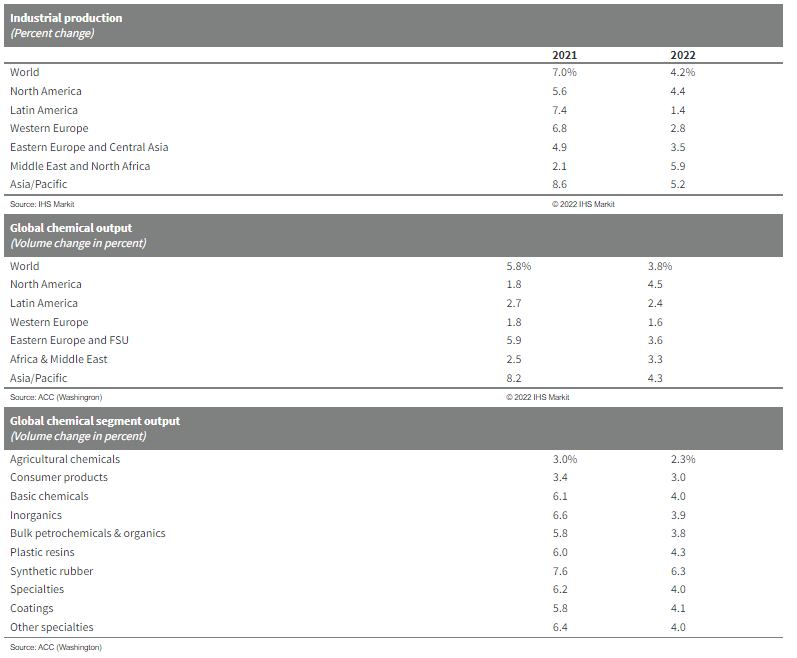

The jump in expected US chemical production in 2022 versus 2021 and the more anemic growth in 2021, is in part due to new capacity in the US but is likely more a function of lost production in the US in 2021 because of the February freeze and the hurricane that hit the New Orleans area. These two weather events, especially the freeze, cause significant production cutbacks, and not only would production have looked better in 2021 without them, but the inventory decline shown in Exhibit 1 in today's daily might have been less severe. IF we assume that climate change is causing more severe weather, then perhaps it would be prudent to build more unplanned downtime into forecasting models and on that basis perhaps the production growth forecast in the exhibit below is too hopeful. However, if you model more unplanned downtime you are inevitably going to end up with a more volatile market as available capacity will swing around the forecast average by a larger amplitude, which would make production and inventory planning more complicated.

Higher US Chemical Production In 2022 Could Be Weather Dependent Again

Jan 12, 2022 1:31:26 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, Chemical Industry, US Chemicals, China, chemical production, COVID, forecasts, inventory planning, weather

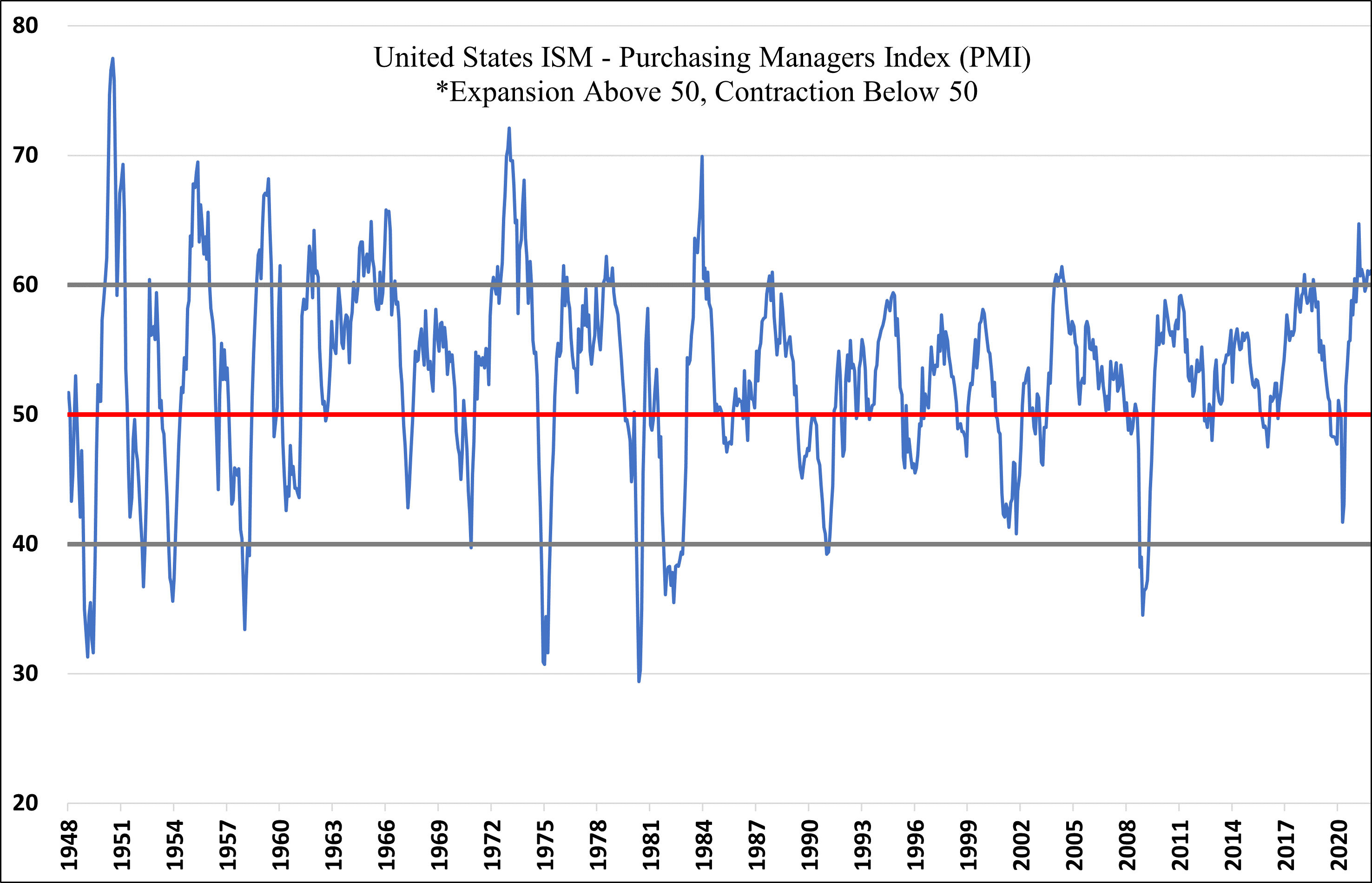

The Need For Manufacturing Support In The US: Enterprise Zones

Dec 6, 2021 1:31:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Dow, polymer producers, manufacturing, US polymer prices, COVID, commodity chemicals, chemicalindustry, plasticsindustry, ISM manufacturing, Enterprise Zones, reshoring, capital spending, chemical investments, PMI

Our latest Sunday Thematic research report titled, "Reshoring Should Remain Supportive of Chemicals in ’22" studied the investment in US enterprise zones, near and medium-term, and the broad-based benefits for domestic supply chains.

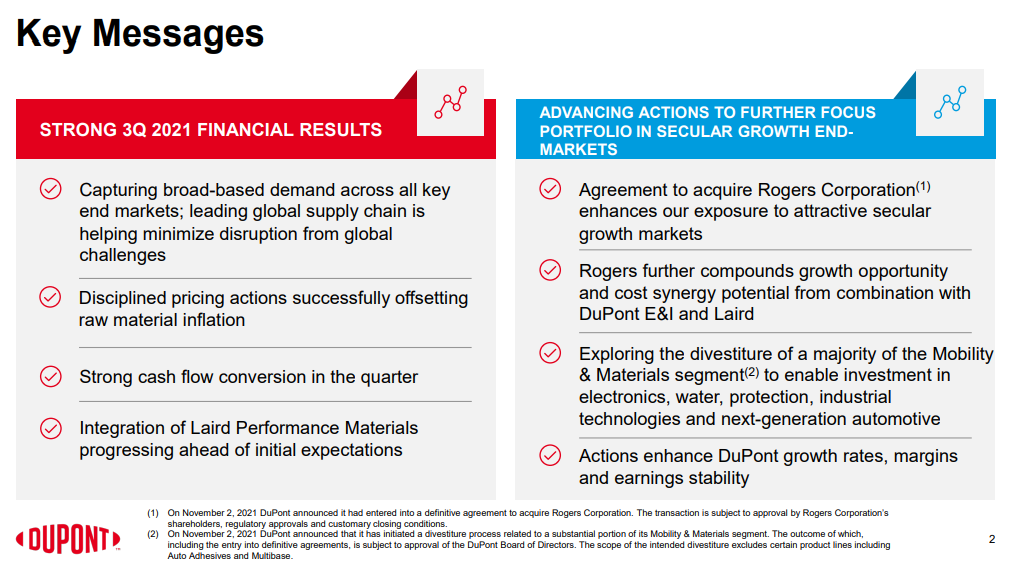

DuPont: More Value From More Actions

Nov 2, 2021 3:44:19 PM / by Cooley May posted in ESG, Chemicals, Polymers, Chemical Industry, COVID, DuPont, acquisitions, electronics, industrial technologies, automotive, divestments, water, resins

We are not surprised by some of the DuPont stories this morning. We had predicted a long time ago that Mr. Breen was far from done on the restructuring of the company and that COVID might have caused a delay in some of the plans but not changed them. Mr. Breen did a very value-enhancing job of taking Tyco from a slightly out of control, then GE wannabe, to a group of focused companies, separated from the whole. What he has panned for DuPont comes from the same playbook in our view. The divestments and acquisitions announced today will create a core at DuPont – focused on electronics, water, protection, industrial technologies, and “next generation” automotive. Given some of the recent industry moves, we would expect significant interest in the engineering polymers and other resins platforms. After these moves are complete, while not yet obvious from a valuation perspective, we could see a further split, carving out an ESG friendly piece focused around water and protection, although the moves announced today may be enough to get the company an earnings multiple boost.