Our latest Sunday Thematic research report titled, "Reshoring Should Remain Supportive of Chemicals in ’22" studied the investment in US enterprise zones, near and medium-term, and the broad-based benefits for domestic supply chains.

The Need For Manufacturing Support In The US: Enterprise Zones

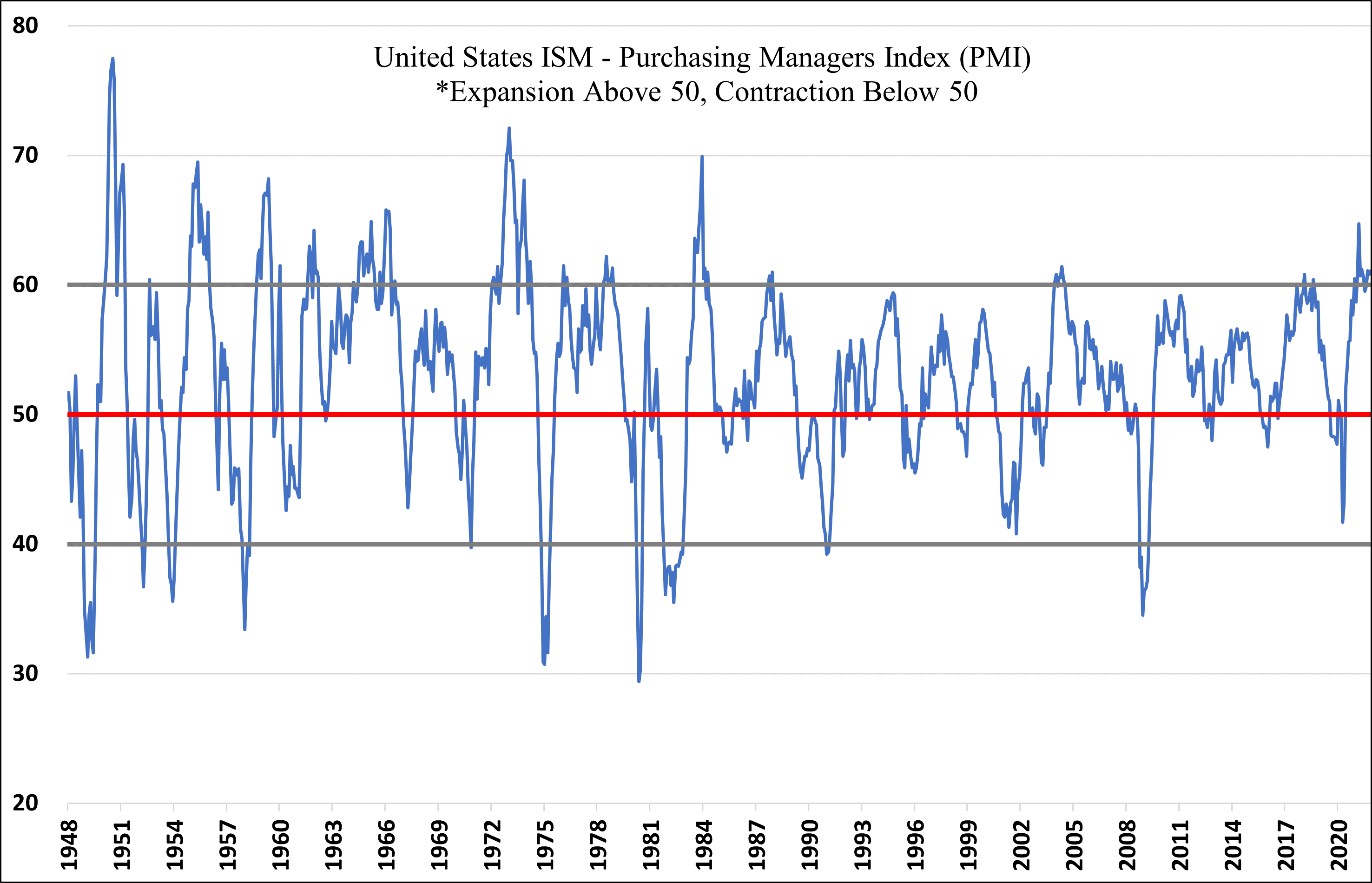

Dec 6, 2021 1:31:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Dow, polymer producers, manufacturing, US polymer prices, COVID, commodity chemicals, chemicalindustry, plasticsindustry, ISM manufacturing, Enterprise Zones, reshoring, capital spending, chemical investments, PMI

Chemical Supply Increases And US Prices Weaken

Nov 19, 2021 12:35:27 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, ExxonMobil, polymer buyers, railcar shipments, Supply Chain, Dow, propane, PDH, ethylene capacity, US polymer prices, US Polymers, propylene prices, energy prices, chemicalindustry, plasticsindustry, spot market, cost arbitrage

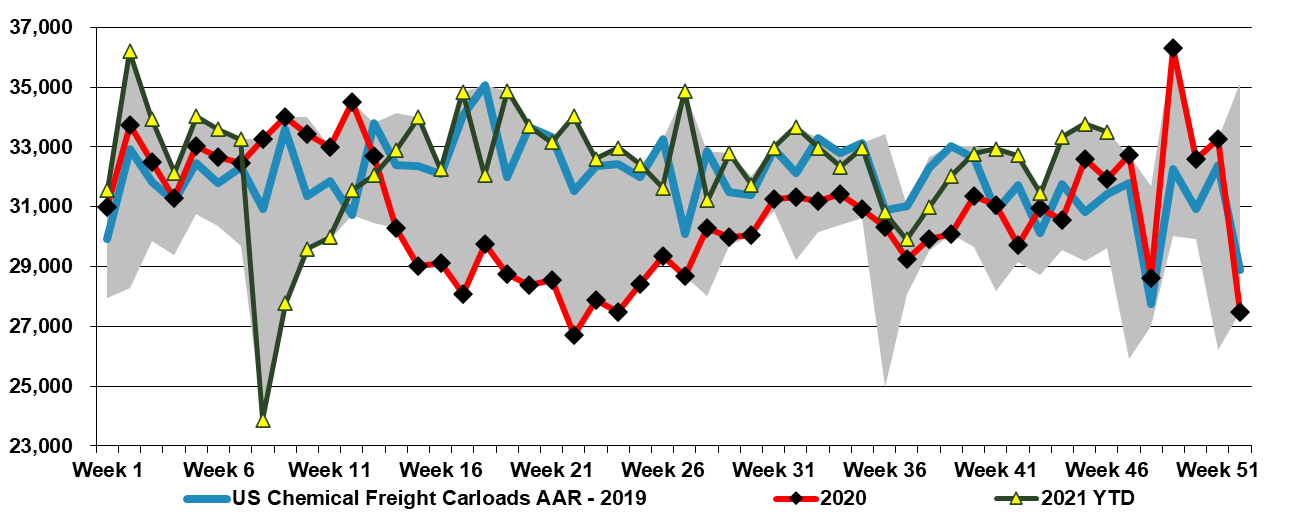

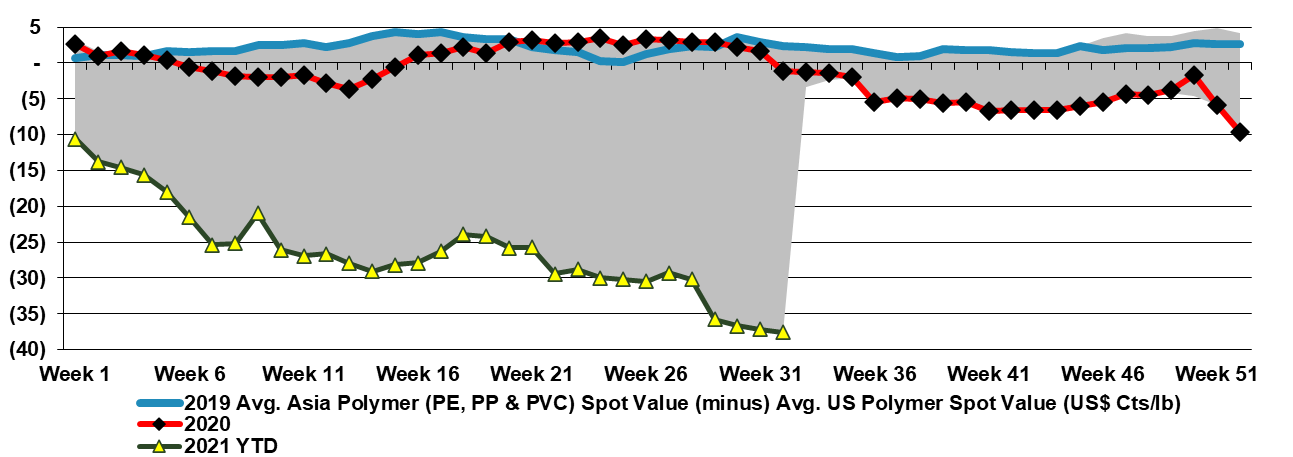

US rail data for chemicals remain at the 5-year highs and have been there for almost 2 months. This is working its way into the supply chain and we are seeing weakness in US polymer prices across the board, except for PVC. US spot polymer prices are in a bit of a “no man's land” right now as they would need to drop significantly to find incremental demand offshore, given US premiums to the rest of the world. We believe that most of the volume leaving the US is doing so within company-specific businesses – ExxonMobil supplying ExxonMobil customers, Dow supplying Dow customers, etc, and consequently, these shipments do not show up in the spot market.

Higher Global Energy Costs - A Real Problem For Most

Oct 12, 2021 3:07:57 PM / by Cooley May posted in Chemicals, Polymers, PVC, Ethylene, Energy, natural gas, Westlake, PVC producer, energy inflation, Occidental, Formosa, Shintech, Olin

With the rapid rise in energy prices, we are seeing price increase announcements for many intermediate chemicals, especially in regions of the world where margins were already very slim. The energy inflation issue is hard to call, with more and more commentators suggesting that it could be prolonged (which generally means it will be short), but lots of dislocations support duration. We would certainly be pushing prices today on the back of energy costs that could move higher again, and given that many chemical and polymer buyers have price protection in their contracts (for at least a month), producers could face a margin squeeze and an uphill climb to get adequate price coverage. Seasonally, demand for chemicals and polymers is at its weakest for the next couple of months, so the price hikes may be difficult. However, because of supply chain constraints, buyers may feel less confident and concede more easily. We could see a significant swing in sentiment from the chemical companies on 3Q earnings calls over the coming weeks as they talk about how good results were in 3Q but throw up all sorts of cautionary statements concerning 4Q.

PVC: The Niche Exposure To Packaging Is Growing Quickly

Sep 16, 2021 3:03:25 PM / by Cooley May posted in Chemicals, Polymers, PVC, Plastics, Pyrolysis, packaging, medical devices

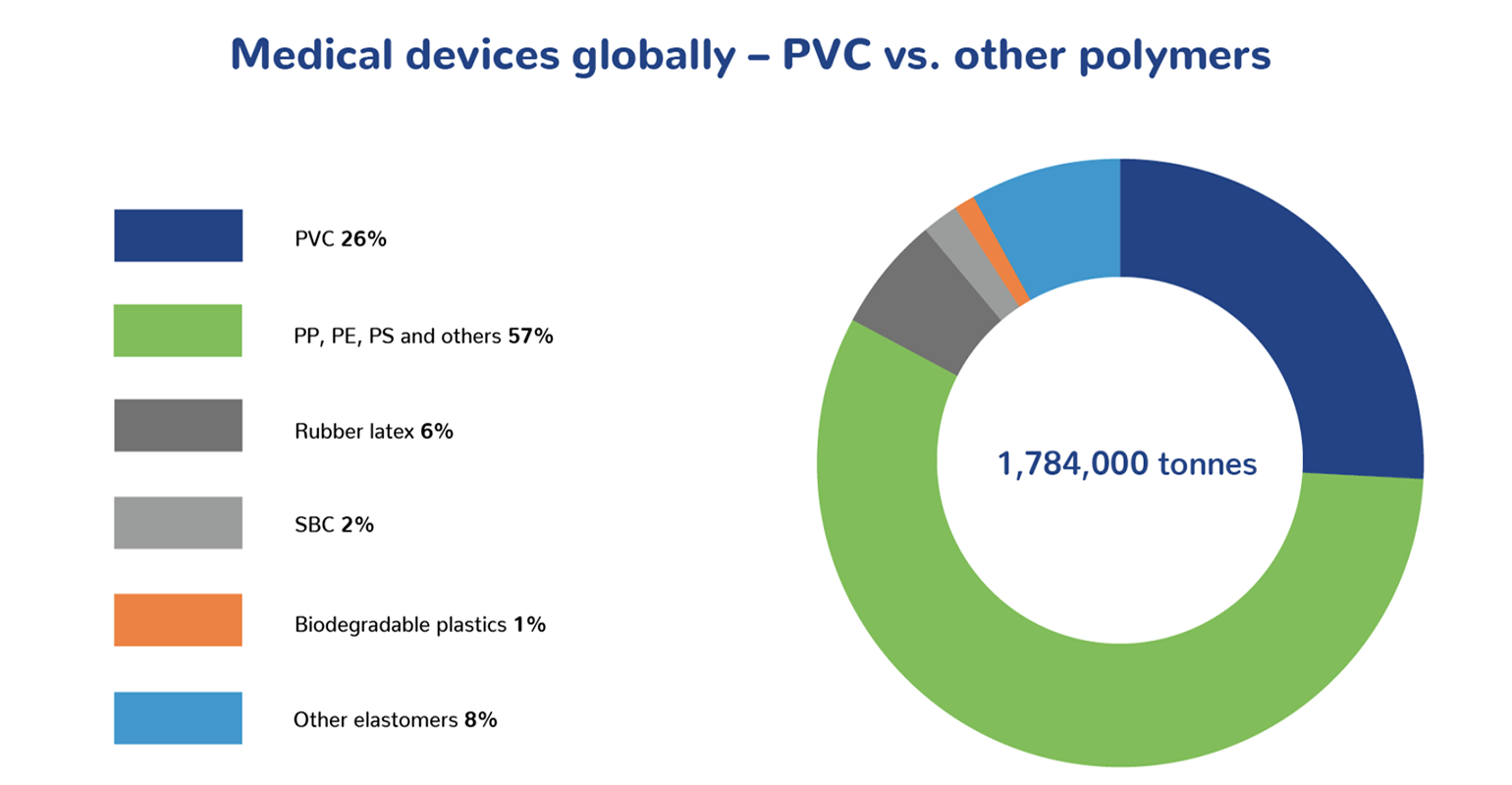

We have talked a lot over the last year about our preference for PVC as likely the better longer-term story within polymers – more stable growth – more limited global investment and less impact from the plastic waste moves, as very little PVC ends up in packaging. The exception is the medical device space, where demand for PVC in single-use applications is growing as illustrated below. While the medical device industry is setting up to use recycled PVC it is going to be hard to close the loop here as medical waste is generally quite contaminated and PVC does not do well in a conventional pyrolysis process because the chlorine molecule is a contaminant. The solution will likely be getting PVC from end-of-life consumer durables and recycling that PVC back into medical applications. Disposal of the medical waste is best done through a pyrolysis or gasification process that includes very high-temperature plasma technology. These facilities exist and operate well outside of the US, and we would expect to see broader acceptance within the US over time. See more in today's daily.

More Examples Emerge Of US Chemical/Polymer Market Tightness Post Ida

Sep 3, 2021 1:18:43 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, PVC, US Polymer, Ethylene, US Chemicals, olefins, US polyethylene, Hurricane Ida, Chemical pricing, ethylene prices

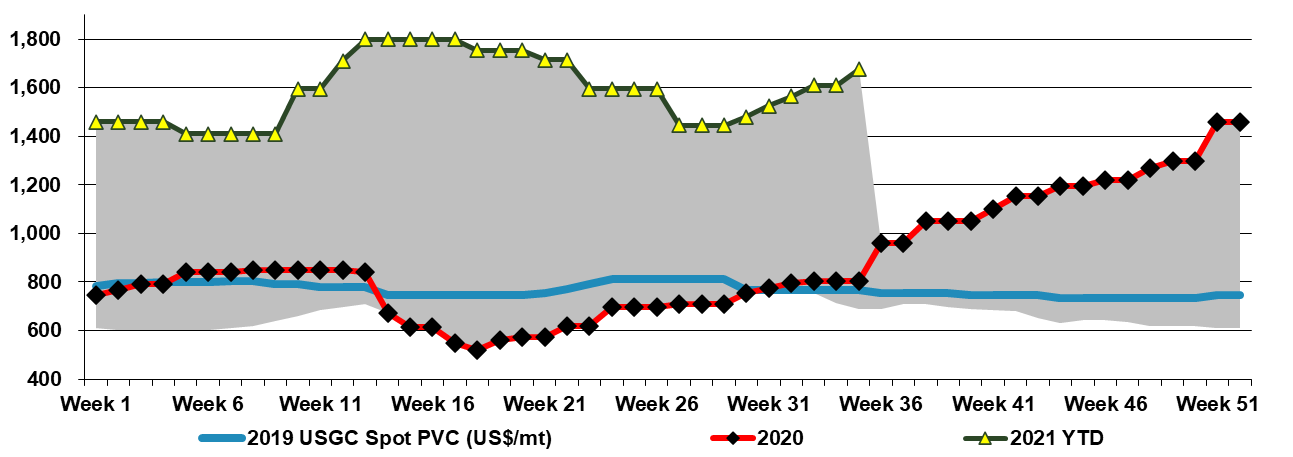

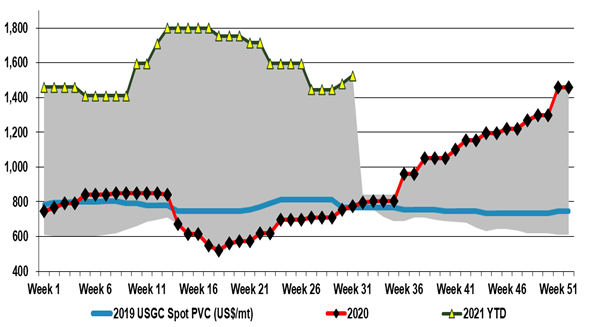

It is increasingly likely that Hurricane Ida will add another leg of strength to US chemical pricing more broadly, with a host of prolonged production outage news and force majeure notices, giving momentum to some price increase announcements for September, some of which looked very speculative at the time they were made. Buyers will have an eye on continued pockets of supply chain disruption, strong demand in general, particularly for those levered to holiday spending, and the not insignificant fact that we still have almost three months of hurricane season to go! Note that two of the more disruptive storms of 2020 hit in October. We talk specifically about PVC in today's daily - See price chart below.

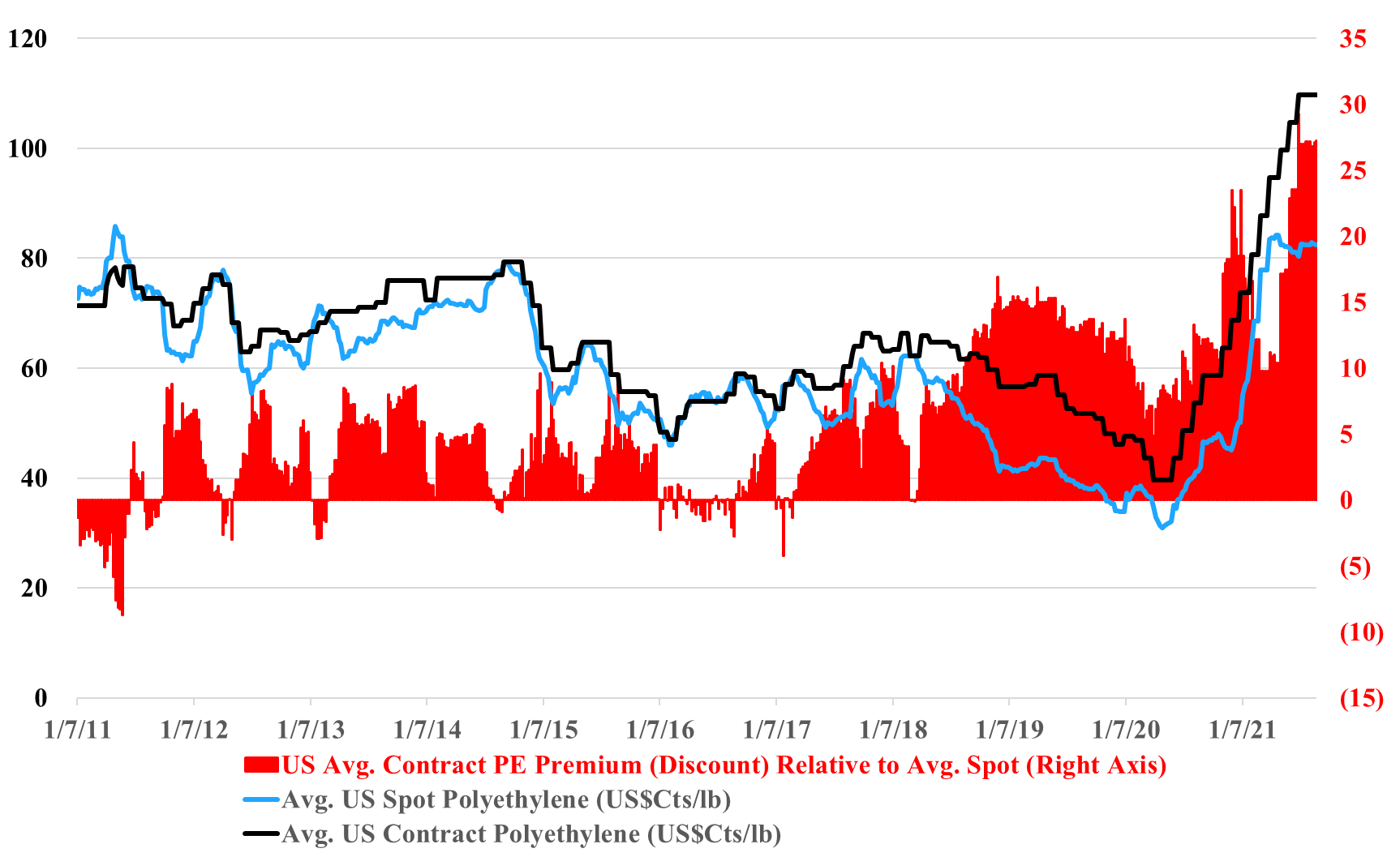

US Polyethylene Prices Reflect Support, In Part Due To High Freight Rates

Aug 31, 2021 2:31:51 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Ammonia, PE, freight, Polyethylene prices, US Polymers, container freight rates, US polyethylene, spot price, Hurricane Ida, distribution

We discuss recent historic highs reached in China to US container freight rates in our daily research today, and (absent Ida) we note that freight charges remain a major component in favor of US polymer price support. With current container rates so high, it is difficult for US consumers to get access to cheaper material from Asia, even if they are willing to try the untested grades in their equipment. Absent the freight extremes today, we would be much more definitive in declaring that the US's record spot/contract polyethylene price difference was unsustainable and would be corrected quickly. While there appear to be some surpluses of US polyethylene today, such that producers are testing the incremental export market, the same producers can hide behind the freight barrier as they make arguments to support domestic pricing. Some US buyers may be getting pricing relief because they have price mechanisms that partly reflect the spot price. It is also possible that large buyer discounts have risen through this period of very high pricing (this has happened before).

High Transportation Costs Supportive Of Unusual Regional Price Shifts

Aug 13, 2021 11:46:48 AM / by Cooley May posted in Chemicals, Polymers, PVC, Lumber, freight, transportation

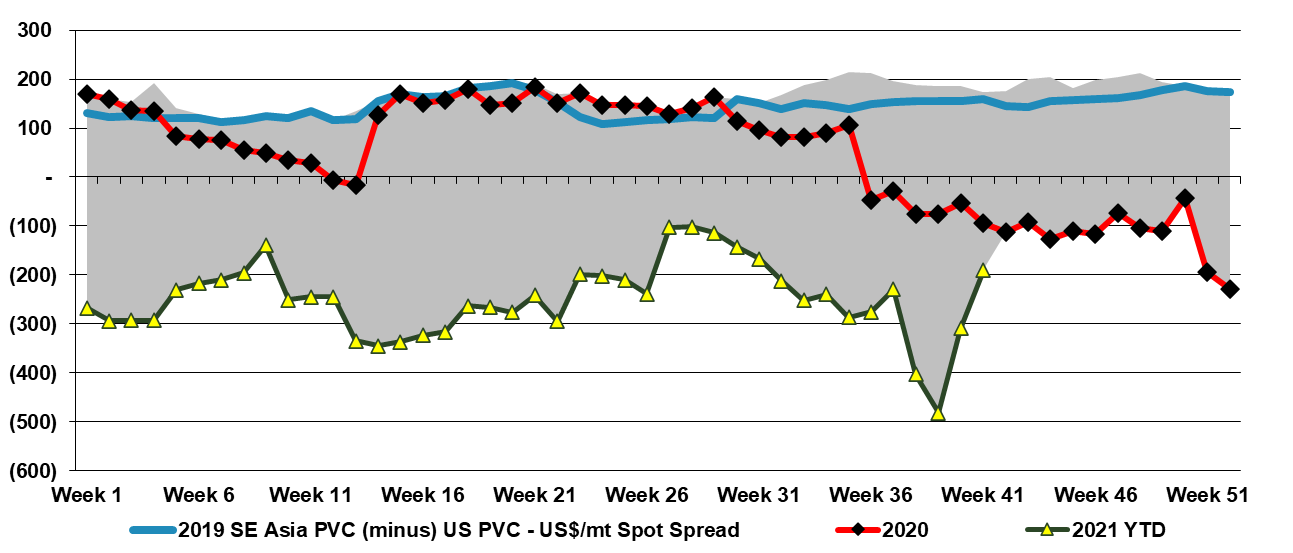

The regional polymer price chart below shows the extreme divergence of prices between the US and Asia, and it has hit a level that has never been reached before. It is in part a function of the wave of new capacity that hit China in 2H 2020 and 1H 2021, which spurred oversupply in some chains, and the dysfunctional global trade backdrop that has kept global supply chains out of balance. As we noted earlier this week, the container costs alone to move polymers from Asia to the US are, best case, 34 cents per pound today, and this is estimate does not include the cost of moving the product to a port in China or from one in the US and also does not include a working capital charge for the time in transit. There would need to be an arbitrage of 10-15 cents a pound above this to make product movements between these regions worthwhile, assuming you can find a buyer in the US willing to experiment with imported products. The other trade impact is that US retailers and manufacturers are pulling on their US suppliers to maximize supply, pushing domestic demand for polymers above trend. The lumber price moves in the US – Exhibit 1 in today's daily report – if they spur incremental home building, it will be another boost for domestic PVC demand.

PVC: Still Our Preferred Polymer

Aug 5, 2021 1:19:46 PM / by Cooley May posted in Polymers, Polyolefins, PVC, housing demand, water infrastructure

We are seeing some of the same dynamics in PVC that have been prevalent in polyolefins this year with some weakness in Asia – although not as much as we are seeing for polyolefins - while markets in the US and Europe are finding enough support for prices to go back up again. As with other polymers, any possible arbitrage between Asia pricing and the West is quickly consumed by the higher container rates. PVC has seen less capacity added over the last few years compared to other polymers and while it has not seen much of a boost from the change in consumer spending patterns around packaged goods and durables (as it has more limited exposure to packaging and durables), it has benefited from strong housing demand and some initial infrastructure spending – with more to come around the globe. The blue sky scenario for PVC would be one in which some of the growing clean water issues that are emerging in many parts of the world move more to the front burner as PVC would be a major beneficiary on investments in desalination for example or simply from water infrastructure upgrades.

PVC: Some Signs Of Weakening Near Term, But Still Better Positioned Than Most Peer Polymers Long Term, In Our View

Jul 15, 2021 2:01:06 PM / by Cooley May posted in Chemicals, PVC, Ethylene, PVC price, chlorine, EDC

Regional PVC price movements are interesting as the World is trying to find balance. Incremental ethylene and chlorine economics in Asia pushed the local spot prices for EDC so low as to shut out US EDC exports – the net result has been more PVC production in the US and a decline in US spot prices. While it is likely that the Asia incremental pricing will improve as some sellers will be losing money and may need to cut back rates, the US will not enjoy a better export market without the acceptance of much lower netbacks, which will maintain negative pressure on domestic prices. That said, PVC is very levered to economic, construction, and housing investment in Asia and there is likely some pent-up COVID-related demand in the region – the oversupplied market may not last for long. We still see a better medium-term outlook for PVC than for other major polymers. There's more detail and coverage on today's daily report linked here.

PVC Off Its Peak, But It's Long Term Outlook Remains Compelling

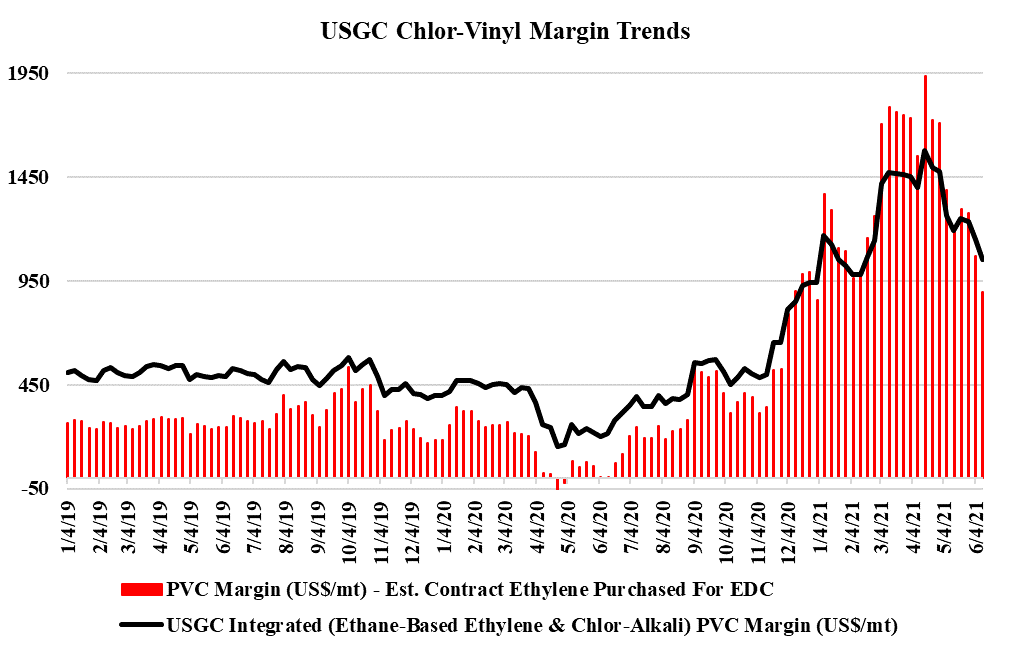

Jun 16, 2021 2:04:55 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Oil, PVC Margins, US Ethane

PVC margins are off their highs, as pricing is falling through June. The building product markets remain robust in our view, albeit off their highs, and some of the strength in PVC in April and May was a consequence of production shortages caused by the winter freeze in February. While PVC may be falling faster than polyethylene today, we see support for US PVC at higher prices and margins than for polyethylene in a weaker market unless oil climbs further relative to US ethane. See more on our daily report.