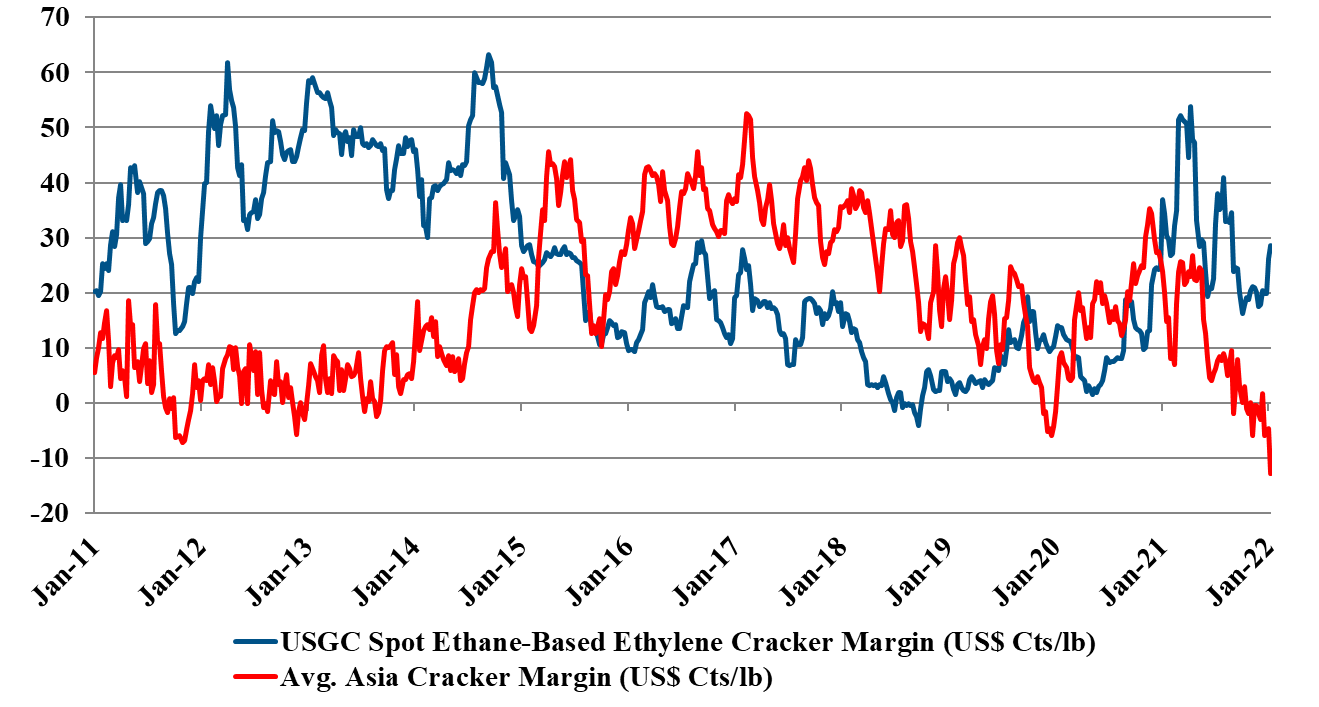

Ethylene producers in Asia are cutting back production because of the negative margins that some are seeing for much of their production. This will initially lead to higher losses as lower rates will impact plant efficiencies and raise unit costs. Cutting operating rates only works if prices rise as a consequence and if other producers choose not to cut back and seek to gain share, things get worse before they get better. The margins we show in the exhibit below are exceptionally low for Asia and are certainly at levels that would have caused many shutdowns in the past, but there are so many new players in Asia, especially in China that it may either take time or government intervention to get enough of a cutback to move prices. But if ethylene prices do improve in the region the arbitrage for moving ethylene in from the US goes up, so the US may gain more than the local producers. Also, as prices rise, someone in the region could look at marginal economics and start increasing rates. See more in today's daily report.

Tough Times For Ethylene In Asia Trigger A Response

Jan 19, 2022 2:22:40 PM / by Cooley May posted in Chemicals, Ethylene, Chemical Industry, petrochemicals, hydrocarbons, ethylene producers, Asia ethylene, ethylene prices, ethylene margins, operating rates

Petrochemical Margins Face More Downward Pressure

Oct 8, 2021 12:28:51 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Polypropylene, Ethylene, Auto Industry, Monomer, petrochemicals, Dow, ethylene margins, shortages

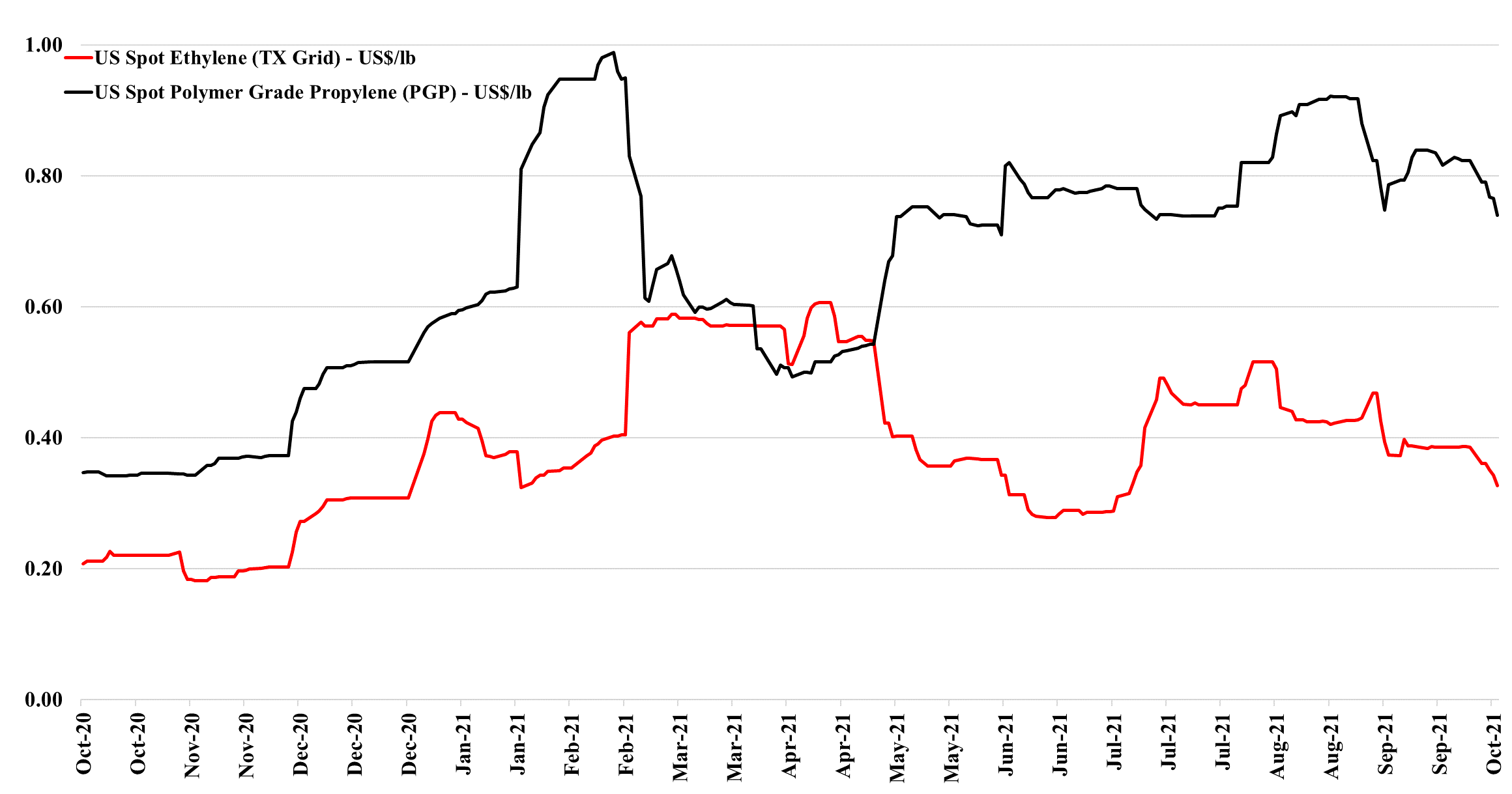

While we will talk more about the Dow project in Alberta on Sunday, one of the problems that the stock faces in the light of the announcement is largely unrelated, which is the growing expectation that margins in 2022 will be significantly lower than in 2021. This is the view coming out of the recent EPCA meeting and as the ethylene/propylene chart below shows, monomer pricing is already weakening in the US as production ramps back up following the recent storms – we note in Exhibit 1 from today's daily report the squeeze on ethylene margins as prices fall, while costs rise. But it is also worth noting that margins remain quite healthy, while well below their highs. Those companies who built new ethylene capacity in the US over the last 5 years would have had a margin similar to the current level shown in Exhibit 1 in an optimistic capital case.