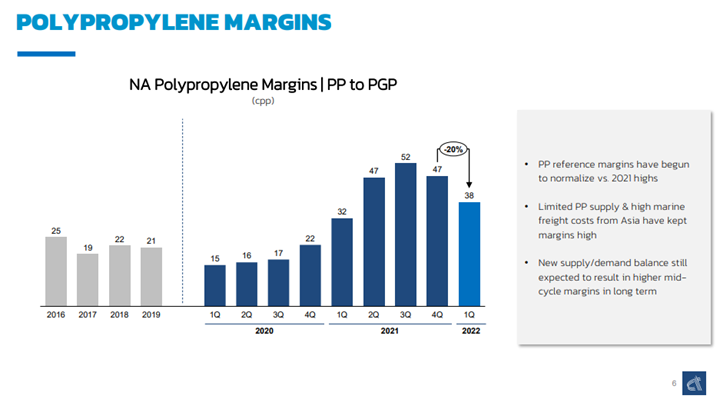

While Alpek shows a decline in the polypropylene to propylene spread in the exhibit below, it is important to note how high margins remain in the US. It is also important to note that the company points to high freight costs from Asia as one of the key drivers. China has significant polypropylene surpluses, and the price delta with the US is very high and, on paper, looks high enough to encourage imports into the US. But it is not that simple. The freight rates for containers from Asia are just one of many roadblocks, including wait time – on the water and the docks – and product quality. A US converter will likely not risk buying a few spot containers from China if focused on a product spec for a US customer. One way to get more material into the US would be for the end-user to buy the product – durable manufacturer or packager – and then ask its supplier to effectively toll-process. That way the product quality and logistic risk sit with the end consumer rather than the converter in the middle. The longer US domestic polypropylene prices remain inflated versus Asia, the more end-users may look at this option.

US Polypropylene & PVC: Both Benefiting From Logistic Challenges

Apr 27, 2022 12:32:52 PM / by Cooley May posted in Chemicals, Propylene, PVC, Polypropylene, freight, Logistics, US polypropylene, Alpek