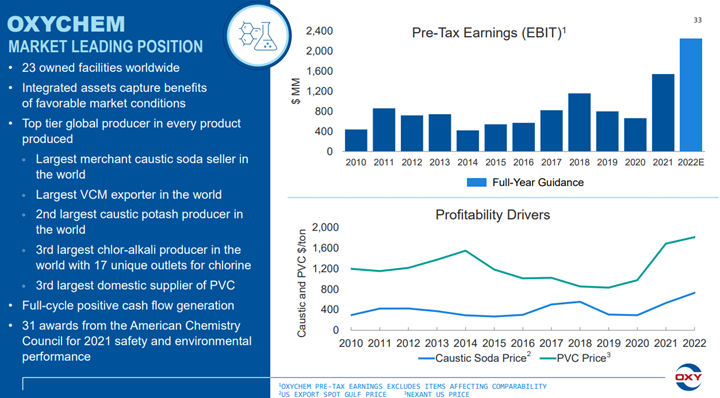

For those who are too young to remember, OxyChems’ 30-year comment is because the company owned ethylene capacity in the late 80s and early 90s and would have made more during that extreme ethylene peak. This is likely the most money that the stand-alone vinyls business has made. The strength in the PVC could see some reversal if the inflation pressure remains high and housing-related spending slows, but the strength in the caustic market could persist, regardless of economic growth because of structural shortages and the challenges with imports.

The Vinyls Chain Shines, Elsewhere We See Warning Signs

May 11, 2022 1:11:52 PM / by Cooley May posted in PVC, Polyethylene, LyondellBasell, Inflation, polymer, ethylene capacity, shortages, ICL, Oxy, vinyls

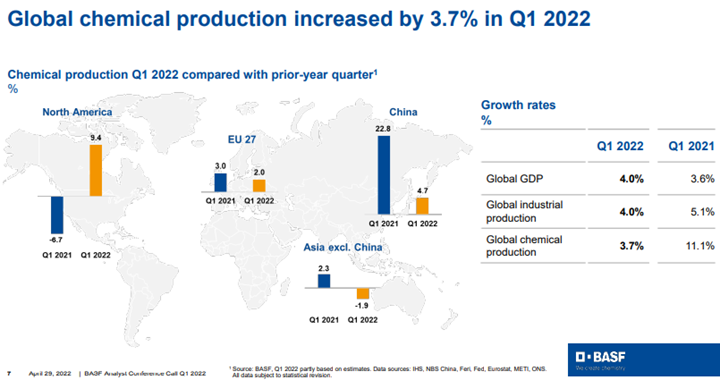

Is BASF Too Bullish? Auto Delays Add To Other Macro Headwinds

Apr 29, 2022 3:38:21 PM / by Cooley May posted in Auto Industry, LyondellBasell, Inflation, Supply Chain, BASF, Eastman, Celanese

We see BASF taking a major risk by reaffirming its 2022 outlook today, as the uncertainty factors, especially in Europe, are rising. This week’s inflation and economic growth data in Europe, suggest an economy that is lowing quickly and the confidence levels in Europe are much lower, as we have discussed already this week. BASF and others will likely continue to push prices, but if consumer spending continues to slow, volumes will disappoint and at some point, there will be pushback on both volumes and pricing. Separately, as we mentioned above, we could see another leg up in energy prices as we approach next winter in Europe, especially if there is no resolution to the Ukraine conflict, which seems likely.

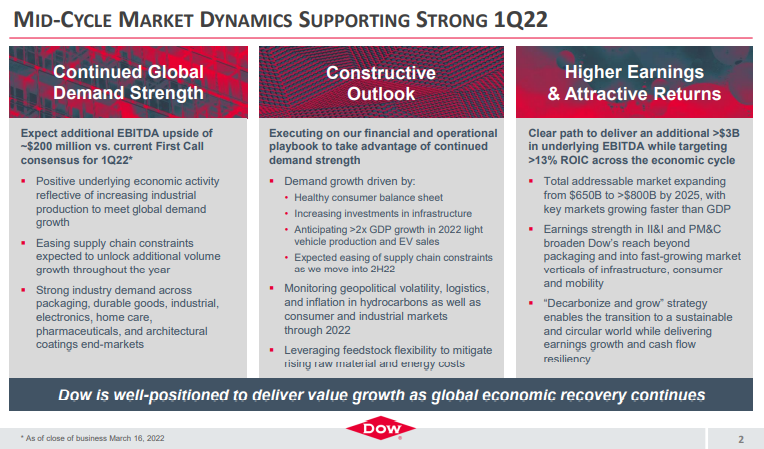

If You Are In The Right Place With The Right Products, Times Are Good

Mar 18, 2022 12:19:25 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, LyondellBasell, Inflation, Dow, US Chemicals, natural gas, Basic Chemicals, Westlake, Braskem, US Polymers, commodity chemicals, demand strength, raw material, silicone

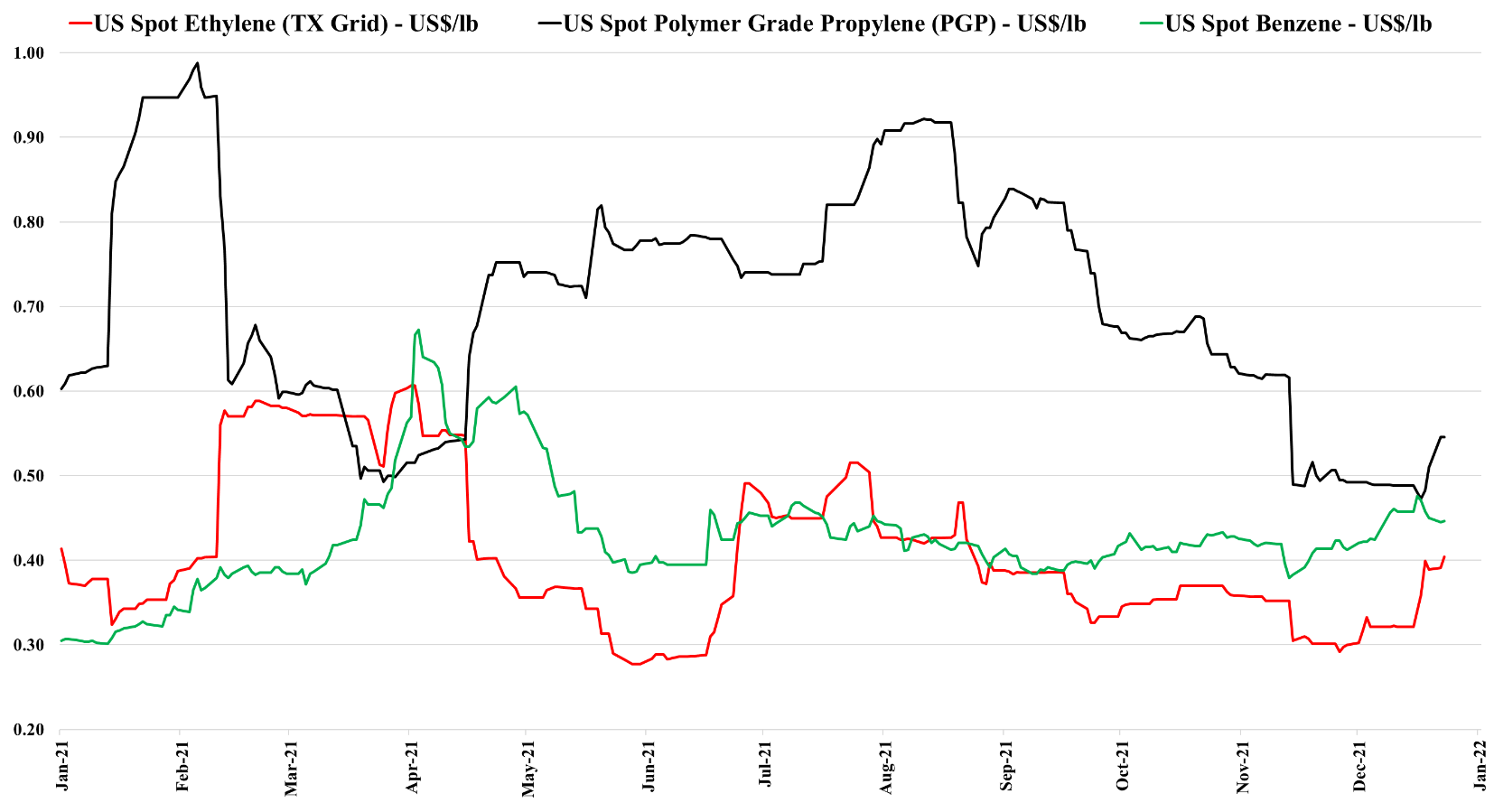

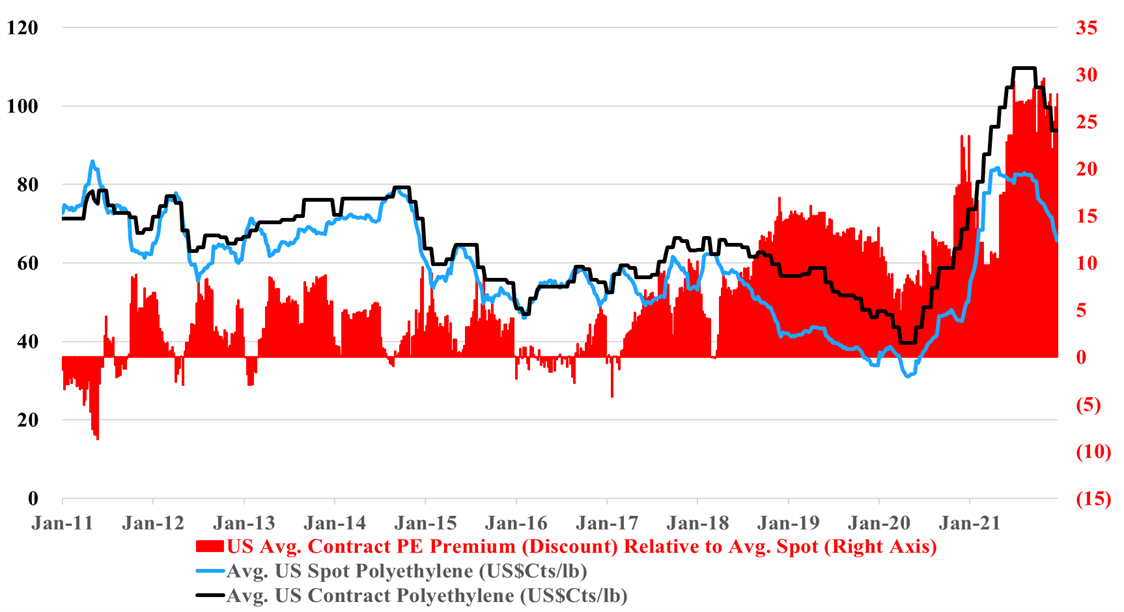

As we have been suggesting for some time, there are pockets of real strength in chemicals; identifying them is the hard part. It is not enough to have pricing strength in a market where raw material prices are volatile daily and we have seen plenty of examples of companies with very strong end demand dynamics missing earnings because of a cost squeeze. We continue to highlight the competitive strength in the US in basic chemicals because of the decoupled and relatively low natural gas price and this is likely a large piece of the Dow earnings strength – strong polyethylene demand against a backdrop of relatively stable and lower costs. While polypropylene (Braskem) remains extremely profitable in the US, it has seen more sequential weakness than polyethylene – as we show in Exhibit 1 of today's daily report. That said, both polyethylene and polypropylene margins in the US are significantly higher than was likely expected this year and certainly what has been reflected in stock valuations, even with the commodity chemicals rally. Dow is also seeing the benefit of a very strong silicones market – something that was covered in detail in Wacker’s release earlier this month.

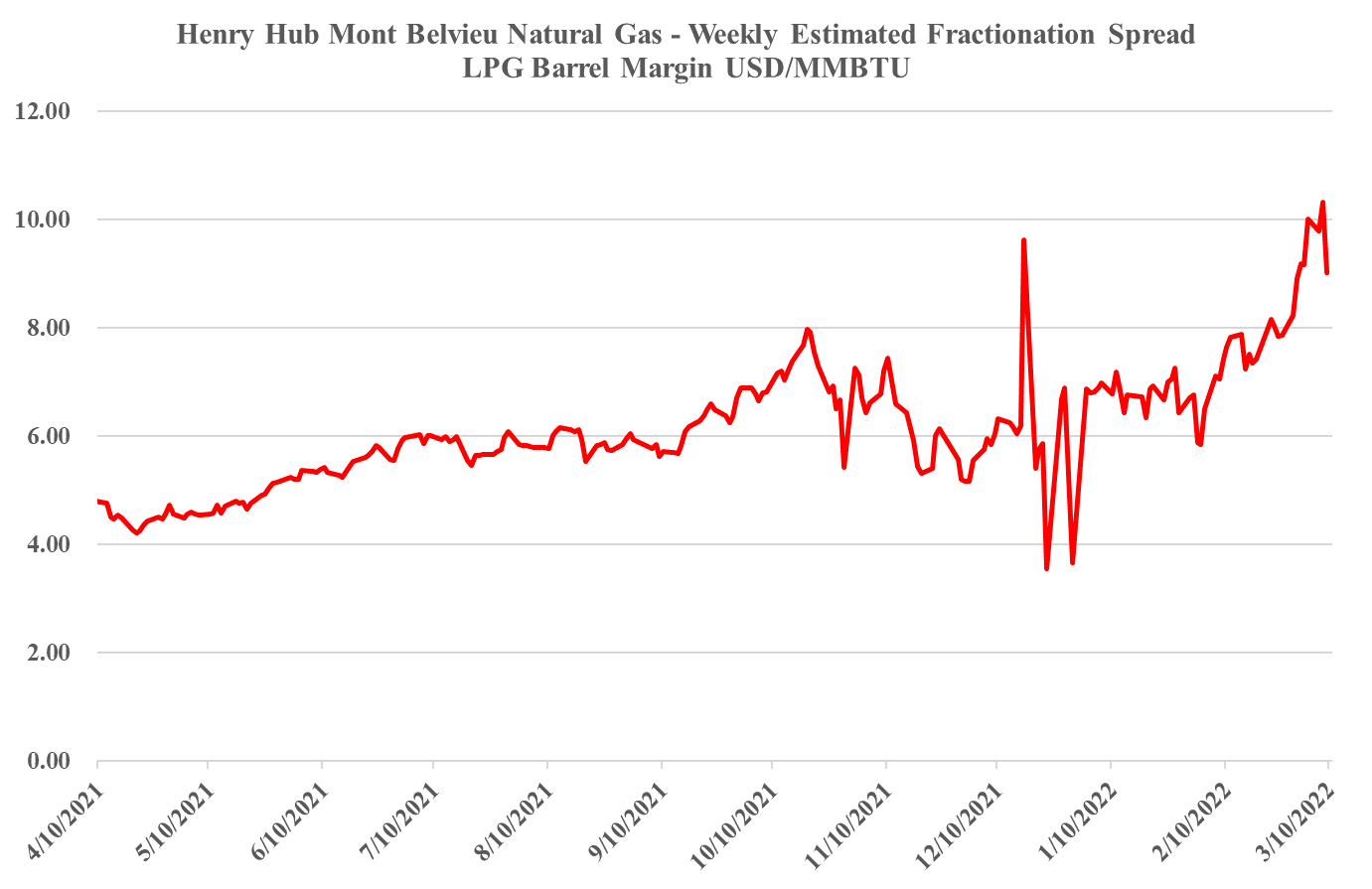

US Competitive Advantage To Offset Some Ex-US Polyethylene Producer Losses

Mar 10, 2022 2:50:46 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, PVC, Polyethylene, LyondellBasell, HDPE, polyethylene producers, polymer producers, ethane, natural gas, Basic Chemicals, NGL, Westlake, oil prices

As noted in Exhibit 1 from today's daily report, the jump in oil prices has plunged the European polyethylene producers into the red and pushed Asian polyethylene producers further into the red. This will inevitably result in price increases as basic chemical and polymer producers will shut down at negative margins, and these price rises offer an opportunity for the US, Middle East, and select other producers.

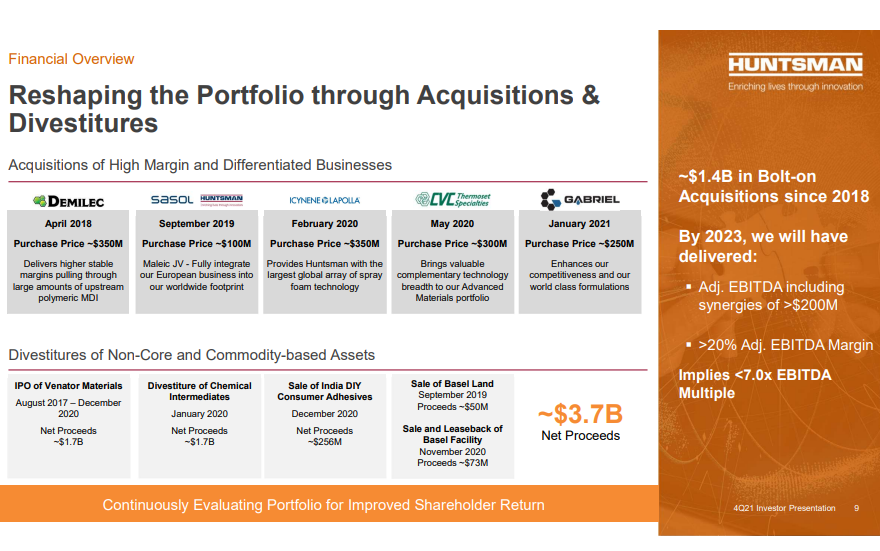

Commodity Leadership Not Best For A Specialty Strategy

Jan 13, 2022 2:57:31 PM / by Cooley May posted in Chemicals, Commodities, Polyurethane, LyondellBasell, Dow, specialty chemicals, Huntsman, strategy

We have covered some of our Huntsman logic in today's daily report, but we would like to point out another concern that we find with Starboard’s proposal – the focus on operations and the nomination of Jim Gallogly as a potential board member. While we have nothing but great respect for Mr. Gallogly, and the work he did at LyondellBasell, we are concerned that Huntsman’s business model would not be best served with a “larger than life” board member with a very strong commodity background. We have seen several significant mistakes made in the past by commodity-minded companies and leadership, applying somewhat linear thinking to acquired businesses and we believe this could be a risk here. When Dow acquired Rohm and Haas one of the few mistakes that were made was looking at the acrylic acid business like a commodity and trying to drive more production through the units. The effect was to oversupply the markets and depress pricing and margins and it took a couple of years for the right management team to get the business back on track. Huntsman likely does not need more polyurethane and epoxy production if doing so creates a race to the bottom with competitors and destroys margins. The intermediate and specialty chemical business is as much about matching supply to demand as it is about plant throughput and efficiency. Every company can improve its operations and improve efficiency and costs but for some businesses, more material is not necessarily better. We believe that Huntsman’s stock would react negatively if the strategy changed to one of pushing as much volume as possible.

Some Chemical Producer Price Initiatives Will Fare Better Than Others

Jan 11, 2022 3:10:34 PM / by Cooley May posted in Chemicals, Polyolefins, Polyethylene, Raw Materials, LyondellBasell, Chemical Industry, polyethylene producers, oversupply, Basic Chemicals, Westlake, chemical producers, Huntsman, Building Products, price initiatives, demand strength, Sika, monomer prices

We are seeing pockets of real demand strength in some areas of chemicals, such as building products, and this is allowing producers to push through price increases to reflect higher costs and most likely add some margin. In other areas where the fundamentals might not be quite as supportive, we are still seeing attempts to pass on higher costs. Sika has supported what we have heard from many over the last few weeks, which is that the building products chain remains tight, as demand is strong, capacity is running hard and logistic issues continue to cause problems in some cases from a raw materials perspective and in others from getting finished products to market. Where there is limited ability to increase supply, those selling into the building products space are likely to make more money as they should have strong pricing power – in the US chemical space, we would favor Westlake as a potential big winner from this trend, but Huntsman should also be on the list.

Polymer Margin Declines Holding Back Commodity Chemical Stocks, For Now

Dec 28, 2021 11:54:49 AM / by Cooley May posted in Polyethylene, Plastics, LyondellBasell, Dow, US Polymers

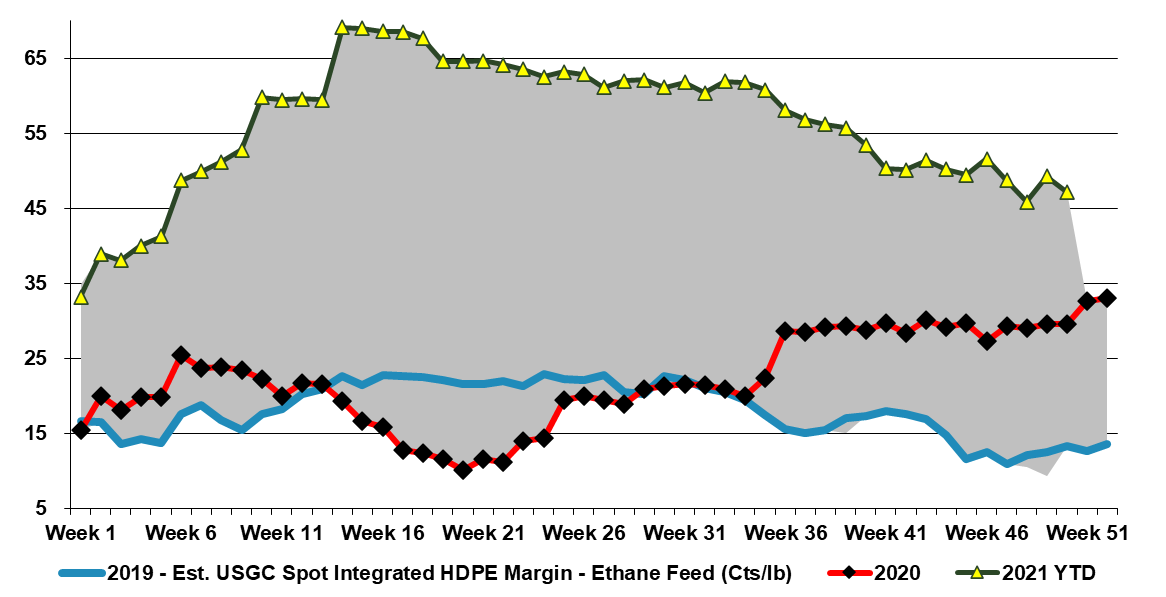

The negative momentum in US polymers prices is overwhelming all other factors in the eyes of public shareholders, with Dow and LyondellBasell share prices both down 6% since October 1st, underperforming the S&P500 by 16%. The data in our Daily Report and the exhibit below show that current industry profitability is very high and much higher than it was in 2019 when share prices were roughly where they are now. Our expectation is for profits to fall in 2022, but not to the levels seen in 2019 unless there is a significant increase in US natural gas and NGL pricing relative to crude oil (which is possible). But while these stocks look very attractive based on historic relationships to cash flow, we cannot ignore years of experience covering this sector which says that no one gets interested until the earnings revisions bottom out - so not yet, and likely not in 1H 2022. Complicating the story is the lack of clarity around what sort of EGS penalty is implied in current valuations and whether it could get worse as ESG funds grow, which they surely will in 2022. In our ESG and Climate report tomorrow we will look at some chemical stocks that could benefit from the rise in energy transition and infrastructure spending in 2022 and are less exposed to commodity polymer global oversupply.

Could Enterprise Beam Up Ethylene?

Dec 17, 2021 2:54:43 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Air Products, LyondellBasell, Chemical Industry, Dow, US ethylene, Basic Chemicals, ethylene exports, Enterprise Products, COP26, acquisitions

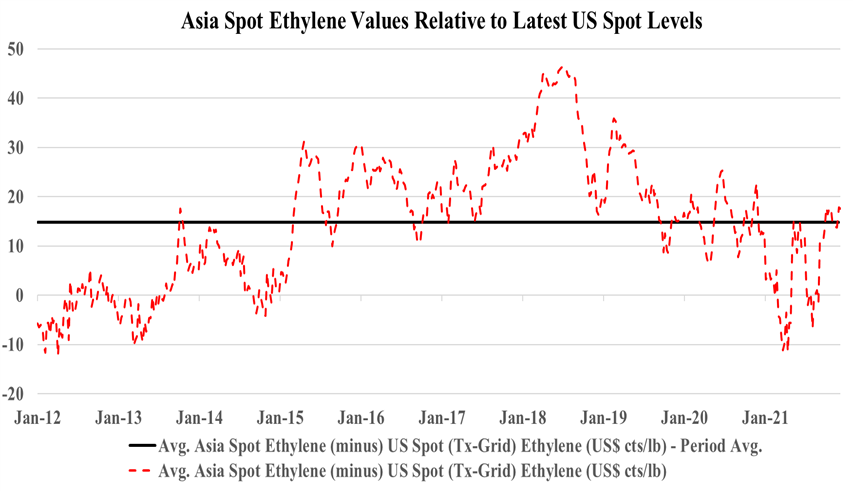

Following on from the Enterprise comments covered in our daily report, the company is more likely to acquire something in chemicals than build it in our view, especially if a move into ethylene or polymers is on the table. Today, building capacity will come with all sorts of emission-related restrictions most likely, and many of the new build announcements we have seen since COP26 have come with a carbon plan (Dow, Air Product, and Borouge). While it is not obvious today that any Gulf Coast ethylene capacity is up for sale, we would imagine that most companies are reviewing strategy and evaluating whether they have assets of entire businesses that may have a better owner. This would be especially true if a basic chemical business is holding back the valuation of a more interesting core. In the recent past, we have talked about the relative value arbitrage open to LyondellBasell from separating its compounding, licensing, and recycling business from the core. Maybe the core would fit well with Enterprise? As the chart below shows, there is money in buying ethylene for export, but there is more money in the US in making ethylene, as discussed in our daily report.

Many Adjustments Ahead For LyondellBasell

Dec 14, 2021 1:27:36 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Propylene, Polyethylene, Polypropylene, LyondellBasell, Chemical Industry, energy transition, US Exports, specialty chemicals, Polyethylene Capacity, US polyethylene, US polypropylene, commodity chemicals, refinery, commodity polymer

Following on from the LyondellBasell commentary in today's daily report, we would make one further, but very important point. With its refinery (granted the company is exploring opportunities to exit) and its huge commodity polyethylene, polypropylene, and propylene oxide business, any attempt to pursue a “specialty” strategy that encompasses the whole portfolio will be seen (crudely) as trying to put some lipstick on a pig! This rarely works in the chemical sector and the real transformation stories involve wholesale portfolio shifts, many of which have taken notable periods of time to develop. We still believe that the right path for LyondellBasell is to spin off the good piece – recycling, licensing, and compounding, or even better, find someone they can sell the business to through a Reverse Morris Trust. This strategy would likely allow the company to pay down (or shift) a significant amount of debt. The commodity business can then focus on the best strategy for a commodity polymer business in the face of energy transition, which might involve taking the business private or merging with another.

US Ethylene: Flexibility Has Lessened, Despite More Funds Available

Aug 24, 2021 12:59:27 PM / by Cooley May posted in Chemicals, Ethylene, Butadiene, LyondellBasell, Dow, feedstock, ethane, US ethylene, naphtha, ethylene capacity, light naphtha

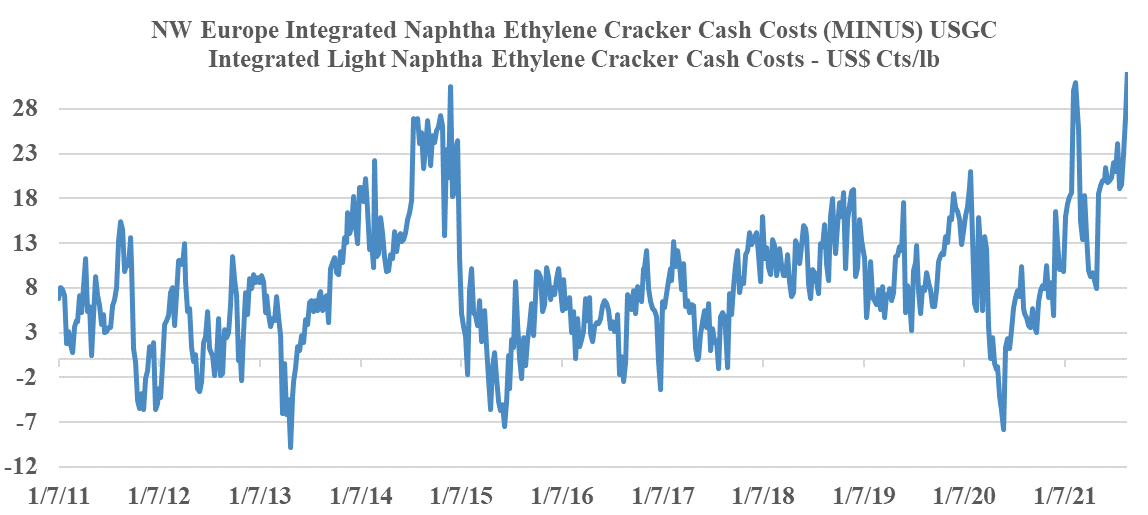

Before the wave on new ethylene capacity came online in the US there were several low-cost expansion projects all of which added the ability to crack ethane and some of which brought constraints around feedstock flexibility. Consequently, it is less clear than it used to be just how much US ethylene capacity can flex to exploit the very attractive light naphtha economics today. Very conservatively, we would estimate that 5-6 million tons of capacity can flex easily and about the same again with some planning and some logistic adjustments. Among the public companies, both Dow and LyondellBasell are well placed, and likely have at least 1 million tons each of flexible capacity – in both cases, there is a need for propylene and LyondellBasell has significant butadiene/C4s capacity. For context, at current prices, both companies are likely looking at an additional ethylene margin benefit in the US of $2.5-3.0 million per week for as long as this opportunity exists. This would be 0.3 cents per share per week for Dow and 0.7 cents per share per week for LyondellBasell – a rounding error in current earning but more free cash regardless. The chart below shows the unprecedented benefit in the US and see our daily report for more.