The US chemical rail volumes should be considered in the context of some of the slowing demand that has been indicated by companies downstream of chemicals, and we see this as further evidence for possible inventory build through the chain. Earlier in the year these builds would have been justified by supply chain issues that have plagued all segments of retail and manufacturing for close to two years, but today we should be at or above inventory comfort levels. We are calling for weakness in demand and some margin erosion in US chemicals and polymers in 2H 2022, before a strong rebound as early as 2024, but if buyers of polymers and chemicals and their customers look to reduce inventories more quickly, the landscape could change quickly. While this is possible, with the threat of higher energy prices very real, we would be surprised in anyone was interesting in dramatically lowering inventories today.

Runaway Trains Into Weaker Demand?

May 13, 2022 1:40:50 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Styrene, Benzene, US Chemicals, natural gas, manufacturing, EDC, ethylene glycol, demand, US chemical rail, ethylbenzene

All Eyes On Costs - Prices Going Higher

Mar 9, 2022 12:38:11 PM / by Cooley May posted in Chemicals, Inflation, Prices, feedstock, HDPE, Oil, polymer producers, ethane, natural gas, Basic Chemicals, manufacturing, polymer, exports, Global Costs, polymer prices

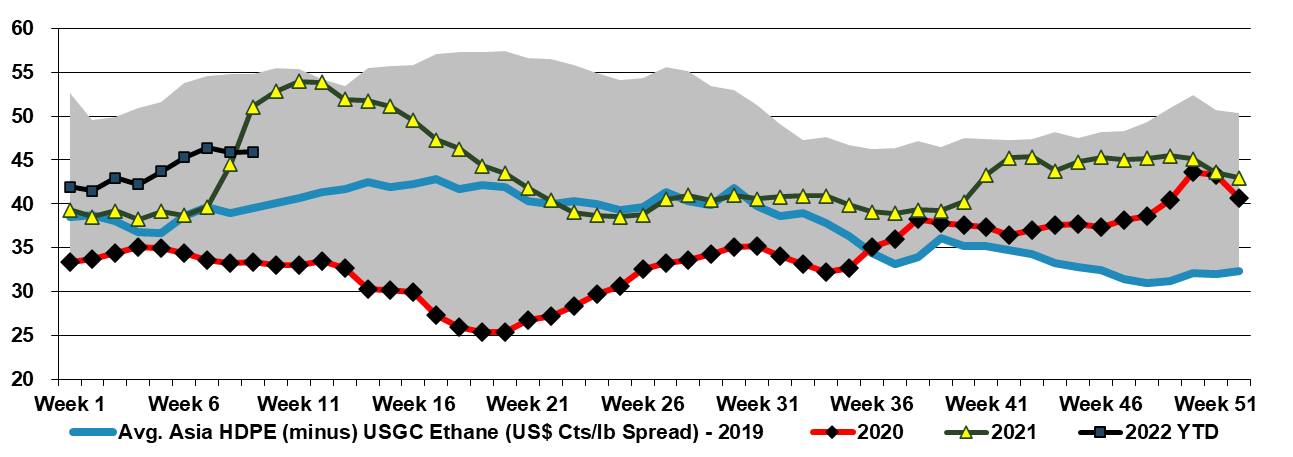

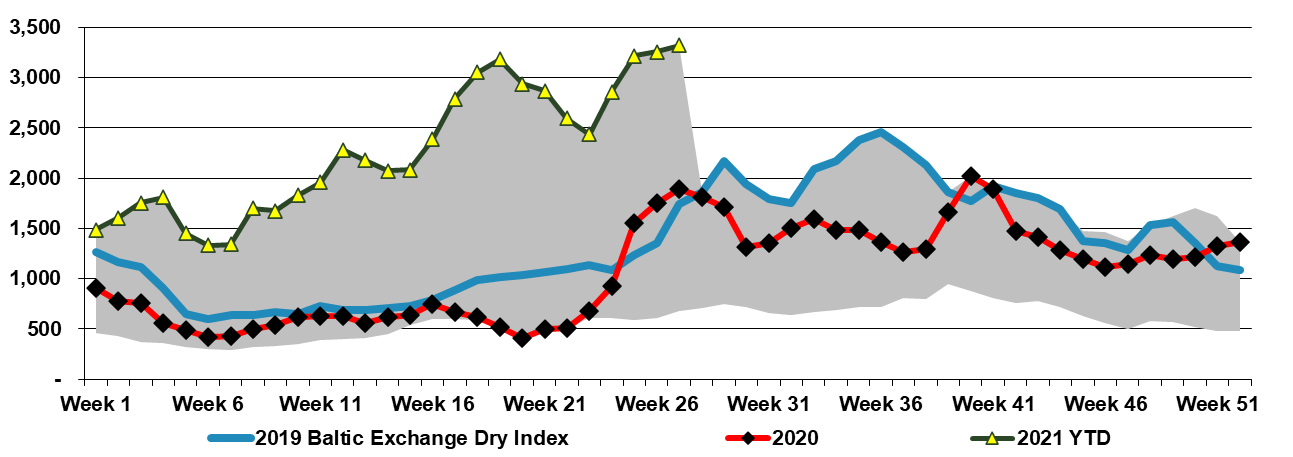

With the rapid jump in international natural gas and oil prices, we would see very concerted efforts to raise basic chemicals and polymer prices in Europe and Asia and will have a positive knock-on effect for the US. In our weekly catalyst report on Monday, we showed that ethylene producers outside the US were all losing money, especially in Europe and Asia. Some European demand will already be lower, because of curtailed product exports to Russia and Ukraine, but producers will want to cover costs at a very minimum and consequently, will be trying to match price increases with cost increases and if possible do a bit better than that. All of this will create a greater margin umbrella for the US, and US exporters selling directly into international markets will see export margins step up and may see incremental opportunities to export more, assuming that the freight rates are not too onerous for incremental containers.

Demand Growth Continues To Favor Strong Corporate Results

Feb 23, 2022 3:56:50 PM / by Cooley May posted in Chemicals, Polyolefins, PVC, Energy, Supply Chain, manufacturing, Westlake, Building Products, construction, housing, diversification, construction market, Element Solutions

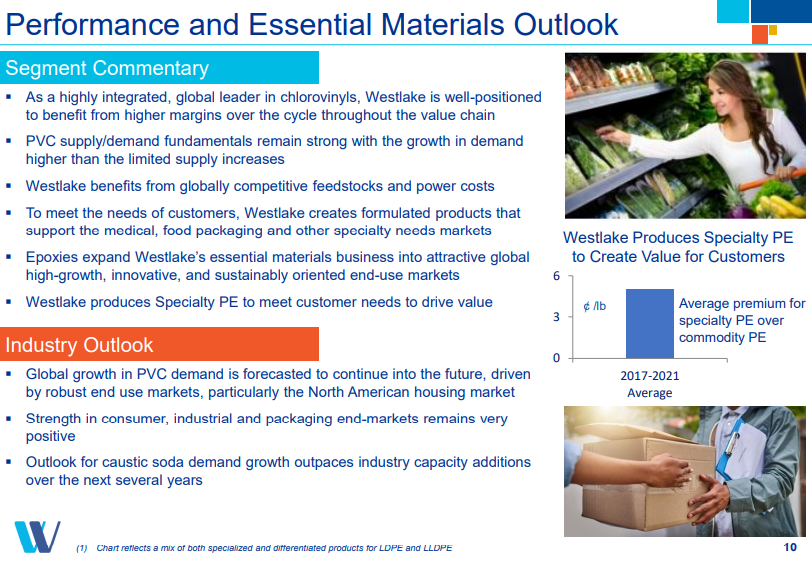

Westlake Chemical began today at a 52 week high on the back of very strong earnings but has retreated with the market. Westlake has been one of our favorite ideas since founding C-MACC in part because we believe in the diversification strategy into building products and in part because the PVC market has not seen the same level of overinvestment as polyolefins globally over the last 3 years. Westlake’s view of the housing and construction market aligns with ours and by breaking out this segment of the business Westlake should see some valuation benefit from the more stable earnings that this segment should provide. Note that the focused building products companies trade at significantly higher multiples than chemicals. We expect Westlake to get earnings and multiple boosts from here.

Linde: Always A Good Barometer For Industrial Activity

Feb 11, 2022 1:54:58 PM / by Cooley May posted in Hydrogen, Chemicals, Energy, Emissions, Air Products, Air Liquide, Industrial Gas, manufacturing, mining, electrolysis, Linde, raw material

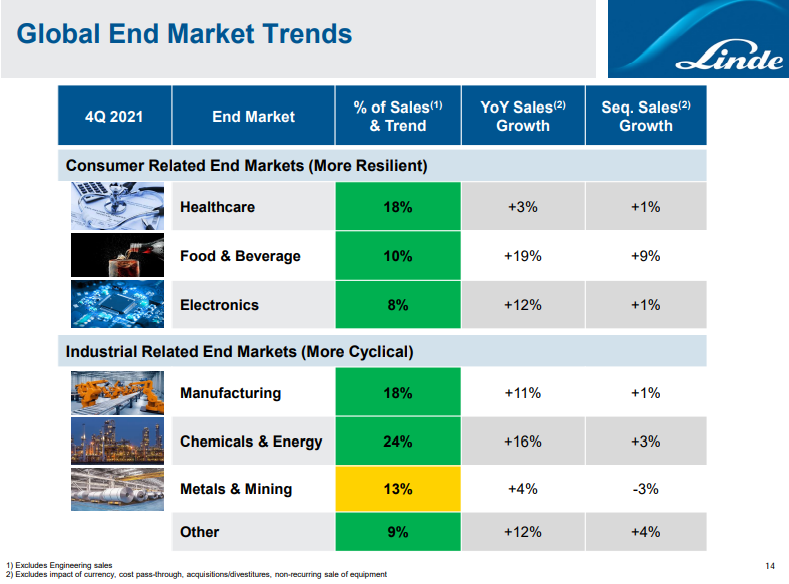

While the Linde results were very strong and surprised to the upside, we also want to focus on what messages they send about the broader economy. As recently as 10 years ago all of the industrial gas companies' results provided a reasonable barometer on the state of the industrial and other parts of the global economy. Industrial gases are an enabling raw material or process gas for so many industries that their direct use is generally a function of operating rates for the industry that they serve. Over the last 10 years, Air Products has deviated from the traditional model, with some very large investments targeting specific projects in Asia and the Middle East and their results are a less useful measure of overall economic activity. While both Air Liquide and Linde continue to reflect the broad economic backdrop well, both could be dragged into large projects around hydrogen over the coming years, and depending on how they choose to report earnings, we could lose the tangential “information” in their reported results. For now, the Linde results are very supportive of the broader industrial-economic strength that is being reflected in earnings and guidance across many industries, including chemicals and refining. The company has added comparisons with 2019 to show how much underlying growth has happened over the two years. While inflation and interest rate increases could slow things down, the Linde numbers confirm that we have a very positive demand backdrop today, and the company’s guidance would suggest that they think it can continue.

Demand Strength Is Showing Through The Inflation Noise

Feb 9, 2022 12:36:45 PM / by Cooley May posted in Chemicals, Paint Companies, manufacturing, construction material, specialty chemicals, construction, OEM, AkzoNobel, paint, ICL, bromine, paint prices

Akzo Nobel is somewhat unusual among the more specialty chemical (in this case paint) producers, as the company has managed to raise prices fast enough to offset costs and produced strong positive results for 4Q 2021. Not having auto OEM exposure will have helped Akzo and the company is well-positioned to manage pricing through its stores in many cases. It is a relatively safe environment to push up paint prices as all of the competitors have the same cost pressure and need to do the same, and demand remains strong – consumers are buying paint.

The ACC Forecasts Look Too Conservative To Us

Dec 9, 2021 2:15:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, Ethylene, Auto Industry, Shell, ExxonMobil, petrochemicals, Sabic, natural gas, natural gas prices, Baystar, Basic Chemicals, manufacturing, polymer production, specialty chemicals, ACC, Polyethylene Capacity, US manufacturing, plastics resin

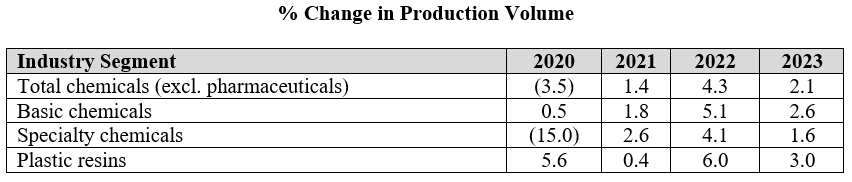

The ACC forecasts below leave us a little confused as the implication for specialty chemicals is that production declines in the US by an average of 2.0% per annum from 2019 to 2023. Given the demand that we are seeing for US manufacturing, as covered in our most recent Sunday Report, we would expect demand for all inputs to rise and it is unlikely that the gap would be filled by a swing in net imports. The lower demand from the Auto industry in 2020 and 2021 and broader manufacturing shutdowns in 2020 explains the 2020 and 2021 numbers to a degree, but it is not clear why there would not be a rebound as auto rates increase. We would also expect to see a stronger rebound in polymer production in 2022, assuming weather events are less impactful than in 2021, given substantial new capacity for polyethylene from ExxonMobil/SABIC, BayStar, and Shell.

The Need For Manufacturing Support In The US: Enterprise Zones

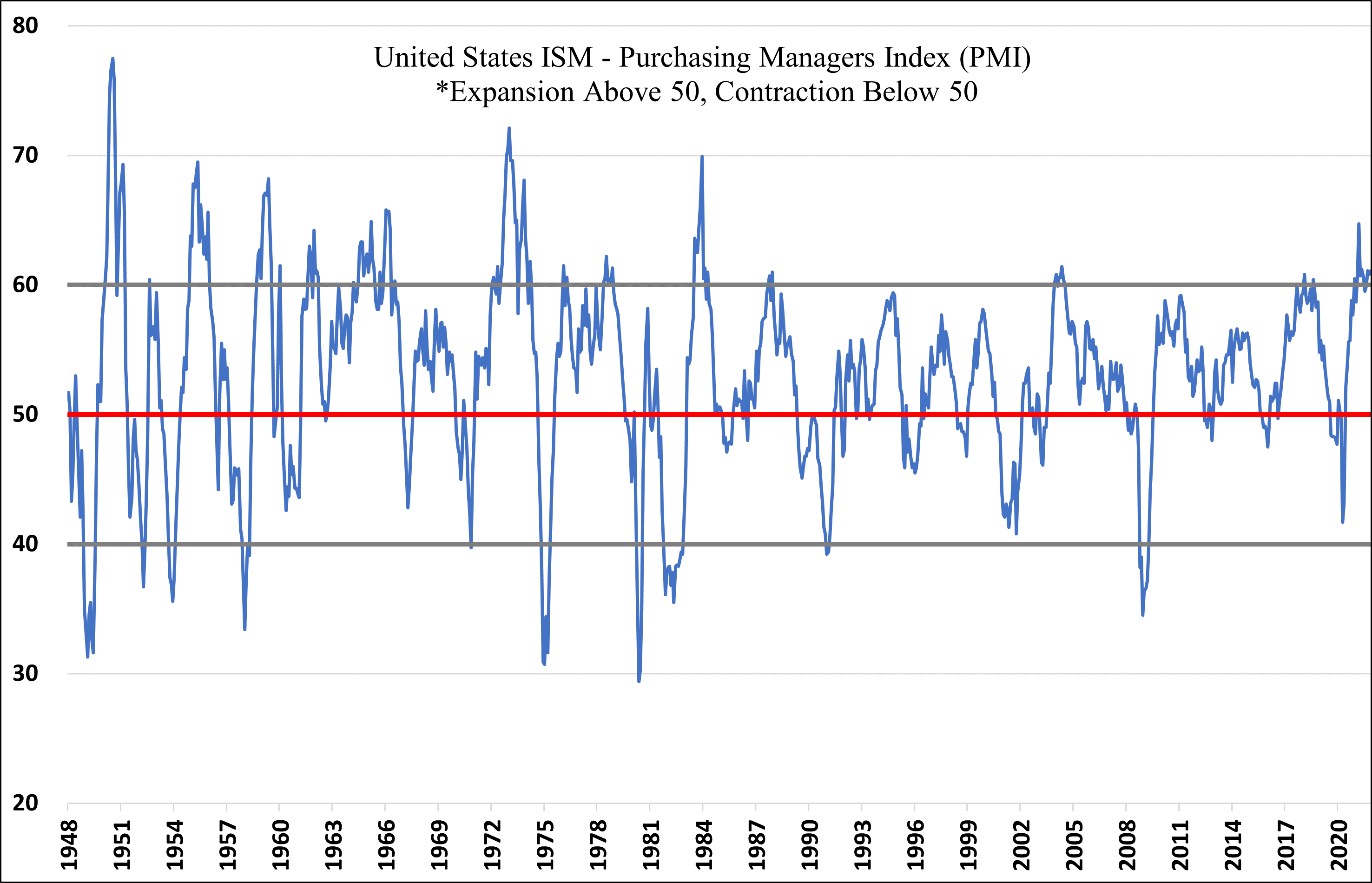

Dec 6, 2021 1:31:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Dow, polymer producers, manufacturing, US polymer prices, COVID, commodity chemicals, chemicalindustry, plasticsindustry, ISM manufacturing, Enterprise Zones, reshoring, capital spending, chemical investments, PMI

Our latest Sunday Thematic research report titled, "Reshoring Should Remain Supportive of Chemicals in ’22" studied the investment in US enterprise zones, near and medium-term, and the broad-based benefits for domestic supply chains.

US Competitive Advantage Pushing Ethylene Exports

Dec 1, 2021 12:43:50 PM / by Cooley May posted in Chemicals, Ethylene, petrochemicals, propane, arbitrage, ethylene producers, Ethylene Surplus, US ethylene, manufacturing, naphtha, ethylene exports, exports, chemicalindustry, ethane imports, petrochemicalindustry, Navigator Gas

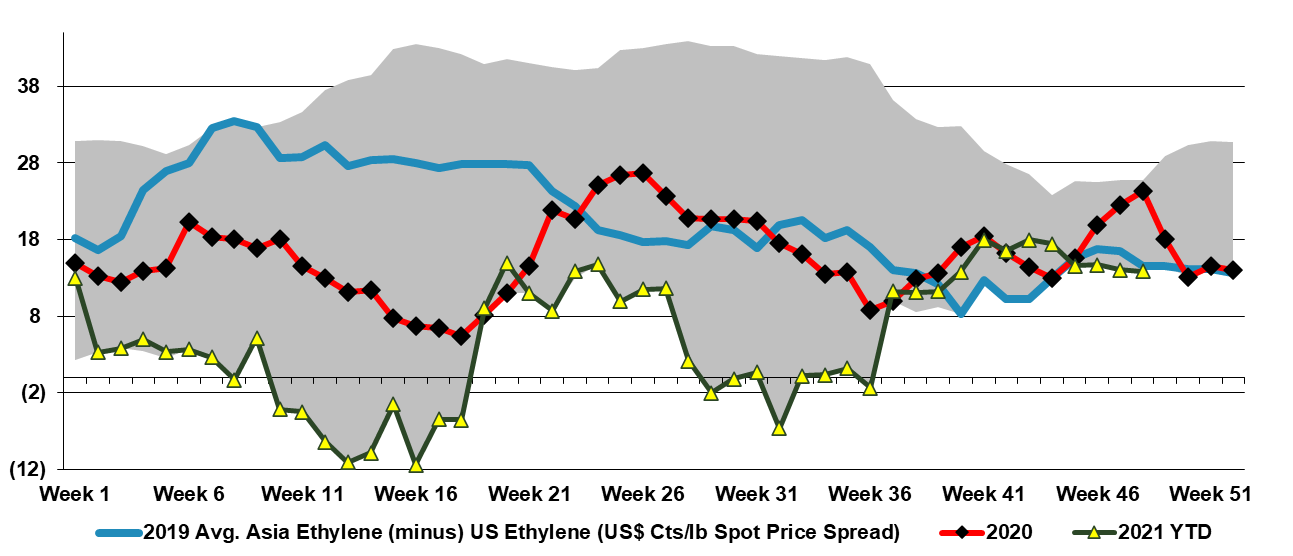

The Navigator Gas announcement should not be a surprise as the ethylene export arbitrage reopened in the US in September (Exhibit below) and since the terminal opened there has been a demand for ethylene exports each time the numbers have made sense. There are ethylene consumers in Asia that are net short and will buy incremental volumes from the US when the price is right relative to local suppliers and there is incremental demand in countries and regions that appear to be in surplus, including Europe, where a buyer can leverage an import to try to push local prices lower. In China, some of the facilities that require either propane or ethane imports might be better off buying ethylene versus making it today, and this is certainly the case for naphtha importers, as we highlighted in our Weekly Catalyst report on Monday. Today a US exporter can buy spot ethylene in the US and deliver it to China for less than the cost of manufacture in China, before the cost of getting the local ethylene to any consumer that is not on site.

Investment in China Continues Despite A Desire For Supply Diversity

Jun 29, 2021 3:01:45 PM / by Cooley May posted in Auto Industry, Air Liquide, China, EV, semiconductor markets, batteries, semiconductor supply, manufacturing

The Air Liquide announcement linked is consistent with the widely held view that semiconductor markets desperately need new capacity and shows that existing China-based manufacturers are stepping up. Air Liquide will supply new capacity in Wuhan, where it has been an active producer of high purity gases for the semiconductor industry for decades. While this is likely a sound investment for Air Liquide, backed by strong “take or pay” agreements from customers, the risk to the expansion is that while the world is in dire need of new semiconductor capacity, it is unclear how much of that need is for more China-based production. There is significant semiconductor demand in China and that demand will continue to grow, but consumers in the West are not only looking for more semiconductor supply but also more semiconductor supply security, and with the concentration of production in China and Taiwan, supply from outside the region is more desirable. We see new semiconductor capacity announced for the US and the auto industry, in particular, is calling for more diversity of supply, not just for semi’s but also for other EV components, especially batteries. There is already anecdotal evidence of a preference for non-China-based materials – all the way back to lithium - but how much more US and European producers are willing to pay for this “preference” will dictate the ultimate level of spending. Despite these concerns and absent broader geopolitical risk, this is likely a relatively safe project for Air Liquide and the capital commitment is not going to break the bank.