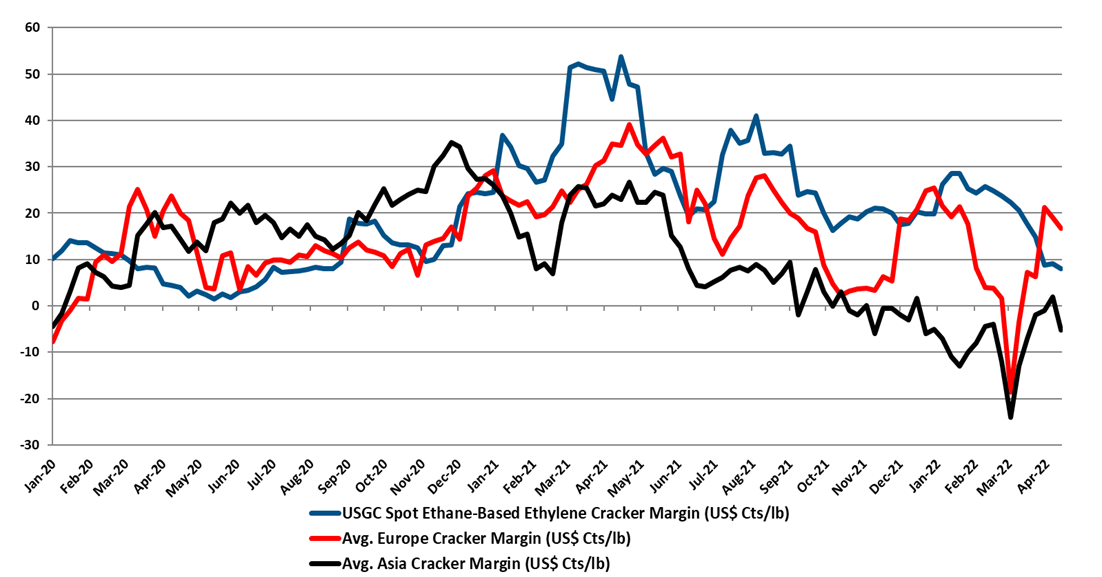

We note the polyethylene price nominations in the US, timed by some to coincide with earnings releases this week and next, and would remind clients that there is always price momentum in commodities, one way or another. In our view, the price increase moves aim to maintain directional momentum (upwards) while giving the polymer producers some cover should natural gas prices spike further. US ethane prices are now tracking natural gas more closely and have moved up meaningfully over the last few weeks, and US ethane-based ethylene margins have fallen around 80% since the start of the year, with at least half of that coming from cost increases. All polyethylene producers are integrated back to ethylene, and the price nominations will be attempts to recoup some of the cost increases. This is against a backdrop of still very strong polyethylene margins in the US, which although way off their 2021 highs remain much higher than in 2019 and 2020 and the longer-term average. This is covered in our Weekly Catalyst report each Monday. Ethylene margins are summarized in exhibit below and the chart shows the impact of higher costs in the US and falling spot ethylene prices as the US now has more surplus ethylene capacity and is looking for export homes for ethylene and easy to ship derivatives. As we have noted before, the jump in margins in Europe and Asia is because of extreme volatility in naphtha markets over the last couple of weeks. We would expect margins to be lower next week based on naphtha moves this week.

US Chemicals: Some Signs Of Continued Strength, But Mostly Lagging Indicators

Apr 20, 2022 2:33:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Polyurethane, Inflation, US Chemicals, ethane, natural gas, naphtha, polymer, US polyethylene, MDI

Many Adjustments Ahead For LyondellBasell

Dec 14, 2021 1:27:36 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Propylene, Polyethylene, Polypropylene, LyondellBasell, Chemical Industry, energy transition, US Exports, specialty chemicals, Polyethylene Capacity, US polyethylene, US polypropylene, commodity chemicals, refinery, commodity polymer

Following on from the LyondellBasell commentary in today's daily report, we would make one further, but very important point. With its refinery (granted the company is exploring opportunities to exit) and its huge commodity polyethylene, polypropylene, and propylene oxide business, any attempt to pursue a “specialty” strategy that encompasses the whole portfolio will be seen (crudely) as trying to put some lipstick on a pig! This rarely works in the chemical sector and the real transformation stories involve wholesale portfolio shifts, many of which have taken notable periods of time to develop. We still believe that the right path for LyondellBasell is to spin off the good piece – recycling, licensing, and compounding, or even better, find someone they can sell the business to through a Reverse Morris Trust. This strategy would likely allow the company to pay down (or shift) a significant amount of debt. The commodity business can then focus on the best strategy for a commodity polymer business in the face of energy transition, which might involve taking the business private or merging with another.

US Polyethylene Producers Strive For Contract Price Support

Oct 20, 2021 2:44:52 PM / by Cooley May posted in Polyethylene, Ethylene, polyethylene producers, polymer, US polyethylene, conventional polymers, contract prices, crude oil prices, transportation cost, alternative polymers

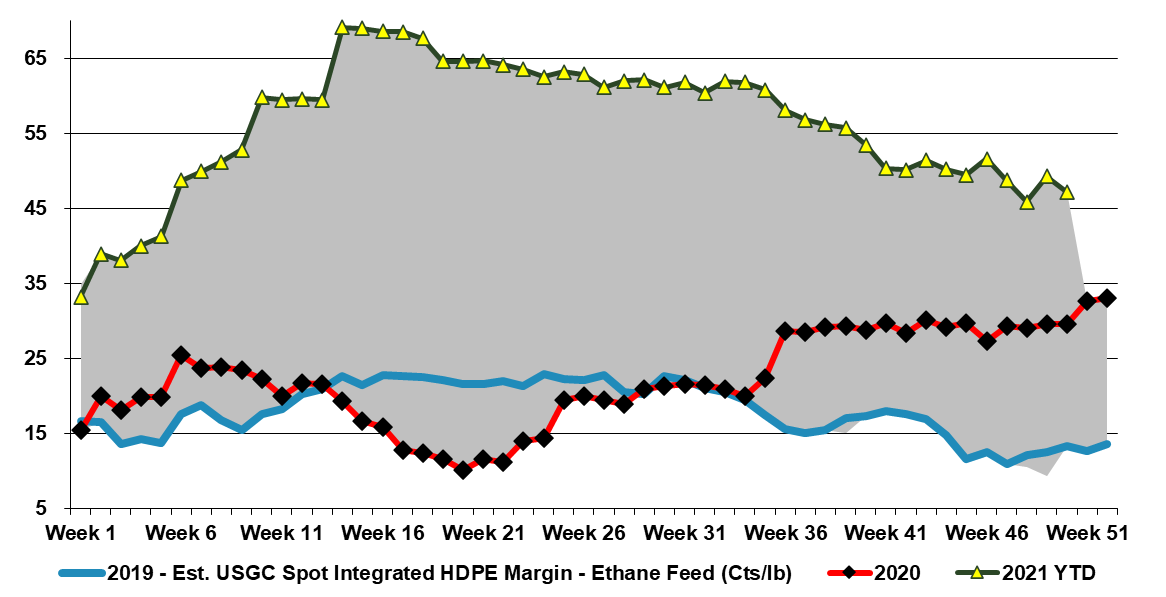

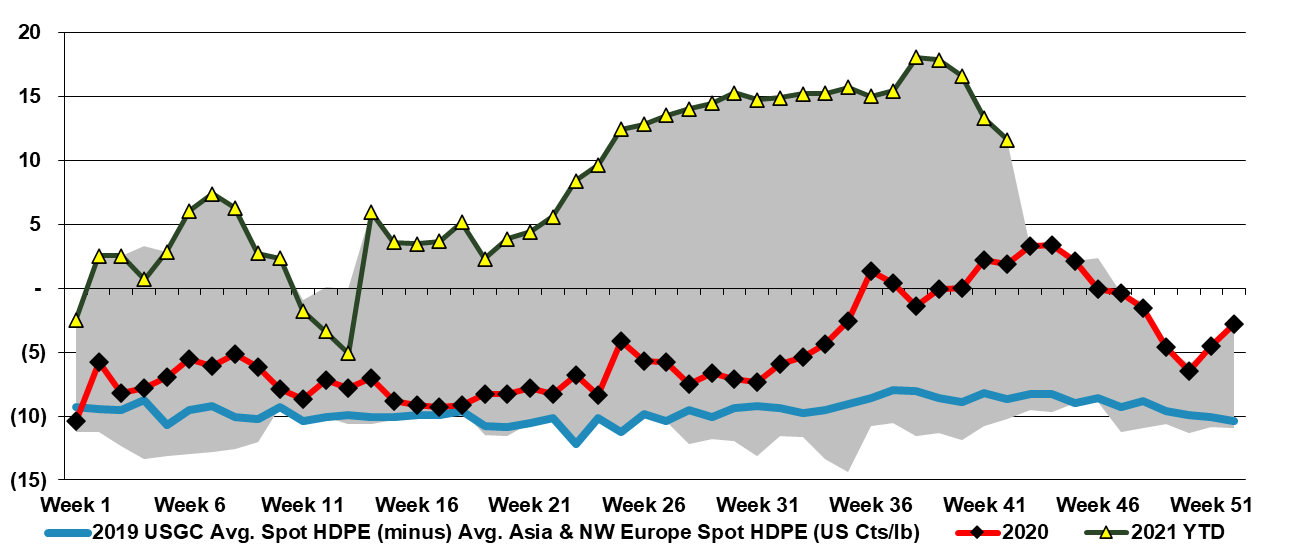

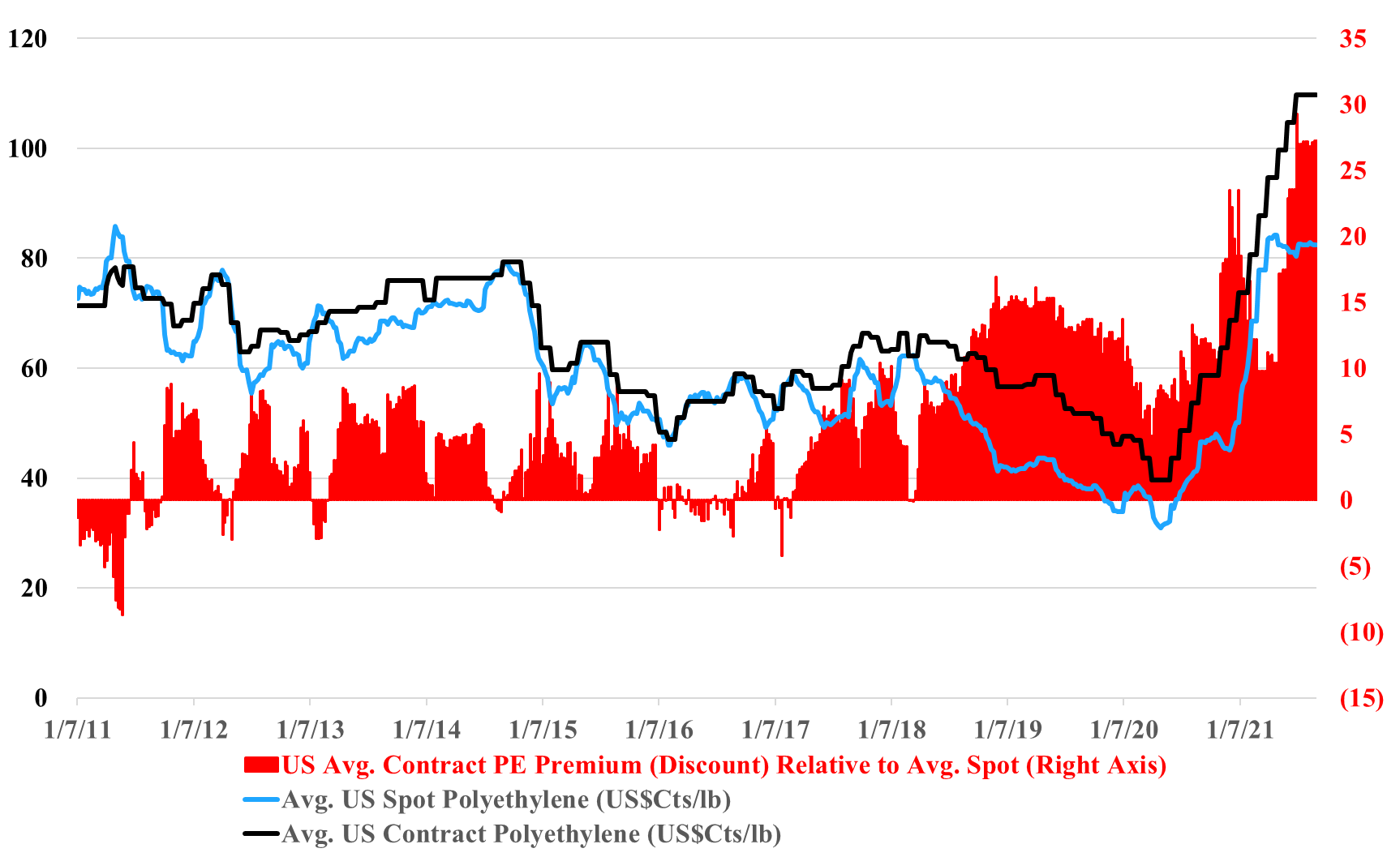

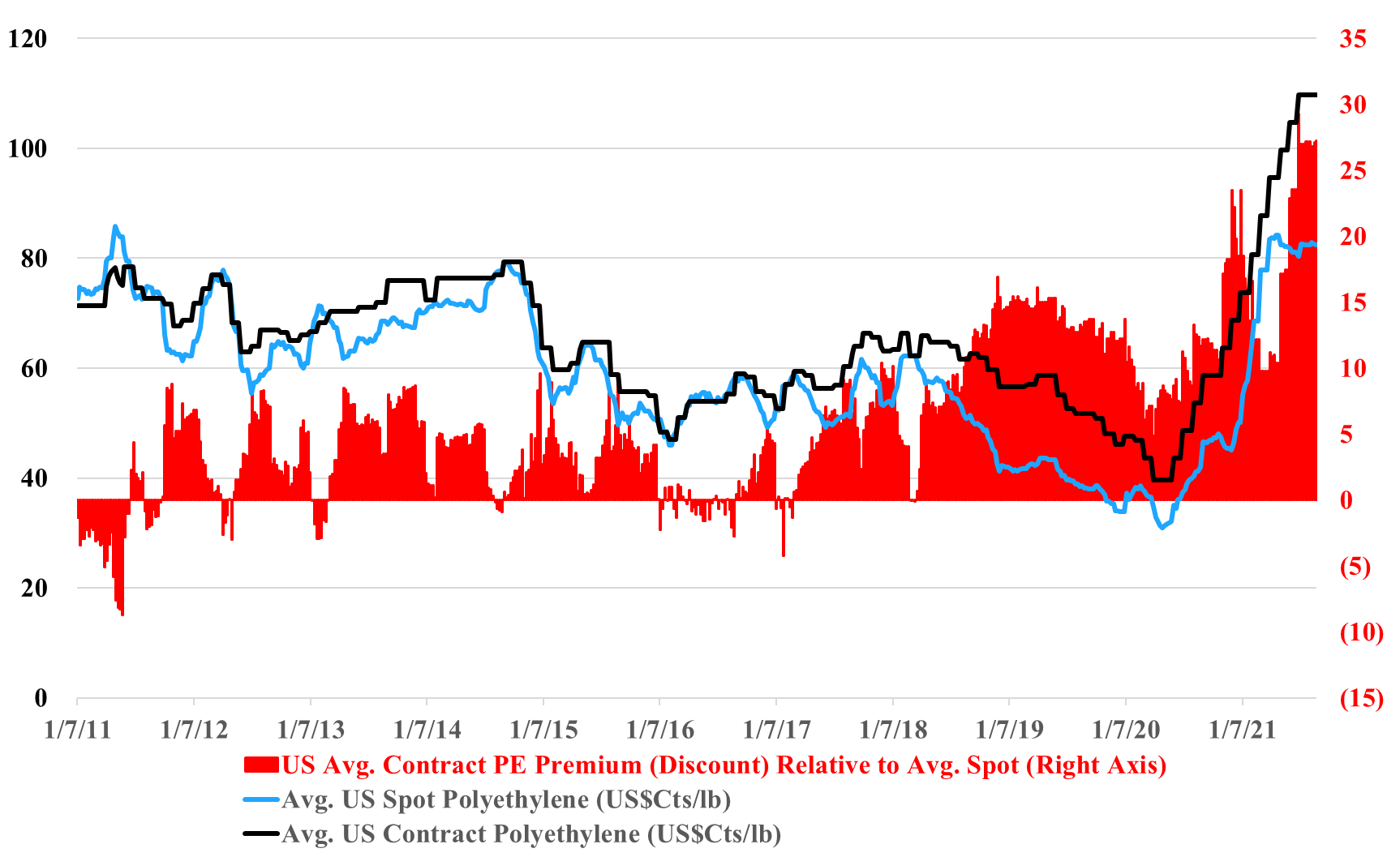

We talk about the US producer’s pressure to keep polyethylene contract prices flat in October earlier in today's daily report but the exhibit below helps to show some of the potential longer-term consequences of that behavior. The desire to keep pricing high by the producers is obvious as they will continue to make outsized margins if they do and carry some of the good 3Q profitability into 4Q – it will still not be as good as 3Q as costs are up for ethylene and every polyethylene producer is integrated back to ethylene in the US. The large gap in pricing with Asia is declining, in part because Asia prices are at costs and costs as rising as crude oil prices strengthen.

US Polymers Holding On To A More Fragile Premium, Mostly Storm Driven

Sep 21, 2021 2:01:48 PM / by Cooley May posted in Polymers, Polypropylene, polyethylene producers, ethane, natural gas, US polyethylene, US polypropylene, polypropylene arbitrage, spot pricing

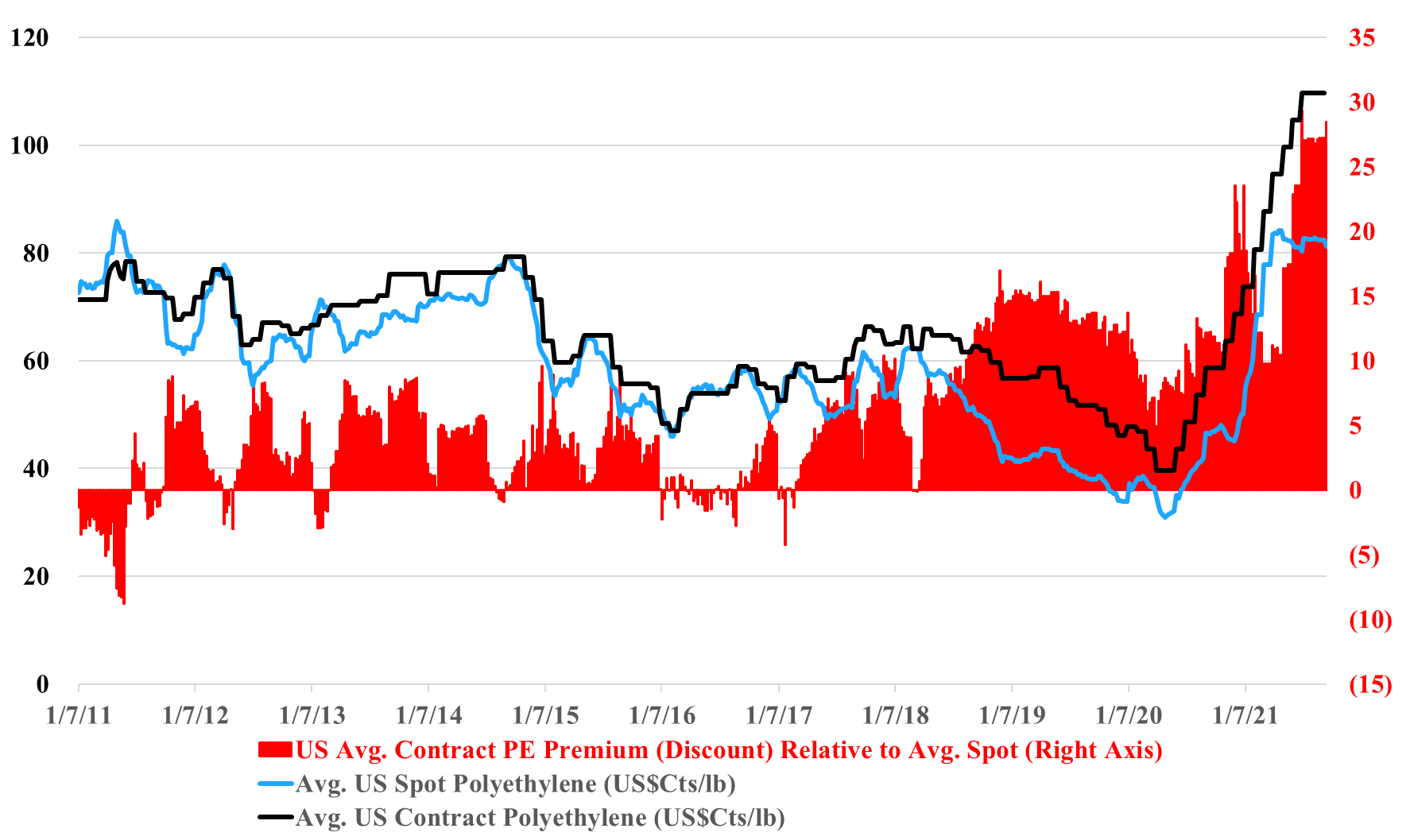

US polyethylene producers are pushing for September price increases and their arguments center around lost production, because of Ida and Nicholas, and rising costs because of the much firmer natural gas and ethane markets. Working against them are the very high margins and what appears to be a stubborn spot market, both covered in the charts below. A contract increase in September would maintain an unprecedented gap between US contract and spot pricing, and while it is likely that the spot market is very thin, it is a very strong push back against producers for a contract hike.

US Ethylene and Polyethylene: Instability From Many Directions

Sep 10, 2021 1:54:53 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, Ethylene, Styrene, Dow, arbitrage, US ethylene, US polyethylene, ethylene glycol

The gap between the US contract and spot price for polyethylene in the exhibit below looks wrong, and it could be wrong in absolute terms but the trend alone makes a statement. In the past, we have seen a couple of instances where reported contract settlements have drifted further from net transaction prices, either because of larger agreed discounts or because of contract formulae that reflect spot pricing to a greater degree. This tends to work for a while, but ultimately smaller buyers with more limited purchasing power become more disadvantaged and there is a breaking point at which the “contract” price is adjusted downwards by the price reporting services to better reflect what is really going on. The current market feels like the times in the past when an adjustment has been needed.

More Examples Emerge Of US Chemical/Polymer Market Tightness Post Ida

Sep 3, 2021 1:18:43 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, PVC, US Polymer, Ethylene, US Chemicals, olefins, US polyethylene, Hurricane Ida, Chemical pricing, ethylene prices

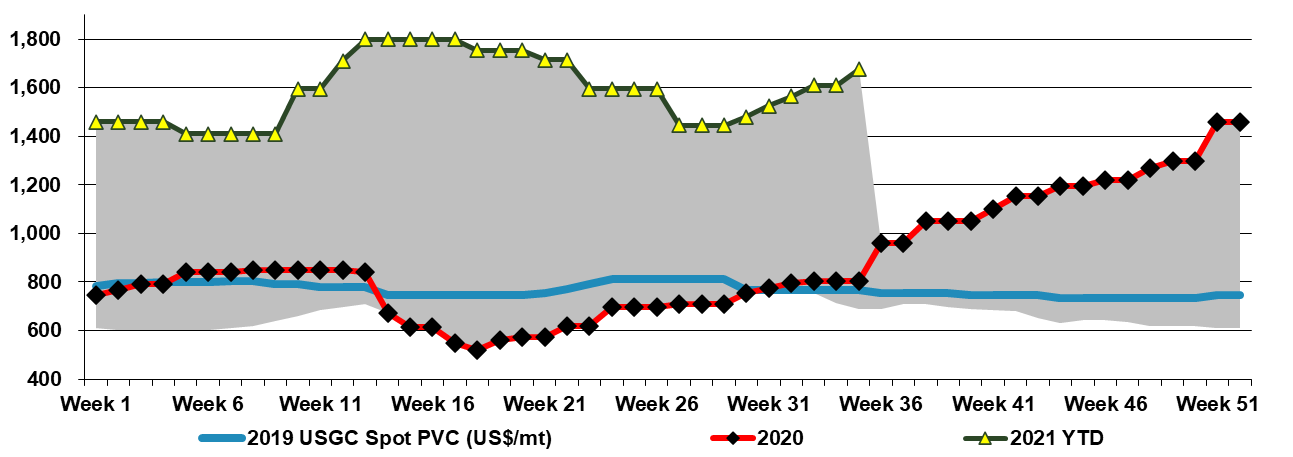

It is increasingly likely that Hurricane Ida will add another leg of strength to US chemical pricing more broadly, with a host of prolonged production outage news and force majeure notices, giving momentum to some price increase announcements for September, some of which looked very speculative at the time they were made. Buyers will have an eye on continued pockets of supply chain disruption, strong demand in general, particularly for those levered to holiday spending, and the not insignificant fact that we still have almost three months of hurricane season to go! Note that two of the more disruptive storms of 2020 hit in October. We talk specifically about PVC in today's daily - See price chart below.

US Polyethylene Prices Reflect Support, In Part Due To High Freight Rates

Aug 31, 2021 2:31:51 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Ammonia, PE, freight, Polyethylene prices, US Polymers, container freight rates, US polyethylene, spot price, Hurricane Ida, distribution

We discuss recent historic highs reached in China to US container freight rates in our daily research today, and (absent Ida) we note that freight charges remain a major component in favor of US polymer price support. With current container rates so high, it is difficult for US consumers to get access to cheaper material from Asia, even if they are willing to try the untested grades in their equipment. Absent the freight extremes today, we would be much more definitive in declaring that the US's record spot/contract polyethylene price difference was unsustainable and would be corrected quickly. While there appear to be some surpluses of US polyethylene today, such that producers are testing the incremental export market, the same producers can hide behind the freight barrier as they make arguments to support domestic pricing. Some US buyers may be getting pricing relief because they have price mechanisms that partly reflect the spot price. It is also possible that large buyer discounts have risen through this period of very high pricing (this has happened before).