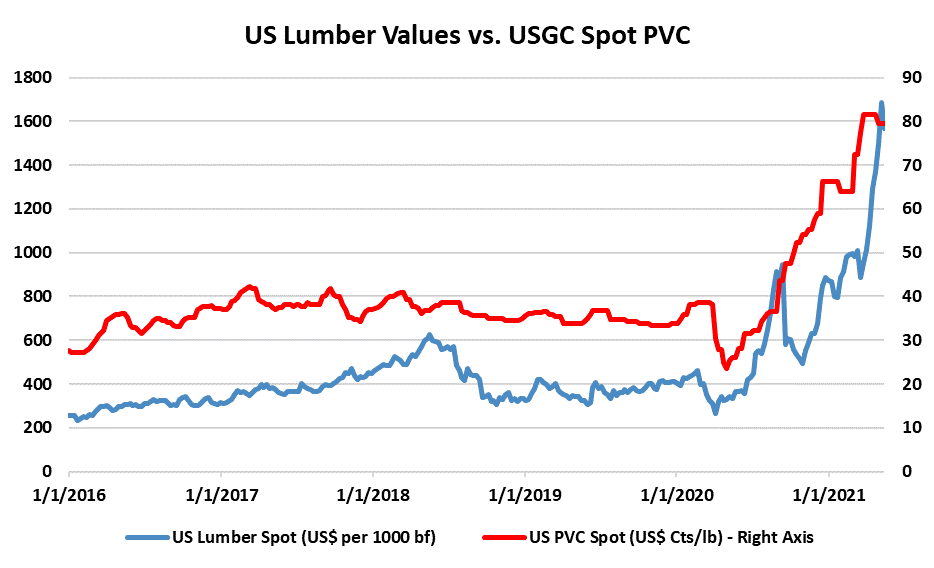

Prices for housing products such as lumber and PVC appear to have hit a pause on their upward march, in part because of lower housing starts, which may be linked to the higher costs – recent estimates suggested that the lumber price moves alone had added $15,000 to the cost of building an average home this year. The overall momentum in the housing market remains strong and the recent lower housing start number could be a one-off. We maintain our preference for the PVC players and still believe that the underlying fundamentals are less precarious than they are for other polymers. See more in Today's Daily.

We Think Housing Stalled In April, But Still Has Momentum; Good For PVC

May 19, 2021 1:55:21 PM / by Cooley May posted in Polymers, PVC, Housing Products, Lumber

Friday Chemical Question: How will global PVC values develop during the next three months? Lower or higher?

May 14, 2021 12:00:54 PM / by Cooley May posted in Chemicals, PVC, supply and demand, PVC Values

2Q-2021 Likely To Be The Polymer Profits Peak, Weather Permitting

Apr 30, 2021 1:54:54 PM / by Cooley May posted in Chemicals, Polymers, Propylene, PVC, Polyethylene, Polypropylene, Ethylene, Styrene, PET, PTA, Acetic Acid, Polyurethane, Glycol

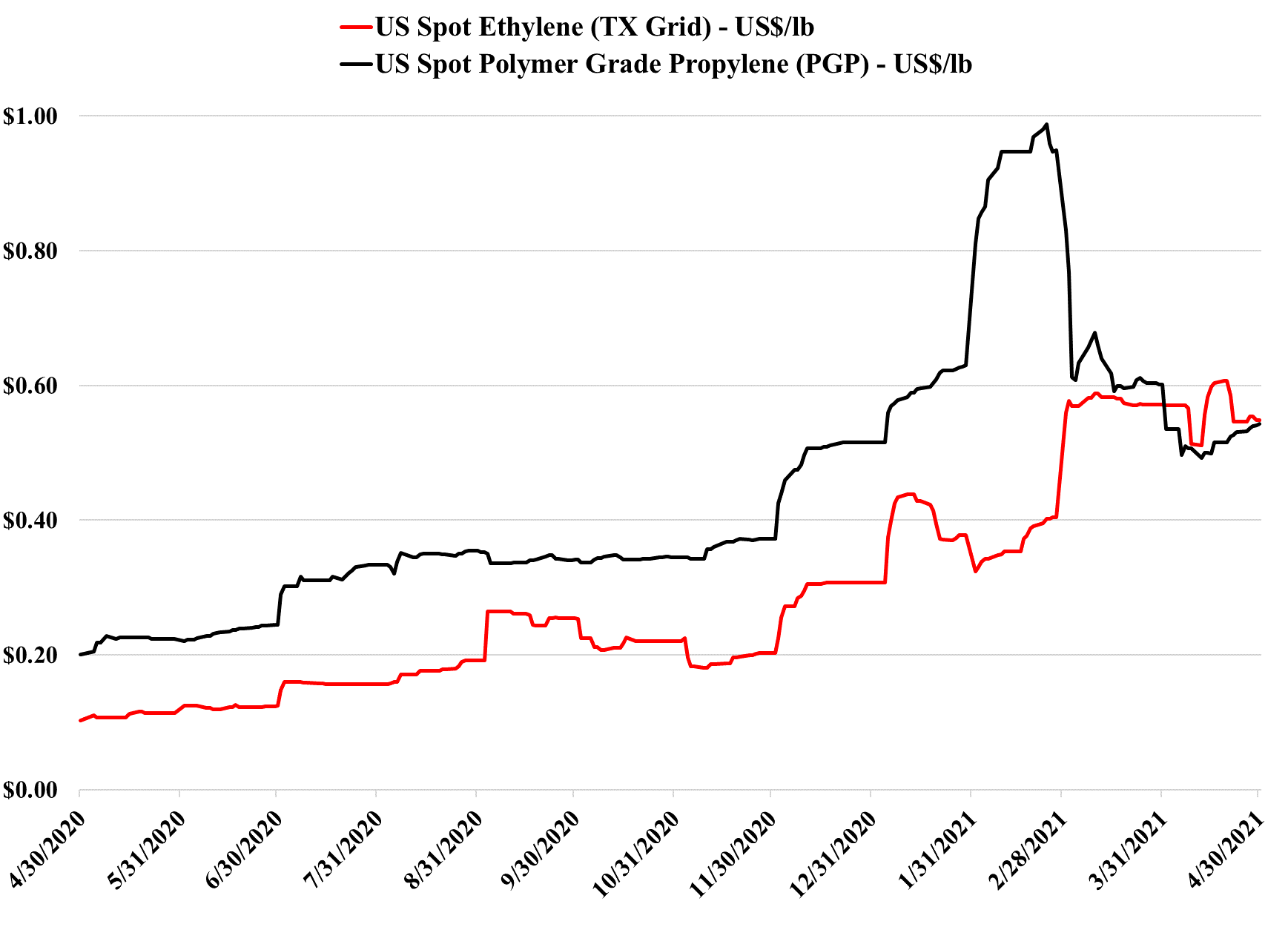

We still believe that there is a good chance that 2Q 2021 is the peak for polymer profits in the US and Europe, but it very unclear how severe the downside could be, given the growth potential. Seasonal turnaround will keep markets more balanced in 2Q, and the major uncertainty beyond that will be weather in the US. A series of storms like last year could hold the market up through 3Q and into 4Q, but an absence of any weather events could expose US surpluses quite quickly, especially for ethylene and derivatives. The new builds in China have focused on ethylene and polyethylene (and some glycol), propylene and polypropylene, and PTA and PET, and this is where the potential weakness will emerge. There has been some new styrene capacity and that is also a vulnerable segment in our view. PVC, acetic acid, and large parts of the polyurethane chains look much more balanced to us and we have more faith in the projections being made by companies like Celanese, Olin, and Orbia than we do the major polyethylene producers. See today's daily report for more details.

Strong Building Products Demand; Good For PVC

Apr 21, 2021 12:39:13 PM / by Cooley May posted in Chemicals, PVC

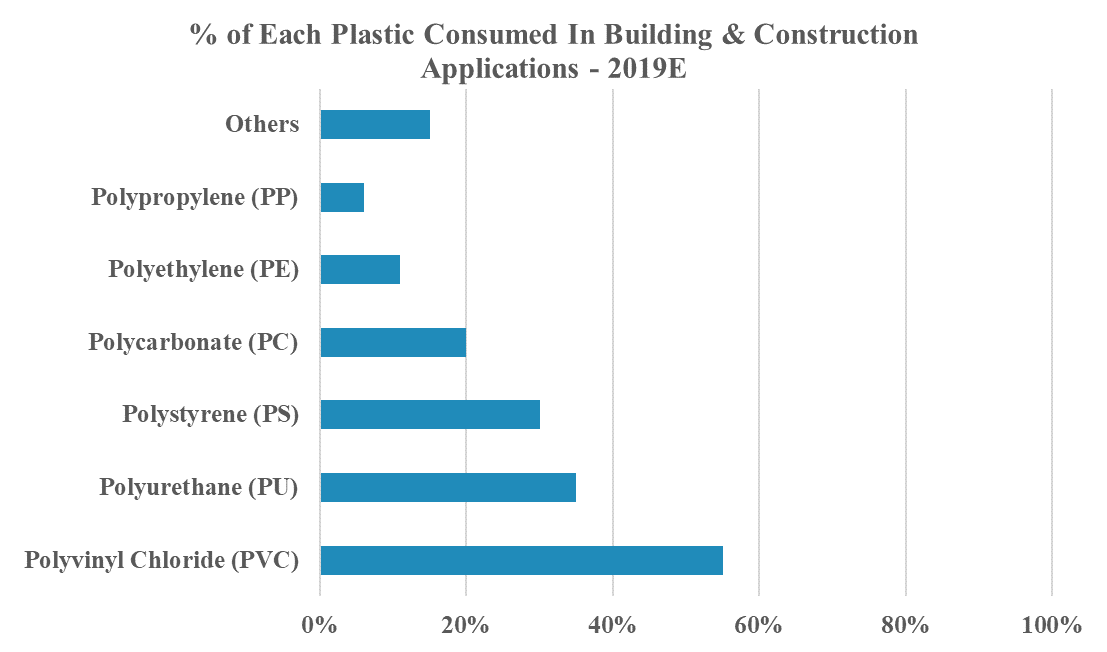

Building products demand remains very strong in the US, but the elevated lumber and PVC prices which appear impressively correlated right now are partly a function of supply chain issues. The housing market remains robust, but the winter storm in the South did damage to plants rather than structures – as opposed to Hurricane Harvey, which had a huge impact on building products. Because the housing market is strong, we are likely seeing speculators accelerate refurbishments to move properties faster, while demand lasts (anecdotally, the speculative renovation pace has picked up dramatically in Houston, where the housing market has bounced back quickly). But supply constraints likely are more of the driver – a random trip to Lowes yesterday found many of the shelves very light or empty in the building materials sections. As the chart below shows, building and construction is more than 50% of PVC demand.

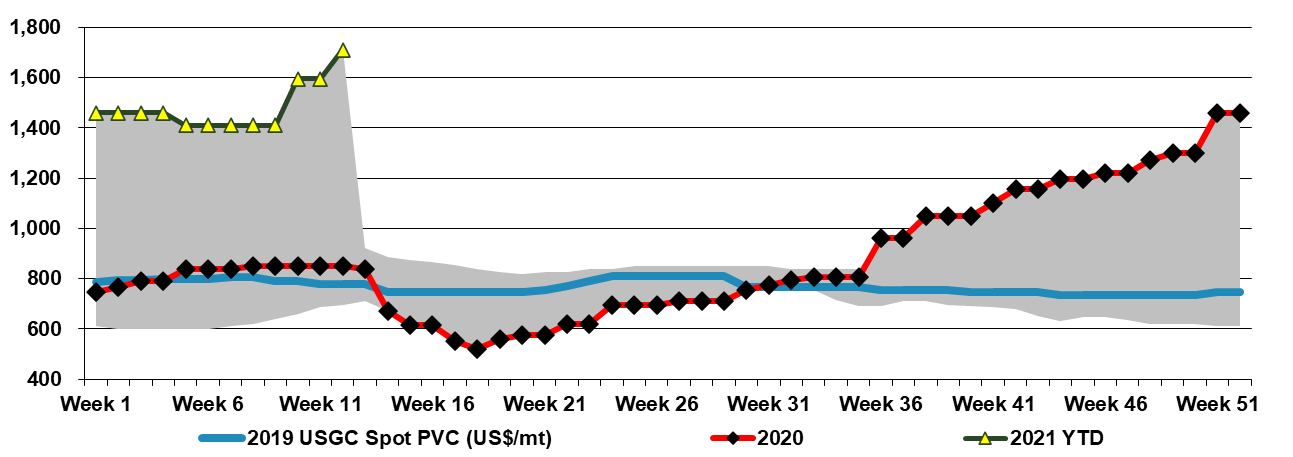

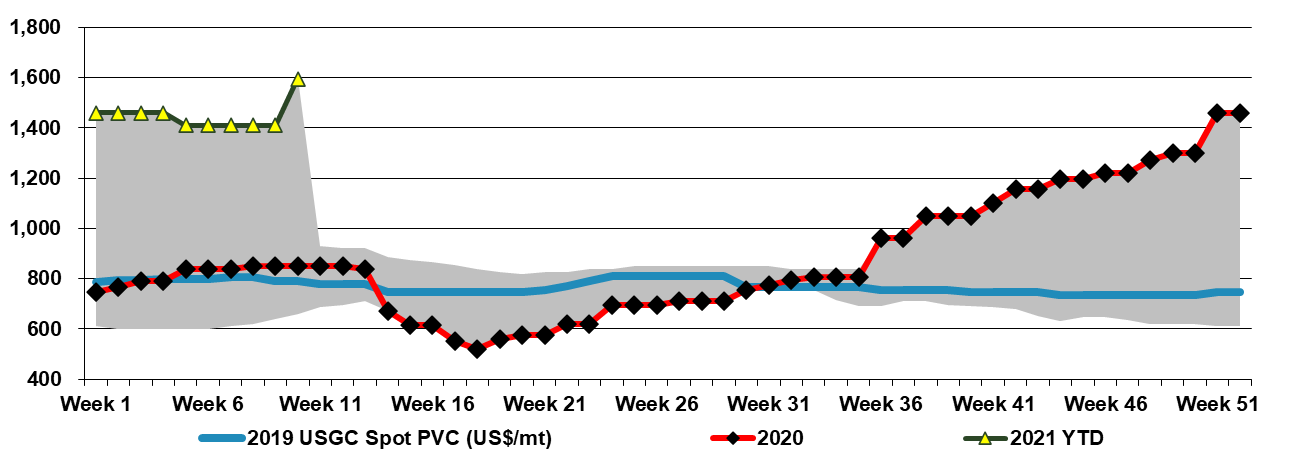

Asia polyvinyl chloride (PVC) prices reflect a five-year low relative to US spot levels, but both price points reflect five-year highs on an absolute basis.

PVC: A Less Volatile But Longer Term Polymer

Mar 9, 2021 10:49:13 AM / by Cooley May posted in Chemicals, PVC

One of the striking conclusions from our Weekly yesterday (charts 41-43) was the steady upward march in PVC pricing in all regions – everywhere is at 5-year highs, the US, Europe, and Asia. While it is very easy to be distracted by the spikes in polyethylene and polypropylene pricing, we believe that these price rises are far more impacted by the spike in consumer durable spending, production outages, and global supply dislocations than PVC, which we have believed for some time has better longer-term fundamentals and will benefit from infrastructure spending increase, while not being materially impacted by a consumer flip from durables to travel.