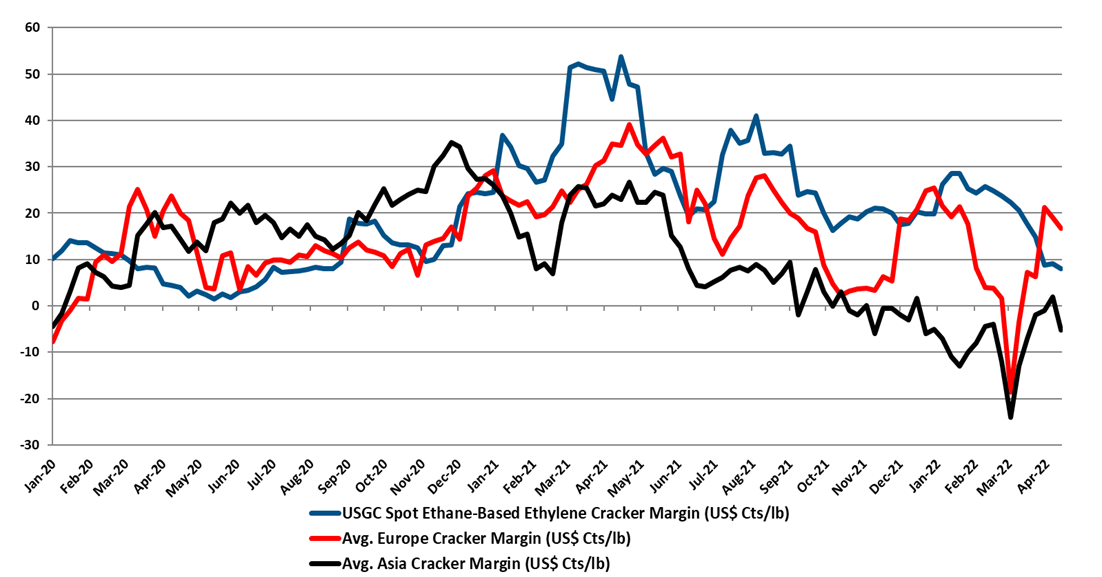

We note the polyethylene price nominations in the US, timed by some to coincide with earnings releases this week and next, and would remind clients that there is always price momentum in commodities, one way or another. In our view, the price increase moves aim to maintain directional momentum (upwards) while giving the polymer producers some cover should natural gas prices spike further. US ethane prices are now tracking natural gas more closely and have moved up meaningfully over the last few weeks, and US ethane-based ethylene margins have fallen around 80% since the start of the year, with at least half of that coming from cost increases. All polyethylene producers are integrated back to ethylene, and the price nominations will be attempts to recoup some of the cost increases. This is against a backdrop of still very strong polyethylene margins in the US, which although way off their 2021 highs remain much higher than in 2019 and 2020 and the longer-term average. This is covered in our Weekly Catalyst report each Monday. Ethylene margins are summarized in exhibit below and the chart shows the impact of higher costs in the US and falling spot ethylene prices as the US now has more surplus ethylene capacity and is looking for export homes for ethylene and easy to ship derivatives. As we have noted before, the jump in margins in Europe and Asia is because of extreme volatility in naphtha markets over the last couple of weeks. We would expect margins to be lower next week based on naphtha moves this week.

US Chemicals: Some Signs Of Continued Strength, But Mostly Lagging Indicators

Apr 20, 2022 2:33:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Polyurethane, Inflation, US Chemicals, ethane, natural gas, naphtha, polymer, US polyethylene, MDI

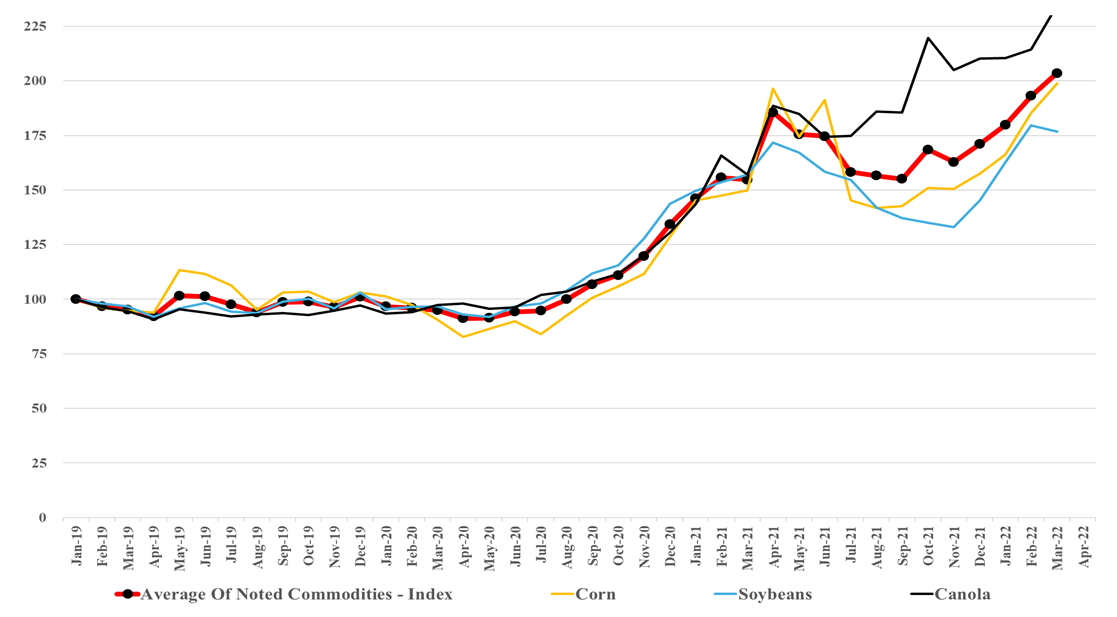

If We Make Chemicals Out Of Crops, What Happens To The Prices Below?

Apr 19, 2022 1:45:16 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, Supply Chain, renewables, naphtha, materials, crude oil, gasoline, renewable fuels, Corn, crops, food chain

In our ESG and Climate report tomorrow, we are focusing on renewable materials and fuels, emphasizing counting carbon and the importance of verification and auditing. However, one of the side issues concerning renewables is their impact on food prices if they bid crops away from the food chain. The chart of the day from our daily chemical reactions report shows that corn prices are above their historical correlation with crude oil, but it also indicates a correlation and fuel markets can pay more for corn and other crop-based fuels when oil prices are high. The issue with exhibit below is that we already have inflated crop prices with minimal incremental demand for the fuel markets today. Prices are rising on strong global demand growth for food – supply chain issues that existed before the Ukraine crisis and – the supply challenges that are a direct consequence of the Ukraine crisis. This is before any significant investment in renewable fuels or materials. As governments implement policies to encourage renewable fuels – especially SAF – they need to consider what policies and incentives might be required in addition to price, encourage meaningful changes to the acres planted around the world, and help productivity where it is low.

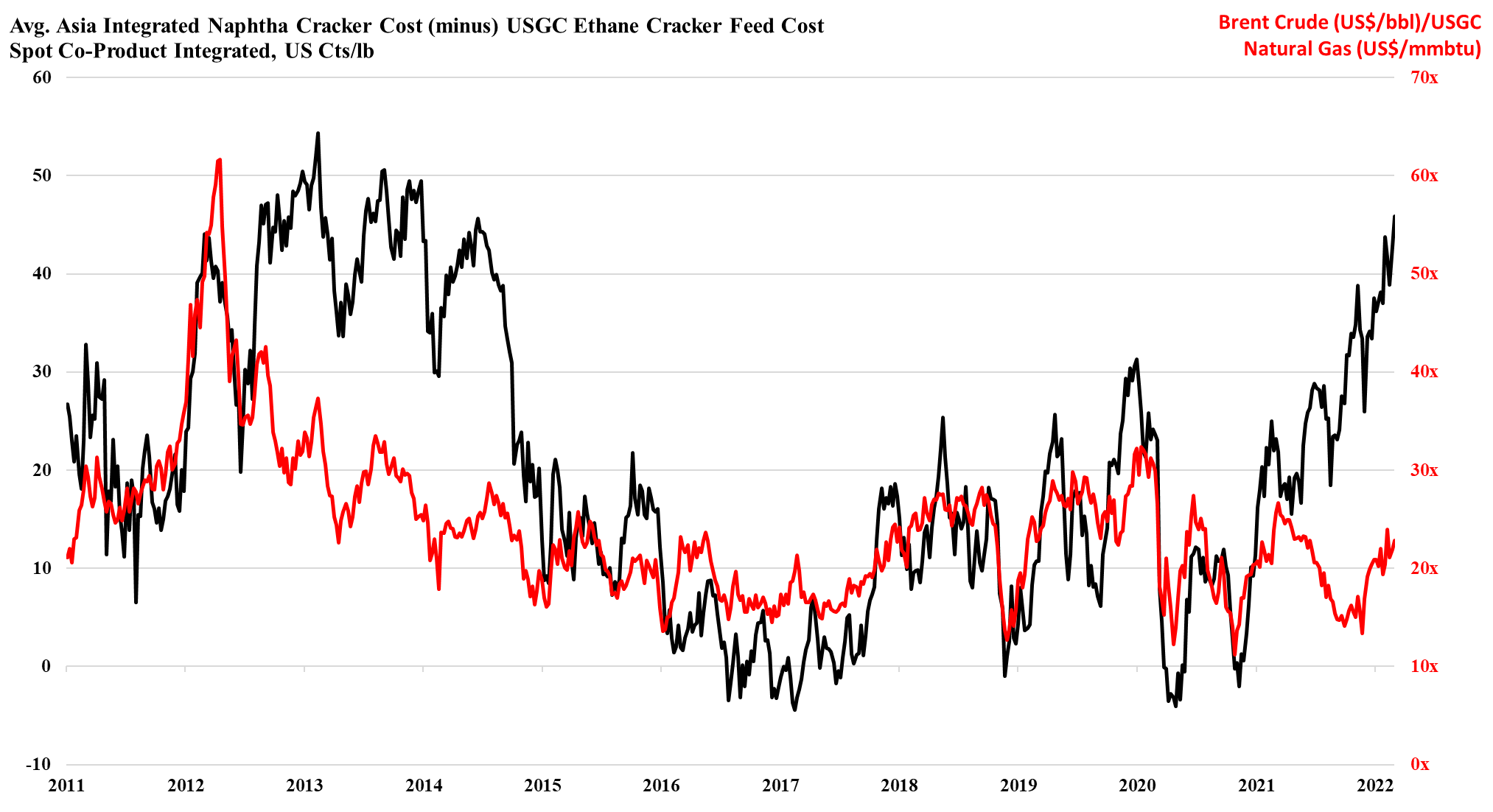

The US Cost Advantage Is Increasing Daily

Mar 4, 2022 1:59:01 PM / by Cooley May posted in Chemicals, LNG, Polyethylene, Ethylene, Inflation, Supply Chain, natural gas, US ethylene, naphtha, US natural gas, crude oil, Brent Crude, cost advantage

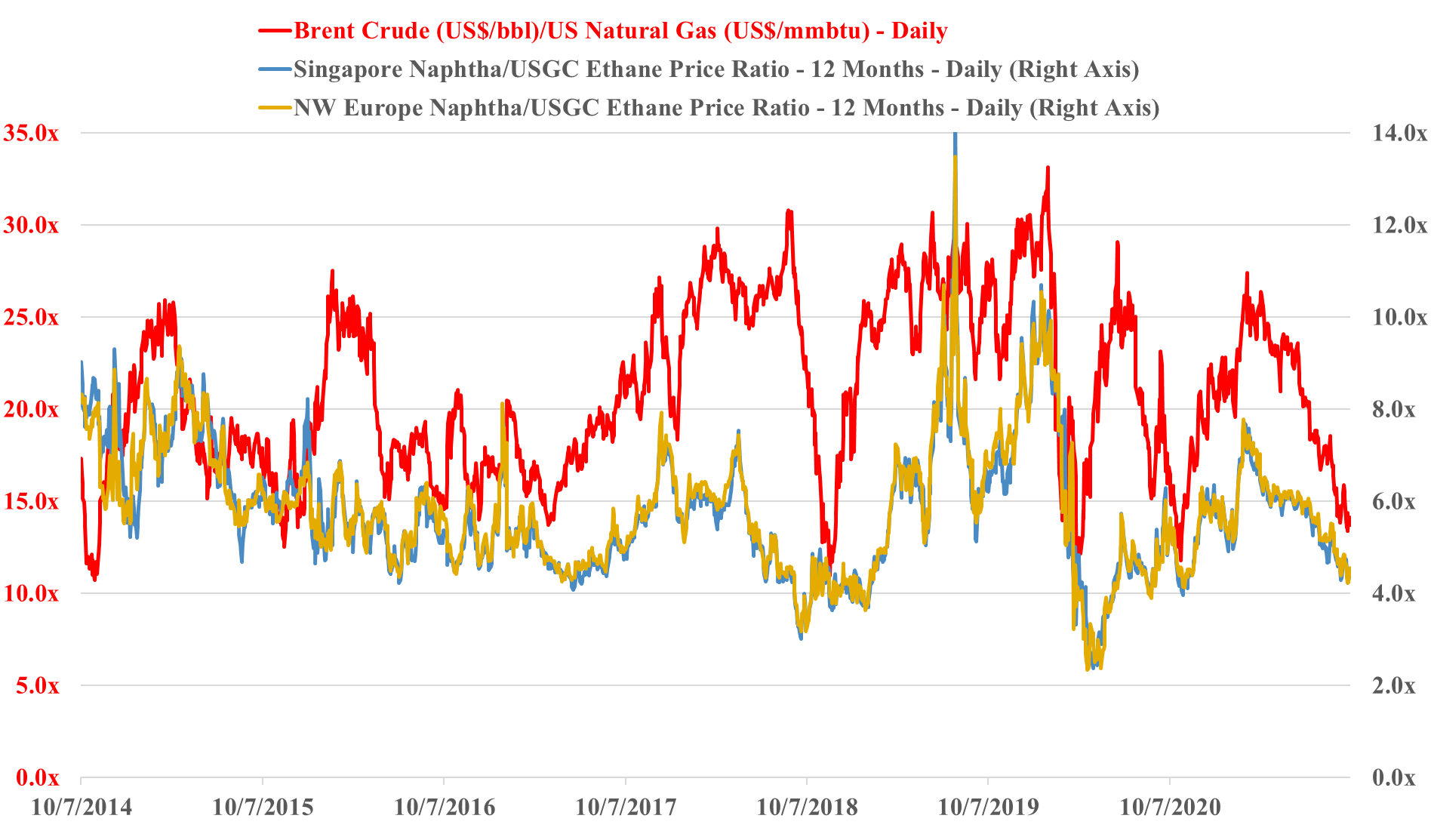

As the ratio of pricing between Brent crude and US natural gas rises, the US ethylene cost advantage is spiking, and as long as the US is producing enough natural gas to feed domestic demand and allow the LNG facilities to run at capacity, the advantage can remain. This gives the US a significant cost advantage and assuming that there is spare capacity the US industry can step up and support Europe if needed. However, it is not clear that there is much spare capacity, either in the production units or in the logistics to get the product to ports or across the Atlantic. There is a surplus of liquid and gas carriers today, but the container problems are global and the inflation and supply chain issues that we seem to be stuck with are likely to keep containers tied up in excess inventory that consumers will want to keep building as a cushion for a less certain supply outlook. The shipping issues are only part of the problem for Asia, as even with better opportunities to export, the region is seeing escalating production costs because of the movement in crude oil and naphtha pricing. We are in an unusual position where strong demand in the US is keeping domestic prices higher than in Asia, despite costs in the US that are low enough, especially for polyethylene to move material to Asia at costs well below the cost of manufacture in Asia. This dynamic can last for a lot longer in our view as long as oil prices remain elevated versus US natural gas. An abrupt turn will occur if US natural gas production falls below domestic demand and LNG demand – this would cause a spike in US natural gas prices. For more see today's daily report.

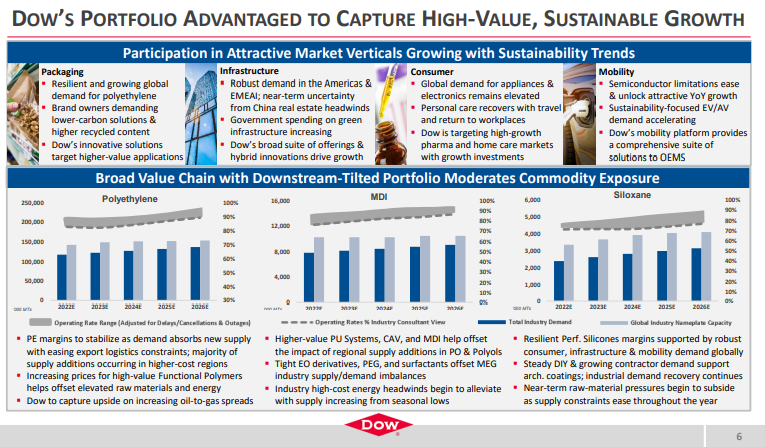

Expectations From Dow Supportive Of Our Mega-Cycle Thesis

Jan 27, 2022 11:50:52 AM / by Cooley May posted in Chemicals, LNG, CCS, CO2, Ethylene, Chemical Industry, decarbonization, Dow, naphtha, CO2 footprint, ethylene production, oil prices, mega-cycle, Alberta

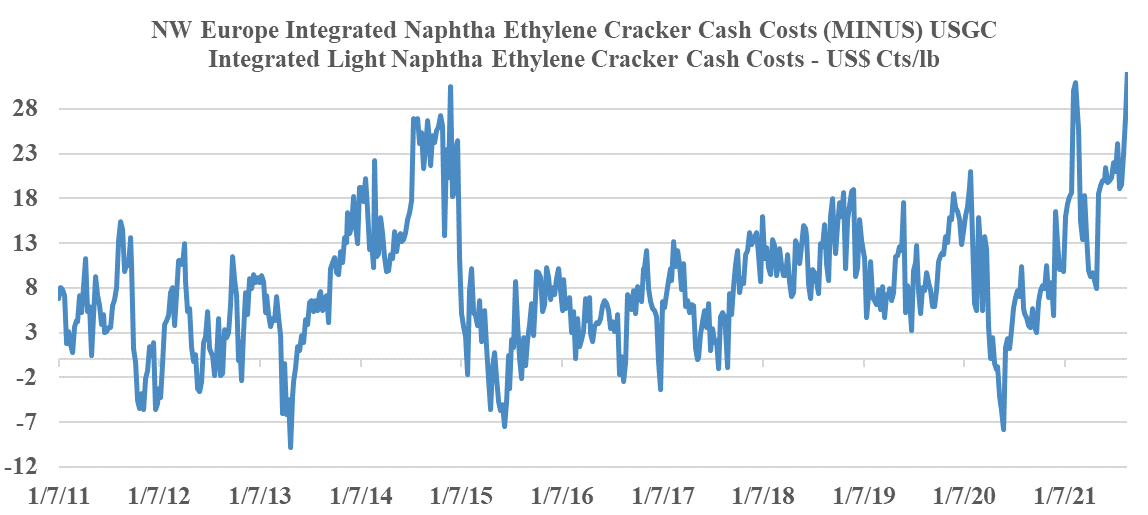

While it might be tempting (and perhaps easier) to focus on the negatives in the Dow earnings release – such as price declines in polyethylene and higher costs in Asia, we think it is much more interesting to focus on the positives. For a while now we have been suggesting that the industry is gearing up for a mega-cycle of profitability, perhaps as early as 2024 – see report – and we see nothing in the current macro environment or in Dow’s release to suggest we might be wrong. Demand growth is very robust across the industry, with consumer spending driving some quite impressive GDP growth numbers in the US in 4Q 2021, as an example. We often see companies suggest improving global operating rates in earnings calls, and while it is mostly hopeful and self-serving, the chart below, from Dow’s report may be conservative. The very high ratio of Asia costs versus US costs in the 2012 to 2014 period (second image below), because of high oil prices, effectively shutdown new naphtha based ethylene investment in Asia for several years and it is what prompted China’s move into coal-based and methanol chemicals (China has almost no ethylene capacity from methanol or coal in 2011, but close to 6 million tons by 2016). As the price of oil rises and the cost curve works against China and the rest of Asia again, the move to more coal is less attractive because of the environmental footprint – coal gasification creates a lot of CO2 emissions and elaborates CCS investment would be needed to justify further expansions, which increases the cost of ethylene production.

US Competitive Advantage Pushing Ethylene Exports

Dec 1, 2021 12:43:50 PM / by Cooley May posted in Chemicals, Ethylene, petrochemicals, propane, arbitrage, ethylene producers, Ethylene Surplus, US ethylene, manufacturing, naphtha, ethylene exports, exports, chemicalindustry, ethane imports, petrochemicalindustry, Navigator Gas

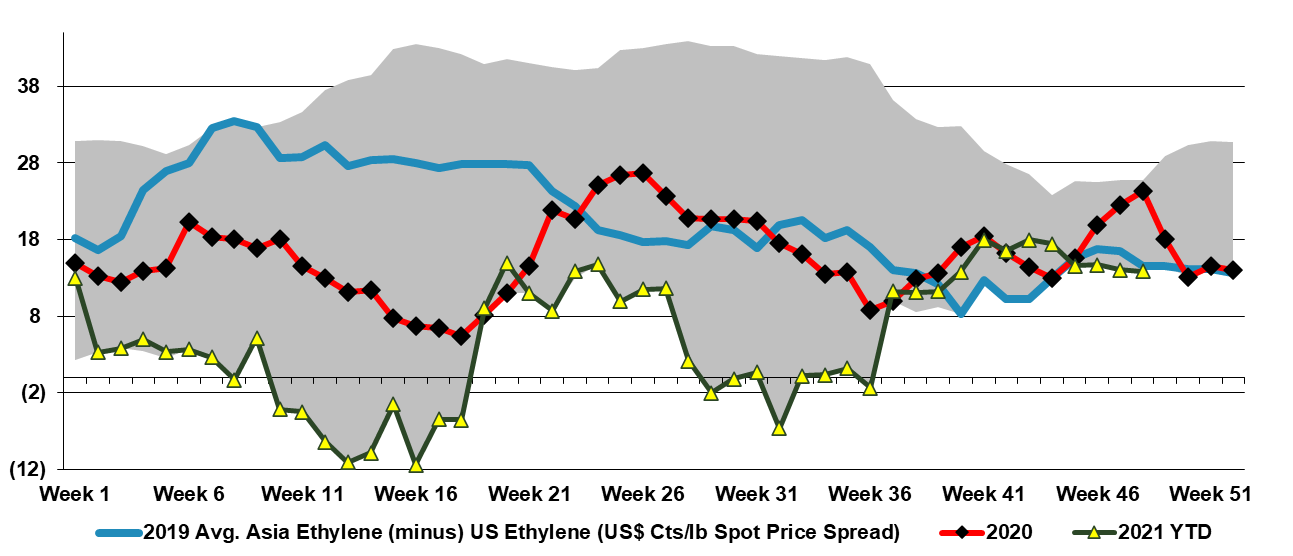

The Navigator Gas announcement should not be a surprise as the ethylene export arbitrage reopened in the US in September (Exhibit below) and since the terminal opened there has been a demand for ethylene exports each time the numbers have made sense. There are ethylene consumers in Asia that are net short and will buy incremental volumes from the US when the price is right relative to local suppliers and there is incremental demand in countries and regions that appear to be in surplus, including Europe, where a buyer can leverage an import to try to push local prices lower. In China, some of the facilities that require either propane or ethane imports might be better off buying ethylene versus making it today, and this is certainly the case for naphtha importers, as we highlighted in our Weekly Catalyst report on Monday. Today a US exporter can buy spot ethylene in the US and deliver it to China for less than the cost of manufacture in China, before the cost of getting the local ethylene to any consumer that is not on site.

Energy Moves Could Drive US Chemical Price Volatility

Nov 30, 2021 1:46:26 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Energy, Benzene, PGP, Oil, US Chemicals, ethane, natural gas, US ethylene, Basic Chemicals, naphtha, polymer, polymer production, NGLs, ethylene feedstocks, crude oil, chemicalindustry, US benzene

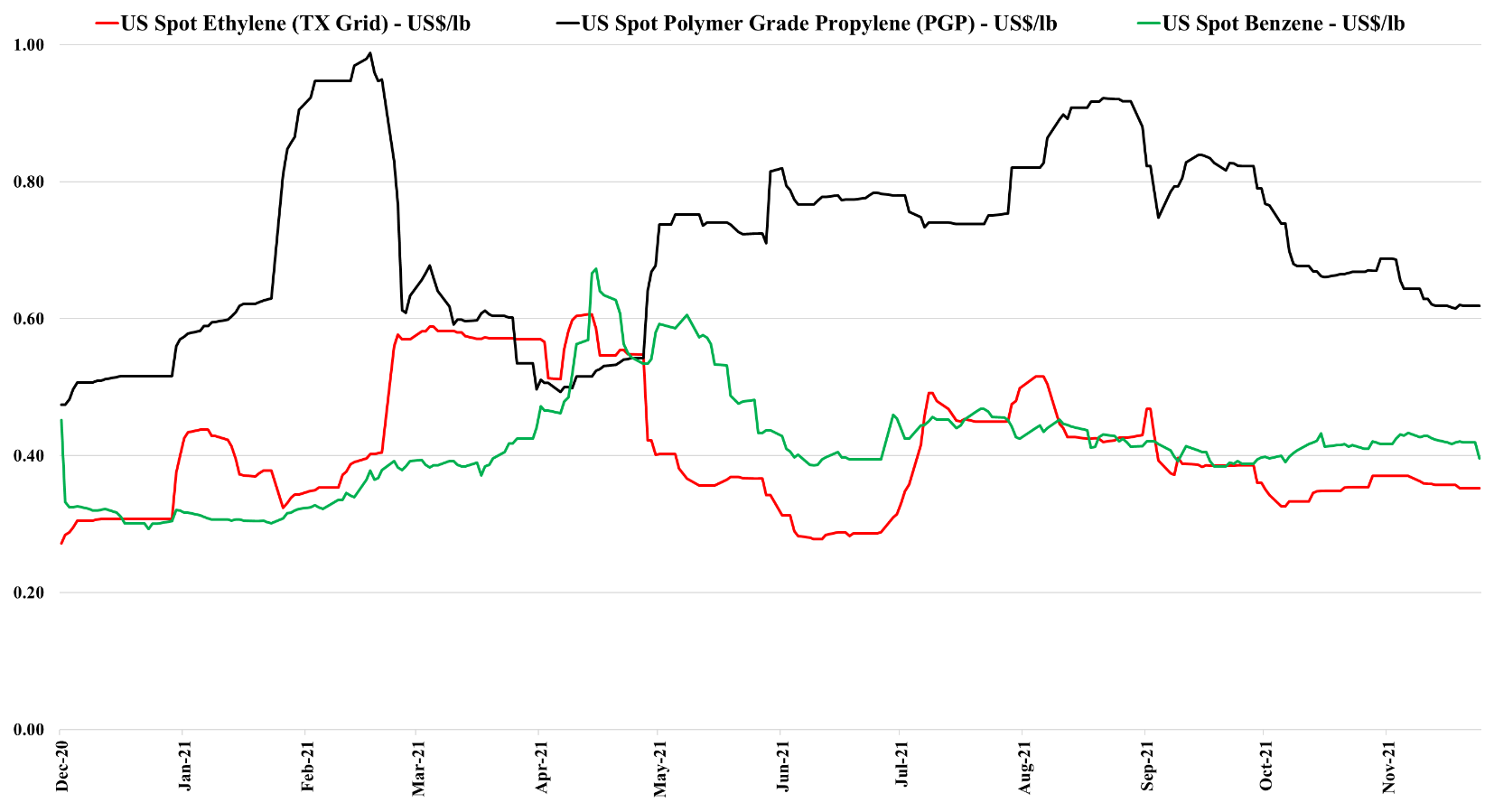

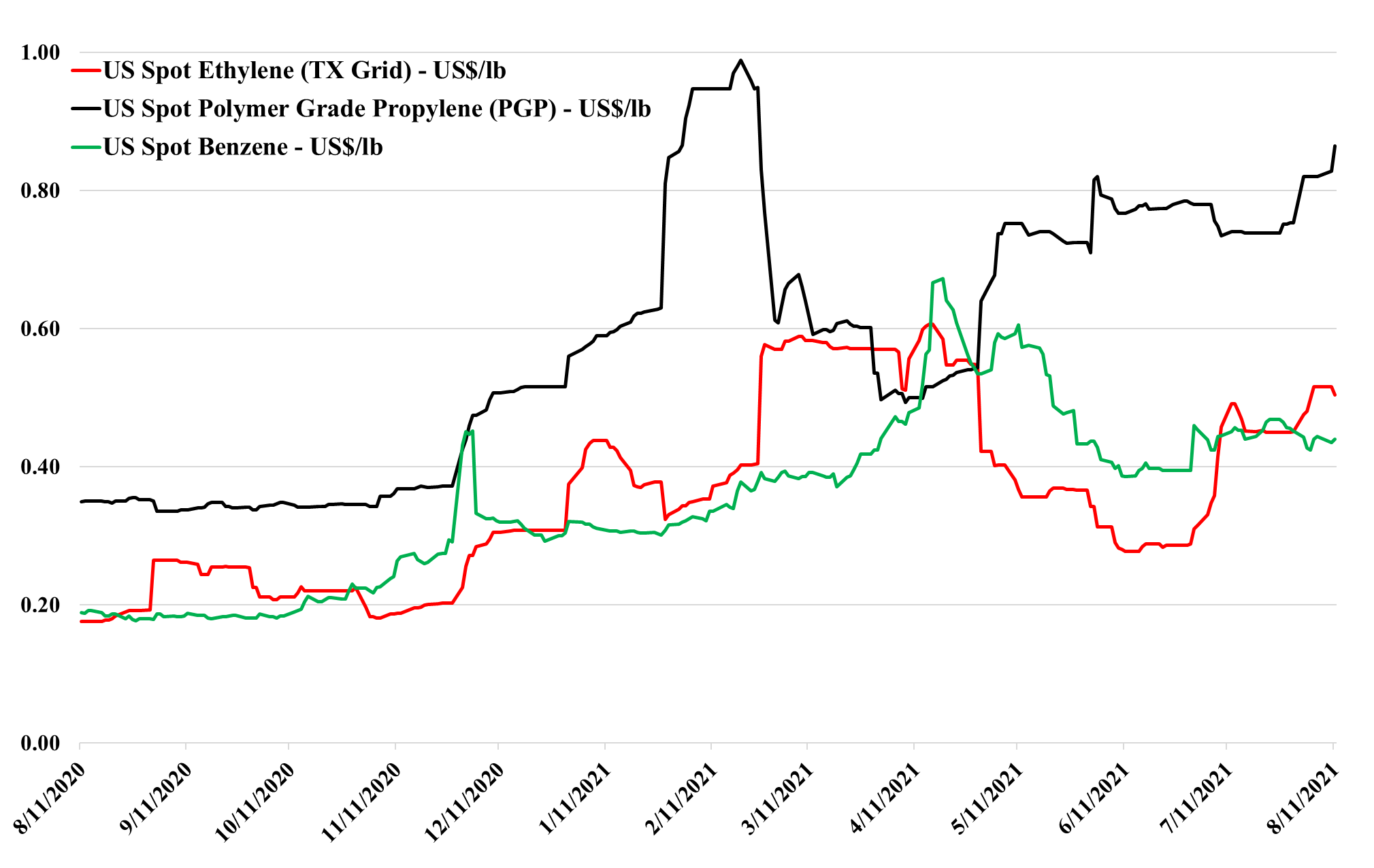

The drop in US benzene pricing is likely a function of lower crude oil pricing and the overall impact this is having on oil product values. As the US has moved to much lighter ethylene feedstocks, the proportion of benzene that is coming from refining is overwhelming and alternative values for benzene or reformate in the gasoline pool are a strong driver of US and international pricing. Lower naphtha pricing for ethylene units outside the US will also hurt benzene values. By contrast, the stronger natural gas market – through the end of last week - supported ethane pricing in the US and we saw a step up in propane pricing – which have provided support for ethylene and propylene – also note that the analysis we published yesterday in the weekly catalyst suggests that the US can export ethylene to Asia at current prices – delivering ethylene into the region below current local costs. This should keep a floor under US ethylene pricing although any further decline in crude oil prices relative to US natural gas and NGLs will close this arbitrage.

US Petrochemical Cost Advantage Erodes As Natural Gas Prices Surge

Oct 5, 2021 2:38:18 PM / by Cooley May posted in Chemicals, Ethylene, petrochemicals, propane, feedstock, ethane, natural gas, NGL, naphtha, US natural gas, crude oil

The US petrochemical production cost competitive advantage reflects a sharp decline at the feedstock level. Natural gas and natural gas liquids prices have risen faster than crude oil and Ex-US naphtha values since mid-1H21. In yesterday's report we identified the disconnect between propane and ethane pricing in the US. While both are high, propane is so high that it is now unprofitable to make ethylene from propane instead of just less profitable. The direction of the lines in the exhibit below shows the changing landscape clearly, and the only reason why the US chemical industry is so much more profitable than the markets in Asia is that chemical product prices are so robust, in part because of the high cost of freight between the regions.

US Methanol Sees Support From Higher US Natural Gas and Overseas Markets

Sep 29, 2021 2:14:00 PM / by Cooley May posted in Chemicals, Polyolefins, LNG, Methanol, propane, olefins, natural gas, naphtha, chemical production

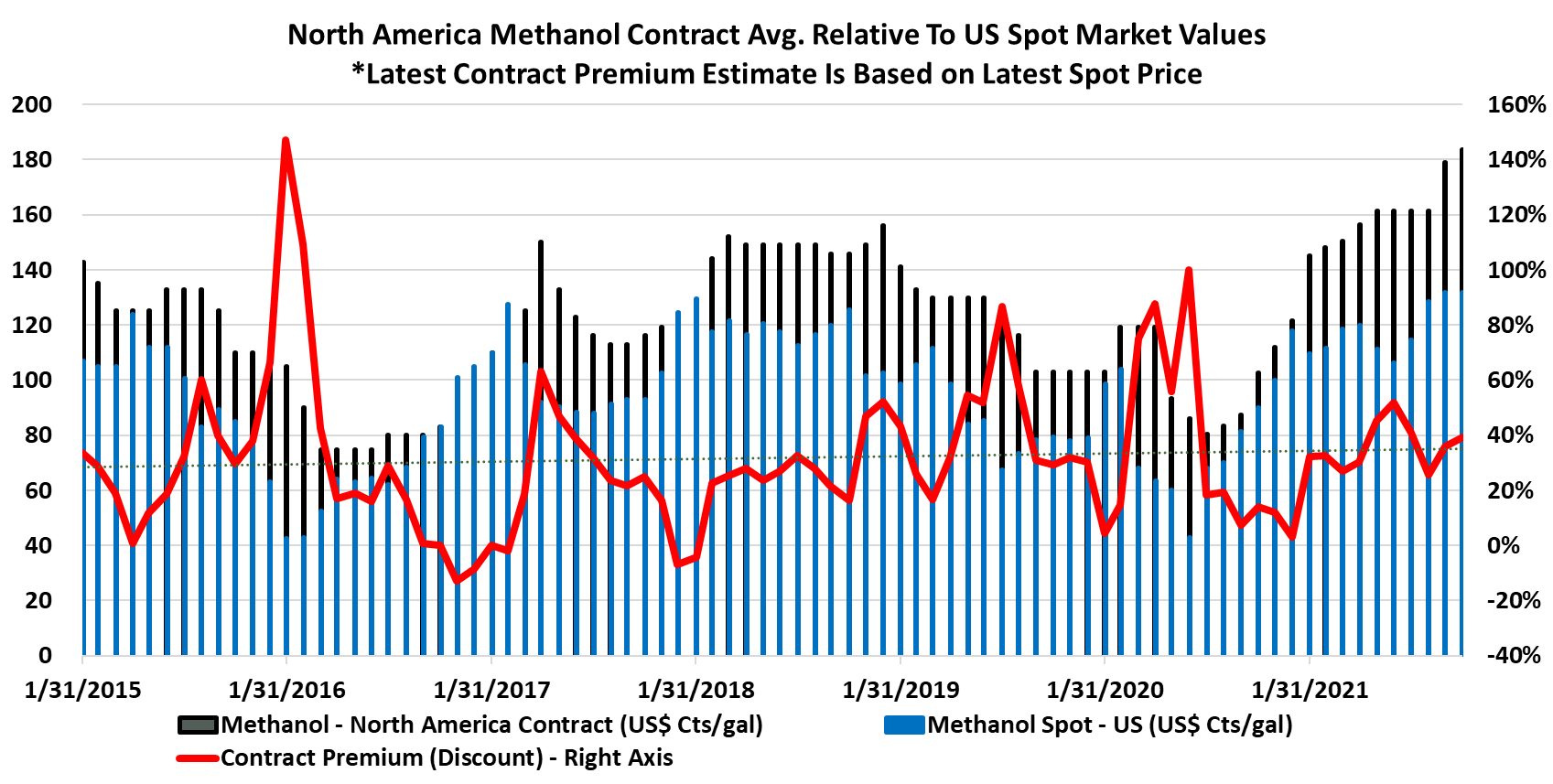

The charts below show that North American methanol pricing is seeing support from higher natural gas prices as you would expect, but we are also seeing some significant price improvement in China, See more in today's daily report. If China is coal constrained, as suggested in many of the power-related stories, it may be impacting chemical production from coal at the margin. Alternatively, with LNG prices so high and imported naphtha and propane prices rising in China, the country may be using more coal at the margin to make chemicals.

US Ethylene: Flexibility Has Lessened, Despite More Funds Available

Aug 24, 2021 12:59:27 PM / by Cooley May posted in Chemicals, Ethylene, Butadiene, LyondellBasell, Dow, feedstock, ethane, US ethylene, naphtha, ethylene capacity, light naphtha

Before the wave on new ethylene capacity came online in the US there were several low-cost expansion projects all of which added the ability to crack ethane and some of which brought constraints around feedstock flexibility. Consequently, it is less clear than it used to be just how much US ethylene capacity can flex to exploit the very attractive light naphtha economics today. Very conservatively, we would estimate that 5-6 million tons of capacity can flex easily and about the same again with some planning and some logistic adjustments. Among the public companies, both Dow and LyondellBasell are well placed, and likely have at least 1 million tons each of flexible capacity – in both cases, there is a need for propylene and LyondellBasell has significant butadiene/C4s capacity. For context, at current prices, both companies are likely looking at an additional ethylene margin benefit in the US of $2.5-3.0 million per week for as long as this opportunity exists. This would be 0.3 cents per share per week for Dow and 0.7 cents per share per week for LyondellBasell – a rounding error in current earning but more free cash regardless. The chart below shows the unprecedented benefit in the US and see our daily report for more.

Price Support From High Shipping Costs & Outages

Aug 11, 2021 2:17:47 PM / by Cooley May posted in Chemicals, Polyethylene, feedstock, PE, Asia ethylene, naphtha, ethylene costs, Asia polyethylene, US polymer prices, US propylene, ethylene feedstock, shipping, PE prices, US Polymers, shipping costs

To put some perspective around the shipping container costs shown in Exhibit 1 of our daily report today, $20,000 per container equates to roughly 34 cents per pound of cargo assuming that the container is filled to maximum weight. If we also add in loading inefficiencies and assume 500 miles of road transport in the US or Europe, we can add another 5-10 cents per pound. Using ethylene costs in Asia at roughly 43 cents per pound as a basic benchmark (see our most recent weekly catalyst report), we thus estimate that it would cost around 90 cents per pound to get Asia polyethylene into the US. This does not include any working capital cost assumptions around ownership of the cargo from point of production to point of use. US spot PE prices are currently below 80 cents per pound for the more commodity grades of polyethylene, which is the market that could most easily be targeted by imports from Asia. When container rates were closer to $3000 per unit, the all-in import costs would have been roughly 30 cents per pound lower and the arbitrage would have been worth exploring. Of course, if the freight rate was only $3000 per container US polymer prices would likely be lower.