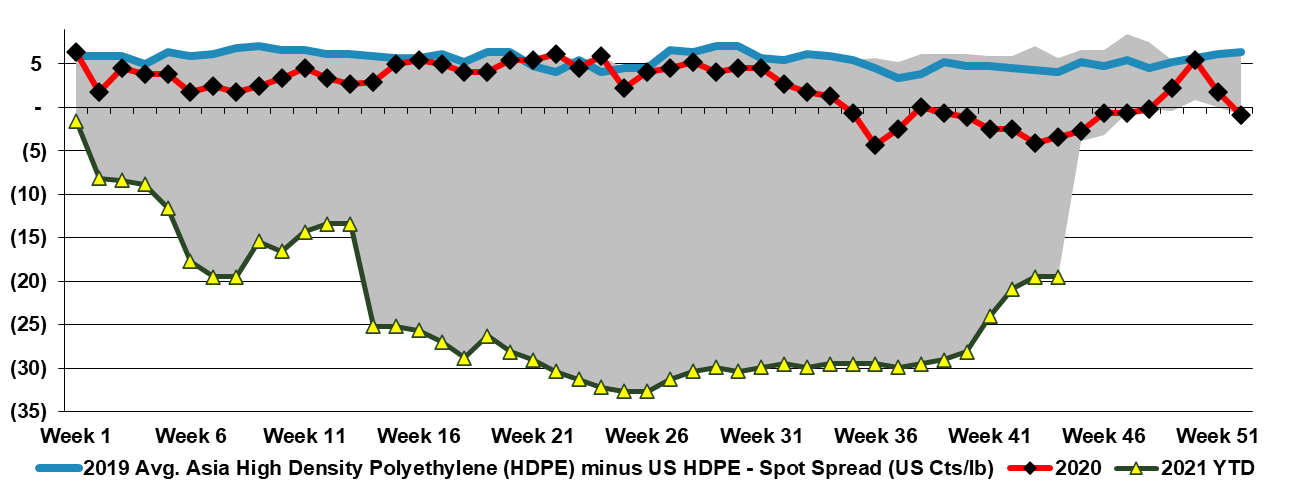

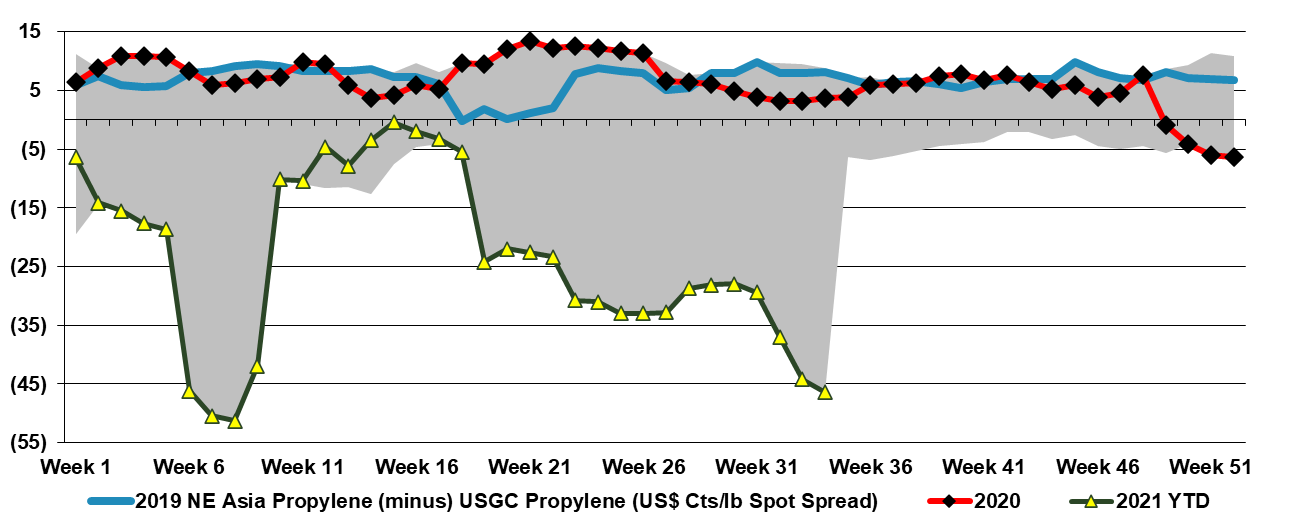

While we are beginning to see some easing in US polyolefin prices we note in today's daily that prices are not falling in step with monomers and so spreads are widening. Because of the very integrated nature of the polyethylene market, we see swings in where the margin is being captured based on relative tightness and today it is squarely biased towards polyethylene in the US. Despite the polymer price declines in the US we maintain a level of pricing that is well above Asia – Exhibit below, but not high enough to attract imports, given the high container rates and the long lead times on shipping. The same is not true for polypropylene, which maintains a spread versus Asia that can cover the very high current costs of transport (bottom exhibit).

US Polymers Continue To Test Relative Limits

Nov 5, 2021 3:23:23 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, Polyethylene, Polypropylene, HDPE, US Polymers, demand

US Polyethylene Prices Reflect Support, In Part Due To High Freight Rates

Aug 31, 2021 2:31:51 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Ammonia, PE, freight, Polyethylene prices, US Polymers, container freight rates, US polyethylene, spot price, Hurricane Ida, distribution

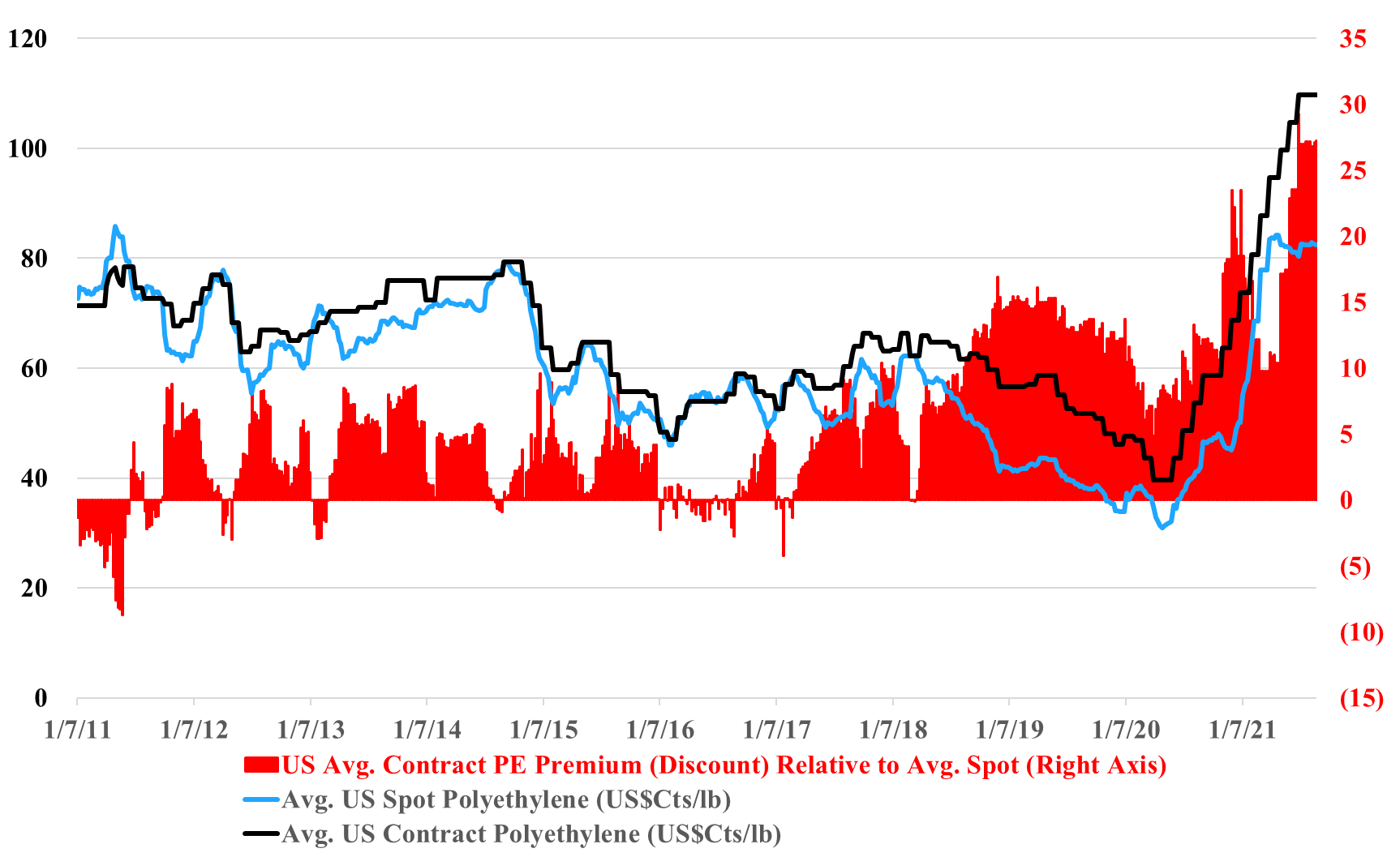

We discuss recent historic highs reached in China to US container freight rates in our daily research today, and (absent Ida) we note that freight charges remain a major component in favor of US polymer price support. With current container rates so high, it is difficult for US consumers to get access to cheaper material from Asia, even if they are willing to try the untested grades in their equipment. Absent the freight extremes today, we would be much more definitive in declaring that the US's record spot/contract polyethylene price difference was unsustainable and would be corrected quickly. While there appear to be some surpluses of US polyethylene today, such that producers are testing the incremental export market, the same producers can hide behind the freight barrier as they make arguments to support domestic pricing. Some US buyers may be getting pricing relief because they have price mechanisms that partly reflect the spot price. It is also possible that large buyer discounts have risen through this period of very high pricing (this has happened before).

The Tale Of Two Regions: Asia Loose, US Tight

Aug 26, 2021 12:49:40 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, Propylene, Styrene, PET, Surplus, polymer producers, US Polymers

China trade data for chemicals and polymers points to a dramatic swing in net imports, partly due to the new capacity added over the last 12 months. Imports are down, and exports are up. Despite the logistic challenges of moving the products and the powerful pull on consumer durables from China driven by US and European demand – much of which consume significant volumes of polymers and chemicals locally. The trade swings talk to the significant capacity additions and the relatively sluggish consumer within China, where spending patterns remain subdued because of the Pandemic. Even with a recovery in domestic spending, China has probably added 2 to 3 years of demand growth in current capacity adds – most notably for polyolefins and PET, but also for styrene, where we believe demand growth could be slowing. If logistics improve and container rates come down, the surpluses in China will have a severe negative impact on international prices. This development will likely be seen in either polymer quantities flowing faster/more freely around the globe or because the export rate of consumer durables will pick up even further at the expense of durable producers in the US and Europe.

US Polymers: Are The First Cracks Appearing?

Aug 25, 2021 1:42:34 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Ethylene, HDPE, derivatives, ethane feed, US Polymers, LLDPE, LDPE

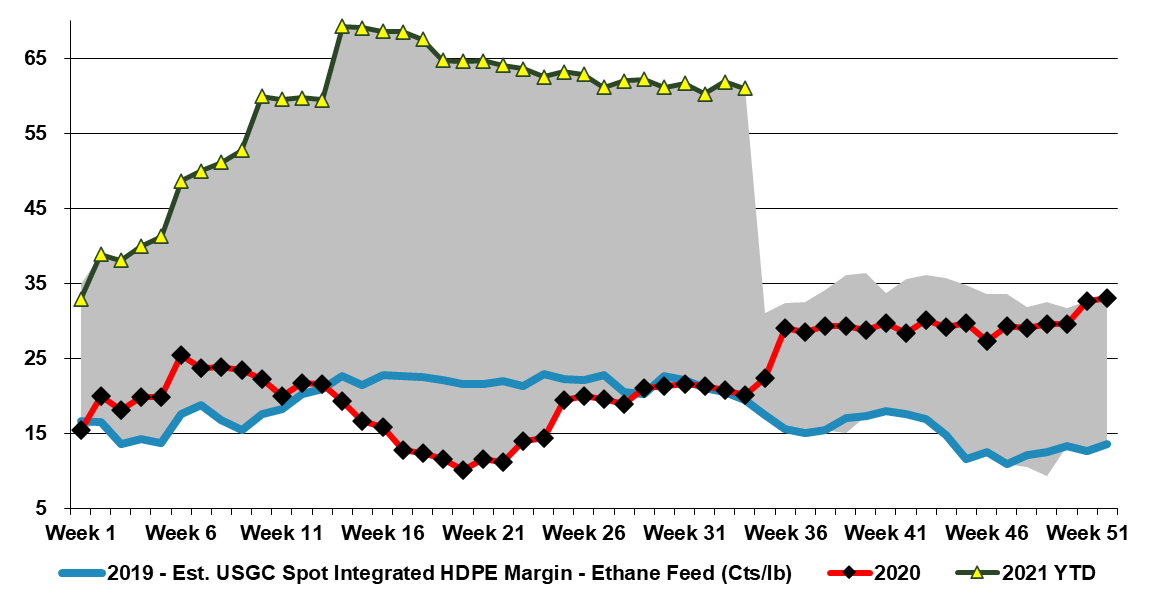

Is this the beginning of the end? The linked report that US traders are struggling to find export homes for incremental HDPE should not be a surprise given the significant price difference between the US domestic price and prices in other markets – Exhibit 1 in today's daily report. HDPE is the more fungible polyethylene, with both LLDPE and LDPE much more grade and application-specific. It is often the first polyethylene grade to spike in a shortage and fall when there is a surplus.

Price Support From High Shipping Costs & Outages

Aug 11, 2021 2:17:47 PM / by Cooley May posted in Chemicals, Polyethylene, feedstock, PE, Asia ethylene, naphtha, ethylene costs, Asia polyethylene, US polymer prices, US propylene, ethylene feedstock, shipping, PE prices, US Polymers, shipping costs

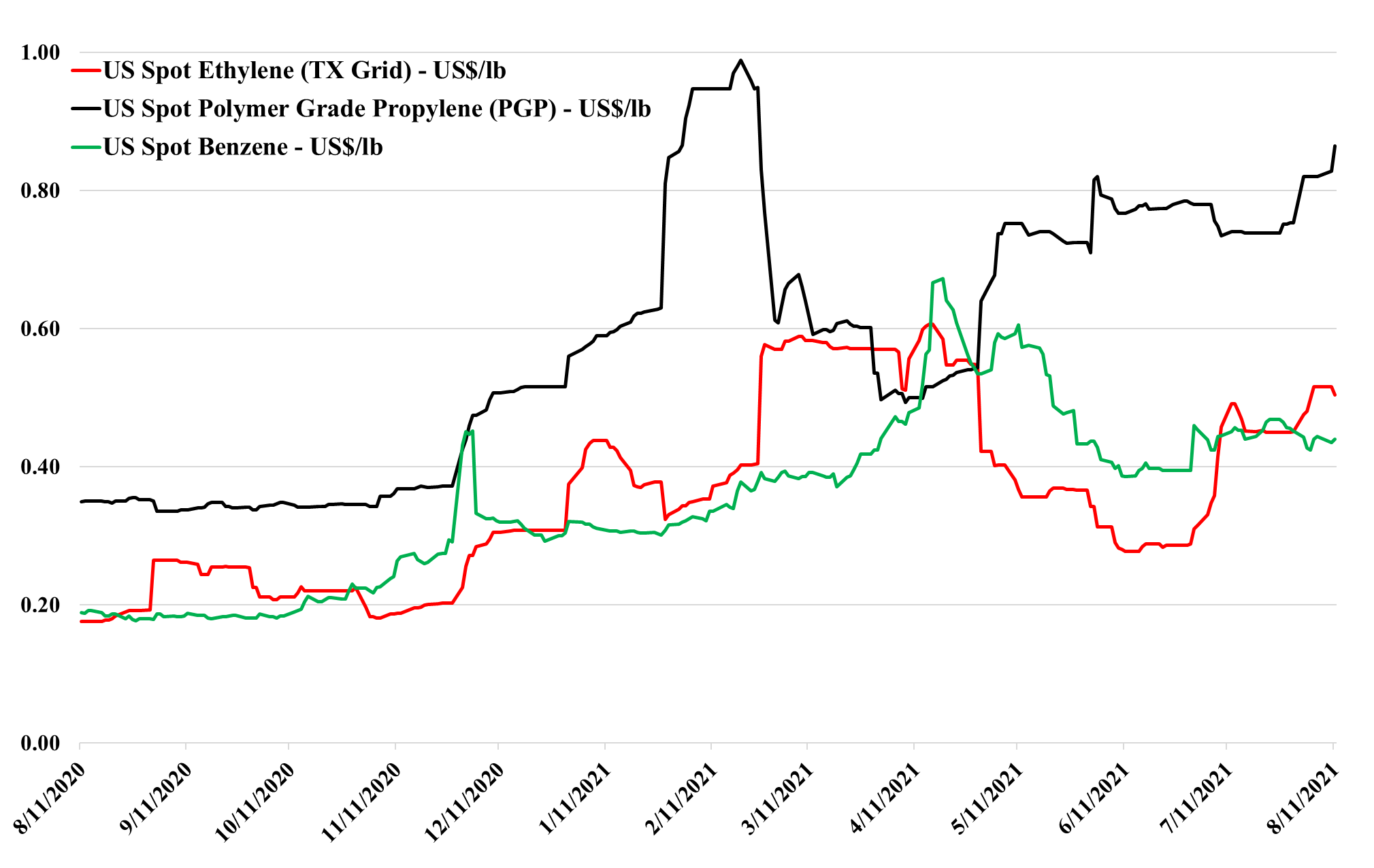

To put some perspective around the shipping container costs shown in Exhibit 1 of our daily report today, $20,000 per container equates to roughly 34 cents per pound of cargo assuming that the container is filled to maximum weight. If we also add in loading inefficiencies and assume 500 miles of road transport in the US or Europe, we can add another 5-10 cents per pound. Using ethylene costs in Asia at roughly 43 cents per pound as a basic benchmark (see our most recent weekly catalyst report), we thus estimate that it would cost around 90 cents per pound to get Asia polyethylene into the US. This does not include any working capital cost assumptions around ownership of the cargo from point of production to point of use. US spot PE prices are currently below 80 cents per pound for the more commodity grades of polyethylene, which is the market that could most easily be targeted by imports from Asia. When container rates were closer to $3000 per unit, the all-in import costs would have been roughly 30 cents per pound lower and the arbitrage would have been worth exploring. Of course, if the freight rate was only $3000 per container US polymer prices would likely be lower.