Global commodity chemicals are often a relative rather than an absolute game, especially where there is significant international trade. The global price of natural gas has risen dramatically, especially in countries or regions where the marginal BTU is coming from imported LNG – see yesterday’s daily report for a comparative chart. The US may be seeing much higher natural gas prices but other parts of the world have it much worse, and with most of its methanol capacity in regions/areas with very competitive natural gas, it is not surprising that Methanex is upbeat. The higher natural gas price in the US is giving Methanex and other US producers the ammunition to raise prices and the higher costs outside the US mean that international volumes are going to find more attractive markets in many locations versus the US. While we have seen some moves to create low carbon polymers and low carbon ammonia, this has not come to methanol yet and methanol does have one of the largest CO2 footprints, per ton of product. While Methanex is currently talking about returning surplus cash to shareholders, there may come a time – sooner rather than later – when some of that cash gets redirected to carbon abatement.

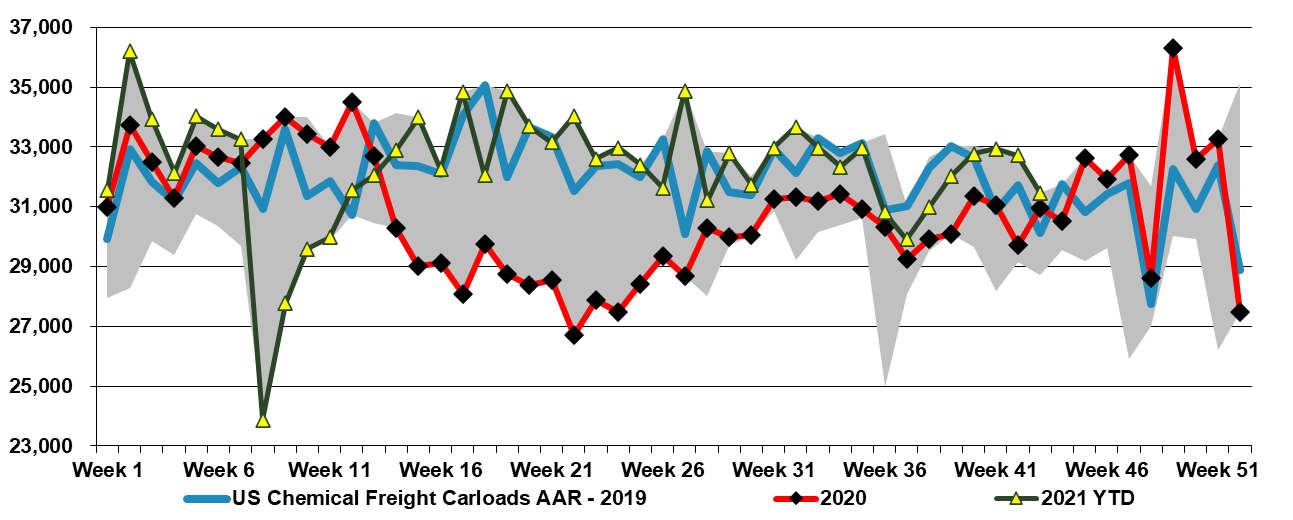

Relative Economics Keep US Chemicals On The Tracks

Oct 28, 2021 2:39:10 PM / by Cooley May posted in Chemicals, LNG, Methanol, carbon abatement, natural gas, CO2 footprint, Methanex, low carbon ammonia, chemical shipments, commodity chemicals, methanol capacity, low carbon polymers