More earnings releases and more discussions of disruptions and higher costs! One thing that is clear from all the reports we have followed, whether from basic chemical companies or those downstream, is that no one has any expectation that the supply disruptions and inflationary drivers are going to end soon. In our Sunday Thematic, we talked about the possibility of demand remaining robust and possibly absorbing new supply in 2022 because of further inventory builds. The idea is that holding more working capital, while possibly less efficient financially, may be more prudent from a business continuity perspective, especially given the reputational risk of failing to fulfill customer orders. While there is appropriate concern that interest rates could rise significantly, lending rates are so low that the cost of holding more inventory would be immaterial for many companies. For many products in the chemical chains and across materials more broadly, global oversupply, where it exists, is not high, and a further upward swing in inventories in 2022 could easily keep tight markets tight and swing some more balanced markets to shortages.

Supply Disruptions Today But Chips With Everything In 2023

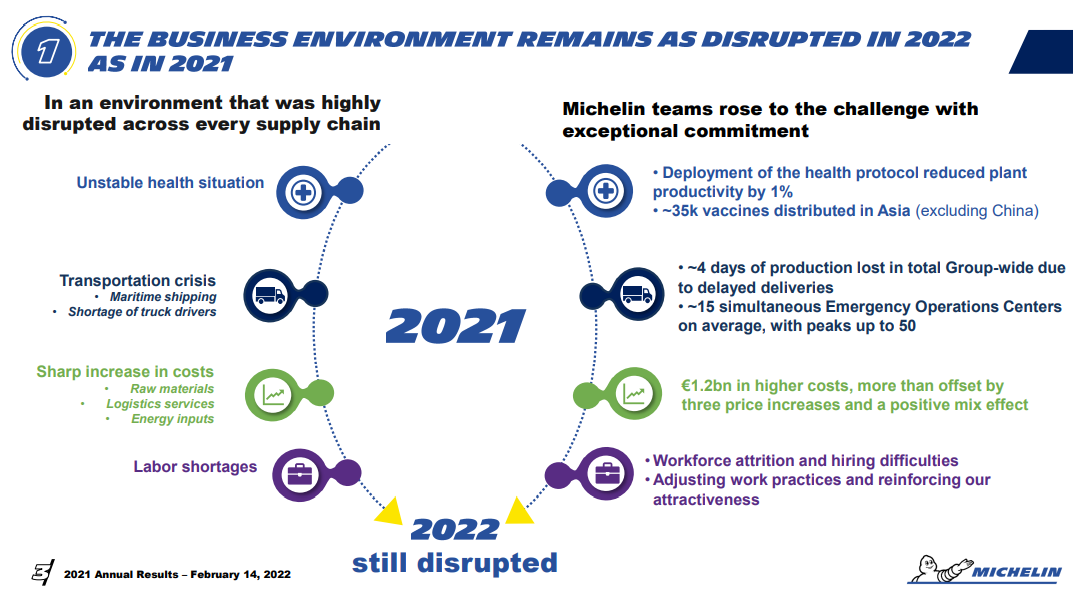

Feb 15, 2022 12:21:04 PM / by Cooley May posted in Chemicals, Inflation, Chemical Industry, Supply Chain, oversupply, downstream, chemical companies, demand, Supply, OEM, inventories, Michelin, semiconductor