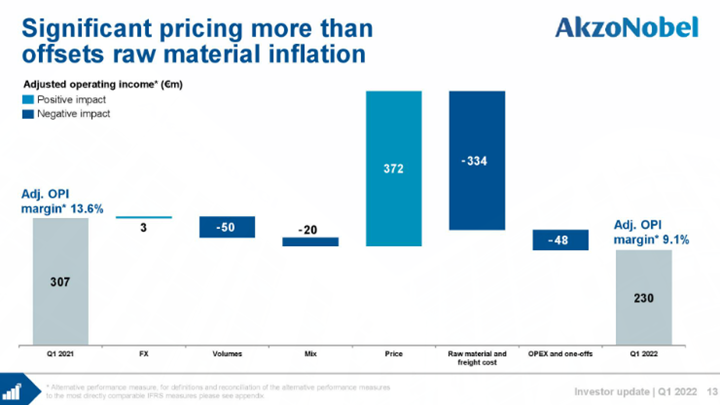

We have discussed in several recent reports the very mixed fortunes in the intermediate and specialty chemical sector related to whether companies have been able to move prices fast enough to cover costs. The two large blue bars in the AkzoNobel chart below show that Akzo was close, but did not make it. We expect other examples like this over the coming weeks but we also expect some companies to have done better – some of this depends on mix and contract terms, but a lot has to do with how early you acted on the rising cost trend and how aggressive you were willing to be with customers. Dow is another example of a company struggling to get pricing high enough to cover cost increases, although Dow and others have aggressive price increase announcements in the market for polyethylene for April and May that would make a significant difference to US margins if successful.

Chasing Costs With Prices And Watching Your Peers

Apr 21, 2022 2:57:41 PM / by Cooley May posted in Chemicals, Polyethylene, raw materials inflation, Chemical Industry, Dow, specialty chemicals, intermediate chemicals, commodity chemicals, price inflation, AkzoNobel

US Propylene Is A Very Different Market Than Ethylene

Apr 8, 2022 1:04:37 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Ethylene, Chemical Industry, Ammonia, Supply Chain, ethane, natural gas, natural gas prices, US ethylene, US propylene, fertilizer

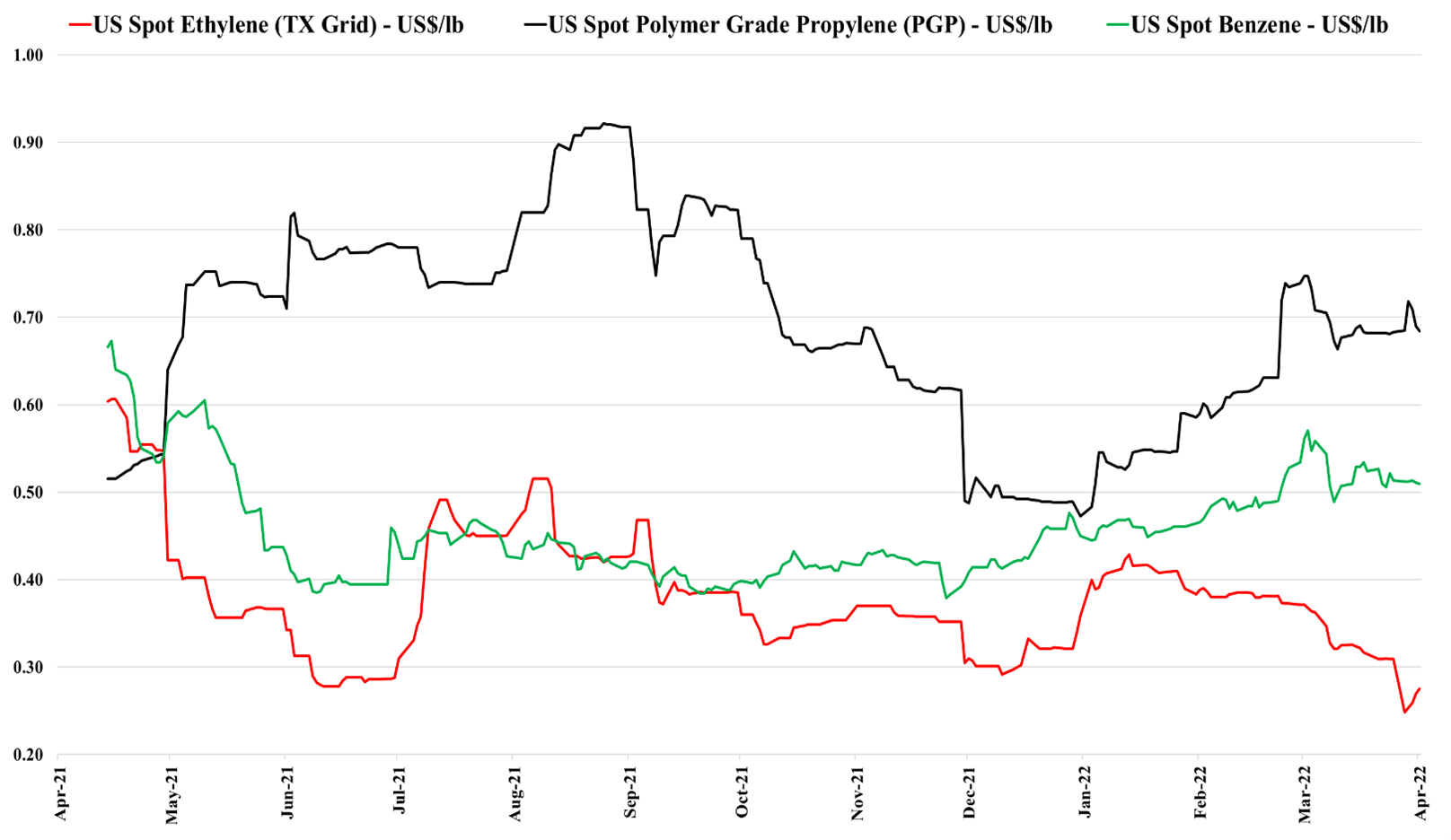

US ethylene prices have bounced off a low this week largely, in our view on the steep rise in natural gas and ethane. The drop in ethylene prices over the last couple of weeks signals an imbalance whereby production is more than enough to satisfy domestic demand and export demand. Export demand is limited by terminal capacity, and we have seen some domestic demand issues for polyethylene, not because of demand weakness, but because of export logistic bottlenecks, that are resulting in product (with homes to go to) backing up in the US ports. Given the timing of this build-up, we may see some higher end-quarter working capital from some of the chemical companies with sizeable export footprints for 1Q 2022. The sharp increase in US natural gas prices and the catch up that ethane has made to natural gas, should keep some upward pressure on spot ethylene prices if gas prices remain high. Propylene remains very supported by high propane prices.

Is Current Enthusiasm Justified Or Preceding A Collapse?

Apr 6, 2022 12:46:26 PM / by Cooley May posted in Chemicals, PVC, Ethylene, Energy, Metals, Auto Industry, Chemical Demand, Chemical Industry, clean energy, materials, Building Products, RPM, MDI

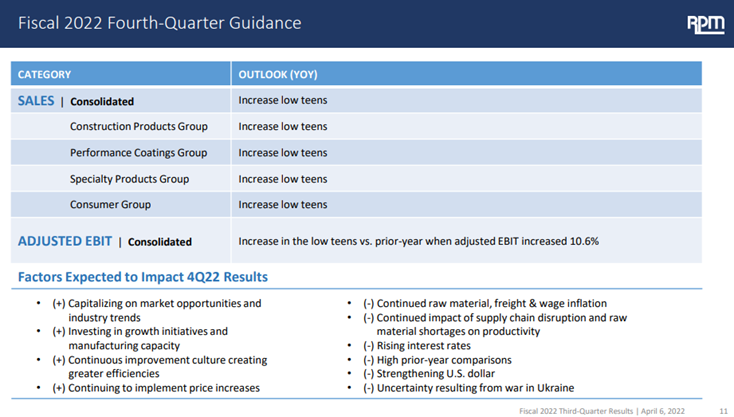

While we remain advocates of “stronger for longer” with respect to chemical demand and pricing in the US, the auto data does suggest that the US consumer may be cooling off a bit in reaction to higher prices and higher borrowing rates. Historically, the chemical industry has a habit of running headlong into a downturn while waving an “everything is great” flag, and the RPM results and outlook have a vague “deja vu” feel to them. We also note some surprise at the robustness of the MDI market in the chart below, and it would be wrong not to admit that our cautionary antennas are rising. The auto exposed products should still see some upside from higher auto production in the second half of the year, but otherwise, a possible consumer pullback to take the wind out of the sector sales, especially if the US is constrained moving out products because of container and shipping issues. The significant cost advantage remains in the US but the ethylene market over the last week is a reminder of what can happen when you struggle to find someone who can take the last pound. Given infrastructure, energy, and clean energy investment, as well as reshoring, many materials could see significant offsets to consumer spending pullbacks and our focus would remain on PVC and building products, as most of the hit would be in consumer durables. Metals demand should remain strong regardless. For more see today's daily report.

Polyethylene Back To The Future

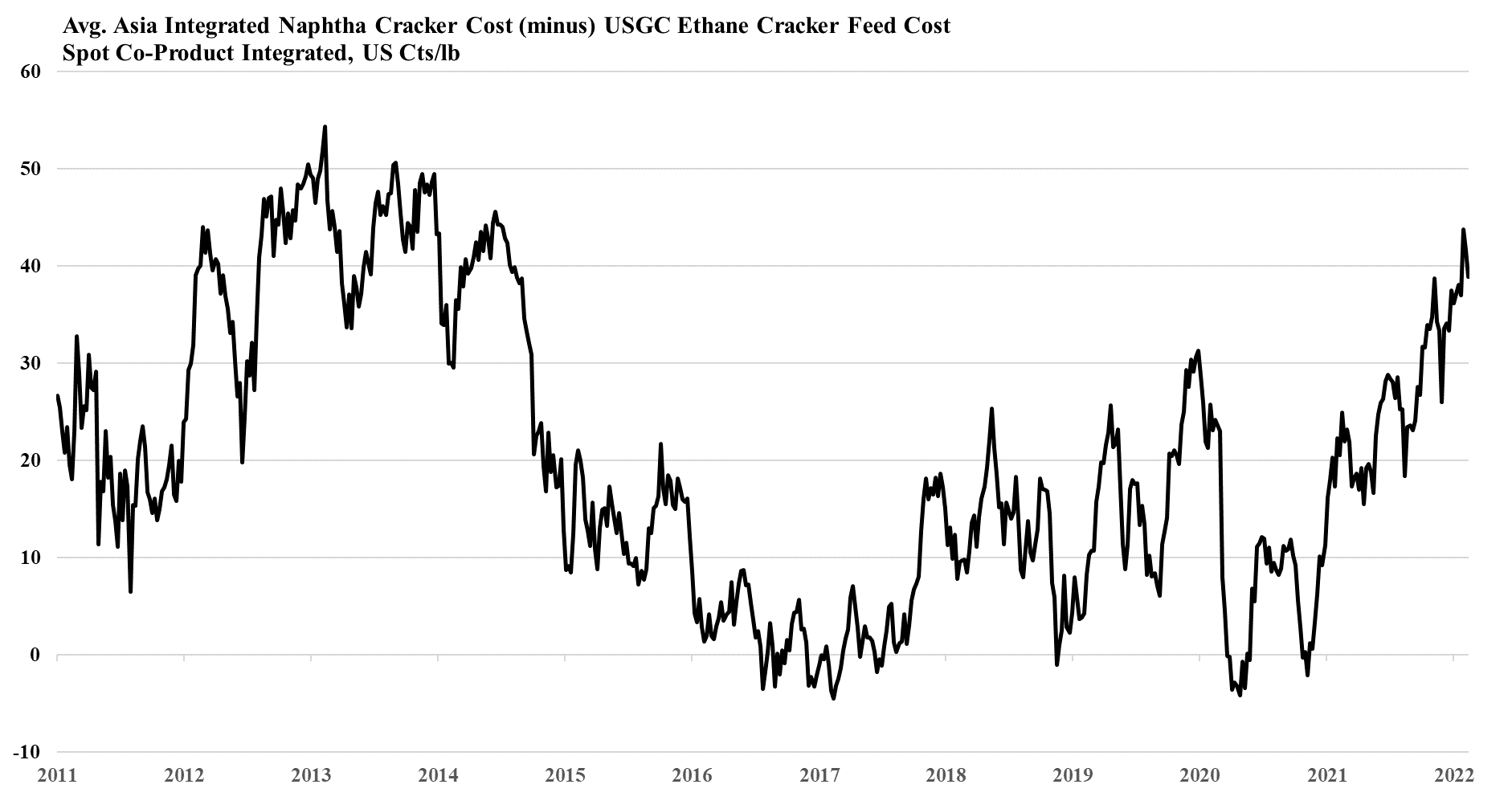

Apr 5, 2022 1:03:31 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, Ethylene, Chemical Industry, PE, basic polymers

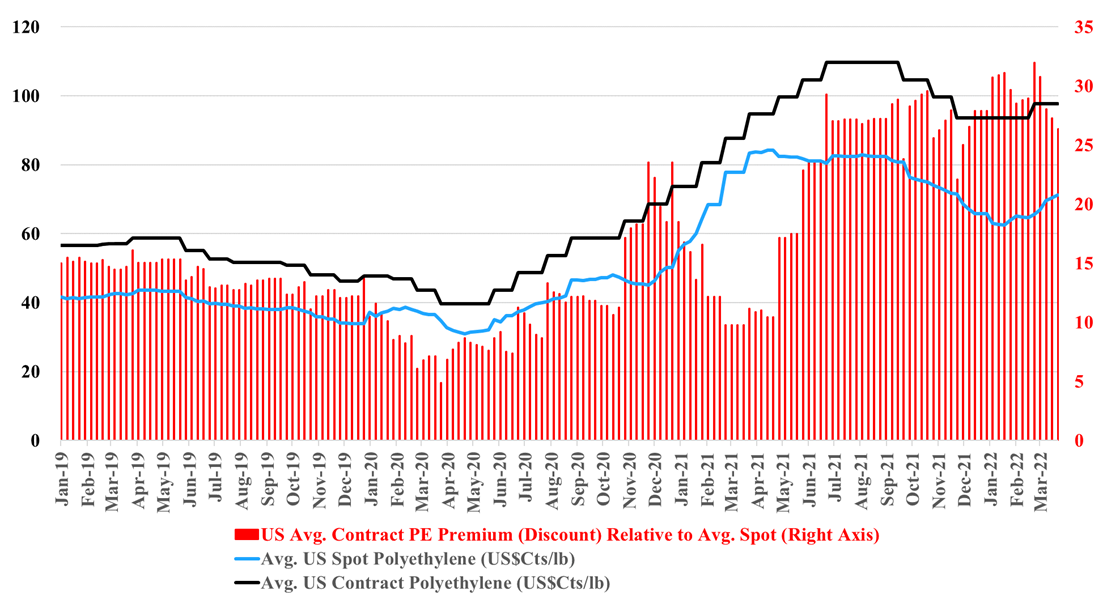

It's back to 2012/2013 for polyethylene, but with a potential twist. As we noted in today's daily report, international prices for polyethylene are being pushed up by oil prices, and even with higher prices in Asia, margins are still negative locally, which suggests that they will go higher. This margin umbrella is what generated windfall profits for US and Middle East producers in 2012, 2013, and half of 2014. The upward pressure remains high for international polyethylene prices because producers are not covering costs locally and in theory, the US should continue to benefit and we see domestic polyethylene prices rising again, both contract and spot. The risk for the US is local overcapacity of polyethylene and potential export challenges. The pricing arbitrage to export US polyethylene is huge and rising, but we are in a constrained trade world and we understand that export terminals are at capacity and warehouses are full. It is possible that the sharply lower US ethylene price is not just a function of new ethylene capacity, but also a function of integrated polyethylene producers choosing to limit production and looking for homes for the extra ethylene. If the polyethylene producers in the US try to push more volume domestically we could see local prices fall well below their export alternative – this is possible, but unlikely, in our view. Polypropylene does not have the same significant net export and the two plant closure in the US are likely enough to drive the price support that we are seeing this week.

Huntsman: Making All The Right Moves

Mar 3, 2022 1:46:01 PM / by Cooley May posted in Chemicals, Raw Materials, Chemical Industry, Supply Chain, downstream, Huntsman, strategy, performance products

The Huntsman activist defense presentation highlighted below does a very good job of explaining why Starboard is focused on a set of concerns that the company has already addressed and while we would generally not comment on something like this, we agree with Huntsman’s assessment that the proposed Board changes bring nothing to the table. Where the Starboard activity may help is improving Huntsman’s communications, as while the company has done a good job, in our view, of repositioning, it has done a less good job, until now, of communicating what the changes mean. The presentation linked below does a much better job than anything we have seen from the company in the past. To be fairer to Huntsman, the chemical industry has always had trouble communicating strategy shifts and portfolio transformations to stakeholders and there have been several instances of good stories not turning into good businesses – Eastman had some false starts in the past but has not been alone with these problems. It often takes some time for investors to believe in a new business model and this is where good corporate communications strategies can help. This presentation is a good start for Huntsman.

Is Demand Growth Driving Inflation? Or Vice Versa?

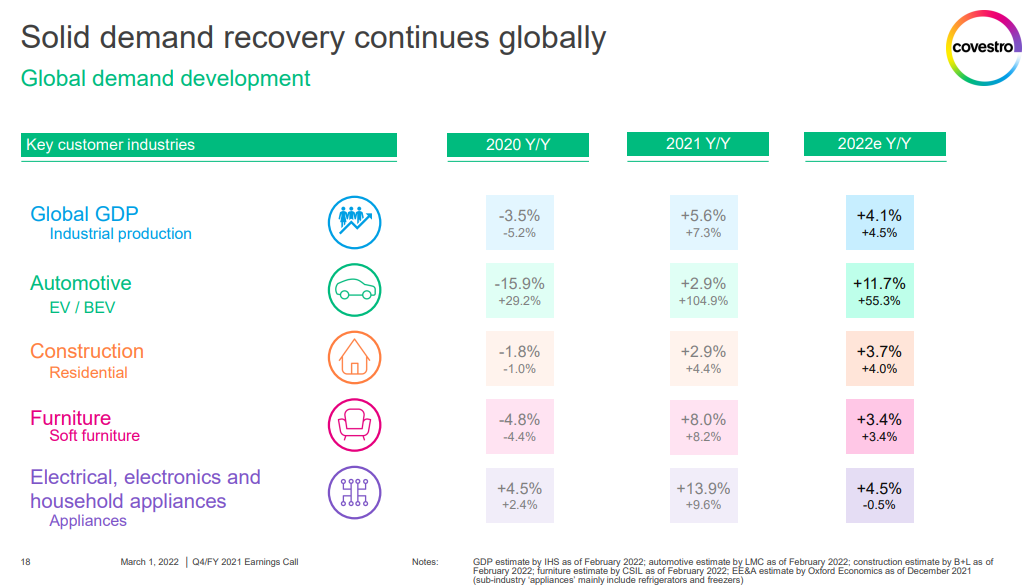

Mar 1, 2022 2:13:44 PM / by Cooley May posted in Chemicals, Polymers, LNG, Methanol, Energy, Raw Materials, Inflation, Chemical Industry, Supply Chain, polymer market, Covestro, energy shortages, Supply, demand strength, supply chain challenges, semiconductor, VW, Renault, semiconductor shortage

More confirmation from Covestro that global demand growth is strong, supporting reports that we have seen from most companies over the last few weeks. Some have struggled with raw material cost squeezes and either late attempts to raise prices or pricing lags in contract agreements, but almost all have pointed to very strong demand outside of auto OEM. We have questioned how much of this strong demand is inflation-driven, but it is very hard to tell as the last time we had significant inflation we did not have such an interwoven global supply chain as we have today, and consequently, it is harder to assess how much pre-buying may be going on, not because of fear of higher prices but because of fear of supply. Note that we have at least two European automakers (VW and Renault) shutting down facilities this week because they cannot key parts from Ukraine. This adds to the already problematic path for parts from China as well as the semiconductor shortage. If everyone is looking for a little bit more it would explain the very high 1Q 2022 demand that all are talking about and it likely means that inflationary pressures will continue as chemical and polymer makers try to make more, against a backdrop of higher raw materials and find it easier to increase their prices because their customers are as concerned about availability as they are prices.

Chemical And Polymer Prices Are Moving Higher

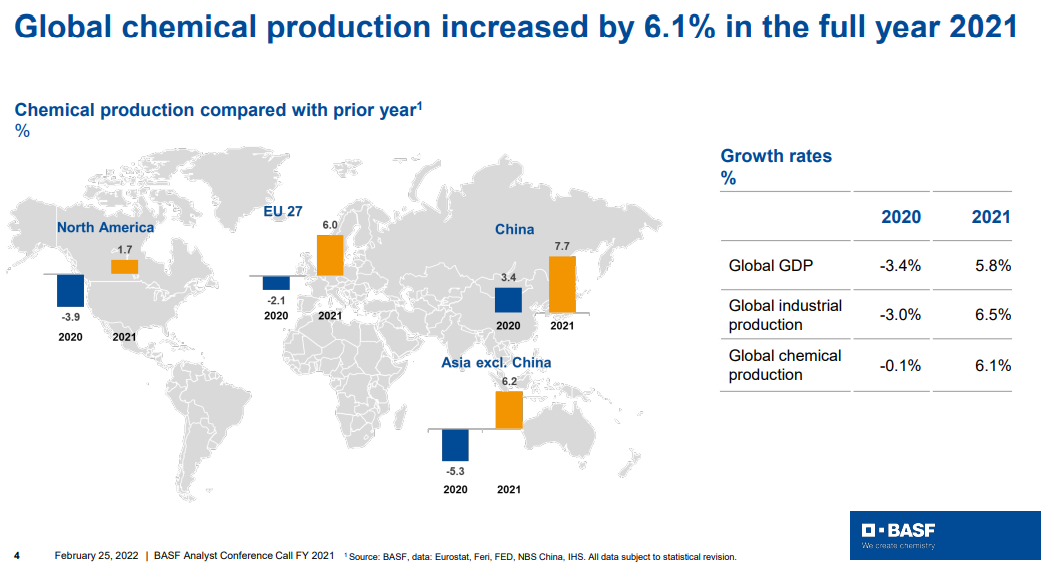

Feb 25, 2022 1:59:11 PM / by Cooley May posted in Chemicals, Commodities, Energy, Raw Materials, Inflation, Chemical Industry, intermediates, specialty chemicals, commodity producers, chemical producers, materials, shortages, intermediate chemicals, energy prices, European energy prices, polymer industry

Fear of shortages is the one factor that is most supportive in terms of helping to push through pricing and the events in Europe and their associated impact on energy prices should be all the support that the chemical and polymer industry needs to push pricing through that will cover cost inflation. Buyers of raw materials and intermediate products will naturally look to buy a little more than they need in the near term, both to ensure that they get something ad to try to build a bigger inventory cushion. This will have the effect of pushing apparent demand higher, making the pricing initiatives easier. Few will push back on pricing if their primary concern is availability. Looking at the BASF results summarized in the chart below, demand is already very robust and this will lead to higher utilization rates and higher volumes for chemical producers as well as high pricing. The commodity producers are likely more interesting here as they can move prices much more quickly than the specialty companies who might see margins squeezed over the next couple of months. None of this is good for inflation. See more in today's daily report.

Troubling Times Ahead For European Chemicals

Feb 24, 2022 1:50:41 PM / by Cooley May posted in Chemicals, LNG, PVC, Energy, Inflation, Chemical Industry, natural gas, materials, feedstocks, energy prices, fuel, Europe, Russia, fuel prices, European Chemicals, industrials, Orbia

It is likely a difficult day for the European chemical industry as all of the fuel prices that they depend on are rising quickly, which will force many difficult decisions over the coming days. There are a couple of factors to consider – what happens to costs and margins if energy prices remain inflated, and what happens if energy availability becomes an issue and plant closures are necessary. In a world that is already reeling from inflationary pressure that we have not seen in four decades, there is at least an acceptance that prices can move higher, but the energy-dependent European industrial and materials companies will need to move prices quickly and meaningfully to absorb their higher costs. If natural gas supplies from Russia are halted, Europe is likely going to need to allocate supplies, as there is no easy fix given an LNG system that is already at capacity. Industry will likely take the hit to ensure power for heating and cooling. This will drive product shortages in Europe, especially for chemicals, which will likely make it easier to get the pricing necessary to cover costs.

Supply Disruptions Today But Chips With Everything In 2023

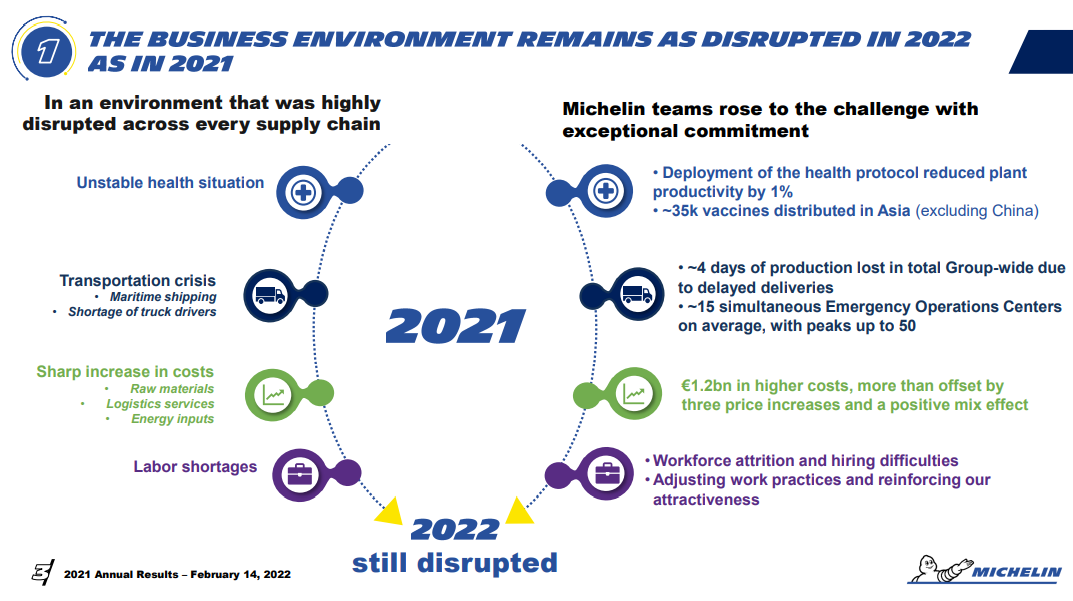

Feb 15, 2022 12:21:04 PM / by Cooley May posted in Chemicals, Inflation, Chemical Industry, Supply Chain, oversupply, downstream, chemical companies, demand, Supply, OEM, inventories, Michelin, semiconductor

More earnings releases and more discussions of disruptions and higher costs! One thing that is clear from all the reports we have followed, whether from basic chemical companies or those downstream, is that no one has any expectation that the supply disruptions and inflationary drivers are going to end soon. In our Sunday Thematic, we talked about the possibility of demand remaining robust and possibly absorbing new supply in 2022 because of further inventory builds. The idea is that holding more working capital, while possibly less efficient financially, may be more prudent from a business continuity perspective, especially given the reputational risk of failing to fulfill customer orders. While there is appropriate concern that interest rates could rise significantly, lending rates are so low that the cost of holding more inventory would be immaterial for many companies. For many products in the chemical chains and across materials more broadly, global oversupply, where it exists, is not high, and a further upward swing in inventories in 2022 could easily keep tight markets tight and swing some more balanced markets to shortages.

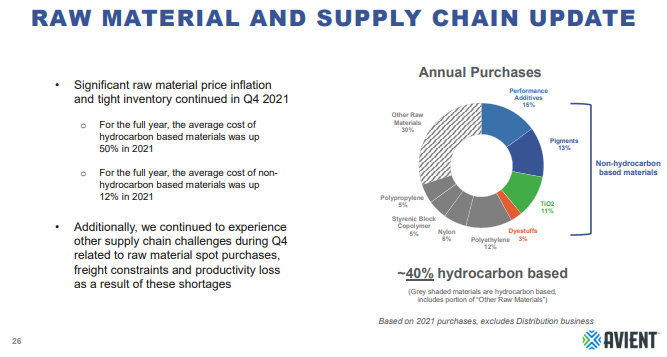

Raw Materials Inflation Not Over For Specialty Materials

Feb 8, 2022 3:04:30 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, raw materials inflation, Chemical Industry, petrochemicals, US Chemicals, Avient, US Polymers, specialty chemicals, materials, DuPont, plasticsindustry, supply chain challenges, logistic inflation

As Avient and the linked paint article remind us, there are sectors of the US chemical industry that rely on imported products – in these cases pigments, and the supply chain challenges and logistic delays have caused production problems in the US and price increases in 2021. The automotive segment of the paint industry has seen lower demand because of the auto OEM production slowdown, and pigment shortages and price spikes would likely have been worse if automakers had been running at full rates. There is no sense of impending relief in the logistic issues as we go through 4Q earnings reports and we could continue to see issues for a while. This should be good for US-based pigment suppliers, but while Chemours, Venator, and Tronox all have capacity in the US, they also have capacity outside the US which likely faces some supply chain challenges.