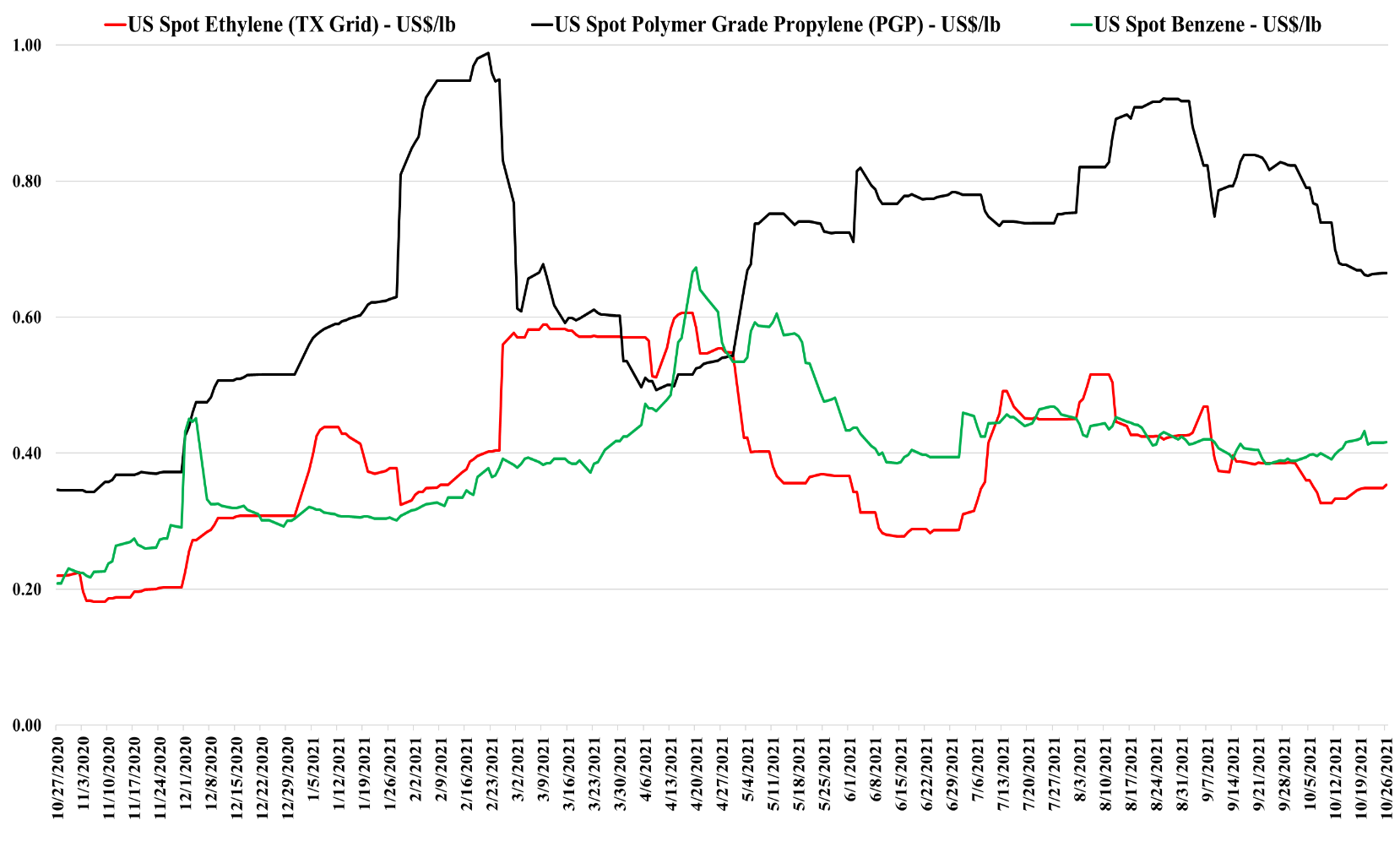

We are seeing some stability in ethylene and propylene pricing in the US to start the week, and with the steady rise in crude prices and the Monday jump in natural gas prices, this is not surprising. As we noted in yesterday’s Weekly Catalyst, there is enough incentive to export ethylene from the US to Asia – most likely Southeast Asia rather than North Asia, and this could offer support for those with surplus ethylene in the US today.

Exports Helping Ethylene; Power Pushing Chinese Caustic

Oct 26, 2021 12:59:13 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, intermediates, natural gas prices, US ethylene surplus, ethylene exports, chlorine, ethylene prices, Caustic Soda, crude prices, PVC prices

Olin Cutting Capacity, Celanese Adding; Both Strategies Can Work

Oct 22, 2021 2:32:02 PM / by Cooley May posted in Chemicals, Methanol, Capacity, chlorine, Olin, Celanese

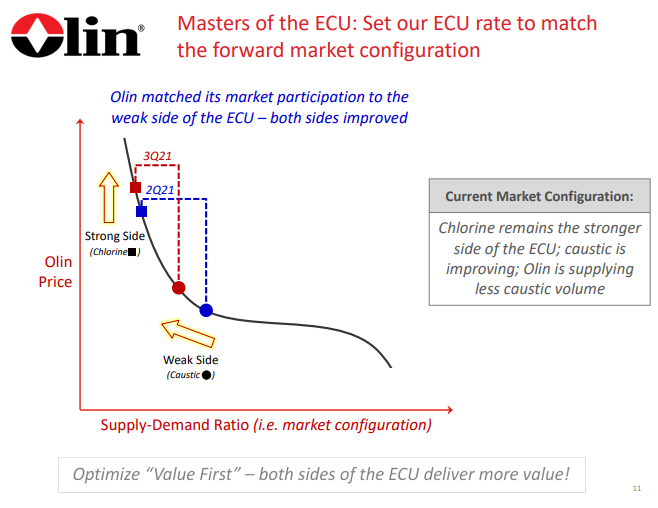

We will expand on the Olin results and some of the benefits and potential pitfalls of the revised strategy in our Sunday piece as we can draw some comparisons (some good and some bad) from other corporate examples over time. For now, it is working and few would have predicted a $50+ stock for Olin a year ago. Some market fundamentals are working in Olin’s favor, but much of the success is coming from a more radical approach to customer engagement and avoidance of customers generating minimal returns, regardless of what that means for production. So far this is a great first act from the new leadership of Scott Sutton – we will talk about what a second act may need to look like on Sunday.

PVC: Some Signs Of Weakening Near Term, But Still Better Positioned Than Most Peer Polymers Long Term, In Our View

Jul 15, 2021 2:01:06 PM / by Cooley May posted in Chemicals, PVC, Ethylene, PVC price, chlorine, EDC

Regional PVC price movements are interesting as the World is trying to find balance. Incremental ethylene and chlorine economics in Asia pushed the local spot prices for EDC so low as to shut out US EDC exports – the net result has been more PVC production in the US and a decline in US spot prices. While it is likely that the Asia incremental pricing will improve as some sellers will be losing money and may need to cut back rates, the US will not enjoy a better export market without the acceptance of much lower netbacks, which will maintain negative pressure on domestic prices. That said, PVC is very levered to economic, construction, and housing investment in Asia and there is likely some pent-up COVID-related demand in the region – the oversupplied market may not last for long. We still see a better medium-term outlook for PVC than for other major polymers. There's more detail and coverage on today's daily report linked here.