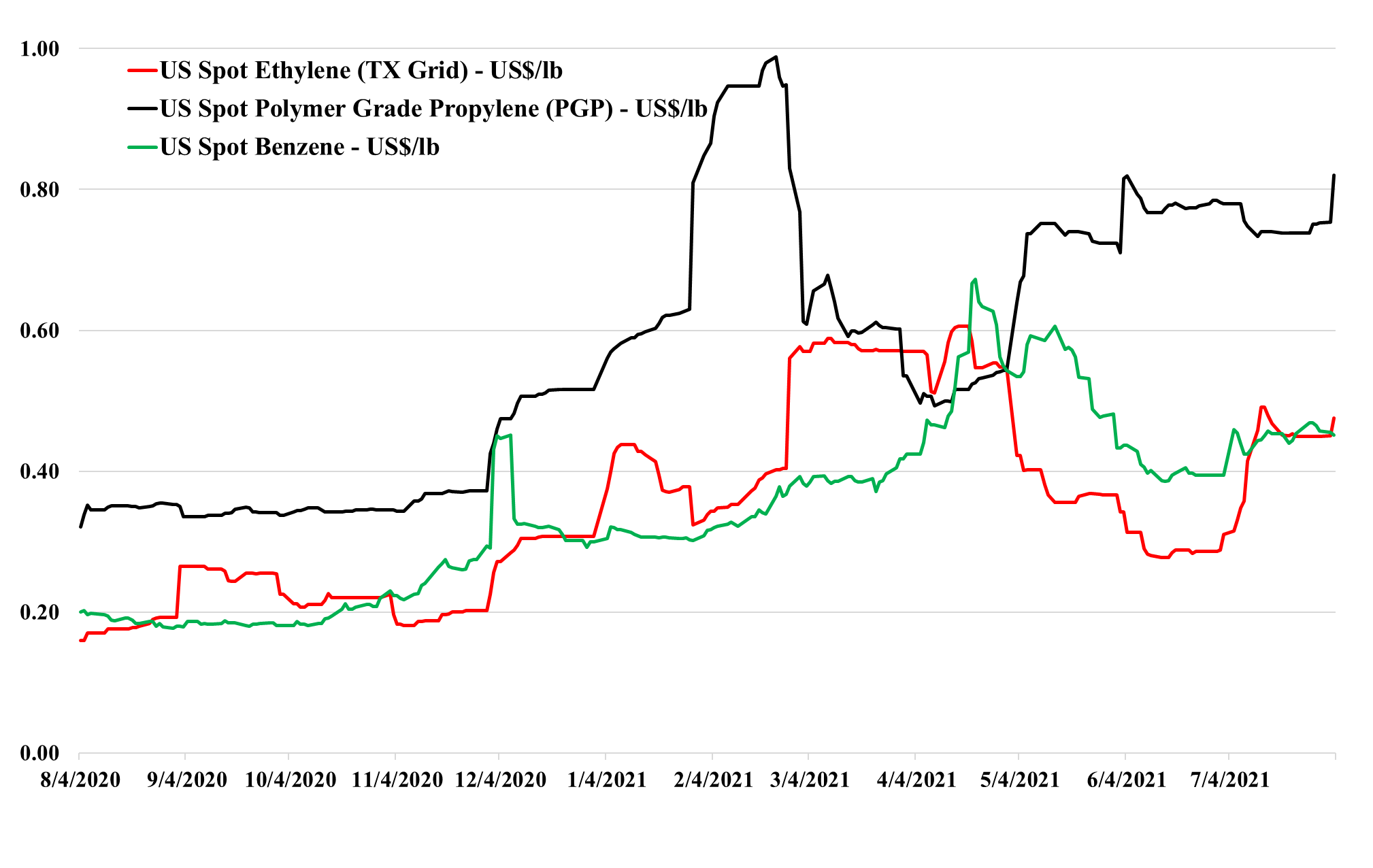

If this commodity cycle has the same drivers as prior cycles, producers like LyondellBasell and others will make comments like “stronger of longer” until prices turn, and if history is any guide, that turn will catch everyone by surprise, and even if it does not, there is no upside for any producer in predicting its end. As with all commodities, markets are tight until they are not, and markets are long until they are not. If you look at the ethylene and propylene price movements in the exhibit below you can see the speed of change that is possible and while the slope may be less severe for polymers in both directions, it can still be abrupt. The worst-case for the US industry would be a step down in demand coincident with the rising natural gas trend. There is no evidence of demand weakness today, but there will not be until it is happening. The extraordinary incremental freight rates shown in Exhibit 1 of today's daily report, make it increasingly unlikely that anyone sitting on surplus polyethylene or polypropylene in Asia can exploit the regional price difference. When demand and sentiment around supply chains turn, we would expect this spot shipping rate to collapse also – but there is no sign of that today.

Incremental Price Strength for US Ethylene and Propylene

Aug 3, 2021 3:17:24 PM / by Cooley May posted in Chemicals, Commodities, Ethylene, supply and demand, LyondellBasell, freight, natural gas, monomers

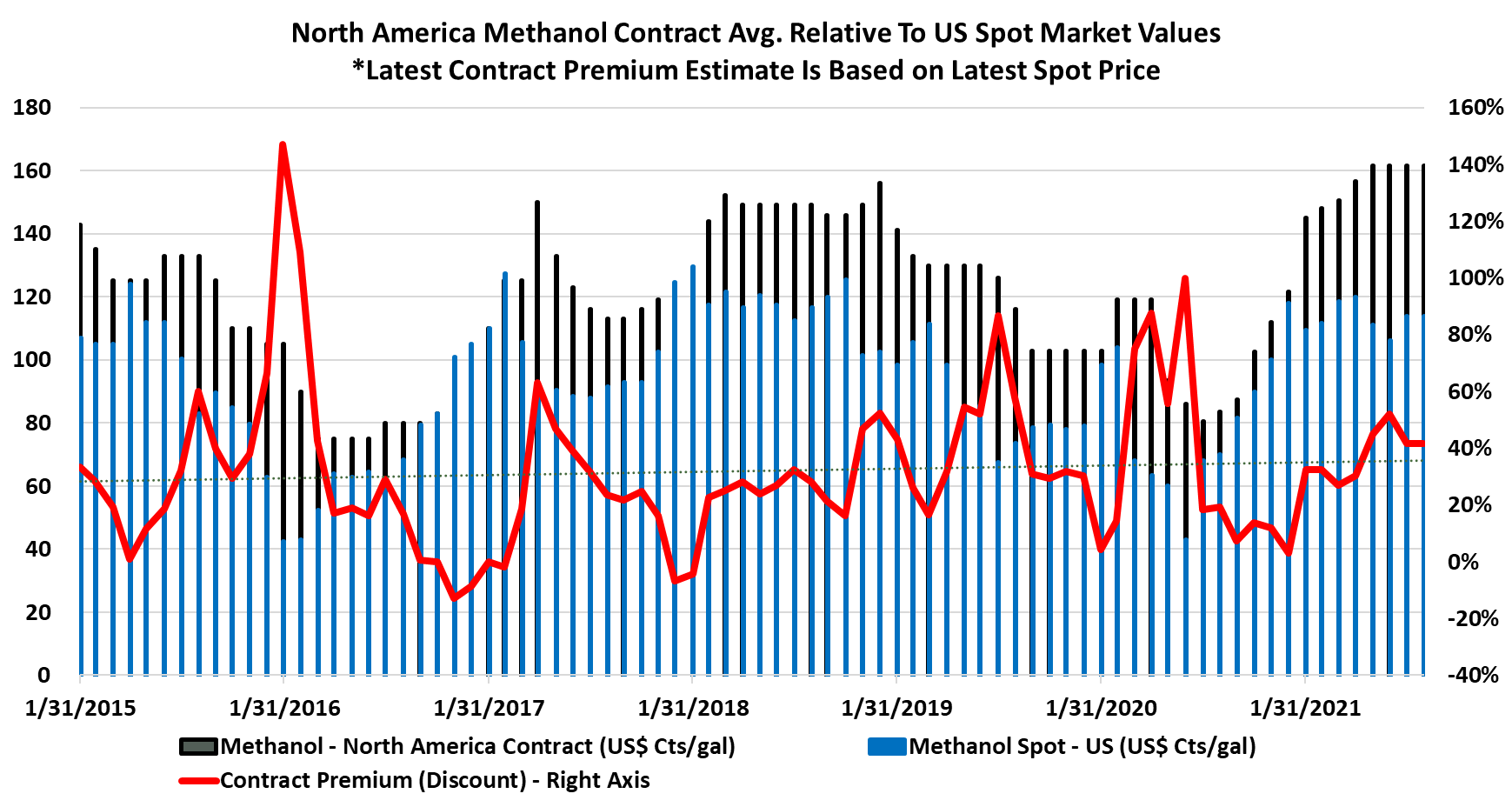

Strong Demand And Higher Costs Keep Methanol Supported

Jul 29, 2021 2:45:35 PM / by Cooley May posted in Chemicals, Polymers, Methanol, LyondellBasell, natural gas, US Methanol, MMA, Methanol demand

Methanol prices in the US remain very robust and quite profitable for producers, despite weakness in China. The higher natural gas price in the US (see today's daily report) provides some support for methanol pricing, but ultimately coal-based methanol in China will win out if US costs keep rising and this may curtail demand for US methanol at the margin. As with all other chemical and polymer markets today, freight costs are making it difficult to play off some of these apparent regional arbitrages and the US methanol producers would have to be somewhat reckless to upset the balance domestically and give up the margins that they have today. Domestic demand for methanol derivatives is high and the LyondellBasell accident may provide more pricing strength through the acetic acid chain. While the incident will decrease the demand for methanol, LyondellBasell should be able to manage this, and higher pricing in the acetic chain would mean that consumers would have no issue paying current prices. Higher MMA production in the US – implied in the headline below - should keep methanol demand high.