Our Sunday Thematic research a week ago (see linked report) discussed slowing growth investment in the traditional commodity chemical industry and suggested that ESG and climate pressures might slow investment even further. Yesterday, our Sunday Thematic made the argument that some of those dollars will target strategic M&A. We have recently seen an uptick in global chemicals sector M&A, and we find few items suggesting activity levels will slow in the near-to-medium term. In part, we think strategic M&A will be easier to get Board approval for than “new build” capacity additions, and it can be viewed as better use than holding cash or complementary to dividends and buybacks. Also, ESG and climate concerns could spur M&A activity, as companies look to separate bad emission assets from good ones – especially if the market values them very differently.

Is M&A The Path Of Least Resistance For The Chemical Industry?

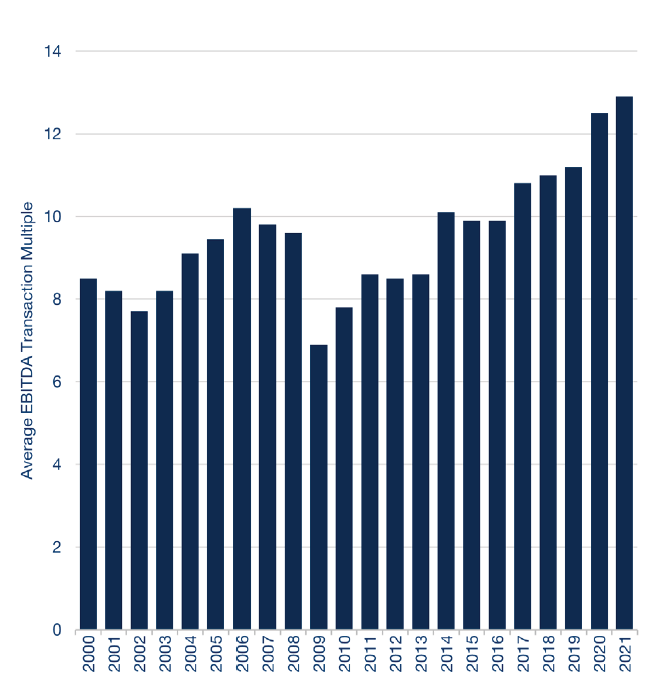

Nov 15, 2021 11:10:57 AM / by Cooley May posted in ESG, Chemicals, Commodities, Emissions, ESG Investing, EBITDA, Capacity, climate, commodity chemicals, chemicalindustry, mergers, M&A, acquisition